Alimony Under Proposed House Tax Plan Consider that someone receiving 300 a week in alimony under the new law will get 15 600 in tax free money annually That creates a disproportionate benefit for the recipient and a detriment to the payer who must shell out the money with no tax benefit

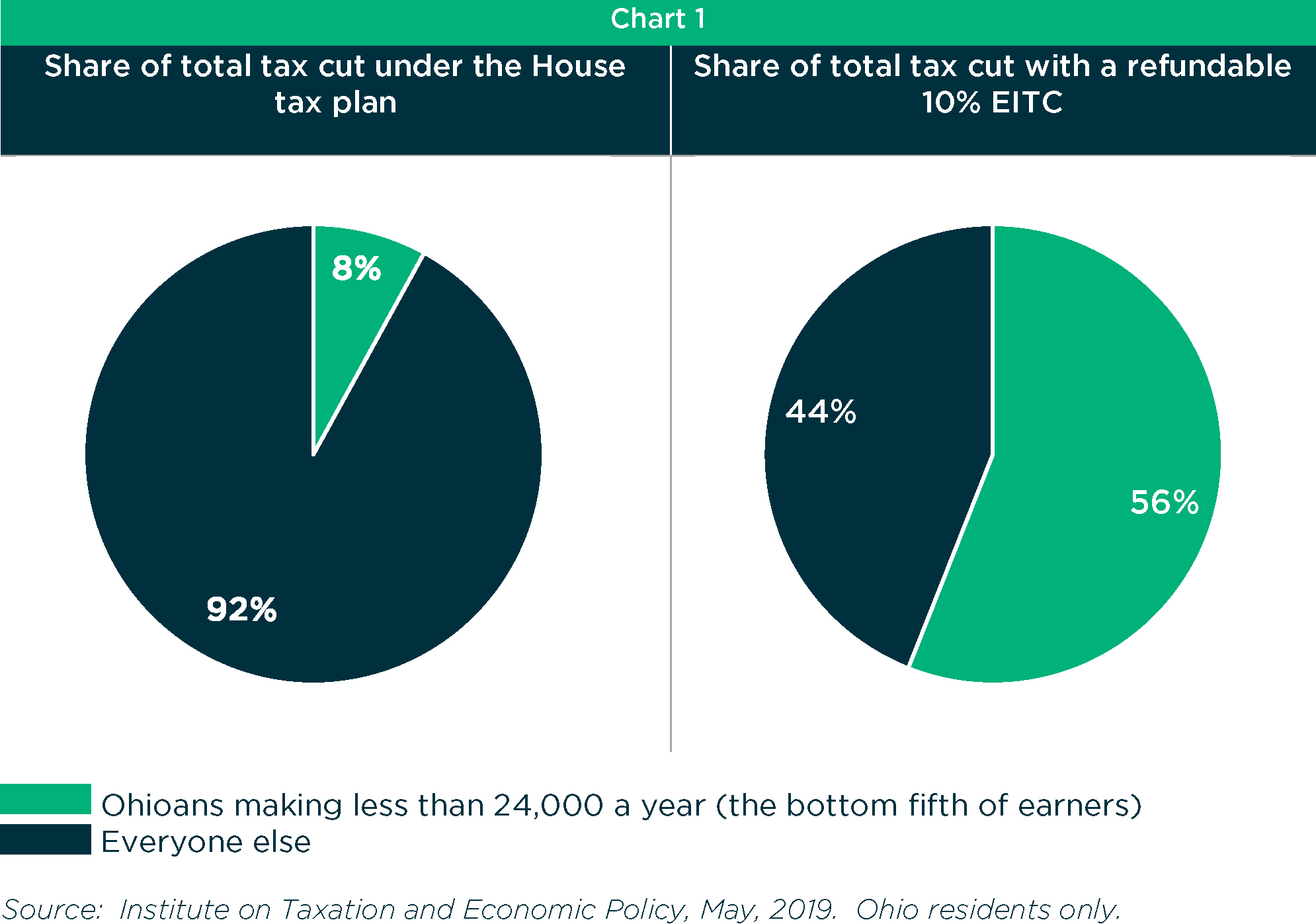

The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100 It would also quicken the phase in for taxpayers with multiple children and allow taxpayers an election to use Currently alimony which is more appropriately By Andrew Zashin If you haven t heard about the competing tax plans proposed by Congress you haven t been reading the news Just as soon as the House of Representatives released their proposed tax plan the phones started ringing at the offices of domestic relations lawyers throughout the

