529 Plan Deduct Housing Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses The main tax benefit of a 529 plan is that you can grow your contributions tax free and any withdrawals are tax free as long as you use them for qualifying education expenses Tax deductions may

529 Plan Deduct Housing

529 Plan Deduct Housing

https://districtcapitalmanagement.com/wp-content/uploads/2023/01/Virginia-529-College-Savings-Plan.jpg

Are Contributions To 529 Plans Tax Deductible In Virginia Tax Walls

https://im.morningstar.com/content/CMSImages/9914.png

Investing Retirement Funds Can You Deduct Losses On A 529 Plan YouTube

https://i.ytimg.com/vi/MMYfzOA9FTk/maxresdefault.jpg

How to spend from a 529 college plan The right way reduces taxes avoids penalties and won t jeopardize financial aid Fidelity Viewpoints Key takeaways Withdrawals from 529 plans are not taxed at the federal level as long as you understand and follow all the rules for qualifying expenses Ohio residents can deduct up to 4 000 per beneficiary per year on their state taxes Oklahoma allows individuals to deduct up to 10 000 per year and joint filers to deduct up to 20 000 Oregon gives a tax credit for 529 contributions The credit is up to 300 for joint filers and up to 150 for individuals

No there is no federal income tax deduction for 529 plan contributions regardless of where you live For students living in housing owned and operated by the institution the full invoice amount will be used to determine the qualified room and board expenses For those students living at home or in off campus housing the cost of A 529 plan is an investment plan created to help save for future education expenses Savings from this plan can go toward K 12 education apprenticeship programs or college tuition payments

More picture related to 529 Plan Deduct Housing

Collegiate 529 Plans Taking Distributions Trost Financial

https://trostfinancialconsulting.com/wp-content/uploads/2018/05/shutterstock_1011346417-1.jpg

Are 529 Contributions Tax Deductible In Virginia Tax Walls

https://im.morningstar.com/content/CMSImages/10402.png

Thika Town Today 3T Govt Orders Employers To Deduct 1 5 From Your April Salary To Fund Uhuru

https://2.bp.blogspot.com/-B4PpCALYMG4/XLV-R3g0tmI/AAAAAAAAa0Y/qzWe7yS7jkISZEdvwutan_2YGTg9XOYZgCLcBGAs/w1200-h630-p-k-no-nu/000.jpg

The American Opportunity Credit is worth up to 2 500 for each of the first four years of college and is based on 100 of the first 2 000 spent on qualified education expenses tuition and fees Most states and the District of Columbia have their own 529 plans with varying contribution limits and restrictions Maryland for example allows up to 2 500 individual filer or 5 000

States can set their own limit however Most states do set 529 max contribution limits somewhere between 235 000 and 529 000 Contributions may trigger gift tax consequences if you earmark more A qualified tuition program QTP also referred to as a section 529 plan is a program established and maintained by a state or an agency or instrumentality of a state that allows a contributor either to prepay a beneficiary s qualified higher education expenses at an eligible educational institution or to contribute to an account for paying

Deber a Transferir Los Saldos A Una Tarjeta De Cr dito Sin Intereses

https://www.debt.com/wp-content/uploads/2020/01/Deduct-529-savings-plan-contributions.jpg

You Can Use 529 Funds To Pay For K 12 Private School But Should You Aspyre

https://aspyrewealth.com/wp-content/uploads/2020/07/529-plan.jpg

https://www.kiplinger.com/article/college/t002-c001-s001-paying-for-off-campus-housing-with-a-529-plan.html

