401k House Tax Plan Financial Advisors 401 k Tax Rules Withdrawals Deductions More Derek Silva CEPF Patrick Villanova CEPF If you re building your retirement savings 401 k plans are a great option These employer sponsored plans allow you to contribute up to 23 000 in pretax money in 2024 or 22 500 in 2023

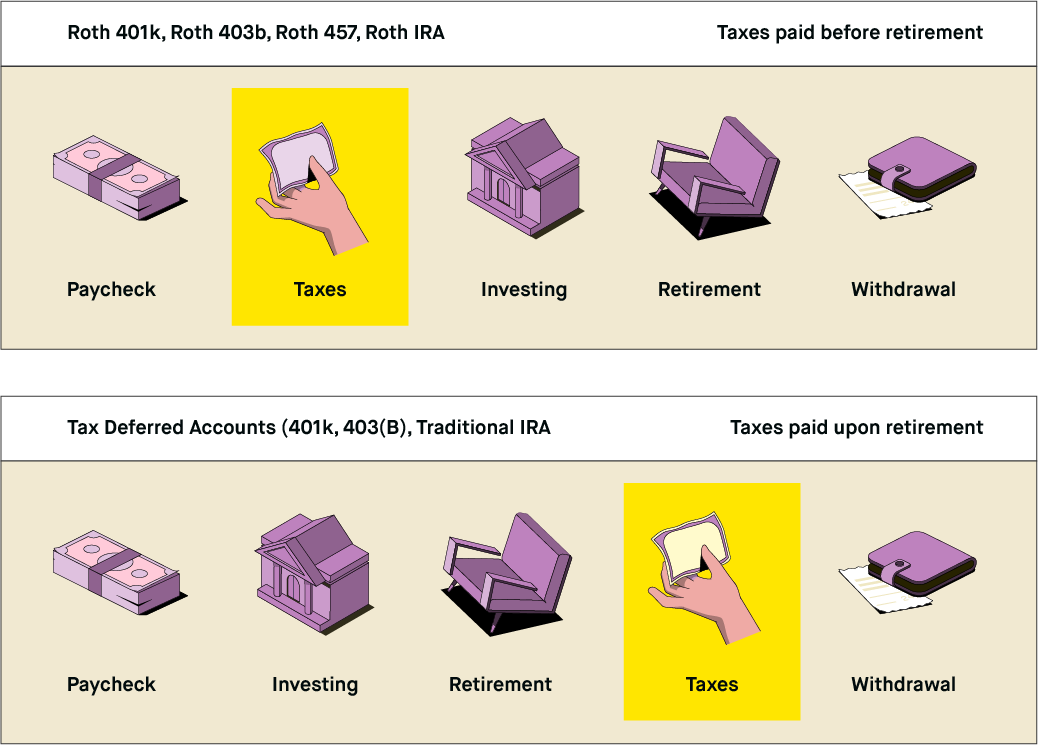

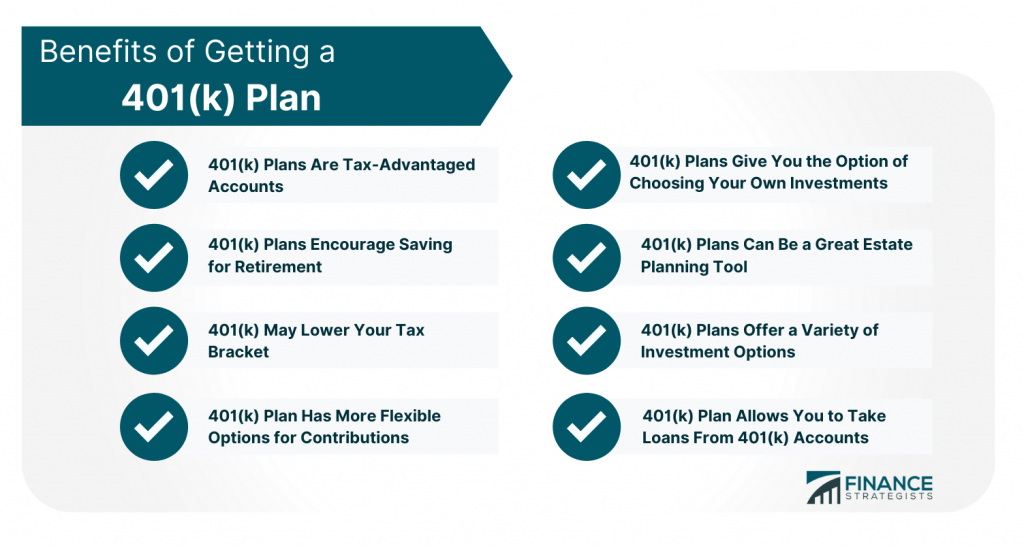

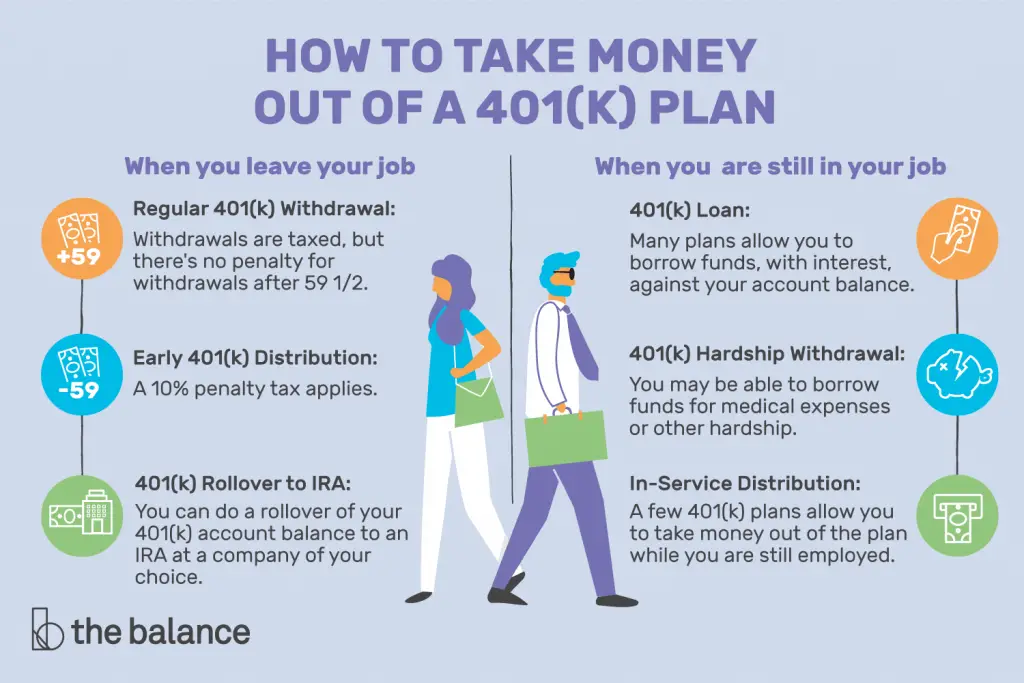

Retirement Plans 401 k Plans 401 k Plans A 401 k is a feature of a qualified profit sharing plan that allows employees to contribute a portion of their wages to individual accounts Elective salary deferrals are excluded from the employee s taxable income except for designated Roth deferrals Employers can contribute to employees accounts A 401 k plan is a powerful tax advantaged tool for retirement savers Employer matches offered by some plans make them even more potent However except in special cases you can t withdraw from your 401 k before age 59 5 Even then you ll usually pay a 10 penalty It s even harder to tap 401 k funds without paying regular income tax

401k House Tax Plan

401k House Tax Plan

https://static.wixstatic.com/media/6d627f_8a011a671005406dbd64ce9b6addf2c1~mv2_d_4220_2808_s_4_2.jpeg/v1/fill/w_1000,h_665,al_c,q_90,usm_0.66_1.00_0.01/6d627f_8a011a671005406dbd64ce9b6addf2c1~mv2_d_4220_2808_s_4_2.jpeg

