401 K Plan To Buy A House First time home buyers can buy a house with a 401 k retirement plan but it s generally a bad idea Here s why 401 k loans are relics when low down payment mortgages didn t exist Except in extreme cases buying a house with 401 k retirement money should be a last resort TABLE OF CONTENTS How The 401 k Retirement Plan Works

1 Obtain A 401 k Loan The first option is to obtain a 401 k loan This is the better of the two options Not only do you avoid the 10 early withdrawal penalty but the amount you withdraw will not be subject to income tax There are other benefits to a 401 k loan as well You can use your 401 k to buy a home through a loan or withdrawal You can borrow up to 50 of your vested balance or 50 000 whichever is less tax free The more money you take out of

401 K Plan To Buy A House

401 K Plan To Buy A House

https://incline-wealth.com/wp-content/uploads/2020/04/1D23AD58-4CC3-4FD3-B0A5-638D47133483-980x648.png

4 Critical Things To Look For In Your Company s 401 k Plan The Motley Fool

https://g.foolcdn.com/editorial/images/593435/401k-plan-document.jpg

An Overview Guide For 401 k Plans California Business Journal

https://calbizjournal.com/wp-content/uploads/2021/01/401k-1536x1024.jpeg

That initial 30 000 would have compounded into 345 184 56 in your 401 k by the time you retire at 65 assuming no additional contributions were made However if you re 55 and you have 30 000 to invest in a home or 401 k the same conservative 7 compounding interest rate over 10 years doesn t equal nearly as much You d have a You can borrow from a 401 k to buy a house if you don t have liquid cash savings for the down payment or closing costs Here s what to consider before you make that move Key Takeaways You could consider borrowing from your 401 k if you don t have the liquid cash for a down payment or closing costs for your new home

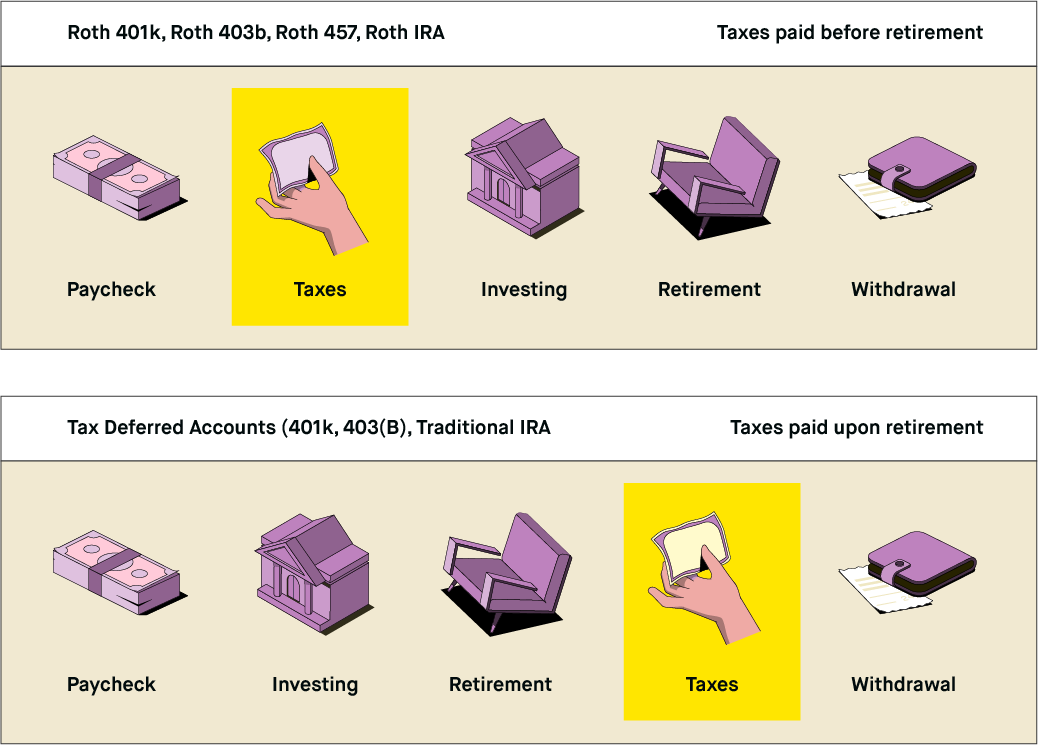

Updated April 10 2021 Reviewed by Chip Stapleton A 401 k plan is a defined contribution retirement account offered by many companies to their employees Typically employees can make The short answer Yes you can After all the money in your 401 k is yours and you can use it as you like However your 401 k probably shouldn t be your first choice for cash In

