529 Plan For Housing Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

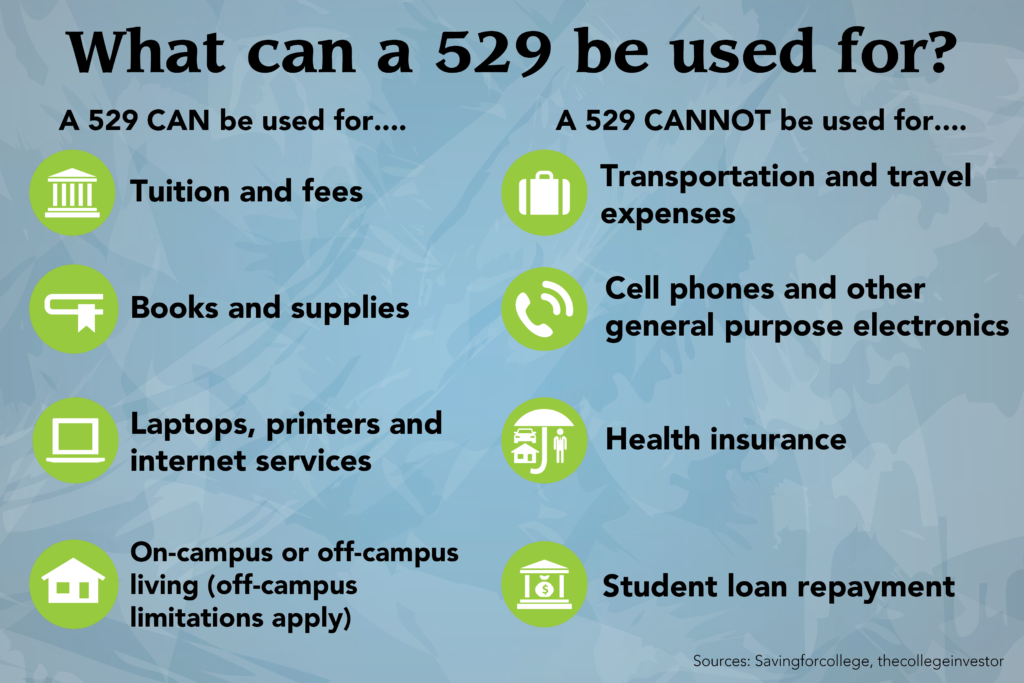

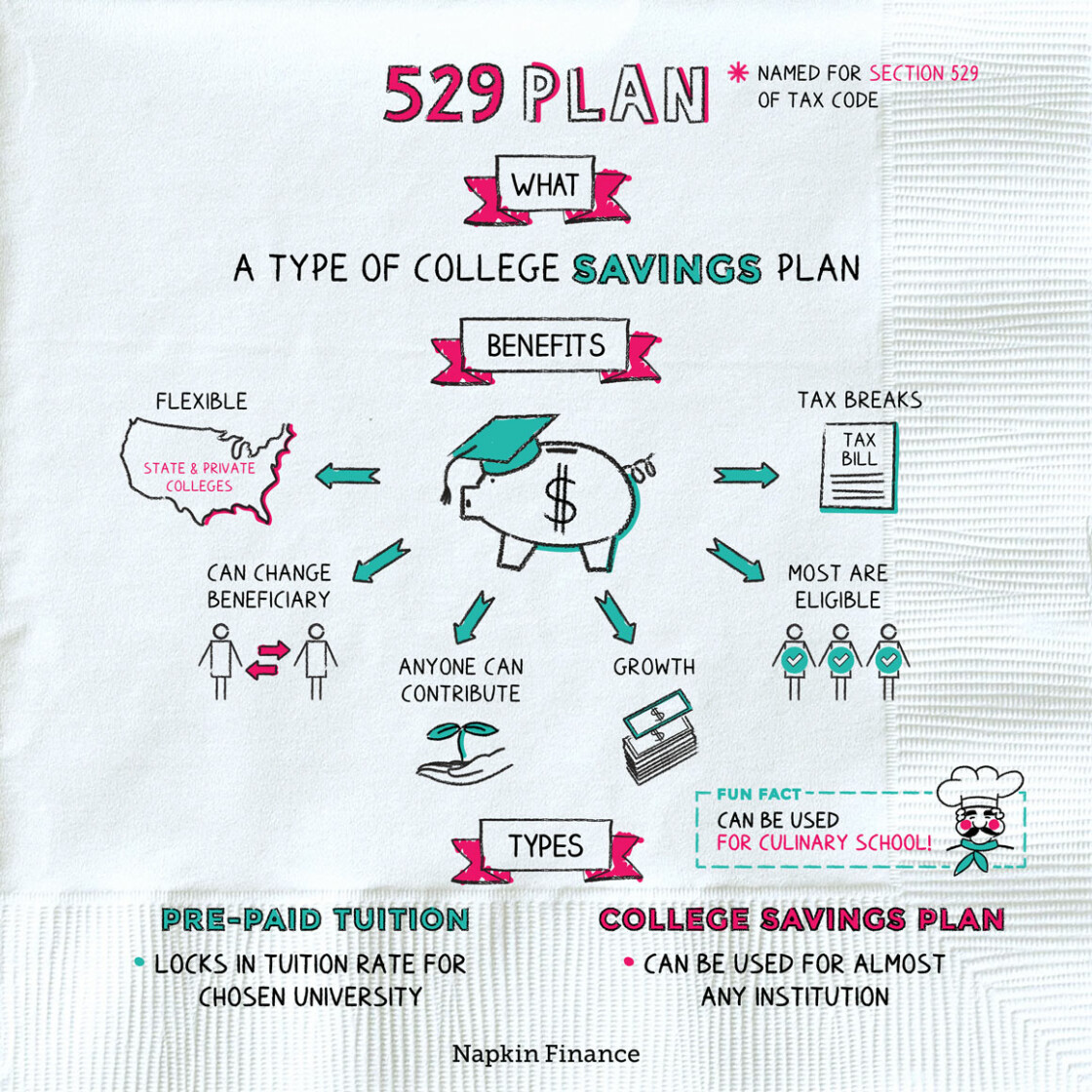

A 529 plan does include off campus rent as long as you re going to college half time for that semester but it only includes rent and utilities up to the amount specified by the college as a room and board allowance A 529 plan is an investment plan created to help save for future education expenses Savings from this plan can go toward K 12 education apprenticeship programs or college tuition payments

529 Plan For Housing

529 Plan For Housing

https://i0.wp.com/morecollegemoney.com/wp-content/uploads/2017/04/529-Plans-2017.jpg?resize=900%2C600&ssl=1

Can 529 Be Used For Rent A Student s Guide ApartmentGuide

https://www.apartmentguide.com/blog/wp-content/uploads/2021/10/what-is-a-529.jpg

What You Need To Know About 529 Plans CNBconnect

https://blog.centralnational.com/wp-content/uploads/2019/09/529-Infographic-1024x683.png

Referring to IRC Section 529 we know that because The actual amount charged if the student is residing in housing owned and operated by the school on campus students can be reimbursed for room and board without regard to the COA allowance A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses

May 29 2019 at 10 43 a m Opening a 529 plan allows parents to achieve tax free college savings for their children But without a full understanding of the 529 plan qualified expenses There is however a lifetime limit of 10 000 in student loan payments that can be made penalty free with 529 funds The SECURE Act s expansion of qualified expenses to include student loans has

More picture related to 529 Plan For Housing

Is A 529 Plan Right For Your Family Federal Employee Education Assistance Fund

https://feea.org/wp-content/uploads/2020/11/529-plan_web.jpeg

529 Plan Comparison Chart

https://wp-media.petersons.com/blog/wp-content/uploads/2018/08/10123950/piktochartlogo.png

