An Analysis Of The House Gop Tax Plan This paper analyzes the House GOP tax reform blueprint which would significantly reduce marginal tax rates increase standard deduction amounts repeal personal exemptions and most itemized deductions and convert business taxation into a destination based cash flow consumption tax

The House GOP tax plan would co nsolidate the regular s tandard deduction additional standard deductions for age or blindness and the personal exemption for tax filers into new standard deduction amounts of 12 000 for single filers 18 000 for head of An Analysis of the House GOP Tax Plan James R Nunns Leonard E Burman Jeffrey Rohaly Joseph Rosenberg Benjamin R Page September 16 2016 Download PDF Print Share Primary tasks Overview Full Report active tab Media Mentions

An Analysis Of The House Gop Tax Plan

An Analysis Of The House Gop Tax Plan

https://staticseekingalpha.a.ssl.fastly.net/uploads/2017/3/993813_14893418538893_rId13.jpg

Www taxpolicycenter Sites Default Files Publication 140226 2001229 an analysis of the house

https://i.pinimg.com/originals/2e/c3/79/2ec3795cb22ea2d067ecb888ab776e6c.png

An Analysis Of The House GOP Tax Plan Full Report Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/alfresco/publication-thumbnails/AP_16194579548989_1.jpg?itok=R-cXZlk6