What Is A 401 k Plan 2020 Robinhood

https://images.ctfassets.net/lnmc2aao6j57/1kivddTqvwypu2AptDbzcF/b928bfa7eec86463ffc1f214ff03f0ea/info_401k_mobile.png

50 Unbelievable Benefits Of 401k You Must Know 2023 Guide

https://static.fmgsuite.com/media/images/5687bb3d-7e50-4b3f-ba3e-f98c1f06b59a.jpg

The funds in your 401 k retirement plan can be tapped to raise a down payment for a house You can either withdraw or borrow money from your 401 k You can either withdraw or borrow money from Simple tax filing for a 50 flat fee powered by Register now Advertiser disclosure 401 k Taxes on Withdrawals and Contributions Contributing to a 401 k could help reduce your taxable

A 401 k plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee s wages to an individual account under the plan The underlying plan can be a profit sharing stock bonus pre ERISA money purchase pension or a rural cooperative plan The Internal Revenue Service IRS limits 401 k loans of 10 000 or 50 of your vested account balance or 50 000 whichever is less The maximum amount you d be able to borrow is 25 000 assuming you re fully vested if your account balance is 50 000 A 401 k loan must be repaid within five years

More picture related to 401k House Tax Plan

House Republicans Plan To Crush Your 401k Alternet

https://www.alternet.org/media-library/image.jpg?id=33243909&width=1245&height=700&quality=85&coordinates=0%2C2%2C0%2C105

What Are The Benefits Of Having 401 k Plan

https://learn.financestrategists.com/wp-content/uploads/Benefits-of-Getting-a-401k-Plan-1024x546.png

Can You Take Loans From 401k Forkesreport

https://www.401kinfoclub.com/wp-content/uploads/how-to-take-money-out-of-a-401k-plan-1024x683.png

Key Takeaways The tax treatment of 401 k distributions depends on the type of plan traditional or Roth Traditional 401 k withdrawals are taxed at an individual s current income tax A 401 k plan is a defined contribution retirement account offered by many companies to their employees Typically employees can make contributions to their 401 k via direct debit from

Tom Brenner for The New York Times WASHINGTON House Democrats on Monday presented a plan to pay for their expansive social policy and climate change package by raising taxes by more than 2 President Joe Biden has proposed changes to 401 k retirement savings plans that will have a big impact on the tax break provided to 401 k participants If the Biden 401 k plan were to become

Hewlett Packard 401k Plan A Brief Review David Waldrop CFP

https://i0.wp.com/www.theastuteadvisor.com/wp-content/uploads/2016/06/Fotolia_110439539_S.jpg

Four Alternative 401 k Plans Due

https://due.com/wp-content/uploads/2021/04/4-types-of-401-k-plans-1024x546.jpg

https://smartasset.com/retirement/401k-tax

Financial Advisors 401 k Tax Rules Withdrawals Deductions More Derek Silva CEPF Patrick Villanova CEPF If you re building your retirement savings 401 k plans are a great option These employer sponsored plans allow you to contribute up to 23 000 in pretax money in 2024 or 22 500 in 2023

https://www.irs.gov/retirement-plans/401k-plans

Retirement Plans 401 k Plans 401 k Plans A 401 k is a feature of a qualified profit sharing plan that allows employees to contribute a portion of their wages to individual accounts Elective salary deferrals are excluded from the employee s taxable income except for designated Roth deferrals Employers can contribute to employees accounts

