Bidens Tax Plan On Housing Launches first of its kind program to address land use and zoning barriers that limit housing President Biden s economic vision is about building an economy from the middle out and bottom up

We ll be in touch with the latest information on how President Biden and his administration are working for the American people as well as ways you can get involved and help our country build Social media has in recent weeks been replete with claims about the various policy proposals that Biden the Democratic presidential nominee has put forth This particular post claims that Biden wants to implement a 3 annual federal tax on your home if he gets elected Under current law state and local governments collect property

Bidens Tax Plan On Housing

Bidens Tax Plan On Housing

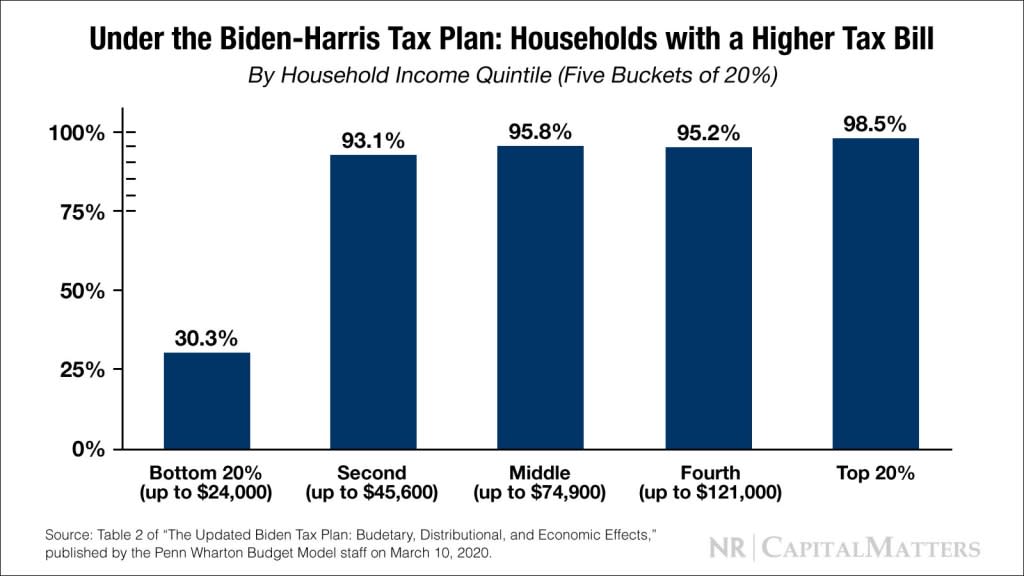

https://s.yimg.com/uu/api/res/1.2/V7miNrgoyDWY5mys2YK1Ng--~B/aD01NzY7dz0xMDI0O3NtPTE7YXBwaWQ9eXRhY2h5b24-/https://media.zenfs.com/en-US/the_national_review_738/3d29437237ec06b4cb8d39664ca2fb73

Details And Analysis Of Joe Biden s Tax Plan Tax Foundation

https://files.taxfoundation.org/20200427111358/2020-Biden-Tax-Plan-Social-01.png

1739 5 Million Housing Shortage Joe Biden s Terrible Tax Plan For Real Estate Investors

https://s3.us-west-1.amazonaws.com/jasonhartman.com-media/wp-content/uploads/20230422215254/Screen-Shot-2021-09-16-at-3.05.25-AM.png

