Biden Tax Plan For Housing This change aims to streamline reporting requirements while maintaining accurate tax reporting Support for affordable housing The Tax Relief for American Families and Workers Act also includes provisions to support affordable housing It increases the nine percent low income housing tax credit ceiling by 12 5 percent for calendar years 2023

In 2018 Congress temporarily raised the amount of tax credits allocated to each state by 12 5 but that expansion expired in 2021 the current tax deal seeks to restore the increase The The Biden Administration on Wednesday unveiled a plan to help low income and first time homebuyers save an average of 800 per year on mortgage insurance costs starting next month an attempt to

Biden Tax Plan For Housing

Biden Tax Plan For Housing

https://static01.nyt.com/images/2021/04/07/business/07dc-biden-tax01alt/07dc-biden-tax01alt-facebookJumbo.jpg

These Are The Plans Biden And Democrats Have For Investment Homeownership And Building Wealth

https://www.gannett-cdn.com/presto/2020/11/09/NETN/531e0b0e-8e84-42e6-bef8-4361ce661051-p1Biden110920.jpg?crop=2901,1632,x289,y279&width=2901&height=1632&format=pjpg&auto=webp

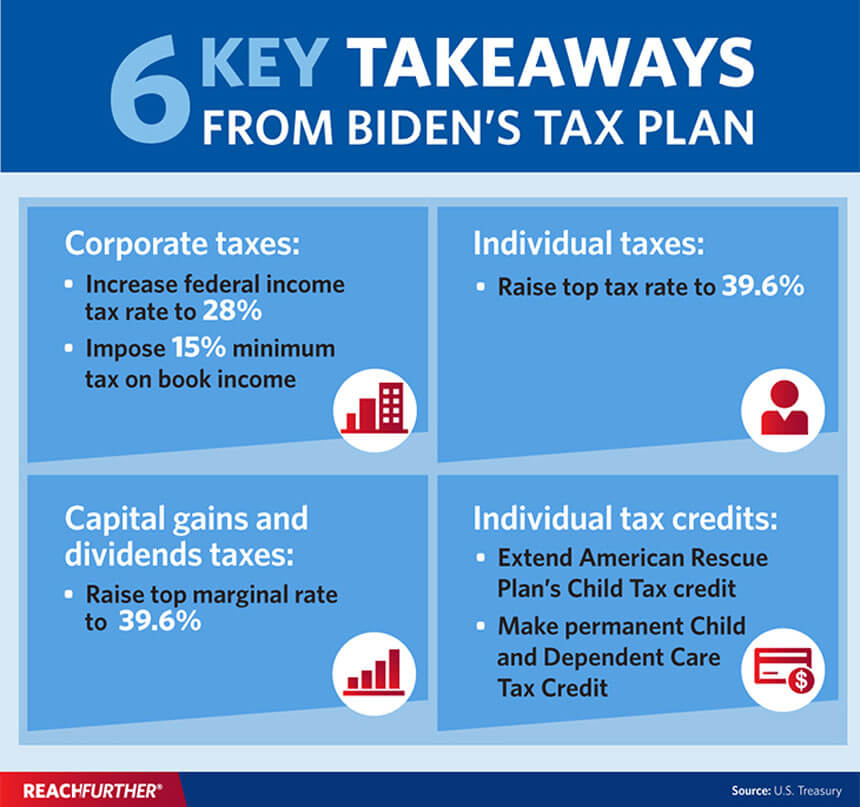

What Biden s Proposed Tax Plan Means For Businesses

https://www.eastwestbank.com/content/dam/ewb-dotcom/reachfurther/newsarticlestore/846/Key-Takeaways-From-Bidens-Tax-Plan.jpg

The most significant pay for in The American Jobs Plan AJP is an increase in the corporate tax rate from 21 to 28 The plan also proposes a minimum book tax for corporations of 15 As President Biden said last week tackling inflation is his top economic priority Today President Biden is releasing a Housing Supply Action Plan to ease the burden of housing costs over time