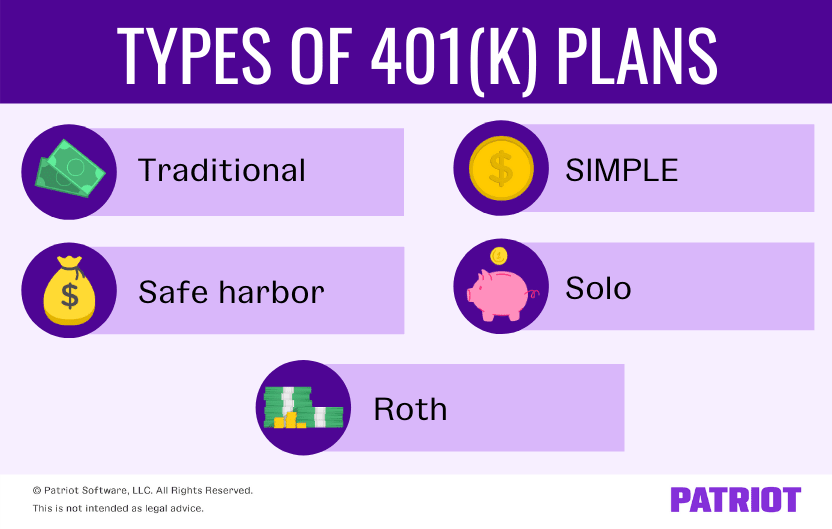

Types Of 401 k Plans Which 401 k Plan Is Right For Your Business

Hewlett Packard 401k Plan A Brief Review David Waldrop CFP

Can You Use Your 401K To Buy A House

401 k Plans What Is A 401 k And How Does It Work

Cash Out Your 401k Plan And Start Investing Part 2 YouTube

