2 Year Capital Gains Rule Real Estate You re eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of

If you lived in a property 2 out of the past 5 years you got to take either 250 000 of capital gains tax free single or 500 000 of capital gains For example if you own and occupy a home for one year 50 of two years and have not excluded gain on another home within two years and otherwise qualify you may

2 Year Capital Gains Rule Real Estate

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)

2 Year Capital Gains Rule Real Estate

https://www.investopedia.com/thmb/7lgVTwV_8orWVzN3kOsup-hL478=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg

Tax Rates 2025 25 Uk 2025 James Aadil

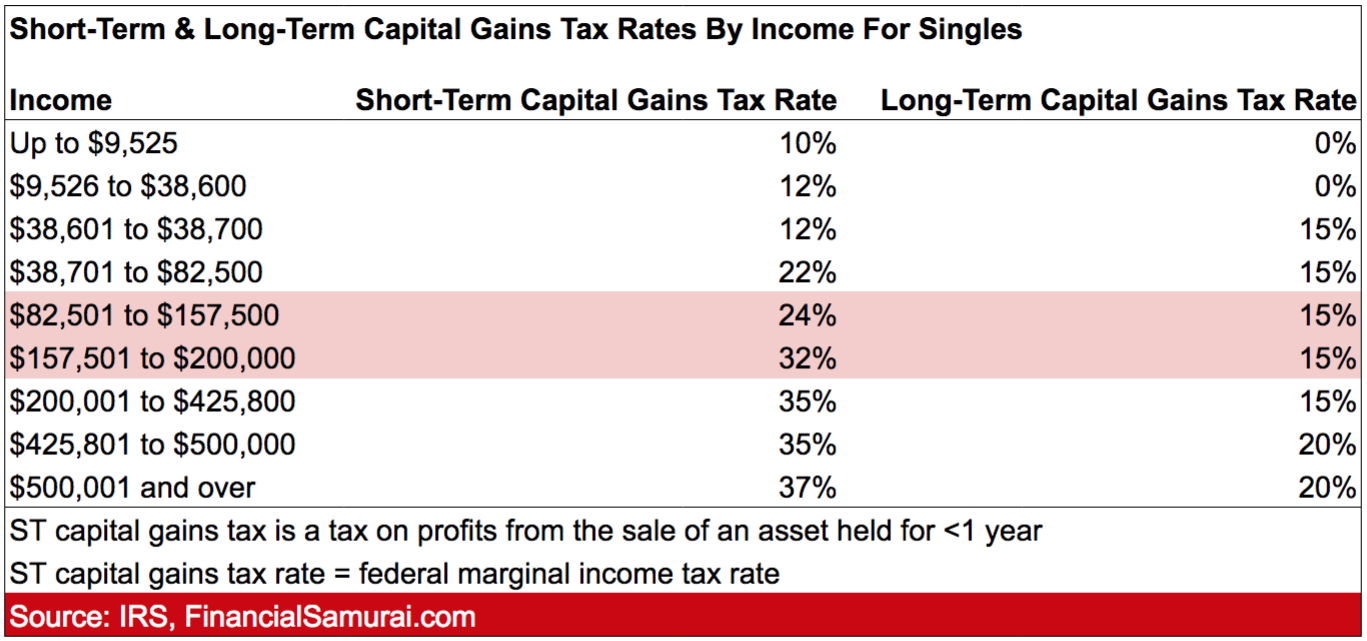

https://www.financialsamurai.com/wp-content/uploads/2018/10/capital-gains-tax-rates-by-income-for-singles.png

Tax Rates 2025 25 Uk 2025 James Aadil

https://curchods.com/wp-content/uploads/3020/12/Porposed-Capital-Gains-Tax-Changes-01.jpg

When selling a home it is important to understand the 2 year rule for capital gains tax The Internal Revenue Service IRS allows homeowners to exclude up to 250 000 of Complete Schedule D Form 1040 Capital Gains and Losses Using the information on Form 8949 report on Schedule D Form 1040 the gain or loss on your home as a capital gain or

During the five year period ending on the date of the sale the homeowner must have owned the home and lived in it as their main home for at least two years Taxpayers who The 2 year capital gains rule is a federal tax regulation that applies to the sale of a home and requires sellers to pay taxes on any profits made from the sale It is important for

More picture related to 2 Year Capital Gains Rule Real Estate

2024 Tax Brackets Irs Capital Gains Oliy Starla

https://thecollegeinvestor.com/wp-content/uploads/2023/11/TCI-_2024_Short_Term_Capital_Gains_Tax_Brackets.png

Capital Gains Tax Rate 2025 Calculator Nj Images References Caleb

https://www.wallstreetmojo.com/wp-content/uploads/2022/11/Long-Term-Capital-Gains.jpg