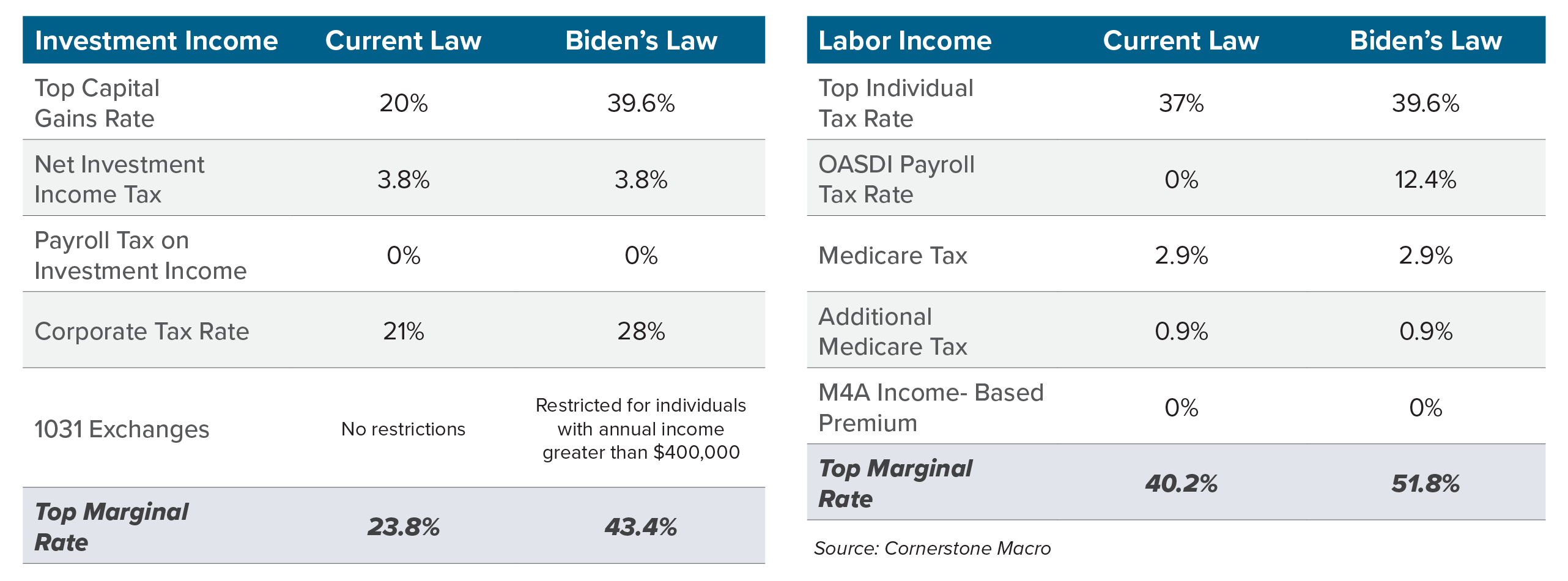

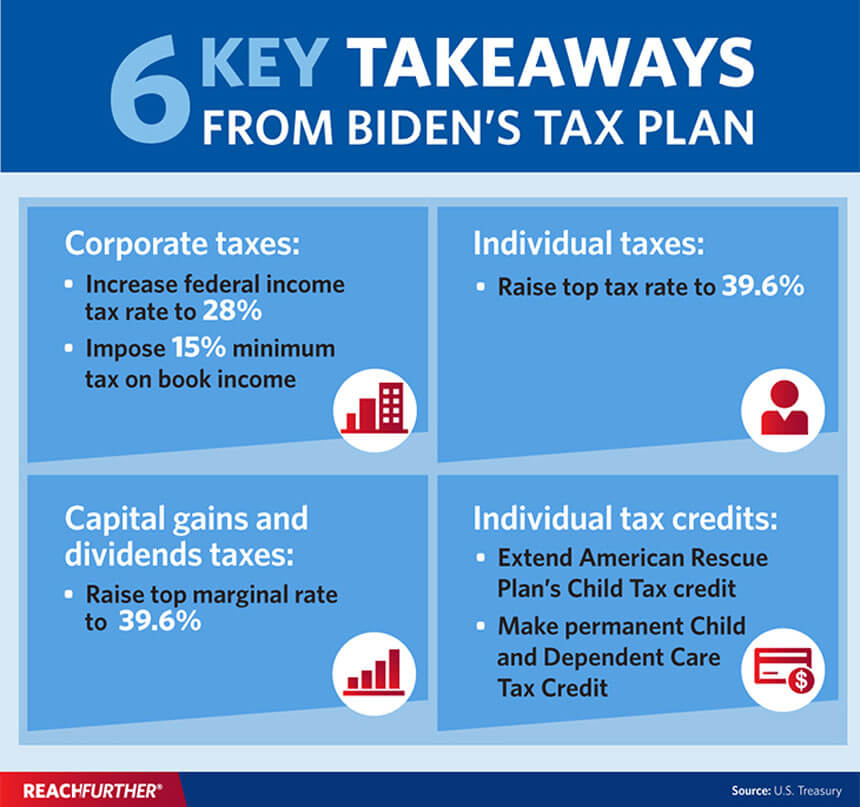

Biden s plan abolishes the right to defer taxes on property gains over 500 000 The measure may affect more people than wealthy investors financial experts say Real estate investors may soon The most significant pay for in The American Jobs Plan AJP is an increase in the corporate tax rate from 21 to 28 The plan also proposes a minimum book tax for corporations of 15

The Biden administration wants to spend 318 billion on housing in the American Jobs Plan Here are the full details Marcia Fudge U S secretary of Housing And Urban Development HUD will A new federal rule could raise the monthly mortgage payments of buyers with good credit scores by over 60 a month while riskier borrowers will get more favorable terms because their fees will be

More picture related to Bidens Tax Plan On Housing

HOW JOE BIDEN S TAX PLAN WILL AFFECT REAL ESTATE

https://blkmillenniaireblog.com/wp-content/uploads/2021/06/how-joe-bidens-tax-plan-will-affect-real-estate-QNWFsXDomrc.jpg

What The Biden Tax Plans Mean For The Housing Market HousingWire

https://www.housingwire.com/wp-content/uploads/2021/05/Trends-in-Revenues.png

Biden s Tax Plans Outlined In Proposed Budget For 2022 R Co

https://rosenfieldandco.com/wp-content/uploads/2021/06/Bidens-Tax-Plans-Outlined-in-Proposed-Budget-for-2022.png

Now their fee has been raised to 1 375 or a total of 4 125 on a 300 000 loan But some borrowers stand to benefit from this change thanks to a reduction in their fees For example a borrower President Joe Biden has unveiled a plan for higher taxes on inherited homes to help fund the 1 8 trillion American Families Plan The proposal would tax inherited property gains at death

An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to As President Biden said last week tackling inflation is his top economic priority Today President Biden is releasing a Housing Supply Action Plan to ease the burden of housing costs over time

