529 Plan Pay For Housing Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

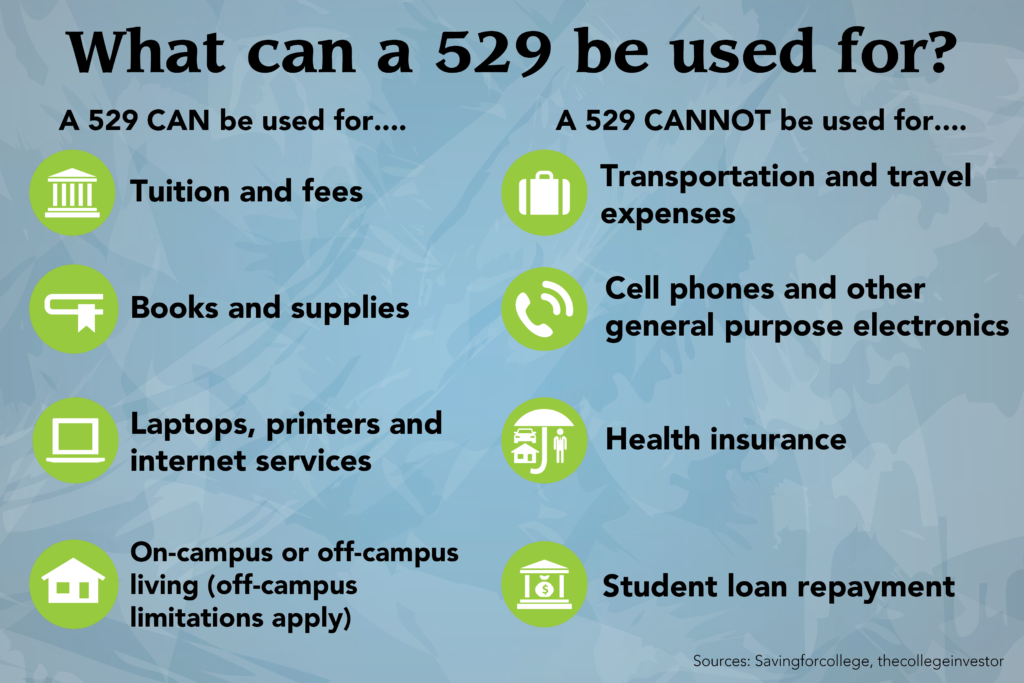

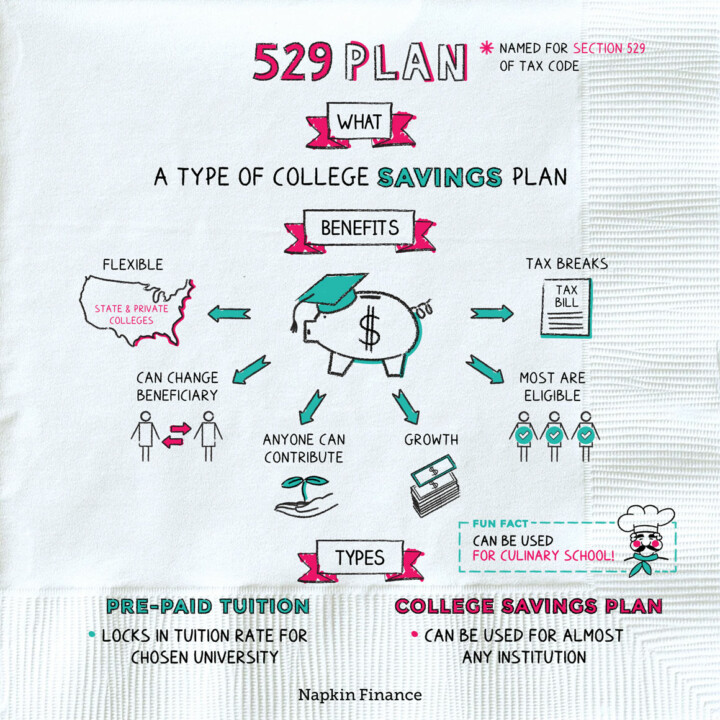

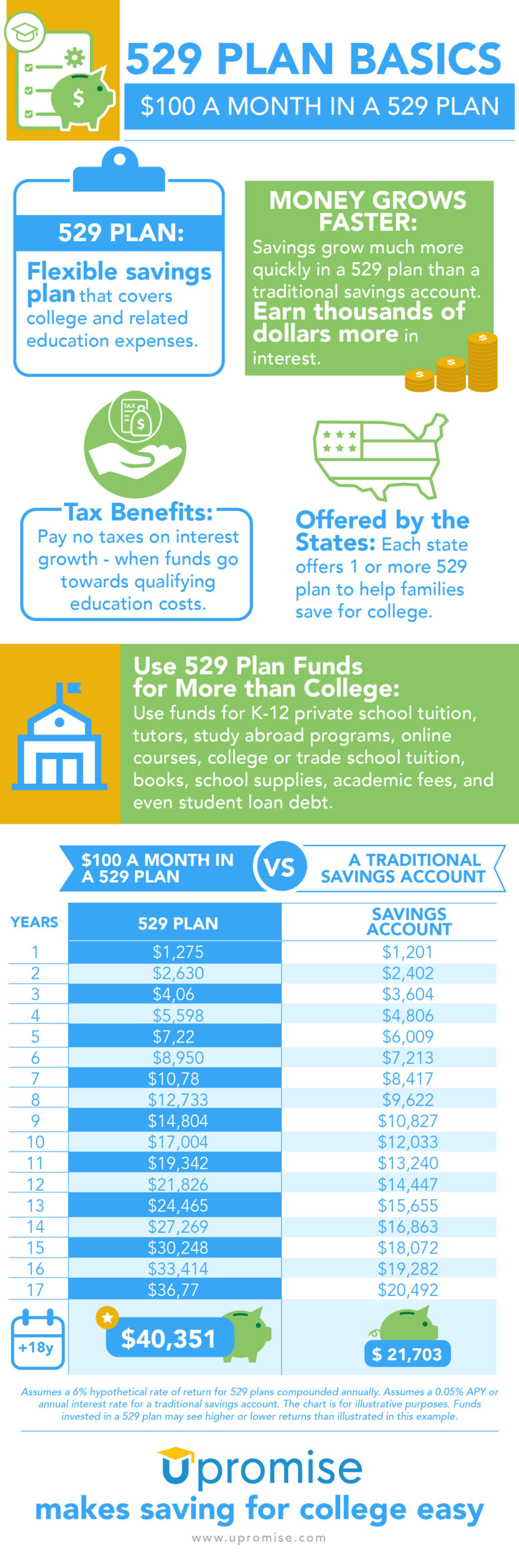

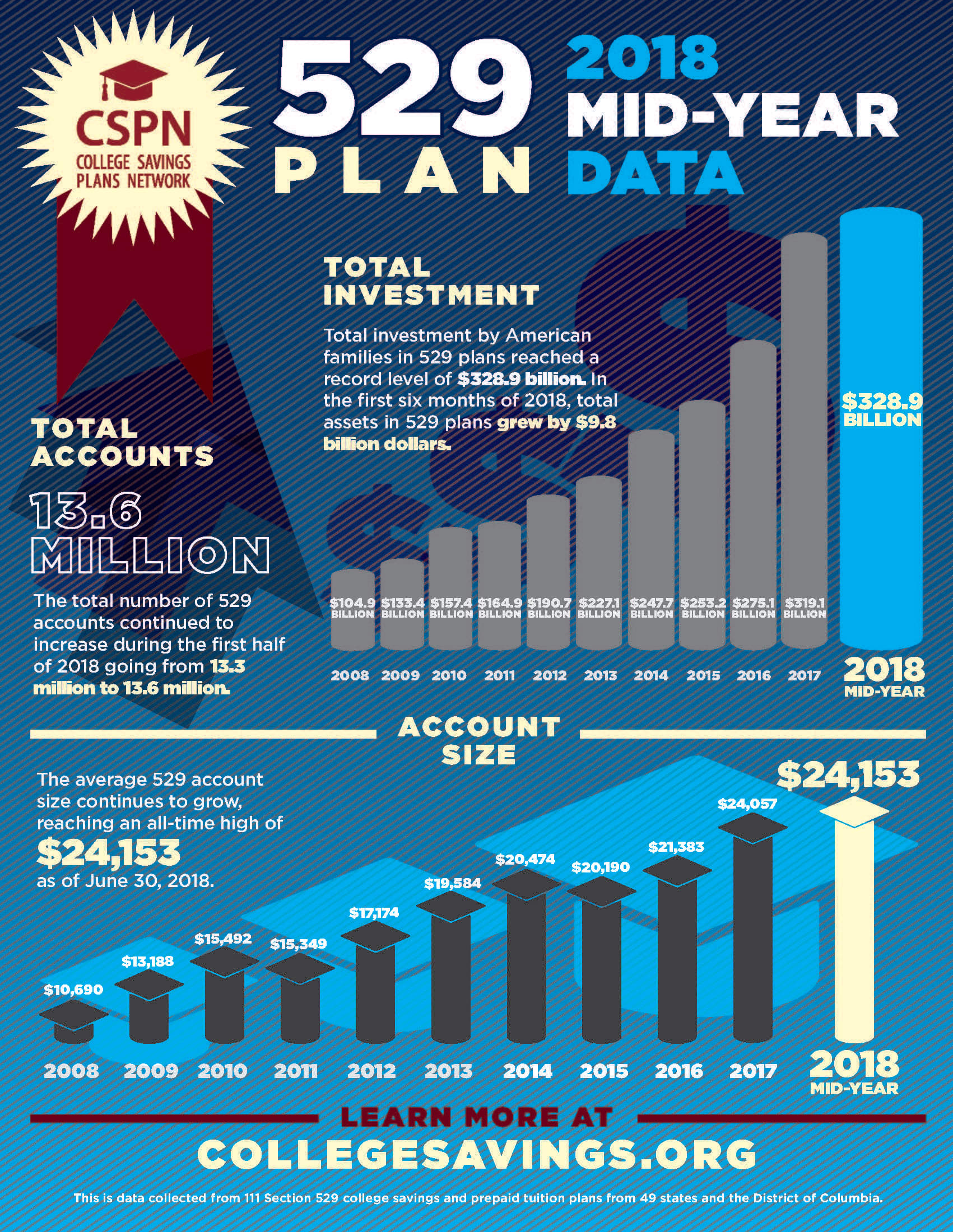

A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses A 529 plan is an investment plan created to help save for future education expenses Savings from this plan can go toward K 12 education apprenticeship programs or college tuition payments

529 Plan Pay For Housing

529 Plan Pay For Housing

http://www.carsonwealth.com/wp-content/uploads/2015/06/529-Plans-Infographic-e1434750644953.jpg

529 Plan Infographic

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/06/529-Plan-Infographic-How-529-Plan-Works-Infographic-Upromise-Rewards-Upromise-makes-saving-for-college-easy-2-scaled.jpg

529 College Savings Plan Tips And Tricks 529 College Savings Plan College Costs Saving For

https://i.pinimg.com/originals/71/ff/e3/71ffe316ea27cb1164cbccee978fcd89.jpg

The purpose of a 529 plan is straightforward at first glance to provide families with a tax advantaged account for future education expenses But not all education costs are eligible How Can The short answer is Yes room and board expenses for off campus housing including a parent s home may be reimbursed through a 529 plan but not necessarily the full cost

