Are Home Improvements Tax Deductible Depending on several criteria related to home improvement a tax deduction might be claimed all at once in a single tax year spread out over several years or it may only apply when selling the

Here are eight ways you can claim a tax deduction or tax credit for home improvements Energy Efficient Improvements The federal government offers tax credits for specific energy efficient home improvements such as the installation of energy efficient windows doors roofing insulation and certain heating and cooling equipment Generally no but there are exceptions Some home improvements are tax deductible such as capital improvements energy efficiency improvements and improvements related to medical care

Are Home Improvements Tax Deductible

Are Home Improvements Tax Deductible

https://bt-wpstatic.freetls.fastly.net/wp-content/blogs.dir/7048/files/2020/01/tax-1.jpg

Are Home Improvements Tax Deductible

https://www.parksathome.com/uploads/agent-1/are_home_improvements_tax_deductible.png

Are Home Improvements Tax Deductible In 2018 Tax Walls

https://help.taxreliefcenter.org/wp-content/uploads/2018/07/Tax-Relief-Center-7-Home-Improvement-Tax-Deductions-For-Your-House-FEATURED.jpg

When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost in the year you spend the money But if you keep track of those expenses they may help you reduce your taxes in the year you sell your house Remodeling a home typically is not a tax deduction The IRS has strict rules on the types of home improvements that qualify for a tax write off Generally you can t write off home

Unfortunately most home improvements aren t deductible the year you make them But even if they aren t currently deductible they ll eventually have a tax benefit when you sell your home What Is a Home Improvement For tax purposes a home improvement includes any work that adapts it to new uses Examples of home improvements include While home improvements typically aren t tax deductible the IRS does offer some tax benefits for certain capital improvements Home improvements are a big investment that can add value

More picture related to Are Home Improvements Tax Deductible

Are Home Improvements Tax Deductible Home Logic

https://www.homelogic.co.uk/wp-content/uploads/2017/04/are-home-improvements-tax-deductible-2.jpg

Are Home Improvements Tax Deductible Remodeling Top

https://www.remodelingtop.com/wp-content/uploads/2024/04/home_improvement-1733-1.jpg

Are Home Improvements Tax Deductible For 2023 Leia Aqui What Is The

https://ecm.capitalone.com/WCM/learn-grow/card/lgc986_hero_are-home-improvements-tax-deductible_v1.jpg

Home improvements are generally not tax deductible but there are exceptions Your upgrade may be tax deductible if it meets the Internal Revenue Service IRS criteria for capital improvements However you won t get the tax benefits until you sell the home There are expectations for certain renovations Home improvements aren t tax deductible in most circumstances However if you run a business out of your home or if you re making environmentally sound or medically necessary home

[desc-10] [desc-11]

Are Home Improvements Tax Deductible LendingTree

https://www.lendingtree.com/content/uploads/2020/09/are-home-improvements-tax-deductible.jpg

Are Home Improvements Tax Deductible The Motley Fool

https://m.foolcdn.com/media/affiliates/original_images/Are_Home_Improvements_Tax_Deductible_4nk10ax_63i40nE.png?width=1200

https://www.forbes.com › home-improvement › home › home...

Depending on several criteria related to home improvement a tax deduction might be claimed all at once in a single tax year spread out over several years or it may only apply when selling the

https://americantaxservice.org › home-improvements-a

Here are eight ways you can claim a tax deduction or tax credit for home improvements Energy Efficient Improvements The federal government offers tax credits for specific energy efficient home improvements such as the installation of energy efficient windows doors roofing insulation and certain heating and cooling equipment

Are Home Improvements Tax Deductible The Ascent By Motley Fool

Are Home Improvements Tax Deductible LendingTree

Are Home Improvements Tax Deductible What To Know Architectural Digest

Tax Deductible Home Improvements What You Should Know This Year In

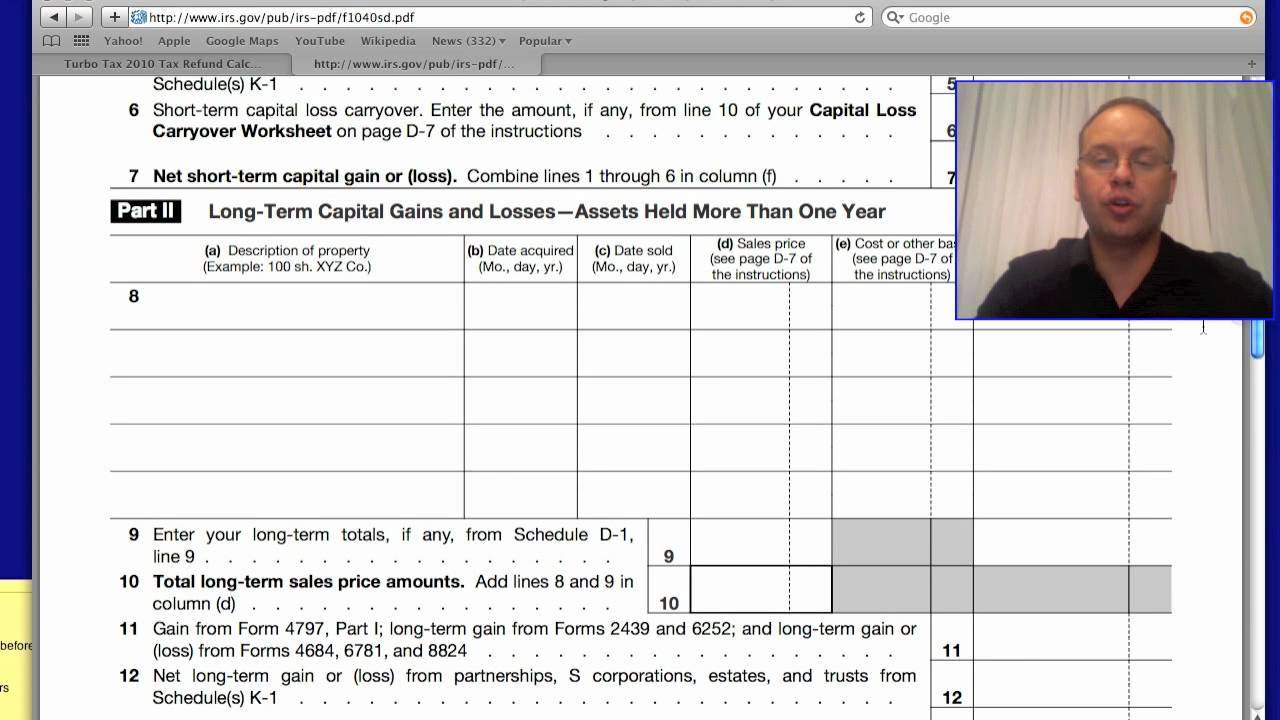

Are Home Improvements Tax Deductible 2012 2013 YouTube

7 Home Improvement Tax Deductions For Your House YouTube

7 Home Improvement Tax Deductions For Your House YouTube

Home Financing Quality Homes

Tax Deductible Home Improvements Tax Deductions Home Improvement

Irs Depreciation Tables In Excel Cabinets Matttroy

Are Home Improvements Tax Deductible - When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost in the year you spend the money But if you keep track of those expenses they may help you reduce your taxes in the year you sell your house