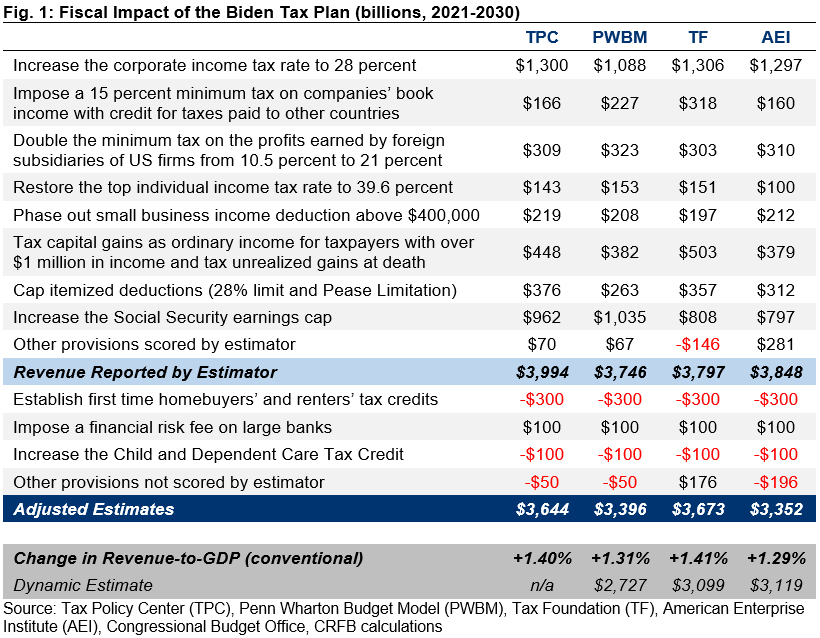

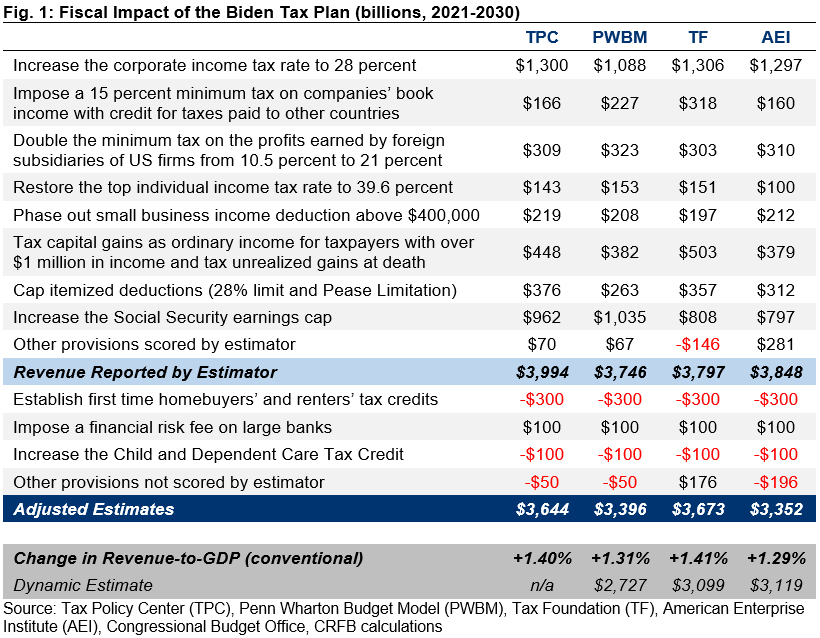

Understanding Joe Biden s 2020 Tax Plan Committee For A Responsible Federal Budget

https://crfb.org/sites/default/files/Biden Tax Paper Fig 1_v1.png

Joe Biden s 2020 Tax Plan

https://www.matthews.com/wp-content/uploads/2020/07/Biden-Tax-Graphs-03-1.png

https://www.whitehouse.gov/briefing-room/statements-releases/2023/07/27/biden-harris-administration-announces-actions-to-lower-housing-costs-and-boost-supply/

Launches first of its kind program to address land use and zoning barriers that limit housing President Biden s economic vision is about building an economy from the middle out and bottom up

https://www.whitehouse.gov/briefing-room/statements-releases/2023/10/16/white-house-announces-new-actions-on-homeownership/

We ll be in touch with the latest information on how President Biden and his administration are working for the American people as well as ways you can get involved and help our country build

3 Ways Biden s New Tax Policies Will Affect Your Estate Plan

Understanding Joe Biden s 2020 Tax Plan Committee For A Responsible Federal Budget

Biden s Tax Plan May 2021 Newsletter Risk Resource

The Biden Tax Plan 8 Changes For Real Estate Investors Everything Real Estate Investing

Biden s Tax Plan Proposal Probate Realtor Estate Clean Out Executor Support Austin Texas