Housing and living costs 20 000 80 000 Tuition Housing 50 000 200 000 If you had the cost of living 80 000 covered by taking on a job you d have 120 000 to repay vs 200 000 Be vigilant about using loans to pay for living expenses and it may be helpful to write down what you re using the funds for Parents can pay for 529 qualified expenses but not all college costs are covered You can pay for room and board with a 529 housing costs meal plan things like that Lee says Off

More picture related to 529 Plan Pay For Housing

What You Need To Know About 529 Plans CNBconnect

https://blog.centralnational.com/wp-content/uploads/2019/09/529-Infographic-1024x683.png

What Is A 529 Plan Napkin Finance

https://napkinfinance.com/wp-content/uploads/2018/07/NapkinFinance-529Plan-Napkin-02-26-19-v05-1-720x720.jpg

Why A 529 Savings Plan Is The Best Way To Save For College

https://www.moneypeach.com/wp-content/uploads/2020/03/529-Plan-Pinterest.png

May 29 2019 at 10 43 a m Opening a 529 plan allows parents to achieve tax free college savings for their children But without a full understanding of the 529 plan qualified expenses and The stated on campus housing and meal plan allowance at UW is 3 000 for a 3 month term 1 000 per month Wendy has chosen to live off campus and spends 1 500 per month on rent and groceries Thus the 529 account can reimburse her for up to 1 000 Wendy will need to cover the remaining 500 out of pocket

A 529 plan does include off campus rent as long as you re going to college half time for that semester but it only includes rent and utilities up to the amount specified by the college as a room and board allowance My mother in law has a 529 plan for my son He is going to be living in a rental house off campus with three other students this year Can he use the 529 plan to pay for his portion of the rent food

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

529 Plan Contribution Limits In 2023

https://www.investopedia.com/thmb/GepQiraogYwUTtMhxzD48_BlGPk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg

Tipps Bringen Hervorheben Benefits Of 529 Plan Kommunismus Junge Dame Mikrocomputer

https://529-planning.com/wp-content/uploads/2020/12/GettyImages-182175346-5c4e721dc9e77c0001d7bb0f.jpg

https://www.kiplinger.com/article/college/t002-c001-s001-paying-for-off-campus-housing-with-a-529-plan.html

