529 Plan Or Pay Off The House A Dear Alex What you are describing is a viable college savings strategy If everything plays out as you hope you ll be in a comfortable position when your daughter turns 13 and with the mortgage paid off the extra cash flow can then be directed into a 529 plan or other appropriate investment

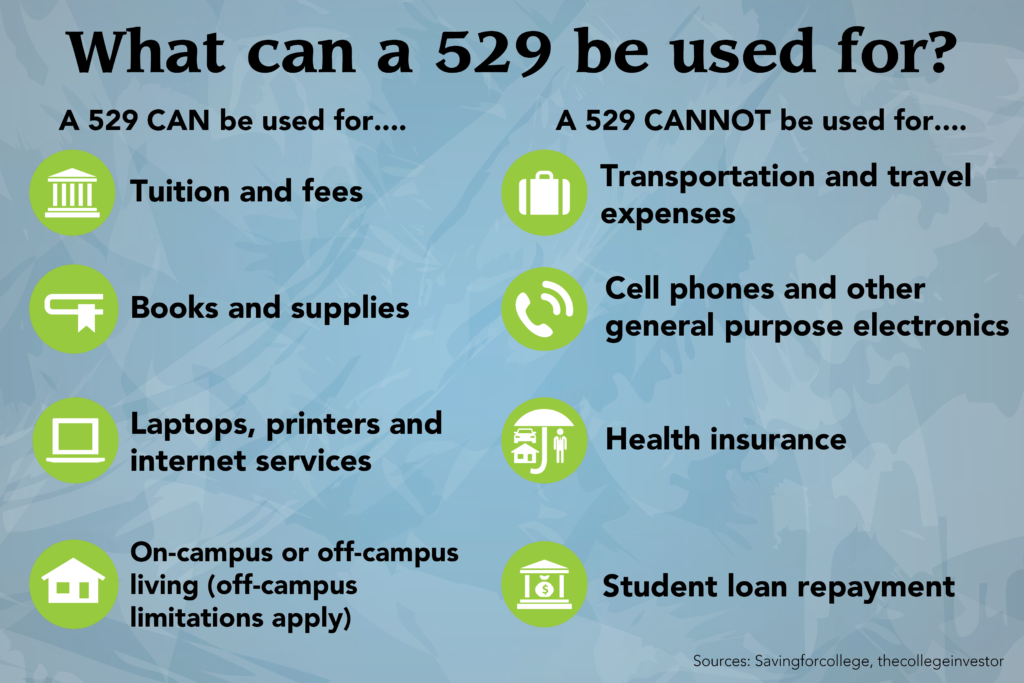

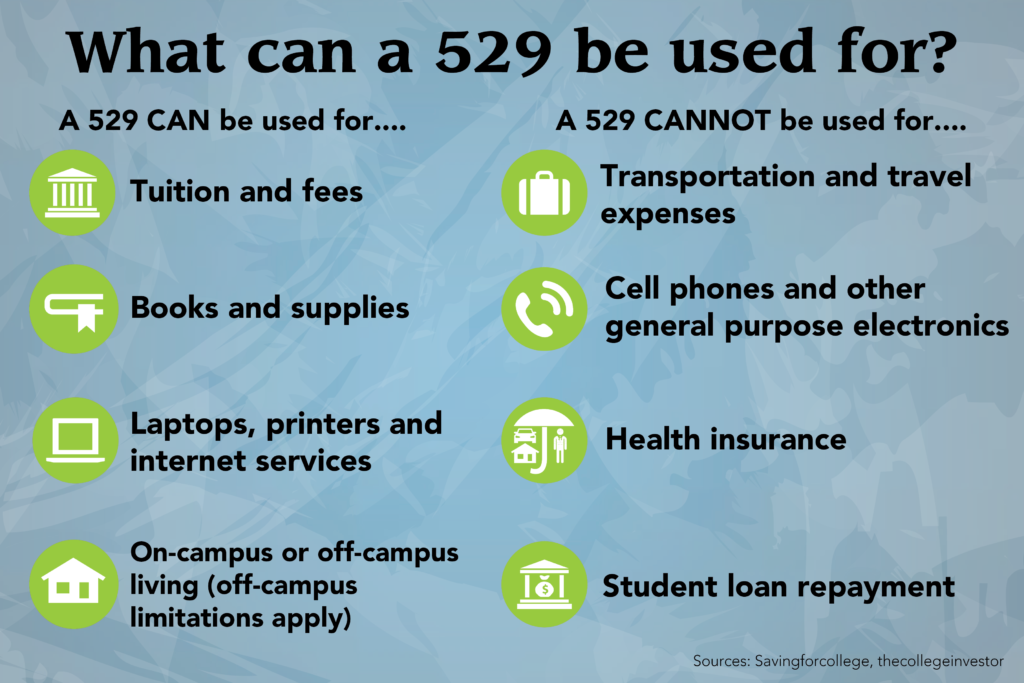

The purpose of a 529 plan is straightforward at first glance to provide families with a tax advantaged account for future education expenses But not all education costs are eligible How Can Paying off your mortgage and contributing to a 529 plan both come with liquidity restrictions says Holeman But in general a 529 account is more liquid than your house

