529 Plan Housing Allowance Part Time You can use your 529 savings to pay eligible expenses at a community college even if your daughter attends part time

Paying for Off Campus Housing with a 529 Plan Kiplinger When you purchase through links on our site we may earn an affiliate commission Here s how it works Home personal finance 14 min Print How to spend from a 529 college plan The right way reduces taxes avoids penalties and won t jeopardize financial aid Fidelity Viewpoints Key takeaways Withdrawals from 529 plans are not taxed at the federal level as long as you understand and follow all the rules for qualifying expenses

529 Plan Housing Allowance Part Time

529 Plan Housing Allowance Part Time

https://access-wealth.com/wp-content/uploads/2020/05/529-m.jpeg

Can 529 Be Used For Rent A Student s Guide ApartmentGuide

https://www.apartmentguide.com/blog/wp-content/uploads/2021/10/what-is-a-529.jpg

A Financial Aid Counseling And Literacy What Is A 529 Savings Plan

https://2.bp.blogspot.com/-DfmLd5QaZSM/W5CaZGeDC_I/AAAAAAAAACQ/d_qTCRz7CQ4Rfup8qgTJEfXpyxyJ9MadACLcBGAs/s1600/Adv.-and-disadv.-of-a-529-Plan-575x768.jpeg

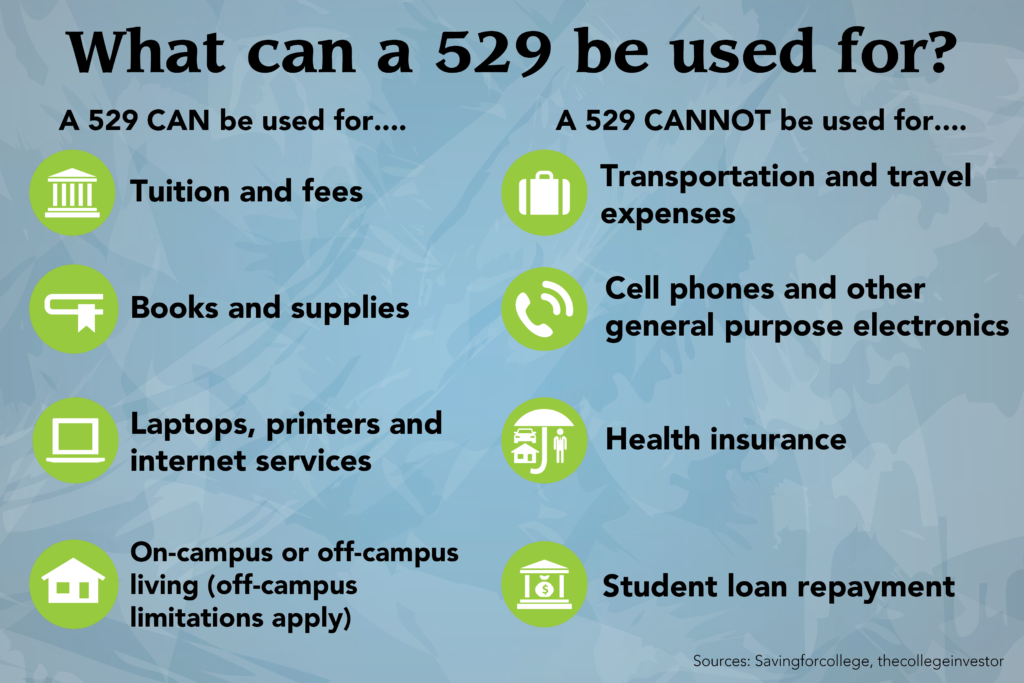

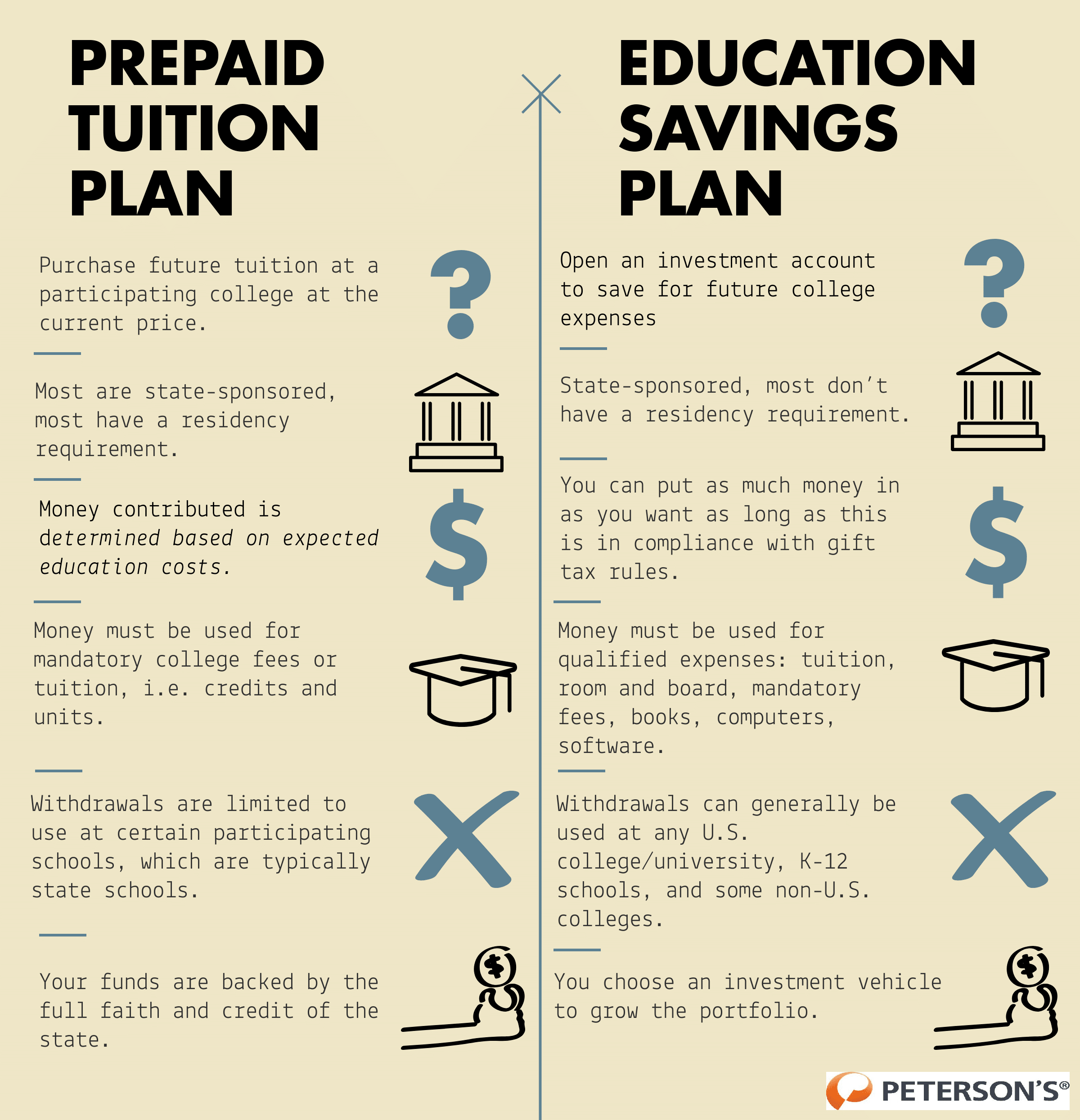

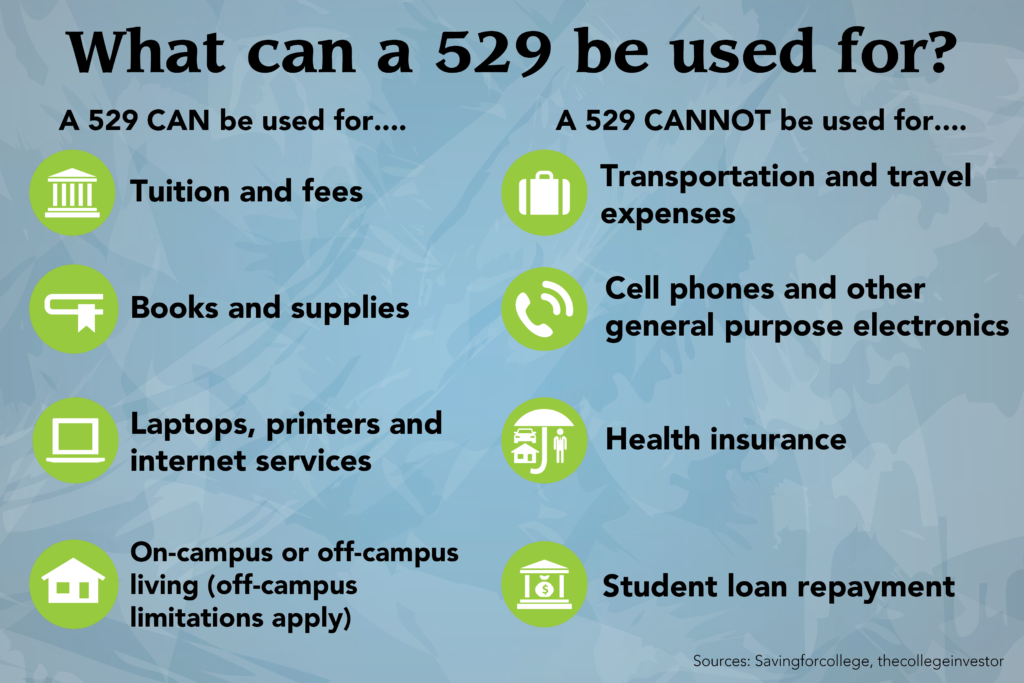

Home Articles 529 Qualified Expenses What Can You Use 529 Money for 529 Qualified Expenses What Can You Use 529 Money for By Martha Kortiak Mert July 27 2023 A 529 plan is a powerful tool that parents and family members can use to save for a child s education For those students living at home or in off campus housing the cost of attendance allowance