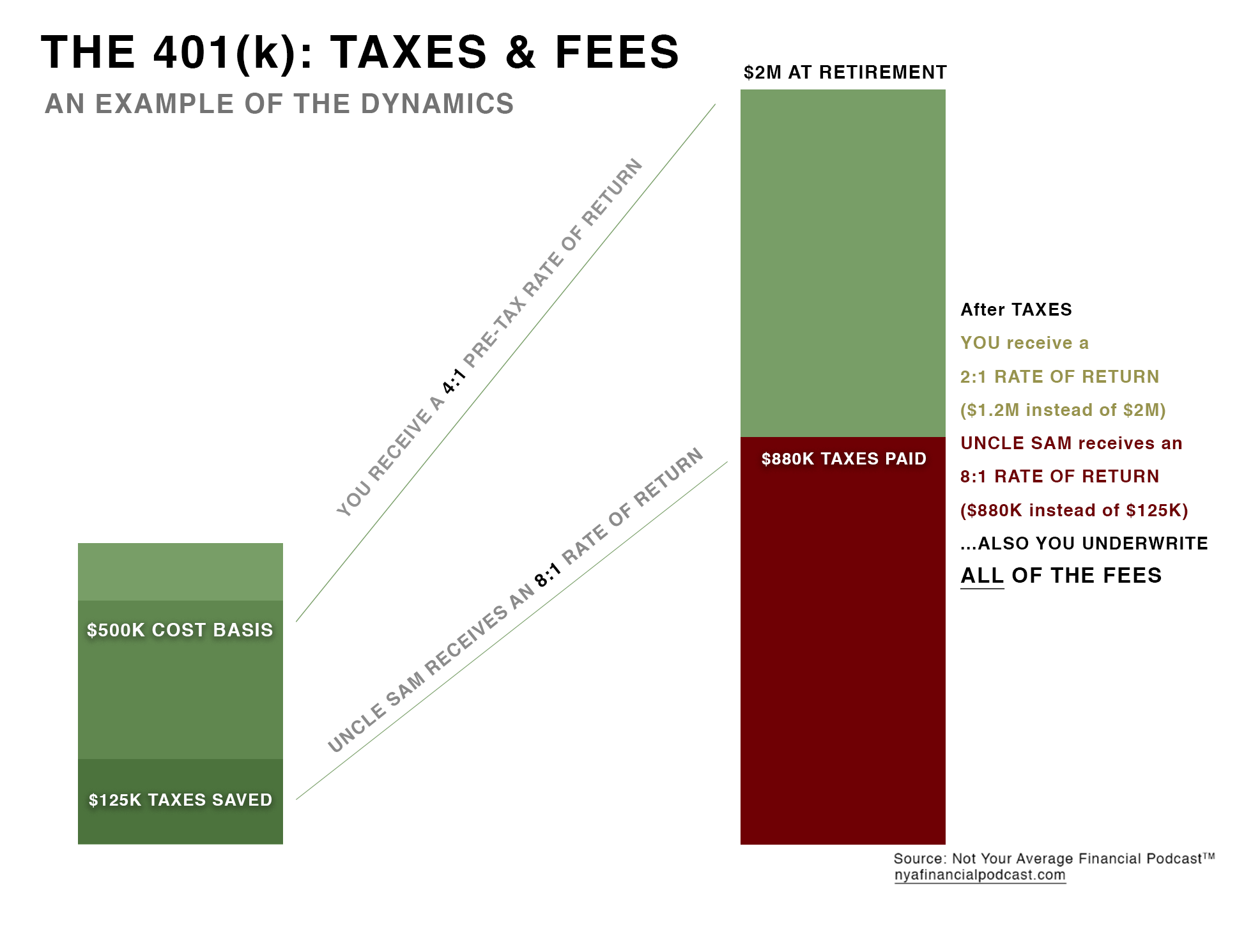

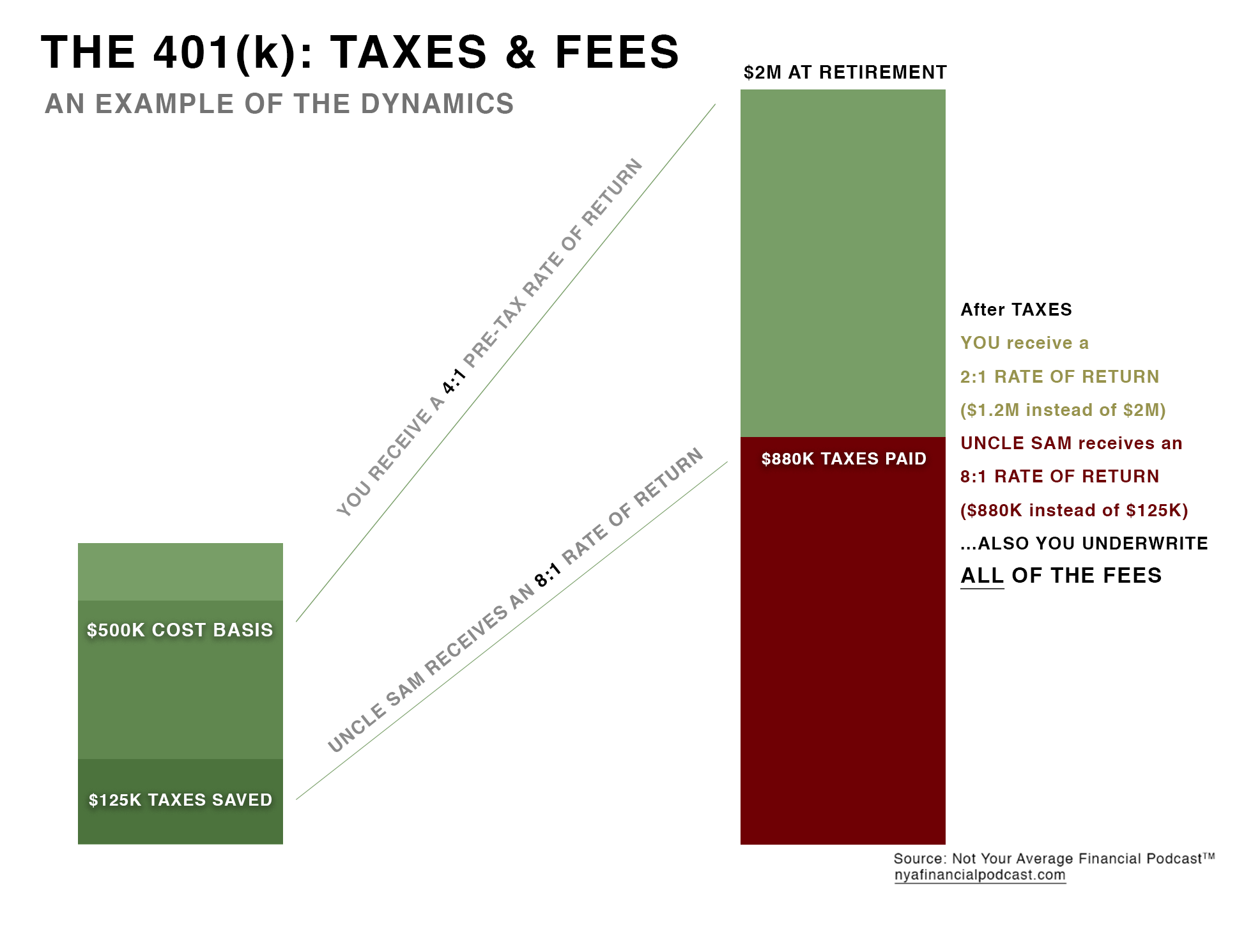

Episode 11 The 401 k How s That Working Out For You

Episode 11 The 401 k How s That Working Out For You

401k And Retirement Plan Limits For The Tax Year 2021

Can You Use Your 401K To Buy A House YouTube

