Biden Tax Plan House Value Tax Published Oct 27 2020 Joe Biden s tax plan includes a 3 federal property tax on privately owned homes During the 2020 U S presidential campaign social media postings repeatedly warned

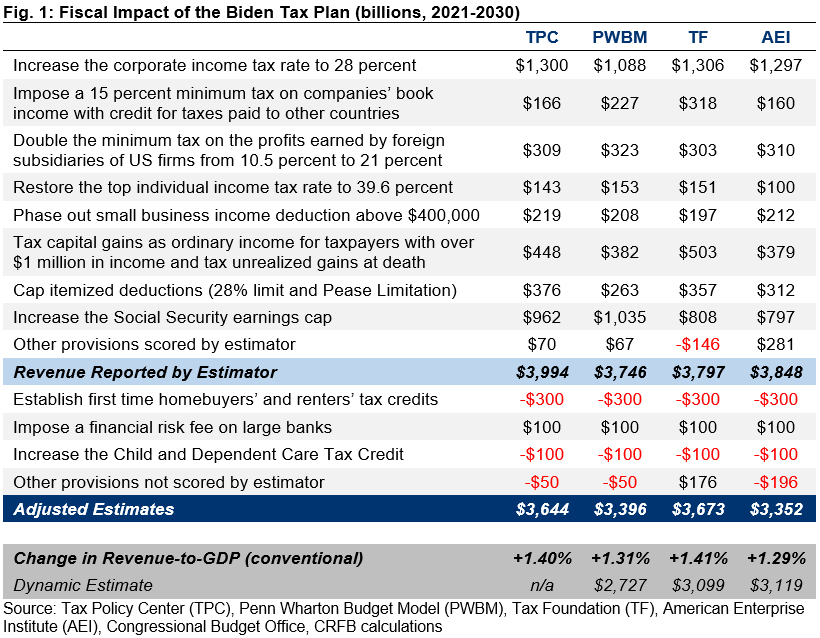

