529 Plan Reimbursement For Off Campus Housing July 27 2023 Room and board costs make up a large portion of a student s total college bill second only to tuition You can use a 529 plan to pay for room and board but only if certain requirements are met Room and board include the cost of housing and the cost of a meal plan

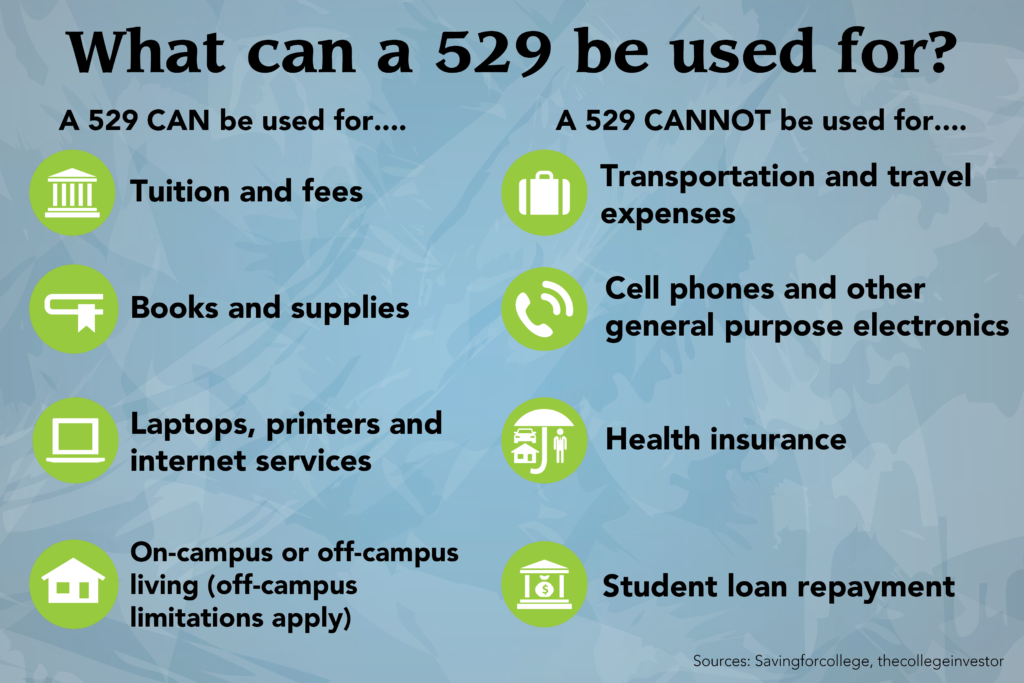

The short answer is Yes room and board expenses for off campus housing including a parent s home may be reimbursed through a 529 plan but not necessarily the full cost The definition of qualified higher education expenses for 529 plan purposes also includes up to 10 000 per year in tuition for K 12 schools and up to 10 000 in student loan repayments Here is a list of common educational expenses and their qualification status

529 Plan Reimbursement For Off Campus Housing

529 Plan Reimbursement For Off Campus Housing

https://unitymedianews.com/wp-content/uploads/2021/06/529-Plan.jpg

529 Plan Reimbursements For Off Campus Housing

https://www.glassjacobson.com/wp-content/uploads/2020/09/529-plan_stock.jpg

May 29 Is 529 Plan Day Access Wealth

https://access-wealth.com/wp-content/uploads/2020/05/529-m.jpeg

A 529 plan does include off campus rent as long as you re going to college half time for that semester but it only includes rent and utilities up to the amount specified by the college as a room and board allowance Off campus room and board 529 plan allowable claim amount My son lived on campus for the first year and is going to live off campus starting this fall The CLA estimate listed on the school website for 2022 2023 is a lot lower than the actual amount charged to us for the school year 2021 2022

All off campus housing expenses that fall within the budget qualify for 529 reimbursement This budget costs can include rent utilities and food The precise value of the room and board allowance is specific to each school and each school year Features What to Know About Reimbursements From 529 Plans You can withdraw money tax free for tuition required books and fees and even a computer and related software Image credit This

More picture related to 529 Plan Reimbursement For Off Campus Housing

What You Need To Know About 529 Plans CNBconnect

https://blog.centralnational.com/wp-content/uploads/2019/09/529-Infographic-1024x683.png

529 Plan Comparison Chart

https://wp-media.petersons.com/blog/wp-content/uploads/2018/08/10123950/piktochartlogo.png

How To Maximize College Savings With A Savvy 529 Plan

https://moneyfitmoms.com/wp-content/uploads/2021/05/529-Plan-Saving-for-College-2.jpg

Learn how to navigate 529 plan qualified expenses like laptops and off campus housing By Andrea Williams and Emma Kerr May 29 2019 at 10 43 a m Opening a 529 plan allows parents You may be able to use your child s 529 plan savings to pay for fraternity or sorority housing costs up to the college s room and board allowance amount Still semester dues sometimes more than 1 000 are considered a non qualified expense Other non qualified personal expenses include gym memberships entertainment dates and childcare