What Biden s Proposed Tax Plan Means For Businesses

What Biden s Proposed Tax Plan Means For Businesses

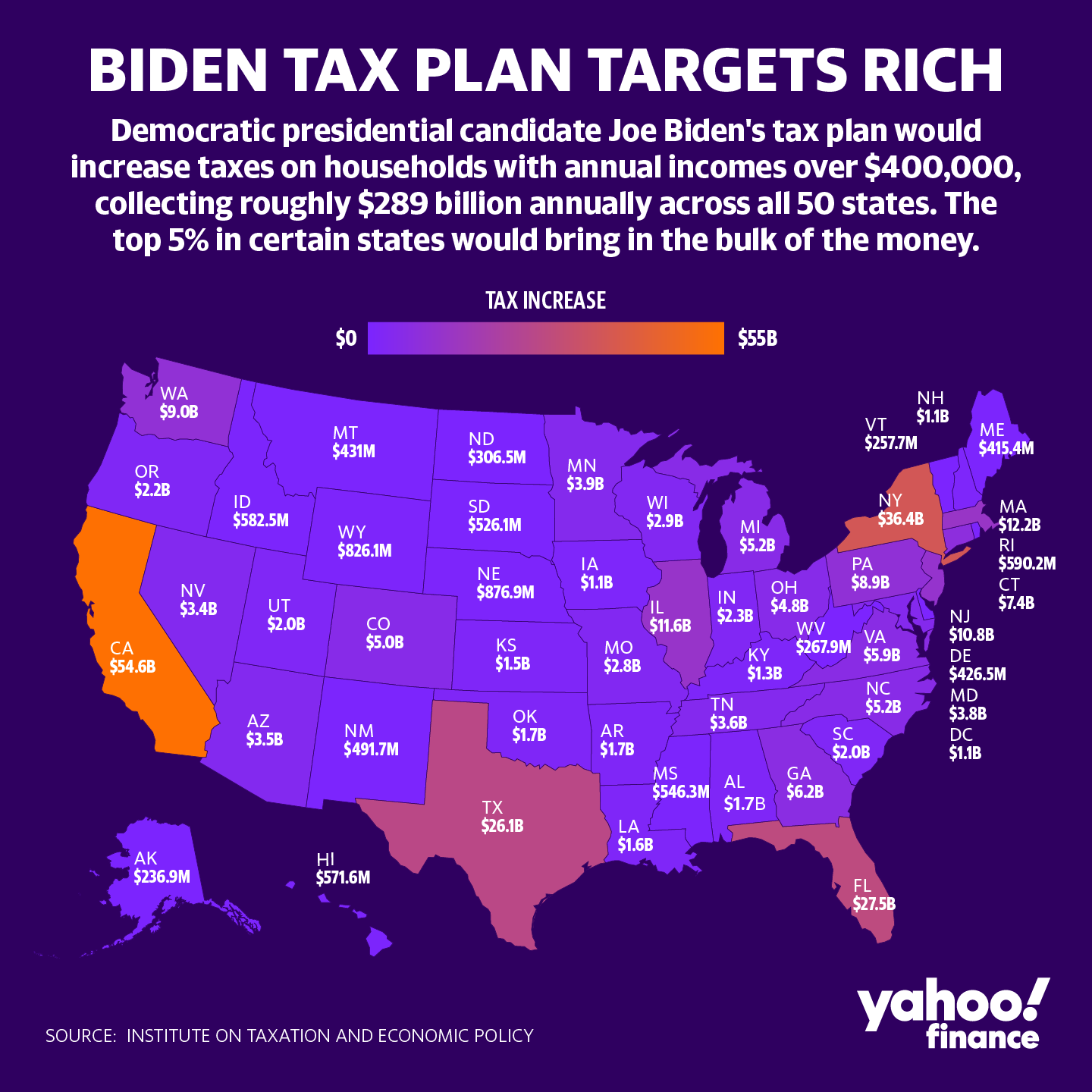

Here s How Biden s Tax Plan Would Affect Each U S State

How Will The Joe Biden Tax Plan Affect Me PayPath

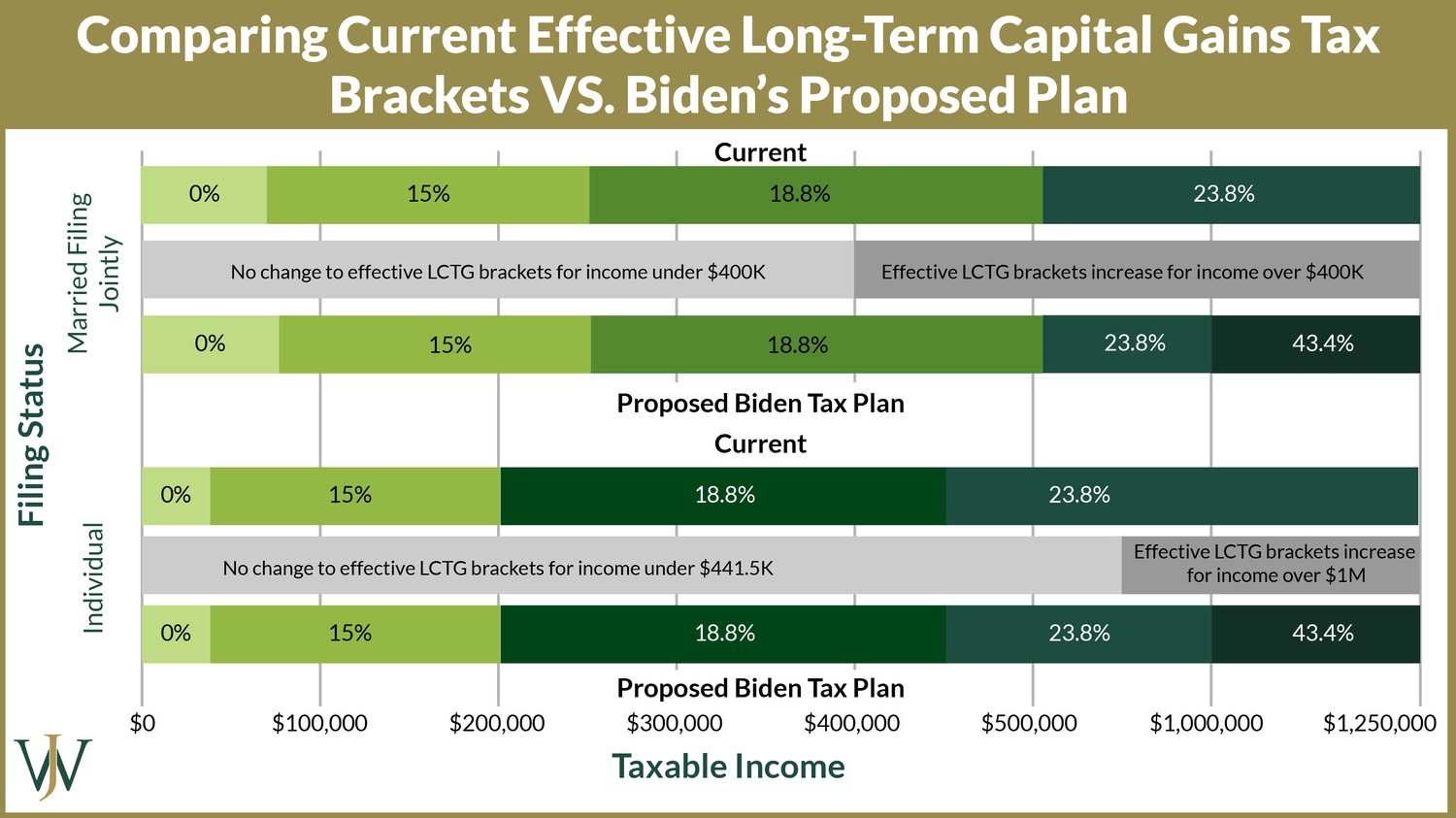

Biden s Tax Plan Explained For High Income Earners Making Over 400 000

Bidens Tax Plan On Housing - The legislation introduced by Senators Ben Cardin a Democrat from Maryland and Todd Young a Republican from Indiana could help 500 000 homes and generate 125 billion in development revenue