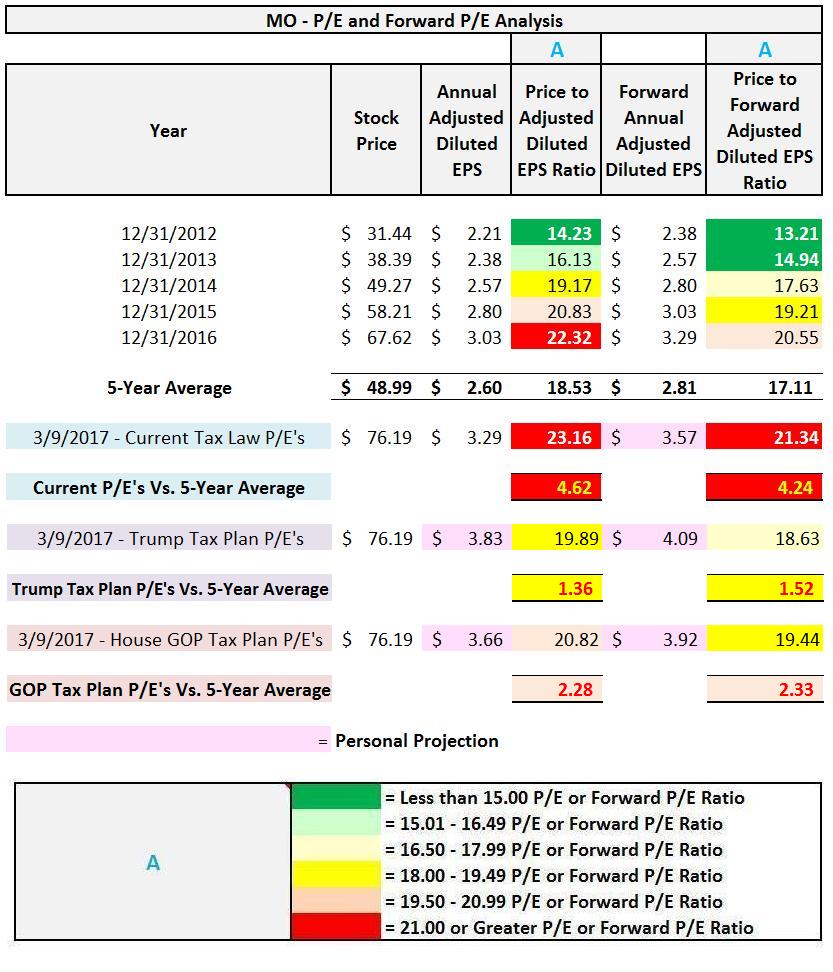

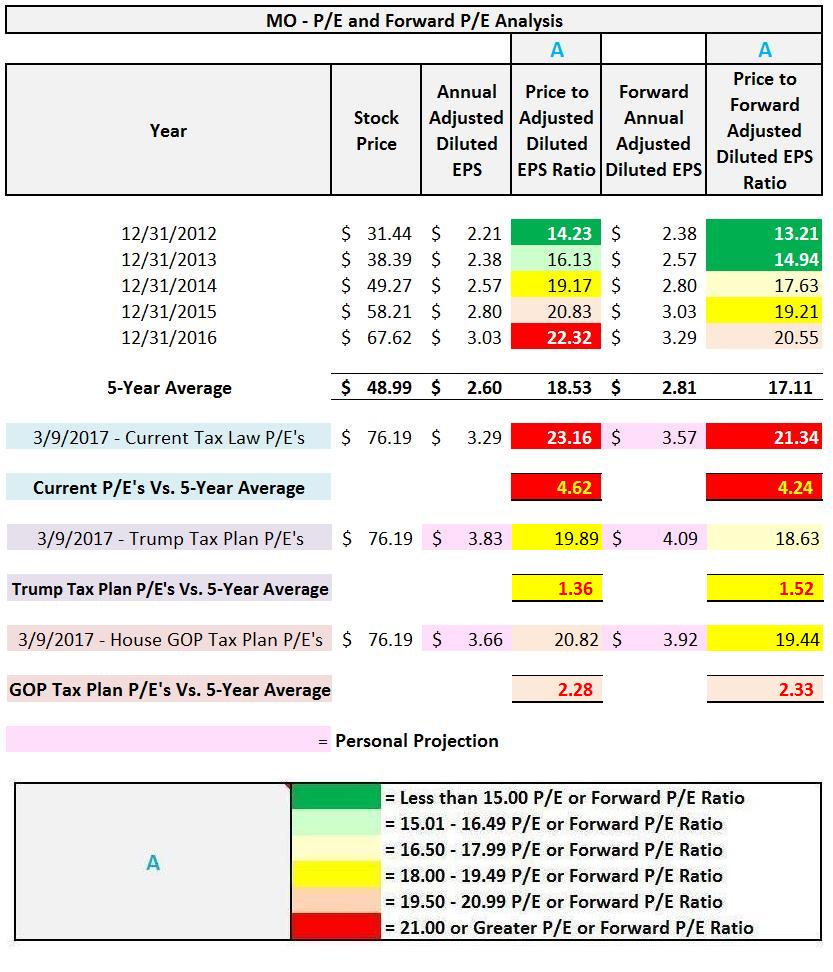

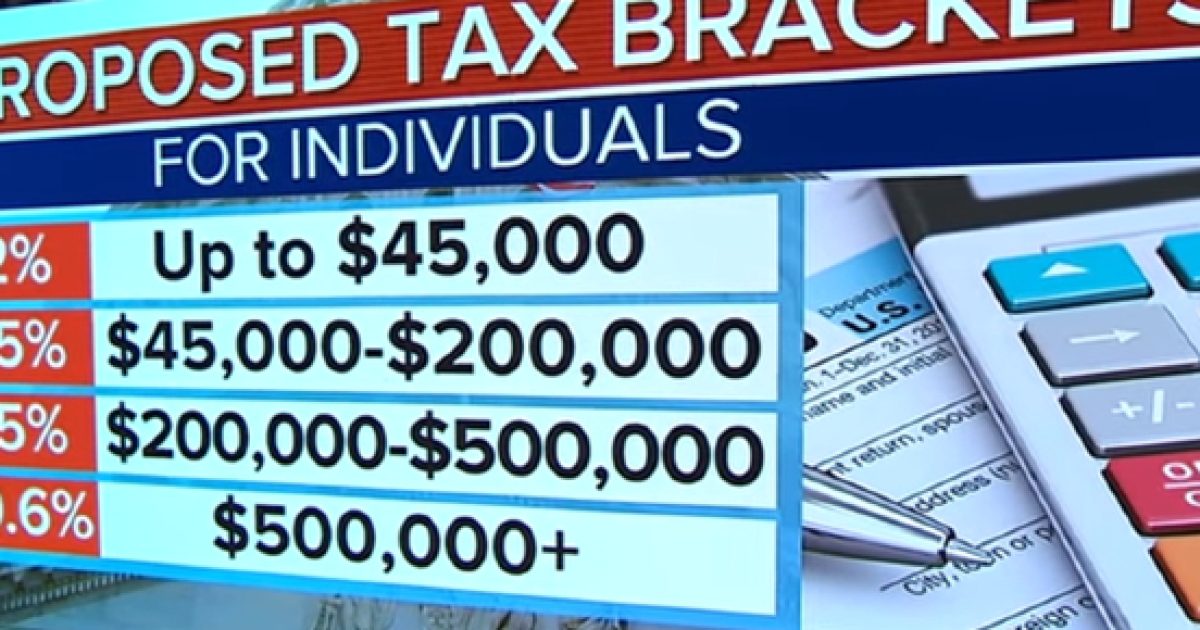

The House GOP plan would reduce the top individual income tax rate to 33 percent reduce the corporate rate to 20 percent and cap at 25 percent the rate on profits of pass through businesses such as sole proprietorships and partnerships that are taxed under the individual income tax An Analysis of the House GOP Tax Plan Leonard E Burman James R Nunns Benjamin R Page Jeffrey Rohaly Joseph Rosenberg April 5 2017 Download PDF Print Share Primary tasks Overview Full Report active tab Media Mentions