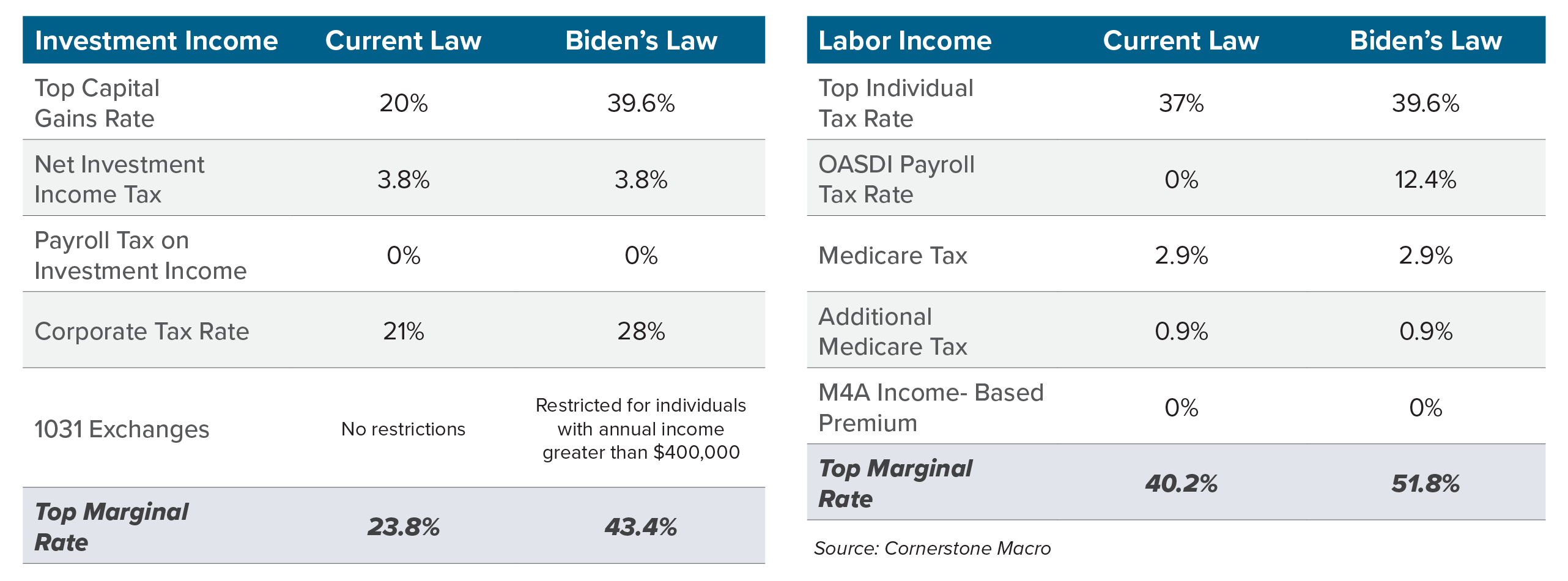

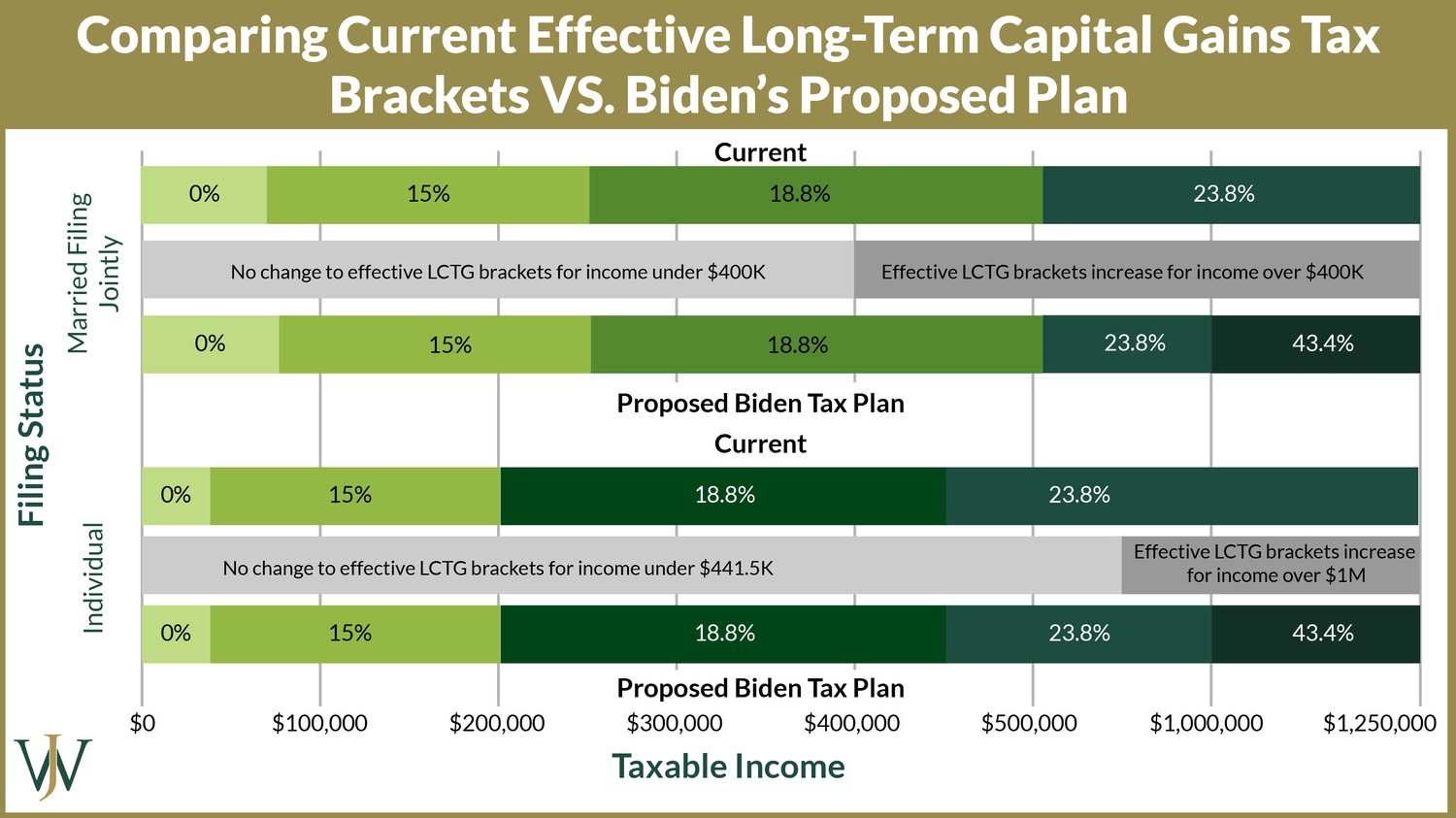

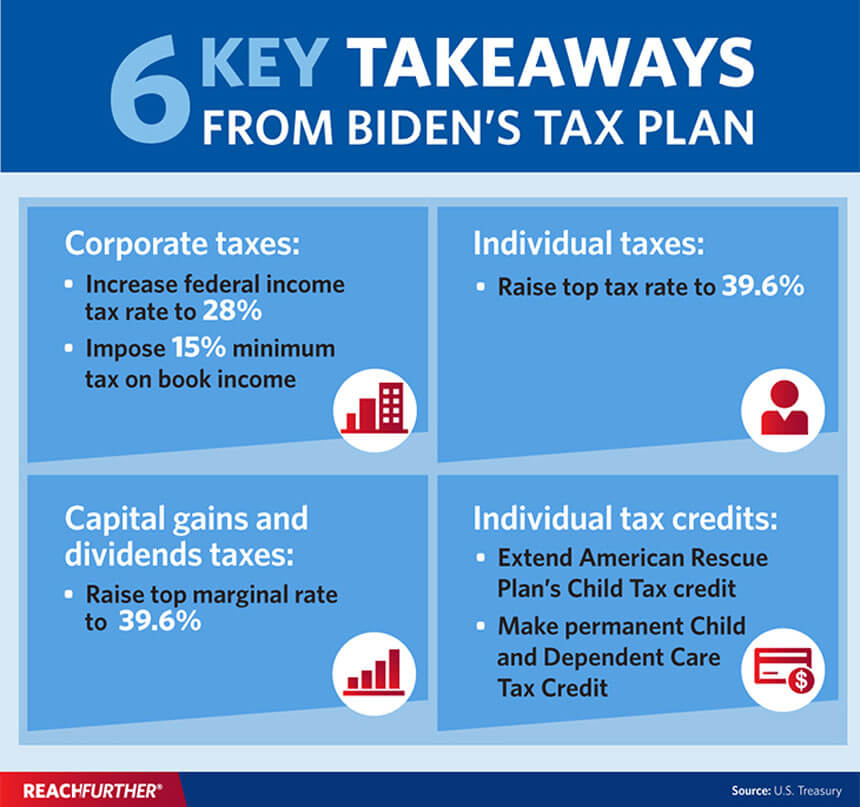

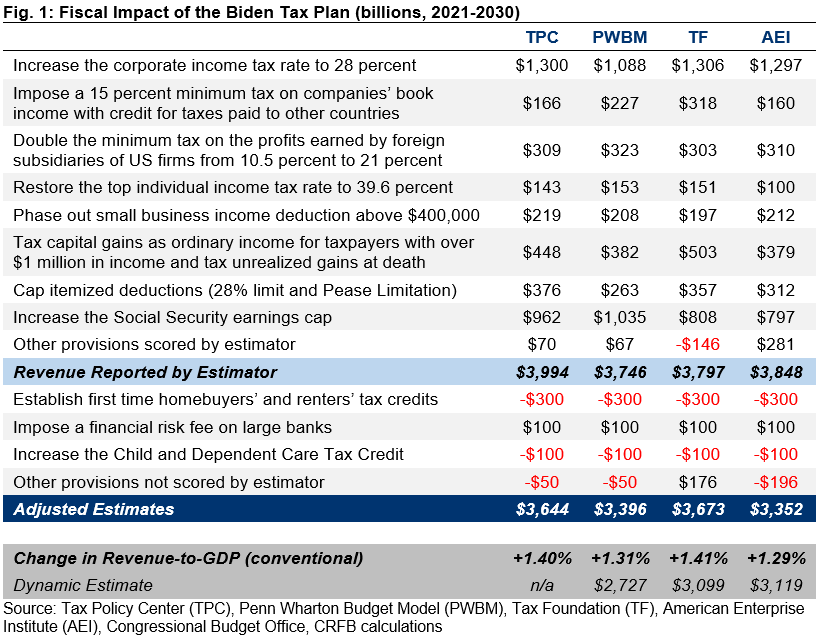

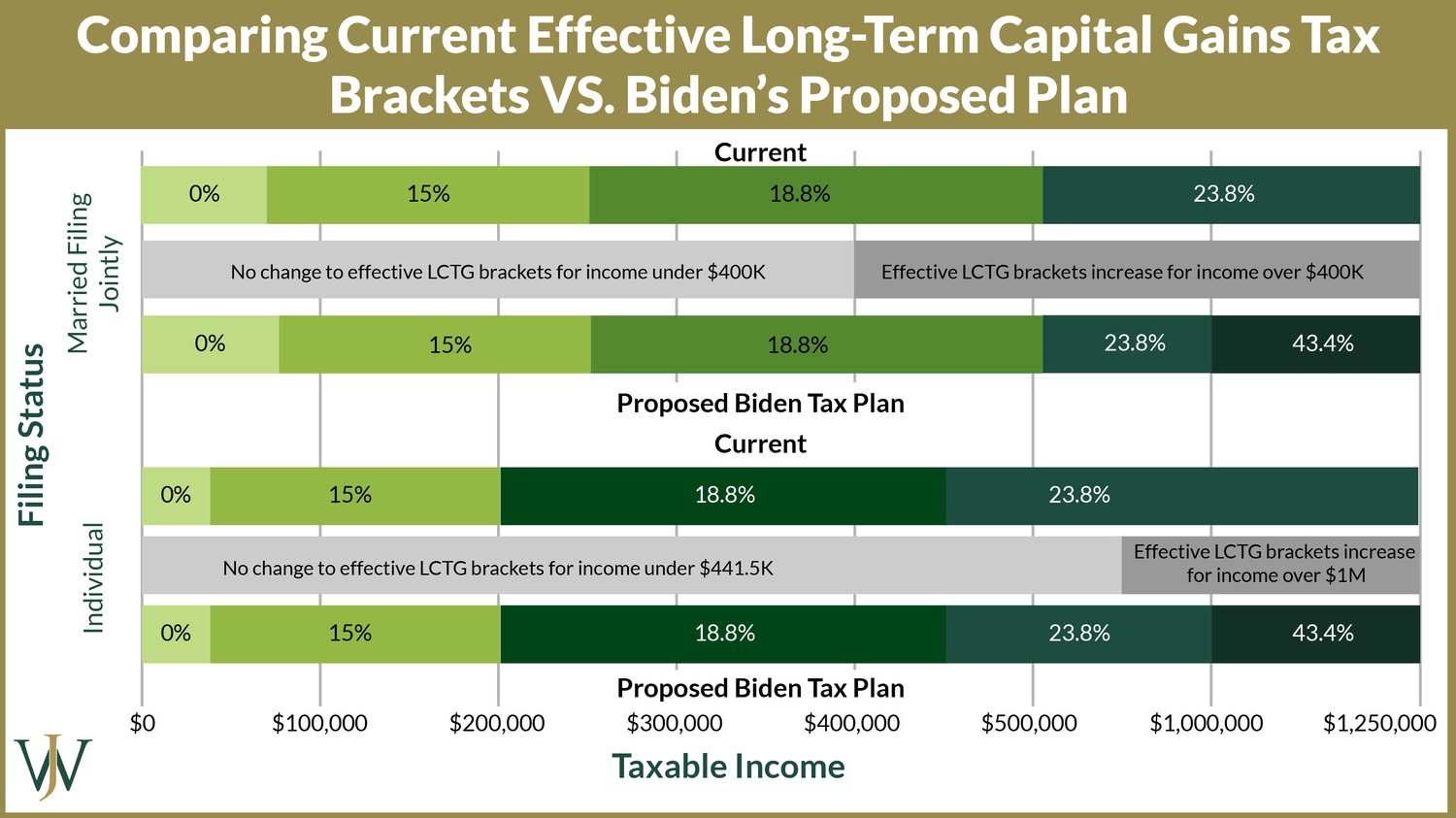

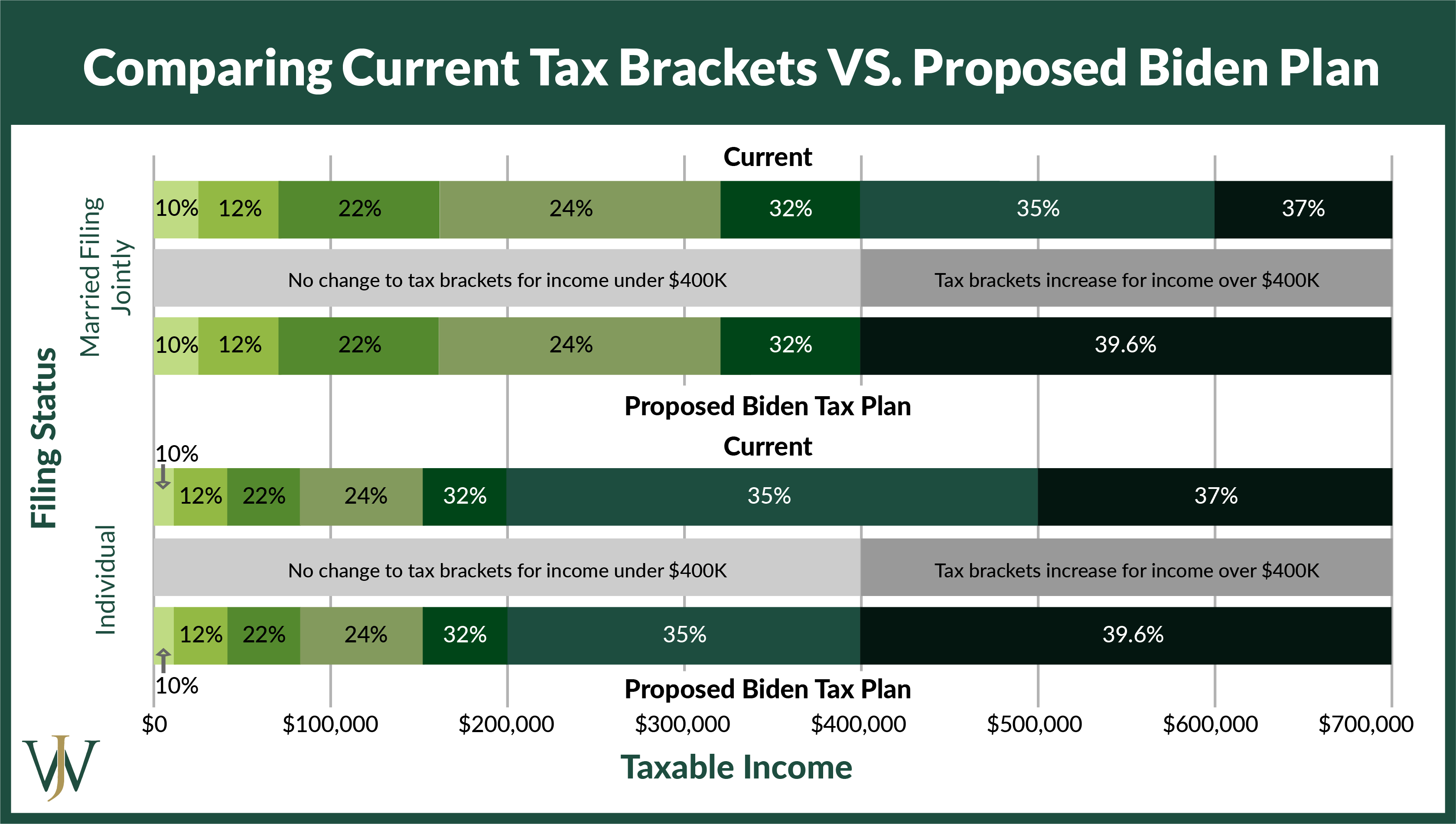

Biden has proposed raising the capital gains tax rate to 39 6 for people making more than 1 million a year My hope one that is shared by many others is that the capital gains tax rate Biden s budget assumes the BBBA increases take effect and would pile on another 2 5 trillion of tax increases 1 6 trillion from corporate and international tax changes 780 billion in individual tax changes and 170 billion from other revenue increases Altogether President Biden is proposing raising revenue by more than 4 trillion

Biden Tax Plan House Value Tax

Biden Tax Plan House Value Tax

https://crfb.org/sites/default/files/Biden Tax Paper Fig 1_v1.png

Here s How Biden s Tax Plan Would Affect Each U S State Video

https://s.yimg.com/os/creatr-uploaded-images/2020-10/3687d260-1a0d-11eb-96fd-134050311d7d