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

https://www.savingforcollege.com/article/what-you-can-pay-for-with-a-529-plan

A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses

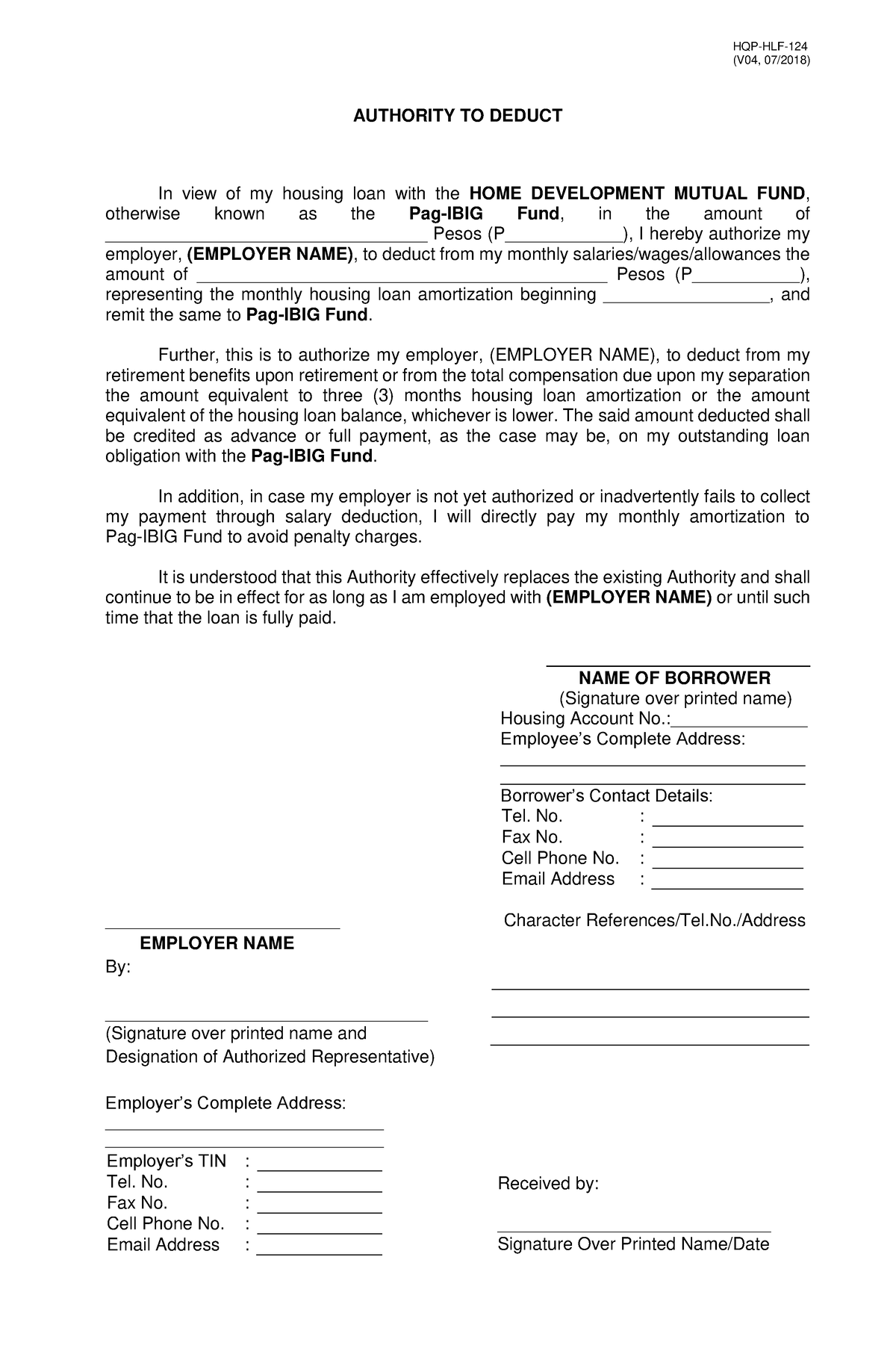

HLF124 Authority To Deduct V04 AUTHORITY TO DEDUCT In View Of My Housing Loan With The HOME

Deber a Transferir Los Saldos A Una Tarjeta De Cr dito Sin Intereses

Deduct Your Home 9780648196617 Frank J Genovesi Boeken Bol

Don t Forget To Deduct TDS On Rent Paid To NRI Section 195 How When To Deduct TDS Form 15CA

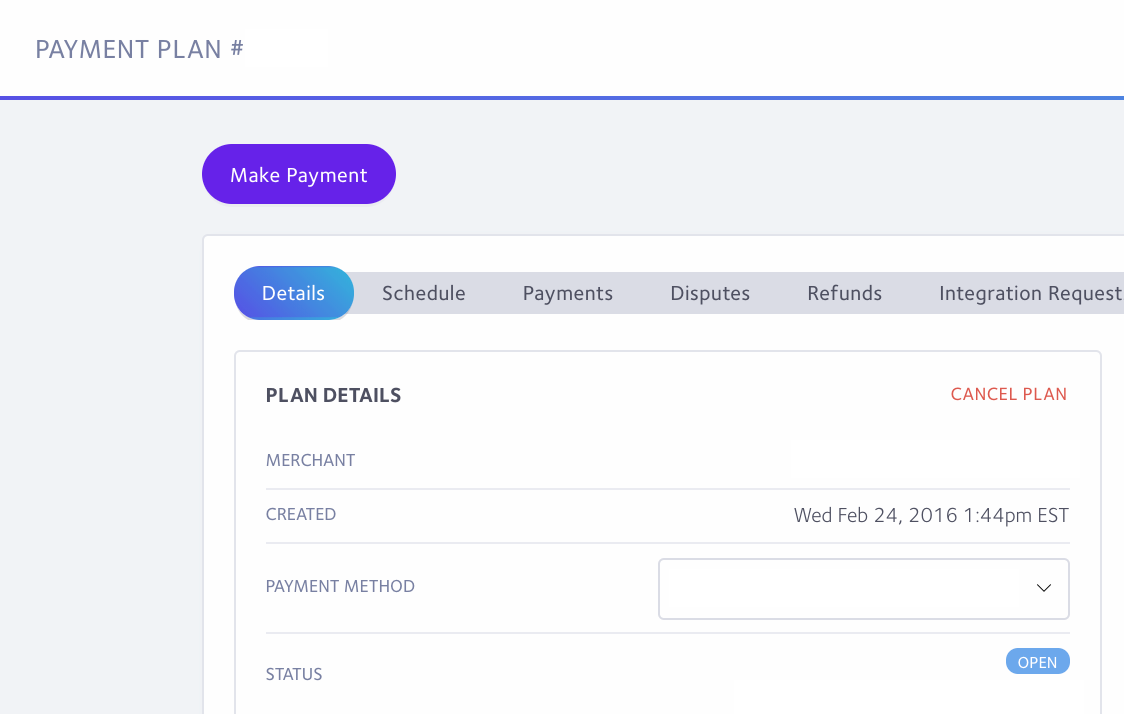

How To Add To Deduct From A Plan

How You Can Deduct Rental Real Estate Losses YouTube

How You Can Deduct Rental Real Estate Losses YouTube

Homedesignsbycygan Iowa College Savings Plan

529 Conference 2016 Distribution Strategies View From The Wirehouses Distribution Strategy

TheBucsAndTheBlues On Twitter Deduct Them Points OfficialPSL

529 Plan Deduct Housing - How to spend from a 529 college plan The right way reduces taxes avoids penalties and won t jeopardize financial aid Fidelity Viewpoints Key takeaways Withdrawals from 529 plans are not taxed at the federal level as long as you understand and follow all the rules for qualifying expenses