529 Plan Or Pay Off The House

529 Plan Or Pay Off The House

https://blog.centralnational.com/wp-content/uploads/2019/09/529-Infographic-1024x683.png

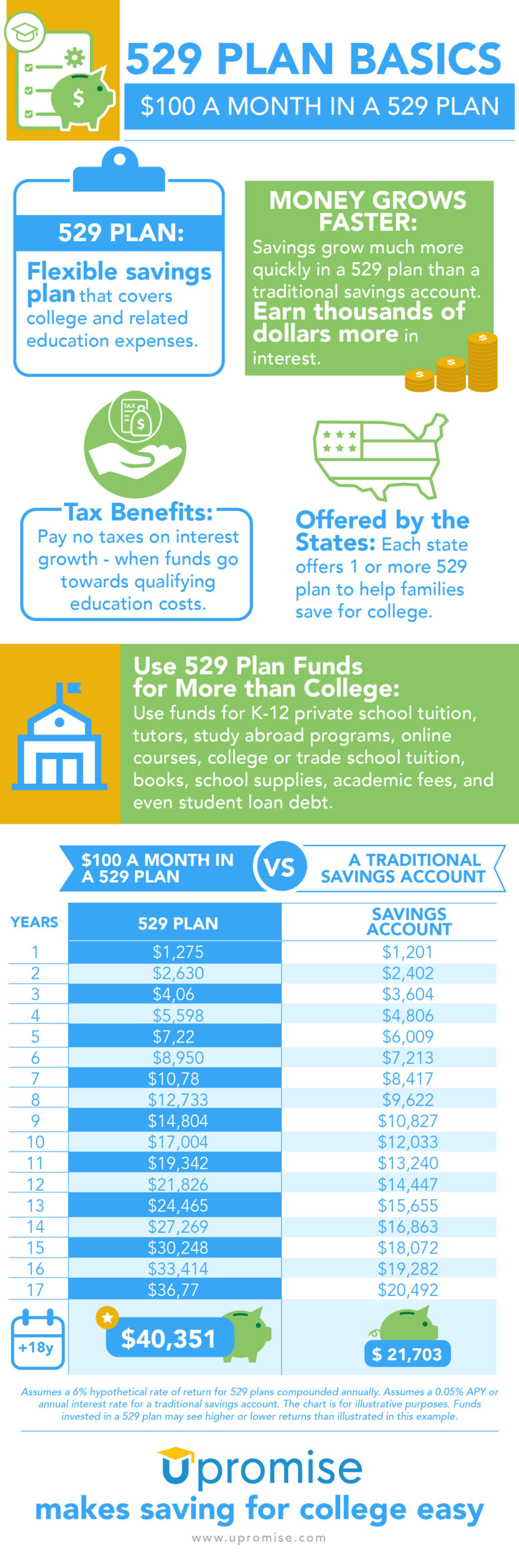

529 Plan Infographic

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/06/529-Plan-Infographic-How-529-Plan-Works-Infographic-Upromise-Rewards-Upromise-makes-saving-for-college-easy-2-scaled.jpg

529 College Savings Plan Tips And Tricks 529 College Savings Plan College Costs Saving For

https://i.pinimg.com/originals/71/ff/e3/71ffe316ea27cb1164cbccee978fcd89.jpg

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the Will you get a better return paying off your mortgage early or investing in a 529 plan The answer depends on your interest rates If the interest rate on your mortgage is very low it may be better to save for college in a 529 plan that earns a higher rate of interest