for the individual institution will be used to determine the qualified room and board expense amount for determining the eligibility of a 529 plan to Roth IRA rollover including tracking and documenting the length of time the 529 plan account

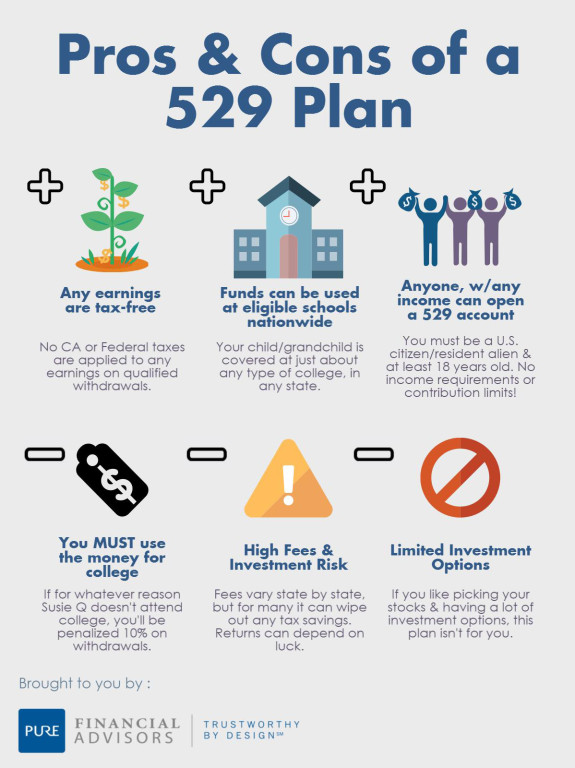

Opening a 529 plan allows parents to achieve tax free college savings for their children But without a full understanding of the 529 plan qualified expenses and potential penalties You may be able to use your child s 529 plan savings to pay for fraternity or sorority housing costs up to the college s room and board allowance amount Still semester dues sometimes more than 1 000 are considered a non qualified expense Other non qualified personal expenses include gym memberships entertainment dates and childcare

