At What Income Can You Not Contribute To A Traditional Ira Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income Income tax Personal business corporation trust international and non resident income tax

At What Income Can You Not Contribute To A Traditional Ira

At What Income Can You Not Contribute To A Traditional Ira

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits-1024x1024.png

Roth Ira Limit 2025 Contribution Images References Amira Sage

https://www.theentrustgroup.com/hs-fs/hubfs/2024-ira-contribution-limits.jpg?width=3072&height=2925&name=2024-ira-contribution-limits.jpg

2

https://cdn.stock2morrow.com/images/lOk95/1704244081306.PNG

Change in individual income tax rate The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more How to make a full or partial payment to the CRA online by mail or in person

For combined Old Age Security pension and Guaranteed Income Supplement amounts consult the Quarterly report of Canada Pension Plan and Old Age Security monthly amounts and Find out the details on how to apply for the Canadian Dental Care Plan

More picture related to At What Income Can You Not Contribute To A Traditional Ira

Roth Contribution Income Limits 2024 Luci Simona

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits-1024x1024.png

Max Magi For 2025 Roth Contribution Adrian Bernardes

https://meldfinancial.com/wp-content/uploads/IRA-Contribution-Limits-in-2023-846x630.jpg

Roth Ira Contribution Limits 2025 Married Joint Joseph K Brown

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits-1536x1536.png

Quebec 2024 Income tax package The following forms and schedules can be used to help you complete your federal tax return Quebec administers its own tax laws Quebec residents may Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

[desc-10] [desc-11]

2025 Simple Ira Contribution Limits Irs Mary D Mayer

https://www.investors.com/wp-content/uploads/2019/12/wFAP-contribution-122719.jpg

Traditional IRAs Vs Roth IRAs 1st National Bank

https://www.bankwith1st.com/wp-content/uploads/2022/12/Traditional-IRAs-vs-Roth-IRAs-Comparison-768x768.png