More picture related to 401 K Plan To Buy A House

What Are The Benefits Of Having 401 k Plan

https://learn.financestrategists.com/wp-content/uploads/Benefits-of-Getting-a-401k-Plan-1024x546.png

401 k Plans Douglas M Farr Co Inc

https://www.dmfarr.com/wp-content/uploads/2017/09/401-K-Plan.jpg

Investing In A 401 k Plan MoneyMatters101

https://www.moneymatters101.com/wp-content/uploads/2020/01/401k.jpg

There are two ways to buy a house using money from your 401 k early hardship withdrawal or a loan Early withdrawal means taking money out of your 401 k before you re ready or old enough to retire Hardship withdrawal is a type of early withdrawal but you need to prove that you need your 401 k money to solve some huge financial problem 401k To Buy A House Using Your 401 k To Buy A House A Guide Victoria Araj 8 Minute Read Published on December 6 2021 If you ve been considering purchasing your first house or just a new one you ve probably got a pretty good idea of what makes up your dream home

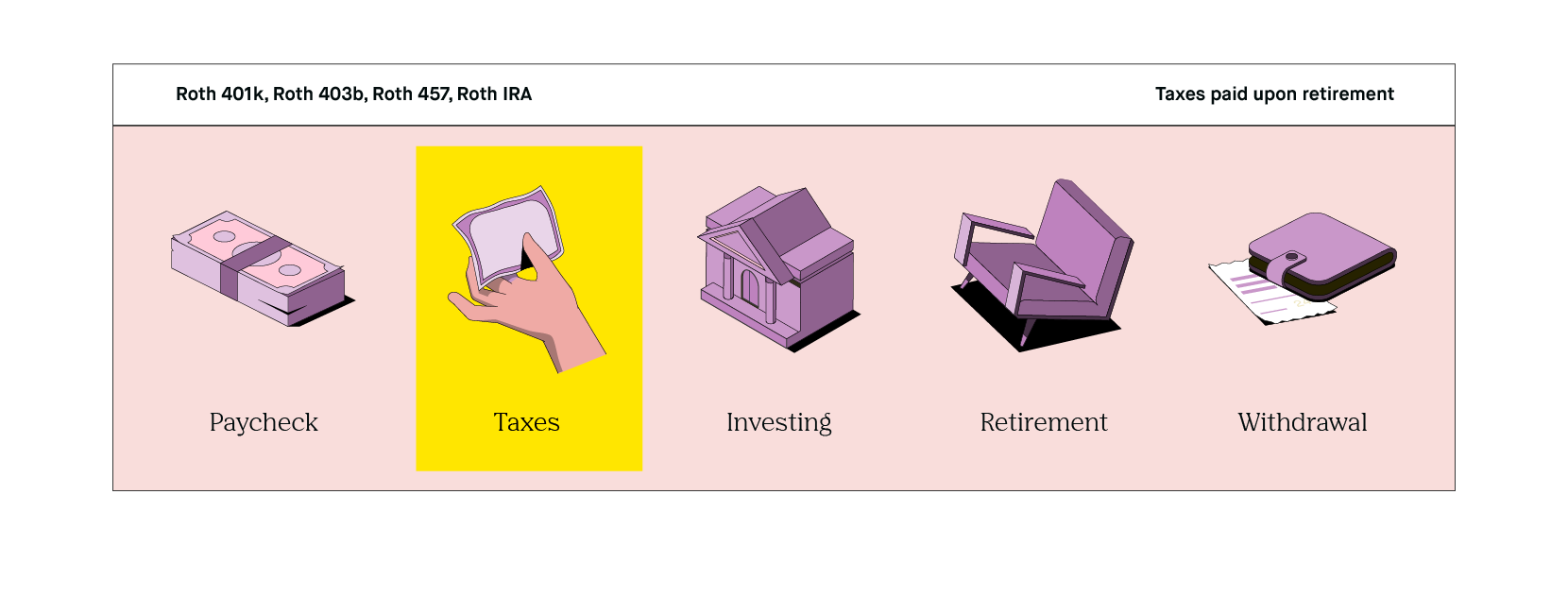

Quick Answer It s possible to use funds from your 401 k to buy a house but whether you should depends on several factors including taxes and penalties how much you ve already saved and your unique financial circumstances In this article 401 k Withdrawal Rules How to Use Your 401 k to Buy a House In simple terms using a 401 k to buy a house is allowed under IRS rules However there are specific situations on when how and which types of 401 k accounts can be used toward your next home For example if you plan on taking out a loan from your retirement account the money can only come from qualified accounts including 401 k plans