529 Plan Rules And Uses Of 529 Plan Advantages And Disadvantages

https://cdn.educba.com/academy/wp-content/uploads/2020/10/529-Plan.jpg

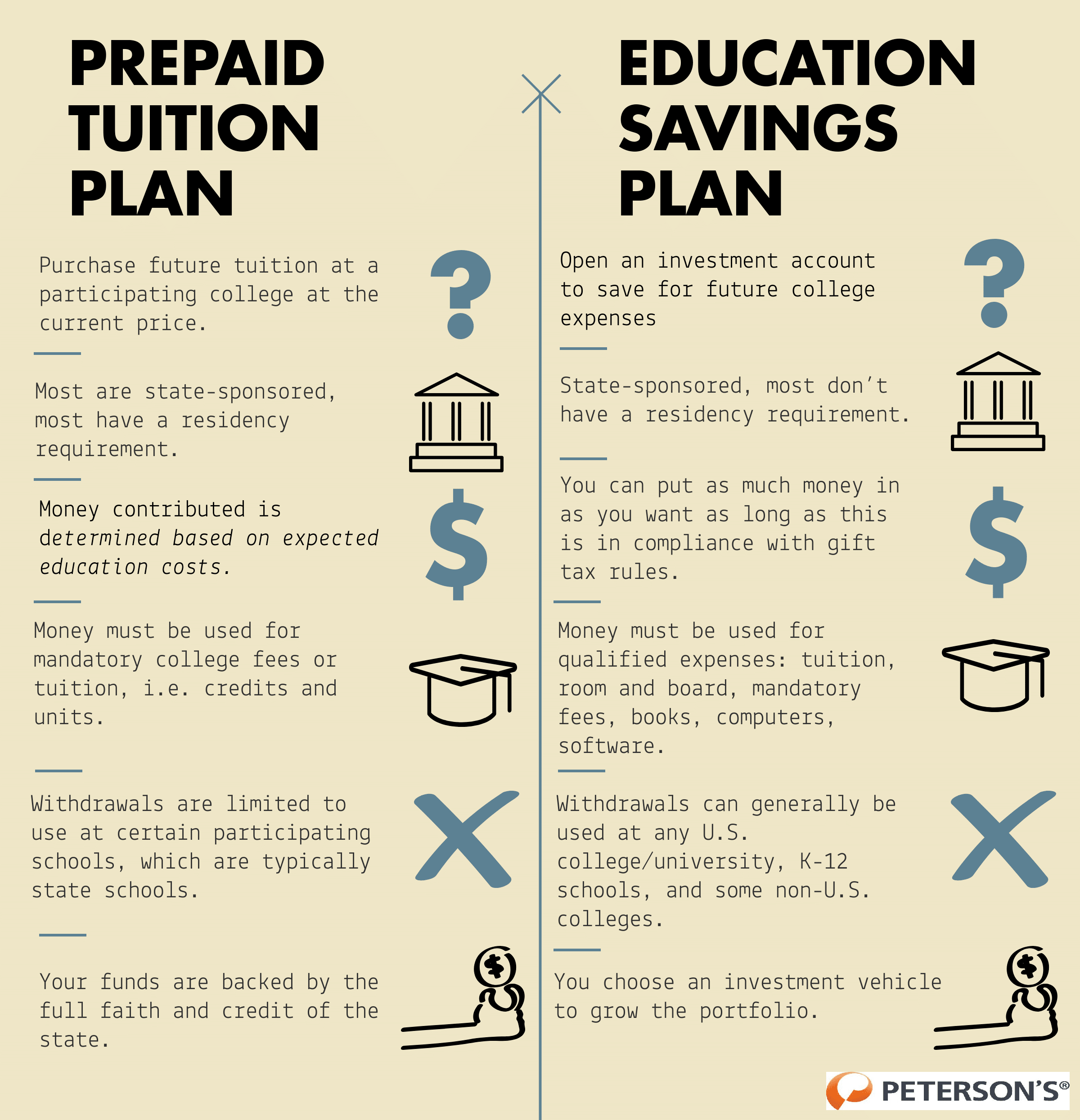

My mother in law has a 529 plan for my son He is going to be living in a rental house off campus with three other students this year Can he use the 529 plan to pay for his portion of the rent food 529 plans are tax advantaged accounts that can be used to pay educational expenses from kindergarten through graduate school There are two basic types of 529 plans educational savings

Housing and living costs 20 000 80 000 Tuition Housing 50 000 200 000 If you had the cost of living 80 000 covered by taking on a job you d have 120 000 to repay vs 200 000 Be vigilant about using loans to pay for living expenses and it may be helpful to write down what you re using the funds for 529 Plan Qualified Expenses Understanding Off Campus Housing Costs 529 plans also known as qualified tuition plans are tax advantaged savings plans designed to help families save for future education costs While these plans are primarily used to cover tuition and fees at accredited colleges and universities they can also be used to pay for

May 29 Is 529 Plan Day Access Wealth

https://access-wealth.com/wp-content/uploads/2020/05/529-m.jpeg

Are You Taking Full Advantage Of Your 529 Plan

https://static.wixstatic.com/media/265f73_a239e6d04de64ed8a7d9c71461a7a7d3~mv2.png/v1/fill/w_1000,h_669,al_c,usm_0.66_1.00_0.01/265f73_a239e6d04de64ed8a7d9c71461a7a7d3~mv2.png

https://www.kiplinger.com/article/college/t002-c001-s001-paying-for-off-campus-housing-with-a-529-plan.html

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

https://www.forrent.com/blog/off-campus-living/529-plan-for-off-campus-housing/

A 529 plan does include off campus rent as long as you re going to college half time for that semester but it only includes rent and utilities up to the amount specified by the college as a room and board allowance

What Is A 529 Plan And What You Need To Know About It Westface College Planning

May 29 Is 529 Plan Day Access Wealth

You Could Use Your 529 Plan If You Have One For Your Student Debt

What Is A 529 Plan Napkin Finance

529 Plans A Simple Honest Guide All Questions Answered

Pennsylvania 529 Plan Review

Pennsylvania 529 Plan Review

All About 529 Plans InfographicBee

529 Plan Millennial Boss

529 Plans 29 Thoughts For 5 29 Lazy Man And Money

529 Plan For Housing - Qualified Educational Housing Expenses Under 529 Plans 529 plan funds can indeed be used to cover housing costs both on and off campus for students during any academic period assuming the student is enrolled at least half time Allowances for how much and how they are used are set by individual schools but certain qualifying restrictions