Alimony Under Proposed House Tax Plan

Alimony Under Proposed House Tax Plan

https://legal60.com/wp-content/uploads/2021/05/tax-on-alimony.jpg

Alimony Payments May Shrink Under New Tax Code

https://www.susantperkins.com/wp-content/uploads/2018/01/iStock-627974856.jpg

Florida Permanent Alimony Laws The New Proposed Changes To The Law

https://mzmlaw.com/wp-content/uploads/2022/05/shutterstock_2168078931.jpg

If divorcing spouses sell their home they may face capital gains taxes TurboTax says The law generally allows a seller to avoid tax on the first 250 000 of capital gains on the sale of a The tax treatment will not change for people already divorced except that if the alimony award is modified after 2018 the parties can choose the new tax treatment as an option Future impact of law change Many legal commentators think that because alimony will be more expensive to paying spouses settlement negotiations could become more heated

Amounts paid to a spouse or a former spouse under a divorce or separation instrument including a divorce decree a separate maintenance decree or a written separation agreement may be alimony or separate maintenance payments for federal tax purposes A payment is alimony or separate maintenance if all the following requirements are met NEW YORK Congress giant tax overhaul will affect a number of deductions even the one for alimony Republicans delivered their sweeping plan to an exultant President Donald Trump who

More picture related to Alimony Under Proposed House Tax Plan

Domestic Violence Would Have An Impact On Alimony Under Proposed Law

https://themonmouthjournalnorthern.com/28-03-2023-08-26-21-am-1610489.jpg

Alimony And Taxes In Florida Divorce Cases Ayo And Iken

https://www.myfloridalaw.com/wp-content/uploads/2018/03/alimony-and-income-tax-768x512.jpg

Is Alimony Always Tax Deductible To The Paying Spouse Alimony Tax Deductions Deduction

https://i.pinimg.com/originals/c9/82/d0/c982d0264d35a44bba60def3ebbbdc7a.png

The law known as the Tax Cuts and Jobs Act P L 115 97 changed the alimony regime effective for alimony agreements executed after Dec 1 2018 so that now the payer spouse does not receive a deduction and the recipient spouse does not include the alimony in income Presumably under the new regime and the Tax Court s reasoning Cynthia The recipient s tax bracket doesn t usually change as a result of the alimony payments and the payor is sometimes more generous because of the tax savings Example If the higher earner has a taxable income of 200 000 a year and pays the other spouse alimony of 80 000 a year the higher earner will owe income tax on 120 000 not 200 000

Alimony taxation The taxation of alimony on federal tax returns recently changed because of the Tax Cuts and Jobs Act of 2017 TCJA Today alimony or separate maintenance payments relating to any divorce or separation agreements dated January 1 2019 or later are not tax deductible by the person paying the alimony Under the Tax Cuts and Jobs Act TJCA the tax brackets for individuals would shift from the current 7 bracket system of 10 15 25 28 33 35 and 39 6 down to a simpler 4 bracket system of just 12 25 35 and 39 6

Proposed Changes May Affect Florida Alimony Requirements

https://ledezmalawfirm.com/wp-content/uploads/2015/04/alimony-legislature-proposed-changes-law.png

How Alimony Tax Changes In 2018 Will Impact You

https://www.normanlawjax.com/wp-content/uploads/2018/01/income-tax-calculation-calculate-alimony-FL-tax.jpg

https://stories.avvo.com/money/taxes/paying-alimony-new-tax-law-means.html

Consider that someone receiving 300 a week in alimony under the new law will get 15 600 in tax free money annually That creates a disproportionate benefit for the recipient and a detriment to the payer who must shell out the money with no tax benefit

https://taxfoundation.org/blog/bipartisan-tax-deal-2024-tax-relief-american-families-workers-act/

The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100 It would also quicken the phase in for taxpayers with multiple children and allow taxpayers an election to use

Alimony Taxes Is Alimony Taxable In 2018

Proposed Changes May Affect Florida Alimony Requirements

Alimony Revisited Under The New Tax Law In Ohio Ohio Family Law Blog

Alimony And Tax Reform H R Block

The Rules For Alimony And Taxes In Tax Year 2019 With Images Alimony Tax Deductions Tax

Income Tax On Alimony Money Or Property Received Under Separation Agreement Or Divorce YouTube

Income Tax On Alimony Money Or Property Received Under Separation Agreement Or Divorce YouTube

The Good And The Bad In The House Tax Plan

New Alimony Tax Law In California Is Alimony Tax Deductible

The Chronicle Of Cultural Misandry Alimony Extorts Not Only Husbands But Also Tax Payers

Alimony Under Proposed House Tax Plan - Amounts paid to a spouse or a former spouse under a divorce or separation instrument including a divorce decree a separate maintenance decree or a written separation agreement may be alimony or separate maintenance payments for federal tax purposes A payment is alimony or separate maintenance if all the following requirements are met