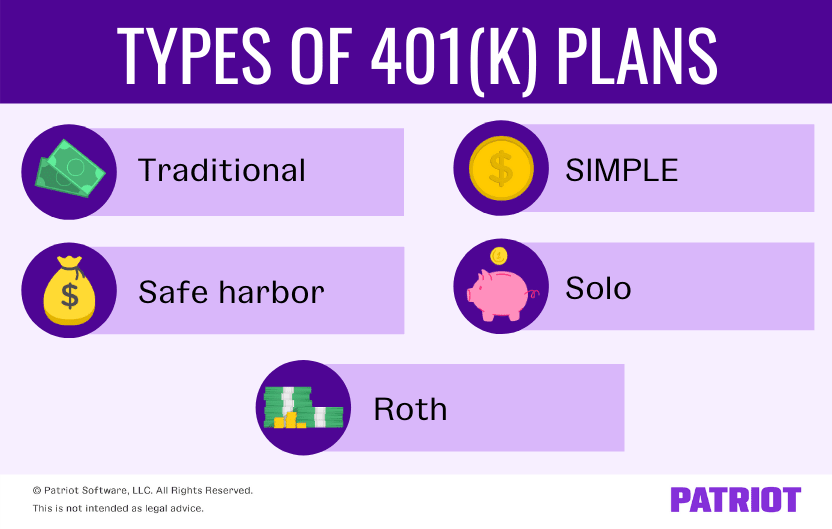

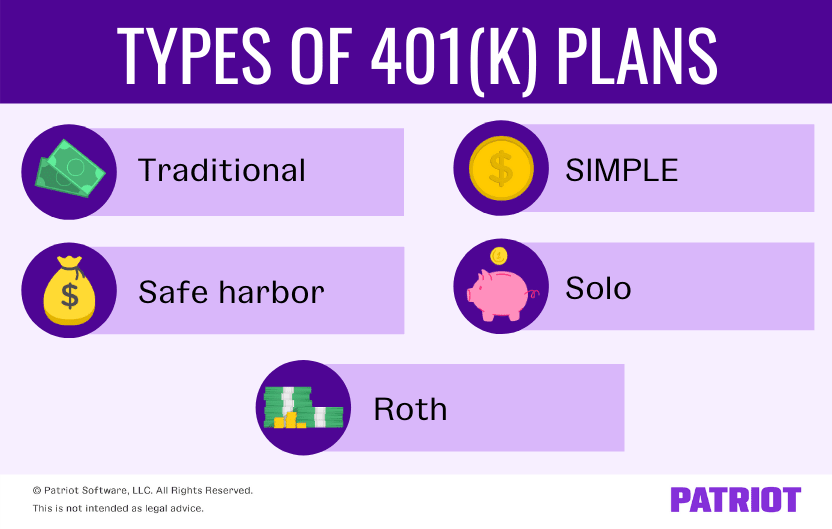

Types Of 401 k Plans Which 401 k Plan Is Right For Your Business

https://www.patriotsoftware.com/wp-content/uploads/2017/03/401k-plans-1.png

Starting A 401 k Plan A Guide For Restaurant Owners SynergySuite

https://www.synergysuite.com/wp-content/uploads/2022/07/Starting-a-401-k-Plan-A-Guide-for-Restaurant-Owners-SynergySuite-2022-2-2048x1152.png

https://homebuyer.com/learn/401k-to-buy-house

First time home buyers can buy a house with a 401 k retirement plan but it s generally a bad idea Here s why 401 k loans are relics when low down payment mortgages didn t exist Except in extreme cases buying a house with 401 k retirement money should be a last resort TABLE OF CONTENTS How The 401 k Retirement Plan Works

https://www.rocketmortgage.com/learn/use-401k-to-buy-house

1 Obtain A 401 k Loan The first option is to obtain a 401 k loan This is the better of the two options Not only do you avoid the 10 early withdrawal penalty but the amount you withdraw will not be subject to income tax There are other benefits to a 401 k loan as well

What Is A 401 k Plan 2020 Robinhood

Types Of 401 k Plans Which 401 k Plan Is Right For Your Business

401 k Plans Durham NC Elefante Financial Services

What Is A 401 K Plan And How Does It Work Estradinglife

+Plan+Distribution+Options+Vision+Retirement+financial+planning+investment+advice+tax+planning+consulting+Ridgewood+Bergen+County+NJ+Poughkeepsie+NY+CFP+fiduciary+New+Jersey.png?format=2500w)