An Analysis of the House GOP Tax Plan Columbia Journal of Tax Law 8 2 257 294 https doi 10 7916 cjtl v8i2 2851 ACM Turabian Download Citation Abstract What Does the Plan Do Well The package would restore deductions for businesses to recover the cost of their investments Why is this important Generally improving investment incentives helps boost the economy create more jobs and spur innovation Imagine a medical device company invests 1 million in developing new technology

More picture related to An Analysis Of The House Gop Tax Plan

Dynamic Analysis Of The House GOP Tax Plan An Update Full Report Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/publication/142556/ap_17173567258555.jpg?itok=GBd3oLEZ

What s In The House GOP Tax Plan YouTube

https://i.ytimg.com/vi/fe0o5qWYlHQ/maxresdefault.jpg

Jobsanger TPC Analysis Of The GOP Tax Plan To Reward The Rich

https://3.bp.blogspot.com/-2riUI0mQ6Nk/WhXLcUg-p9I/AAAAAAABsas/DeKyYxNVfKg6DI-jx_aFHOno_J1rwuTpgCLcBGAs/s1600/tax%2Bplan.png

This paper analyzes the House GOP tax reform blueprint which would significantly reduce marginal tax rates increase standard deduction amounts repeal personal exemptions and most itemized deductions allow businesses to expense new investment and not allow businesses to deduct net interest expenses Taxes would drop at all income levels in 2017 but most savings would go to the highest This paper analyzes the House GOP tax reform blueprint which would significantly reduce marginal tax rates increase standard deduction amounts repeal personal exemptions and most itemized deductions and convert business taxation into a destination based cash flow consumption tax

This paper presents estimates of the macroeconomic effects and resulting dynamic impact on revenues of the House GOP tax plan announced in June 2016 The estimates were produced in two ways One set of estimates uses a combination of TPC s Keynesian model to project short run effects on output relative to its full employment or potential level and TPC s Neoclassical model to project This paper analyzes the House GOP tax reform blueprint which would significantly reduce marginal tax rates increase standard deduction amounts repeal personal exemptions and most itemized deductions and convert business taxation into a destinationbased cash flow consumption tax Taxes would drop at all income levels in 2017 but the highest income households would gain the most Federal

Opinion The GOP Tax Plan Is Just A Prelude To Attacking Entitlements The Washington Post

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/EJZUKCHVYY6VXCVPI3XFUNGPIY.jpg&w=1440

Who Will Benefit Most From GOP Tax Plan Early Report Suggests The Wealthy MPR News

https://media.npr.org/assets/img/2017/10/03/gettyimages-450753659_slide-4084fcb4fe4d3ff5cb8d8bf0c9344d3d29bc6658.jpg?s=1000

https://www.taxpolicycenter.org/publications/analysis-house-gop-tax-plan-0

This paper analyzes the House GOP tax reform blueprint which would significantly reduce marginal tax rates increase standard deduction amounts repeal personal exemptions and most itemized deductions and convert business taxation into a destination based cash flow consumption tax

https://www.taxpolicycenter.org/sites/default/files/alfresco/publication-pdfs/an_analysis_of_the_house_gop_tax_plan_9-16-16.final_.pdf

The House GOP tax plan would co nsolidate the regular s tandard deduction additional standard deductions for age or blindness and the personal exemption for tax filers into new standard deduction amounts of 12 000 for single filers 18 000 for head of

House GOP Tax Plan Would Slow Economic Growth Add Trillions To The Deficit

Opinion The GOP Tax Plan Is Just A Prelude To Attacking Entitlements The Washington Post

What The GOP Tax Plan s New Standard Deduction Means For You Money

GOP Tax Bill Mostly Benefits The Wealthy Tax Policy Center Finds

Opinion The GOP Tax Plan Will Raise Taxes On Lots Of People A New Analysis Shows How Many

GOP Tax Plan Favors The Richest Analysis Shows

GOP Tax Plan Favors The Richest Analysis Shows

Tax Foundation Sees House GOP Tax Plan Costing 191 Billion POLITICO

House GOP Tax Plan Would Hurt Wealthy NYers Crain s New York Business

GOP Campaigns Discuss Tax Plans Committee For A Responsible Federal Budget

An Analysis Of The House Gop Tax Plan - What Does the Plan Do Well The package would restore deductions for businesses to recover the cost of their investments Why is this important Generally improving investment incentives helps boost the economy create more jobs and spur innovation Imagine a medical device company invests 1 million in developing new technology