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

https://www.savingforcollege.com/article/what-you-can-pay-for-with-a-529-plan

A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses

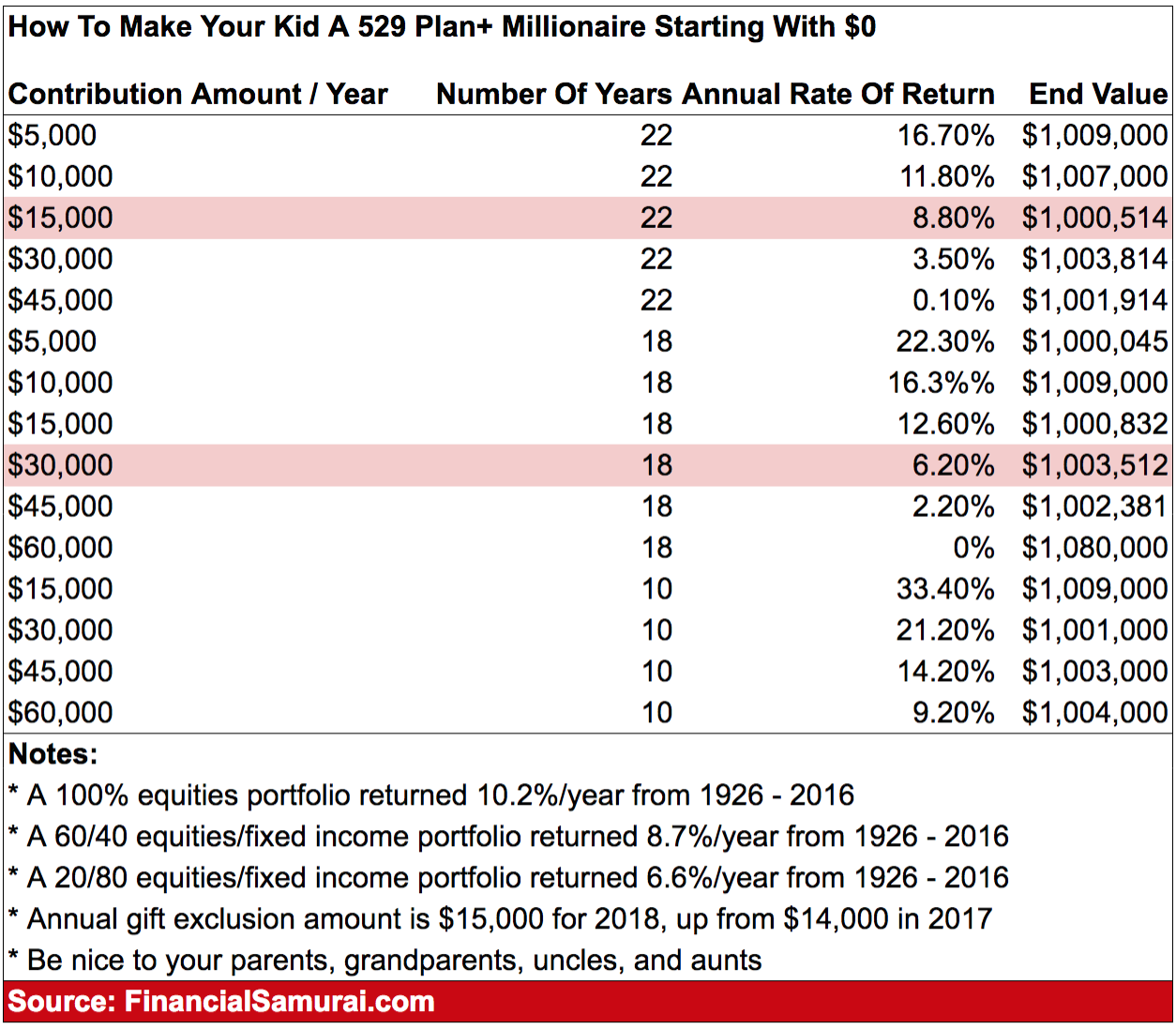

The Making Of 529 Child Millionaires To Pay For Tuition Financial Samurai

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

529 Plan Contribution Limits In 2023

Understanding 529 Plan Qualified Expenses For Off Campus Housing House Plans

Is Your 529 Savings Plan In The Red Here s What To Do

Can A 529 Plan Pay For Preschool Intrepid Eagle Finance

Backer Review Making Your 529 Plan Accessible 529 College Savings Plan Saving For College

Backer Review Making Your 529 Plan Accessible 529 College Savings Plan Saving For College

Tax Smart 529 Education Savings Plans Eco Tax Inc

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2020 My Money Blog

Can A 529 Plan Pay For Private Elementary School Sootchy

529 Plan Pay For Housing - Parents can pay for 529 qualified expenses but not all college costs are covered You can pay for room and board with a 529 housing costs meal plan things like that Lee says Off