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

https://www.canada.ca › en › services › benefits › disability › canada-dis…

The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income

Traditional IRAs Vs Roth IRAs 1st National Bank

2025 Simple Ira Contribution Limits Irs Mary D Mayer

Roth Ira Magi Limits 2025 Andreas L Jorgensen

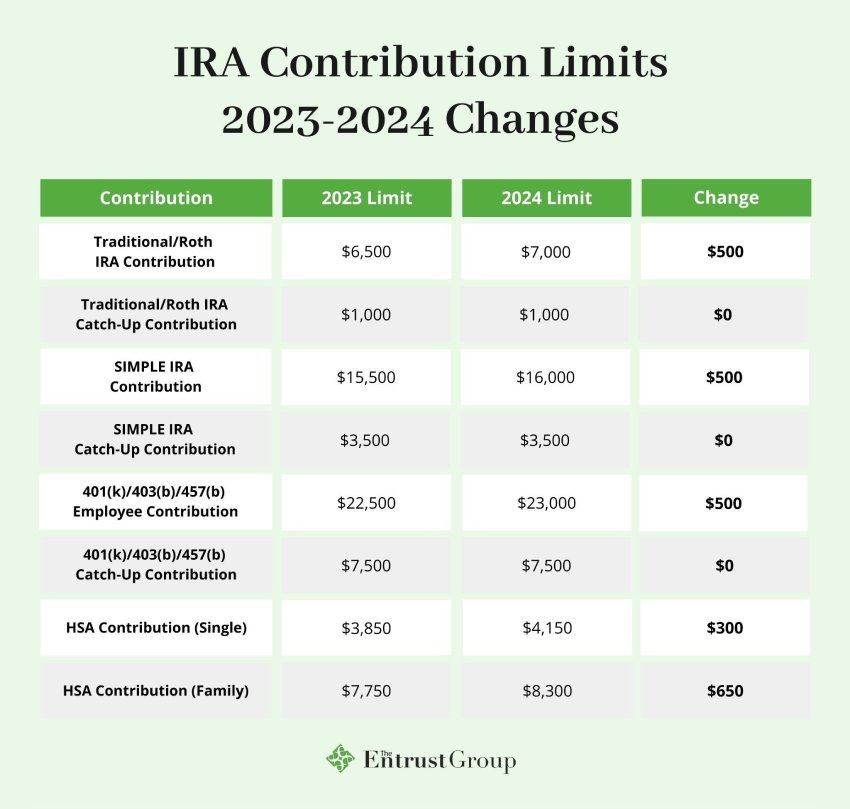

IRA Contribution Limits In 2023 Meld Financial

How Much Can You Contribute To An Ira In 2025 Michel S Greiner

Income Limits For Roth Ira Contributions 2025 Allen S Cranston

Income Limits For Roth Ira Contributions 2025 Allen S Cranston

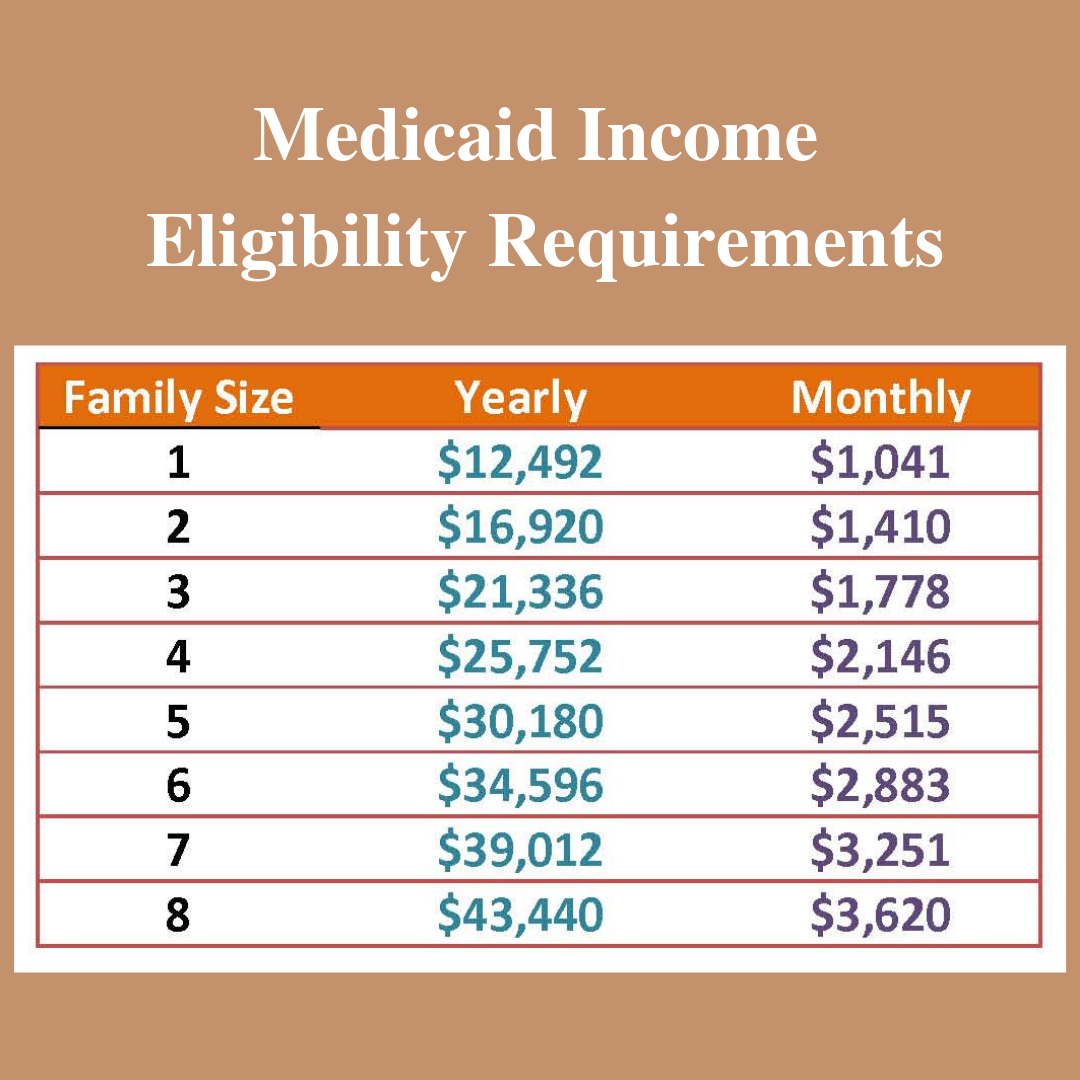

Income Limit For Medical Family Of 2 For 2025 Alma K Jespersen

How To Open An Roth IRA In 5 Steps The Motley Fool

[img_title-16]

At What Income Can You Not Contribute To A Traditional Ira - [desc-13]