A critical foundation of that vision and the central goal of the Biden Harris Administration s Housing Supply Action Plan is an economy where everyone has access to a safe and affordable home An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to

More picture related to Biden Tax Plan For Housing

Zoning Biden Infrastructure Bill Would Curb Single family Housing

https://www.gannett-cdn.com/presto/2021/04/13/USAT/ae56bb3e-6c2b-40d6-b1fb-234a005253a4-XXX_OHCOL_053120_MT_EVICTION_BJP_01.JPG?crop=2399%2C1350%2Cx0%2Cy401&width=1200

President Biden Releases 2020 Federal Tax Returns

https://www.gannett-cdn.com/presto/2021/05/10/USAT/0b094928-abf9-4f4e-9f1d-76de8f2cad6a-AP_AP_Poll_Biden.jpg?crop=3107,1748,x0,y158&width=3107&height=1748&format=pjpg&auto=webp

Fact Check National Property Tax Isn t Part Of Joe Biden s Plan

https://www.gannett-cdn.com/presto/2020/09/09/PDTF/ccf8e43f-51a2-4b6c-8ddc-57877b22263b-AP_Election_2020_Biden_MIPA3_3.jpg?crop=5392,3033,x0,y369&width=3200&height=1800&format=pjpg&auto=webp

The plan didn t follow up on the president s campaign promise of providing a 15 000 tax credit for first time home buyers Biden s Housing Plan Aims to Help First Time Buyers Address June 24 2021 at 12 53 p m How a Homebuyer Tax Credit Would Work Getty Images President Joe Biden included a first time homebuyer tax credit in his campaign platform and now many lawmakers are taking action in Congress to see some form of assistance available to first time buyers Between ensuring a good credit score and saving for a down

Explore the child tax credit and other provisions in the 2024 bipartisan tax deal Tax Relief for American Families and Workers Act of 2024 Increase the amount of low income housing tax credit LIHTC available to states by 12 5 percent and lower the bond financing threshold for the credit from 50 percent to 30 percent from 2023 through 2025 The act will introduce a new federal tax credit to help fund the development and renovation of 1 4 family housing in distressed urban suburban and rural neighborhoods according to a draft of

Bidens Tax Returns Show Income Of 607 336 In 2020 WSJ

https://images.wsj.net/im-339803/?width=860&height=573

Here Come The Biden Taxes WSJ

https://images.wsj.net/im-319017?width=860&height=573

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

This change aims to streamline reporting requirements while maintaining accurate tax reporting Support for affordable housing The Tax Relief for American Families and Workers Act also includes provisions to support affordable housing It increases the nine percent low income housing tax credit ceiling by 12 5 percent for calendar years 2023

https://www.bloomberg.com/news/articles/2024-01-22/new-tax-deal-includes-boost-for-affordable-housing

In 2018 Congress temporarily raised the amount of tax credits allocated to each state by 12 5 but that expansion expired in 2021 the current tax deal seeks to restore the increase The

Joe Biden s Tax Returns Show More Than 15 Million In Income After 2016 The New York Times

Bidens Tax Returns Show Income Of 607 336 In 2020 WSJ

Zoning Biden Infrastructure Bill Would Curb Single family Housing

What s In Biden s Tax Plan The New York Times

President elect Joe Biden s Tax Plans Are The Latest Trend On Twitter

Biden Releases Financial Info Made More Than 15 5M Before Taxes Over Past Two Years

Biden Releases Financial Info Made More Than 15 5M Before Taxes Over Past Two Years

Biden s Modest Tax Plan The New York Times

Tax Foundation President Biden Tax Plan Will Make US Less Competitive Globally Fox News

Here s President Biden s Infrastructure And Families Plan In One Chart The New York Times

Biden Tax Plan For Housing - President Joe Biden is calling on Congress for a tax hike on real estate investors to help fund the 1 8 trillion American Families Plan Biden s plan abolishes the right to defer taxes on