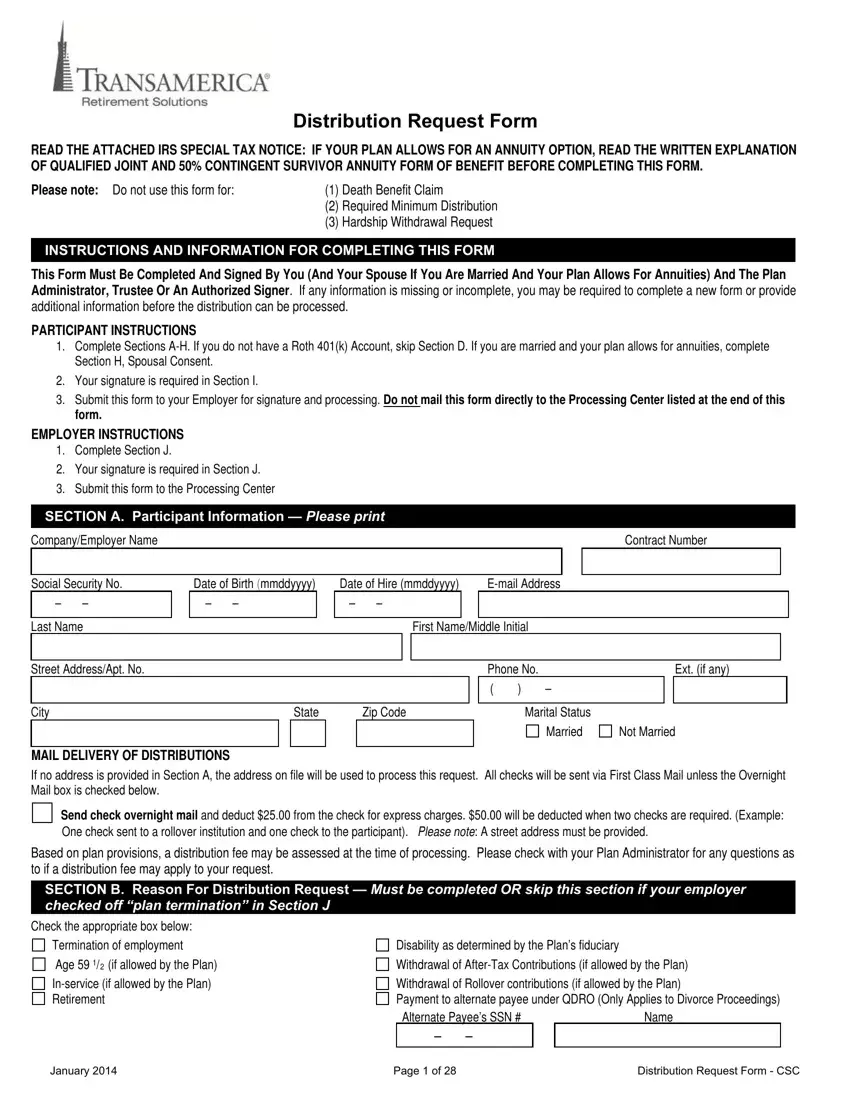

Transamerica 401K Withdrawal Fill Out Printable PDF Forms Online

401k House Tax Plan - The funds in your 401 k retirement plan can be tapped to raise a down payment for a house You can either withdraw or borrow money from your 401 k You can either withdraw or borrow money from