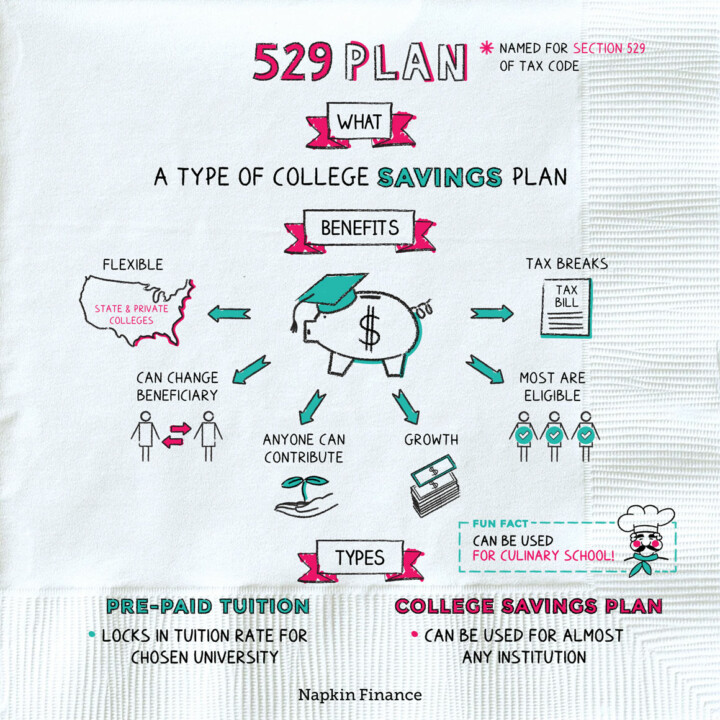

July 27 2023 A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses A 529 plan is a tax advantaged account that can be used to pay for qualified education costs including college K 12 and apprenticeship programs Starting in 2024 a specified amount of

More picture related to 529 Plan Or Pay Off The House

Why A 529 Savings Plan Is The Best Way To Save For College

https://www.moneypeach.com/wp-content/uploads/2020/03/529-Plan-Pinterest.png

Tipps Bringen Hervorheben Benefits Of 529 Plan Kommunismus Junge Dame Mikrocomputer

https://529-planning.com/wp-content/uploads/2020/12/GettyImages-182175346-5c4e721dc9e77c0001d7bb0f.jpg

What Is A 529 Plan Napkin Finance

https://napkinfinance.com/wp-content/uploads/2018/07/NapkinFinance-529Plan-Napkin-02-26-19-v05-1-720x720.jpg

In a worst case scenario as much as 5 64 of the 529 plan account s value will count against your son s aid eligibility i e 1 692 on 30 000 in assets But Congress is likely to pass legislation that will ignore all assets on the FAFSA by the time your son enrolls in college I just sold my house and moved in with my new husband Your 529 money can also be spent on expenses for K 12 education up to 10 000 per student each year But not every state will recognize elementary and secondary school expenses as qualified

You can also use your 529 plan money to fund room and board for a beneficiary enrolled at least half time However the price you pay can t exceed the estimated costs of on campus housing determined by the college You can usually get this information from the school s financial aid office or its website 1 Are Contributions to a 529 Plan Tax Deductible 2 What is a New York 529 Plan 3 What Are Qualified Expenses for a 529 Plan A 529 plan is a tax advantaged college savings

Can A 529 Plan Pay For Preschool Intrepid Eagle Finance

https://static.twentyoverten.com/5d5413591d304774fba39eb3/VjVVaWme3rU/Can-a-529-Plan-Pay-for-Preschool.jpg

Pennsylvania 529 Plan Review

https://mljw3yedita9.i.optimole.com/w:auto/h:auto/q:mauto/f:avif/https://i0.wp.com/madimanagesmoney.com/wp-content/uploads/2023/02/PA-529-PLAN.png

https://www.savingforcollege.com/questions-answers/article/paying-off-debt-versus-a-529-plan

A Dear Alex What you are describing is a viable college savings strategy If everything plays out as you hope you ll be in a comfortable position when your daughter turns 13 and with the mortgage paid off the extra cash flow can then be directed into a 529 plan or other appropriate investment

https://www.forbes.com/advisor/student-loans/qualified-expenses-529-plan/

The purpose of a 529 plan is straightforward at first glance to provide families with a tax advantaged account for future education expenses But not all education costs are eligible How Can

How Much Should You Have In A 529 Plan By Age

Can A 529 Plan Pay For Preschool Intrepid Eagle Finance

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2020 My Money Blog

Can A 529 Plan Pay For Private Elementary School Sootchy

Backer Review Making Your 529 Plan Accessible 529 College Savings Plan Saving For College

Determining The Best 529 Plan For You Davidlerner

Determining The Best 529 Plan For You Davidlerner

Can I Use A 529 Plan To Pay Off My Student Loans Nj

Four Mistakes You Might Be Making With A 529 Plan

The 529 Savings Plan The New Dispatch

529 Plan Or Pay Off The House - The act allows the beneficiary of a 529 account to pay off up to a lifetime limit of 10 000 in student loans The money can be withdrawn and paid to the lender extinguishing the debt The act