Joe Biden s 2020 Tax Plan

https://www.matthews.com/wp-content/uploads/2020/07/Biden-Tax-Graphs-03-1.png

Certain rules apply to qualify for this exemption such as having owned and used the house as your primary residence for at least two years Under Biden s plan sellers would only pay the 39 6 percent tax rate on profit made from the sale of their home if they make more than 1 million in taxable income annually according to the report They were unanimous Biden s infrastructure agenda doesn t contain a 3 property tax or any federal property tax at all This claim is not true said Garrett Watson a senior tax policy

The Biden administration has announced a number of tax proposals to fund new government investments such as infrastructure education and family programs as part of the Build Back Better Building a Better America agenda From analyzing the Build Back Better Act and Inflation Reduction Act to the U S Treasury s international tax proposals The TCJA doubled this amount from roughly 5 5 million to 11 million per person meaning that very few people have to worry about it Many of the earlier versions of Build Back Better accelerated

More picture related to Biden Tax Plan House Value Tax

Biden Tax Plan And 2020 Year End Planning Opportunities

https://www.kitces.com/wp-content/uploads/2020/09/Comparison-of-Individual-and-MFJ-Tax-Brackets-1-2048x1345.png

Understanding Joe Biden s 2020 Tax Plan Committee For A Responsible Federal Budget

http://www.crfb.org/sites/default/files/Biden Tax Paper Fig 2_v1.png

How Will The Joe Biden Tax Plan Affect Me PayPath

https://assets.rebelmouse.io/eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJpbWFnZSI6Imh0dHBzOi8vYXNzZXRzLnJibC5tcy8yNDc2ODM3NS9vcmlnaW4uanBnIiwiZXhwaXJlc19hdCI6MTYzNDEzNDA0Mn0.5xjQgThXHlmPT9JREdNmZmbopjeazhRO1N5IlOl3qU4/img.jpg?width=980

You would pay capital gains on that 300 000 increase in property value at a 20 tax rate But under Biden s tax plan individual long term gains would increase from a 20 rate to a maximum rate The plan also includes Biden s promised billionaires tax which would establish a minimum 25 rate for the top 0 01 of earners and include taxes on unrealized capital gains without taxes

Ahead of the 2020 election the Tax Policy Center estimated Biden s plan would raise 2 1 trillion over a decade As Bloomberg notes his White House proposal could be smaller According to the Tax Foundation s General Equilibrium Model the Biden tax plan would reduce GDP by 1 62 percent over the long term On a conventional basis the Biden tax plan by 2030 would lead to about 7 7 percent less after tax income for the top 1 percent of taxpayers and about a

Biden s Tax Plan Explained For High Income Earners Making Over 400 000

https://insights.wjohnsonassociates.com/hs-fs/hubfs/Biden Tax Plan - Long Term Capital Gains Tax Brackets-02-02.png?width=1500&name=Biden Tax Plan - Long Term Capital Gains Tax Brackets-02-02.png

What Biden s Proposed Tax Plan Means For Businesses

https://www.eastwestbank.com/content/dam/ewb-dotcom/reachfurther/newsarticlestore/846/Key-Takeaways-From-Bidens-Tax-Plan.jpg

https://www.snopes.com/fact-check/biden-property-tax-3/

Published Oct 27 2020 Joe Biden s tax plan includes a 3 federal property tax on privately owned homes During the 2020 U S presidential campaign social media postings repeatedly warned

https://www.kiplinger.com/real-estate/real-estate-investing/603008/how-bidens-tax-plan-could-affect-your-real-estate

Biden has proposed raising the capital gains tax rate to 39 6 for people making more than 1 million a year My hope one that is shared by many others is that the capital gains tax rate

Biden s Tax Plans Outlined In Proposed Budget For 2022 R Co

Biden s Tax Plan Explained For High Income Earners Making Over 400 000

Biden Tax Plan Gives 620 Tax Cut To Middle Class New Study Says Business News

Biden s Tax Plan Explained For High Income Earners Making Over 400 000

The Biden Tax Plan Here Is What We Are In For YouTube

A Comparison Of The Trump And Biden Tax Plans Advisorpedia

A Comparison Of The Trump And Biden Tax Plans Advisorpedia

All The Ways Biden Plans To Tax The Rich YouTube

Biden s Tax Plan How It Will Impact Investors YouTube

The Biden Tax Plan 5 Ways That The Proposed Changes Will Affect Real Estate Millcreek

Biden Tax Plan House Value Tax - The TCJA doubled this amount from roughly 5 5 million to 11 million per person meaning that very few people have to worry about it Many of the earlier versions of Build Back Better accelerated