More picture related to 529 Plan Housing Allowance Part Time

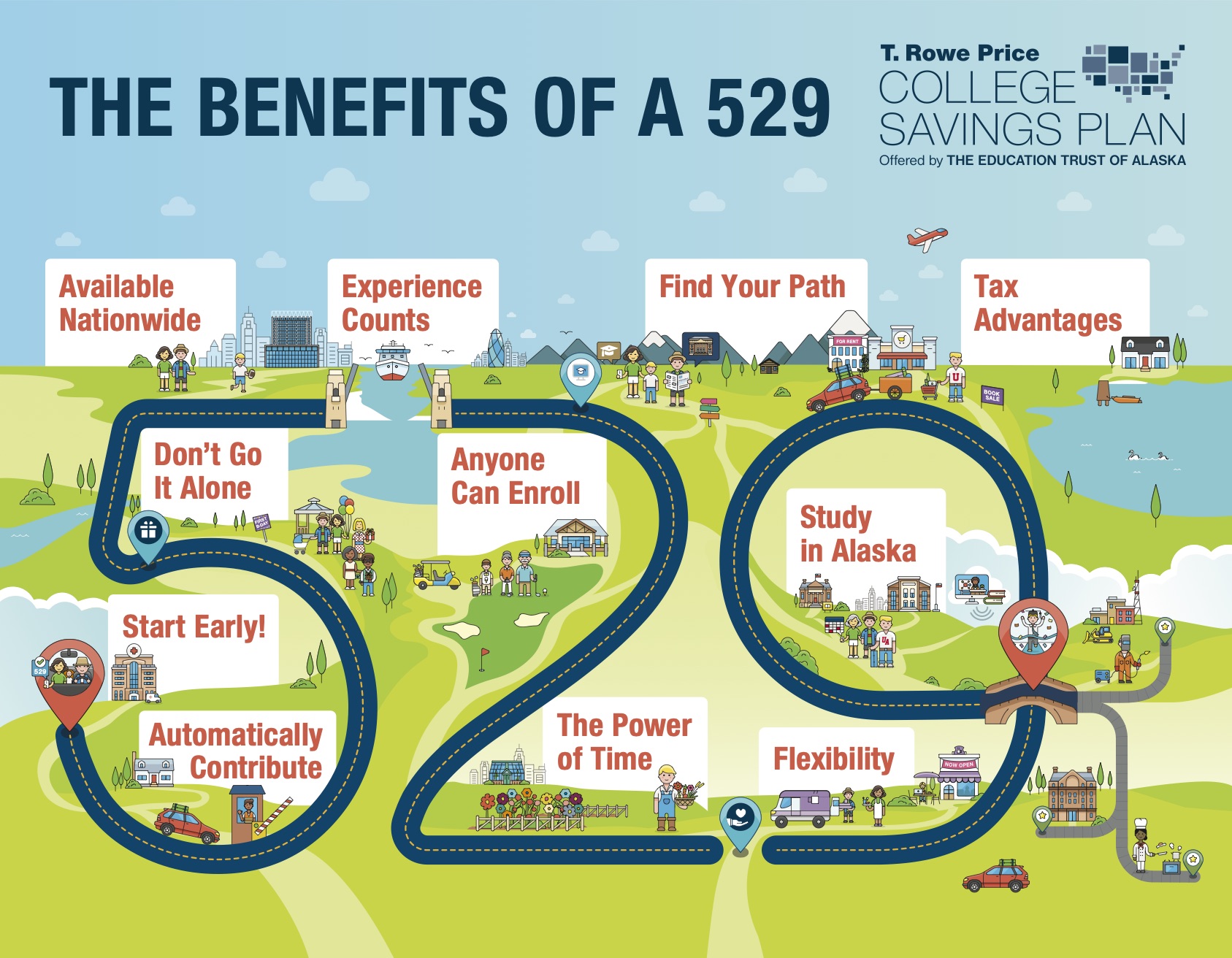

The Benefits Of A 529 Plan INFOGRAPHIC

https://web-resources.savingforcollege.com/images/sponsored-articles/the-benefits-of-a-529-infographic-thumbnail.jpg

Is A 529 Plan Right For Your Family Federal Employee Education Assistance Fund

https://feea.org/wp-content/uploads/2020/11/529-plan_web.jpeg

All About 529 Plans Infographic Presentational ly

https://presentational.ly/i/2021/05/29/10478/big/all-about-529-plans-infographic-091d58.png

In the case of students living at home or in off campus housing the cost of attendance allowance for the individual institution will be used for the qualified room and board expenses for determining the eligibility of a 529 plan to Roth IRA rollover including tracking and documenting the length of time the 529 plan account has been Best Colleges Education Home Qualified Expenses You Can Pay for With a 529 Plan Parents can pay for 529 qualified expenses but not all college costs are covered By Farran Powell and Emma

What Is a 529 Plan 529 plans facilitate planning for higher education by giving high income families a way to set aside money for expenses without facing tax penalties Because 529 plans are managed by states their details vary by location Referring to IRC Section 529 we know that because The actual amount charged if the student is residing in housing owned and operated by the school on campus students can be reimbursed for room and board without regard to the COA allowance

What You Need To Know About 529 Plans CNBconnect

https://blog.centralnational.com/wp-content/uploads/2019/09/529-Infographic-1024x683.png

529 Plan Comparison Chart

https://wp-media.petersons.com/blog/wp-content/uploads/2018/08/10123950/piktochartlogo.png

https://www.kiplinger.com/article/college/t002-c001-s003-529-college-savings-plan-money-part-time-students.html

You can use your 529 savings to pay eligible expenses at a community college even if your daughter attends part time

https://www.kiplinger.com/article/college/t002-c001-s001-paying-for-off-campus-housing-with-a-529-plan.html

Paying for Off Campus Housing with a 529 Plan Kiplinger When you purchase through links on our site we may earn an affiliate commission Here s how it works Home personal finance

What Is A 529 Plan And What You Need To Know About It Westface College Planning

What You Need To Know About 529 Plans CNBconnect

Cross Border Implications Of Holding A 529 Plan Unitymedianews

What Is A 529 Plan The Complete Guide How To Plan 529 Plan Saving For College

529 Plan Rules And Uses Of 529 Plan Advantages And Disadvantages

Are You Taking Full Advantage Of Your 529 Plan

Are You Taking Full Advantage Of Your 529 Plan

529 Plans Archives College Aid Consulting Services

What To Do With Leftover Money In A 529 Plan

If 529 Plans Get Taxed Here s Another Tax free Option

529 Plan Housing Allowance Part Time - The purpose of a 529 plan is straightforward at first glance to provide families with a tax advantaged account for future education expenses But not all education costs are eligible How Can