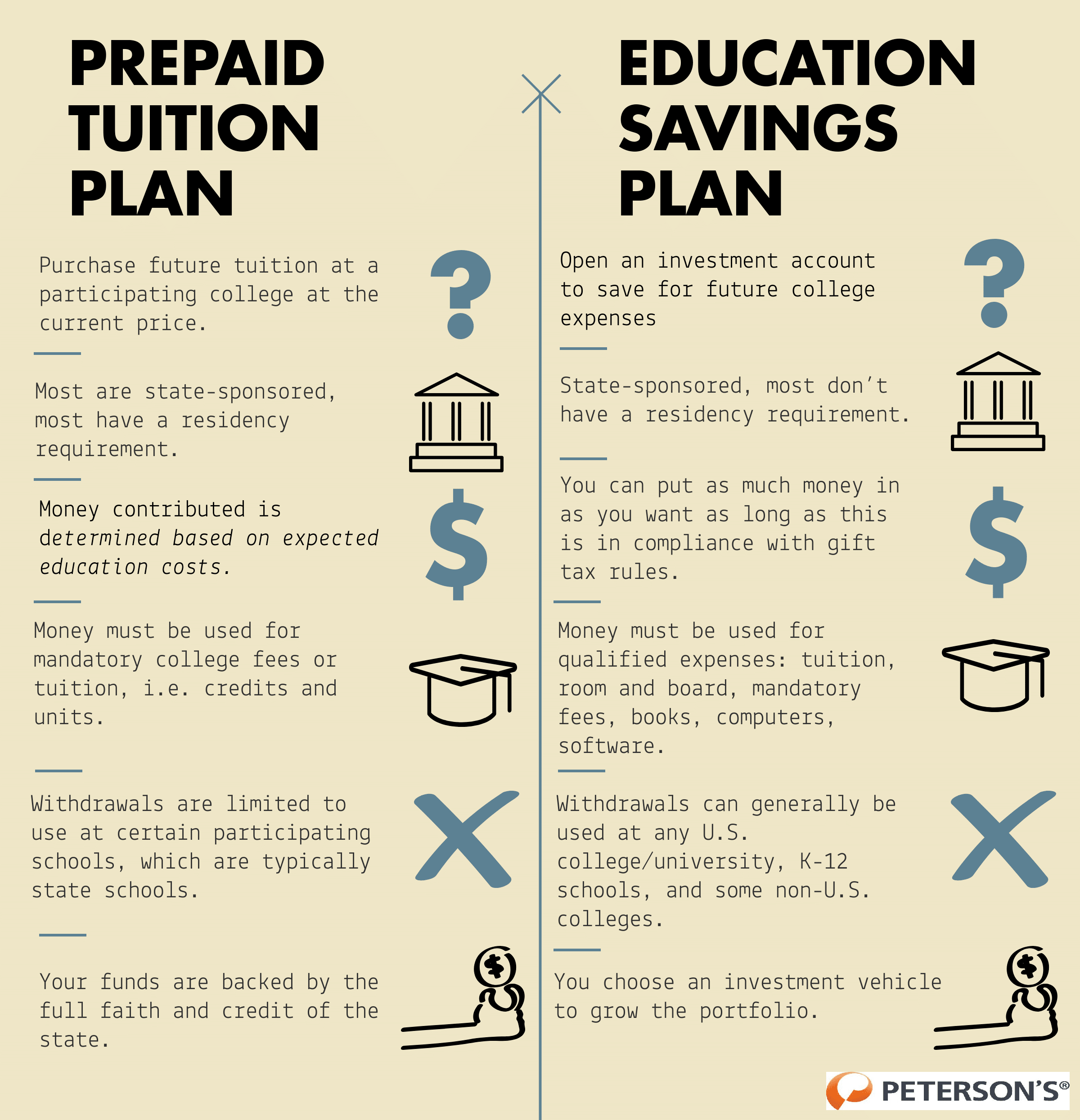

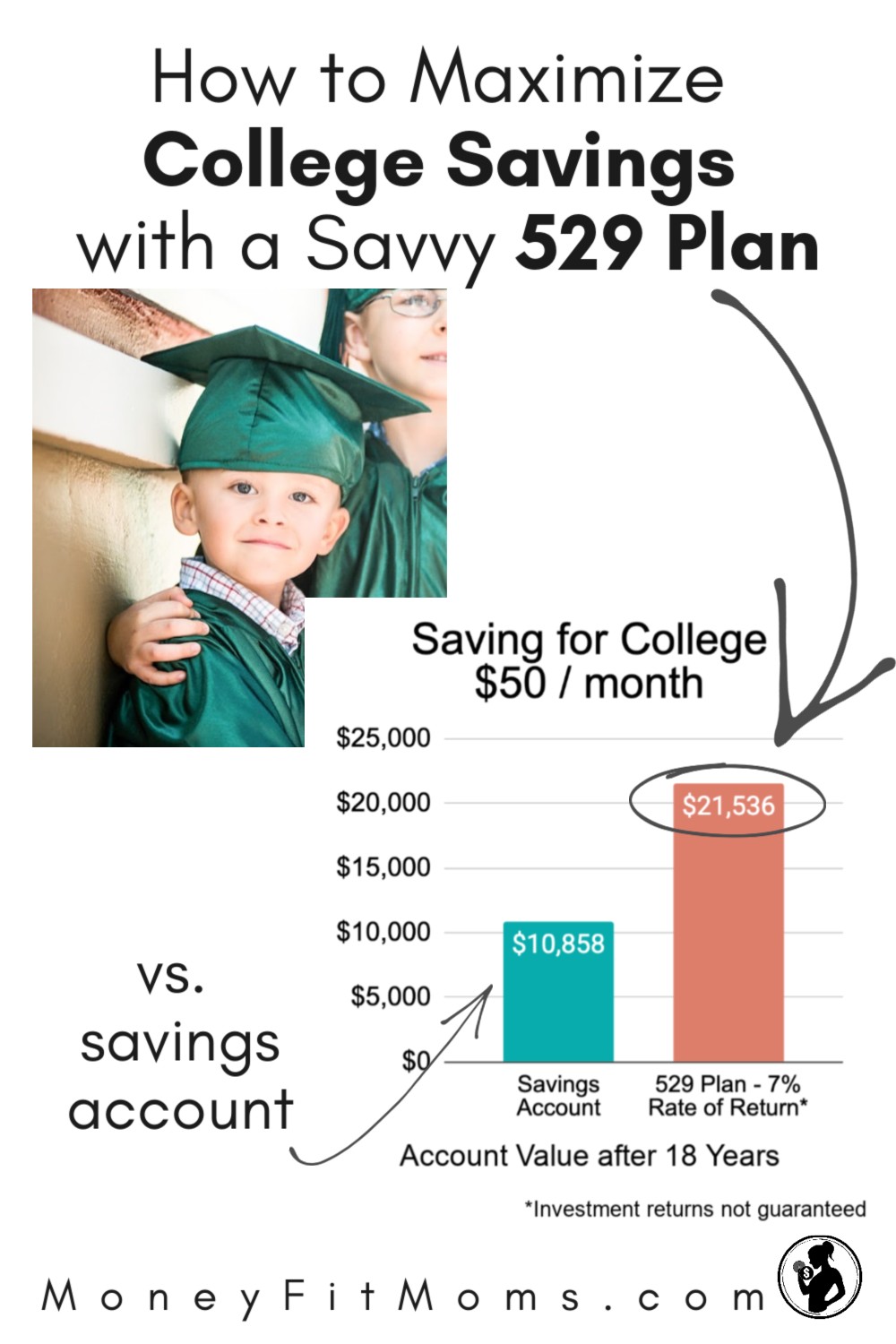

A 529 plan is a tax advantaged savings plan Legally referred to as qualified tuition plans the plans are sponsored by states state agencies or educational institutions Earnings in plans are not subject to federal tax and in many cases state tax provided you use withdrawals for eligible college expenses such as room and board Room and board As a significant part of the college bill room and board is considered a qualified expense under 529 plans Because of the pandemic many colleges have changed to a remote curriculum Some students may have changed plans and are living off campus this semester or year

What Is A 529 Savings Plan Community 1st Credit Union

https://www.c1stcreditunion.com/webres/Image/personal/savings/529 plan_512030656.jpg

What Is A 529 Plan And What You Need To Know About It Westface College Planning

https://westfacecollegeplanning.com/wp-content/uploads/65400391_l-2048x1365.jpg

https://www.savingforcollege.com/article/using-your-529-plan-to-pay-for-room-and-board

July 27 2023 Room and board costs make up a large portion of a student s total college bill second only to tuition You can use a 529 plan to pay for room and board but only if certain requirements are met Room and board include the cost of housing and the cost of a meal plan

https://www.glassjacobson.com/blog/529-off-campus-housing/

The short answer is Yes room and board expenses for off campus housing including a parent s home may be reimbursed through a 529 plan but not necessarily the full cost

What Is A 529 Plan For College Research

What Is A 529 Savings Plan Community 1st Credit Union

Understanding 529 Plan Qualified Expenses For Off Campus Housing House Plans

529 Plan Rules And Uses Of 529 Plan Advantages And Disadvantages

529 Plans Archives College Aid Consulting Services

What To Do With Leftover Money In A 529 Plan

What To Do With Leftover Money In A 529 Plan

All About 529 Plans Infographic Presentational ly

529 College Savings Plan Unused White Oaks Wealth Advisors

Best 529 Plans College Savings Plans For Kids RealWealth

529 Plan Reimbursement For Off Campus Housing - All off campus housing expenses that fall within the budget qualify for 529 reimbursement This budget costs can include rent utilities and food The precise value of the room and board allowance is specific to each school and each school year