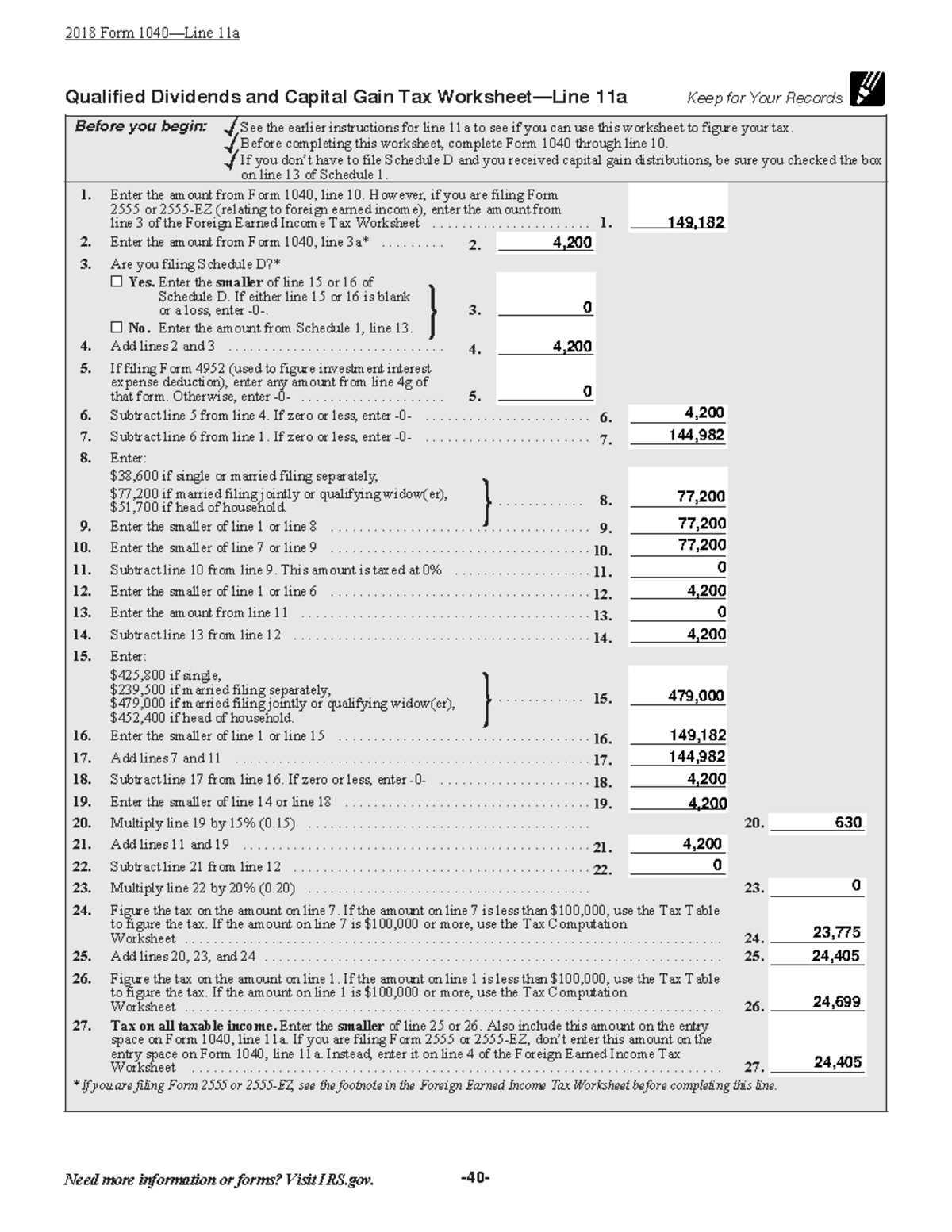

Irs Capital Gains Worksheet 2024

https://www.pdffiller.com/preview/1/575/1575301/large.png

The two year rule states that if you sell a home or other real estate you must use it as your primary residence for at least two of the five years prior to the sale in order to avoid To be exempt from capital gains tax on the sale of your home the home must be considered your principal residence based on Internal Revenue Service IRS rules These rules state that you

Capital gains tax is a levy imposed by the IRS on the profits made from selling an investment or asset including real estate Primary residences have different capital gains guidelines than Owned for at least 2 years in the past 5 years Married couple One spouse can meet this requirement Use Test Occupied as primary residence for at least 2 years Non

Capital Gains Tax 2025 California Adil Rhea

https://blog.commonwealth.com/hs-fs/hubfs/Images_Blog/Understanding the Capital Gains Tax - Chart.png?width=2781&name=Understanding the Capital Gains Tax - Chart.png

2025 Federal Capital Gains Tax Rate Tana Zorine

https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/Long-term-Capital-Gains-Tax-Rates-Infographic-1024x536.png

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg?w=186)

https://www.irs.gov › taxtopics

You re eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of

https://www.ustaxaid.com › blog

If you lived in a property 2 out of the past 5 years you got to take either 250 000 of capital gains tax free single or 500 000 of capital gains

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)

Capital Gains Definition Rules Taxes And Asset Types

Capital Gains Tax 2025 California Adil Rhea

Capital Gains Tax 202420243 Emmy Norrie

How To Avoid Short Term Capital Gains Treatbeyond2

Irs Capital Gains Tax Worksheet 2023

Capital Gains Tax On Stocks 2025 Antonio Porter

Capital Gains Tax On Stocks 2025 Antonio Porter

Qualified Dividends Capital Gains Worksheet Qualified Divide

Rental Property Capital Gains Tax Worksheet

Difference Between Short And Long Term Capital Gains Compare Apply

2 Year Capital Gains Rule Real Estate - Are you required to pay the capital gains tax on your real estate property Review our guide to learn what the capital gains tax is when to pay it and more