Your 401 k Plan Distribution Options Vision Retirement

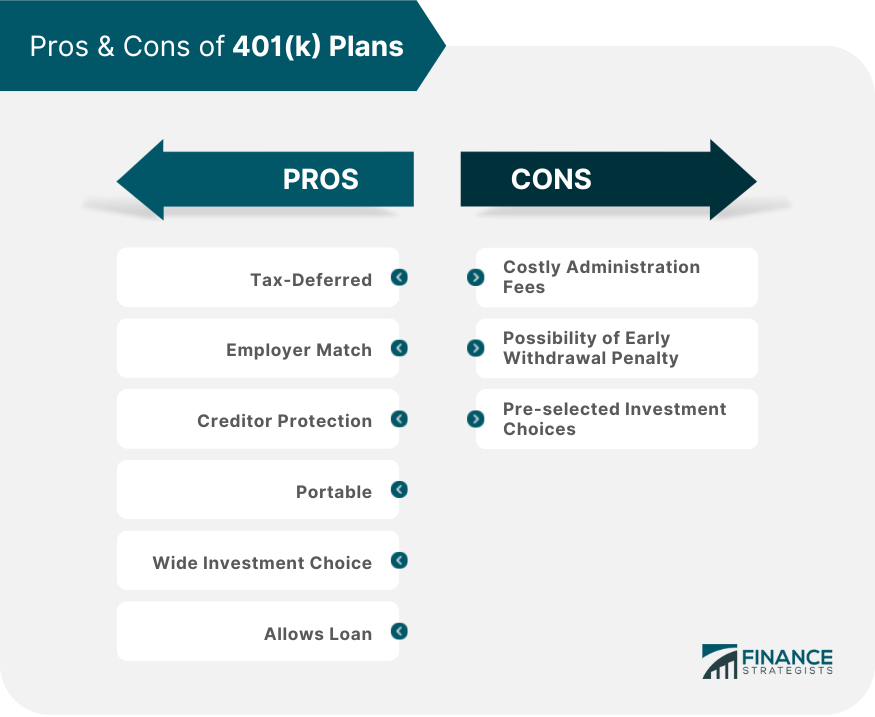

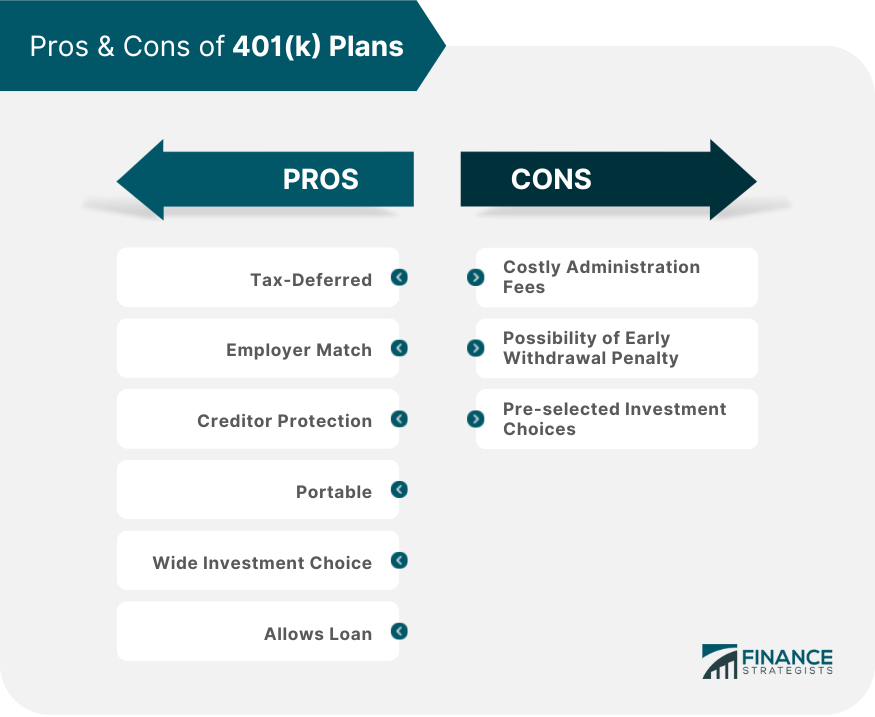

401 k Plan Pros And Cons Finance Strategists

401 k Plan Pros And Cons Finance Strategists

What Is The 401 K Plan How To Be Vested In It Tricky Finance

401 k Plan HRWordGenius

What Is A 401 k Plan 2020 Robinhood

401 K Plan To Buy A House - Take the first step towards buying a house How To Use Your 401 k To Buy A House Individuals with a 401 k have two ways to access their money to purchase a house they can take out a 401 k loan or make an early withdrawal A 401 k loan is taken out against your retirement account You re essentially borrowing money from yourself