Borrowing From A 457 Plan To Buy A House Penalty 457 b Plan Loan Rules If your 457 b plan allows loans the minimum amount is 1 000 and the maximum can vary You can typically borrow up to 50 of your vested balance or up to 50 000 whichever is less Some plans have an exception to this limit If your vested balance is less than 10 000 you can borrow up to your full vested balance

For 2021 the maximum amount you can contribute to your 457 plan is 19 500 If you are 50 years or older you may be eligible to make catch up contributions of up to 6 500 for a total of 26 000 Keep in mind that these contribution limits apply to your total contributions for the year across all 457 plans you may have with different employers Contribution Limits for a 457 b Account For 2022 the 457 b contribution limit is 20 500 for those under 50 with an optional catch up contribution limit of 6 500 for those 50 or older Additionally employees who are within three years of retirement age as specified in the plan can make special 457 b catch up contributions

Borrowing From A 457 Plan To Buy A House Penalty

Borrowing From A 457 Plan To Buy A House Penalty

https://www.financestrategists.com/uploads/Types-of-457-Plan.png

Benefits Of A 457 Plan

https://static.wixstatic.com/media/91203e_085aa414ad8e43438b875606c0c82422~mv2.jpg/v1/fill/w_980,h_716,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/91203e_085aa414ad8e43438b875606c0c82422~mv2.jpg

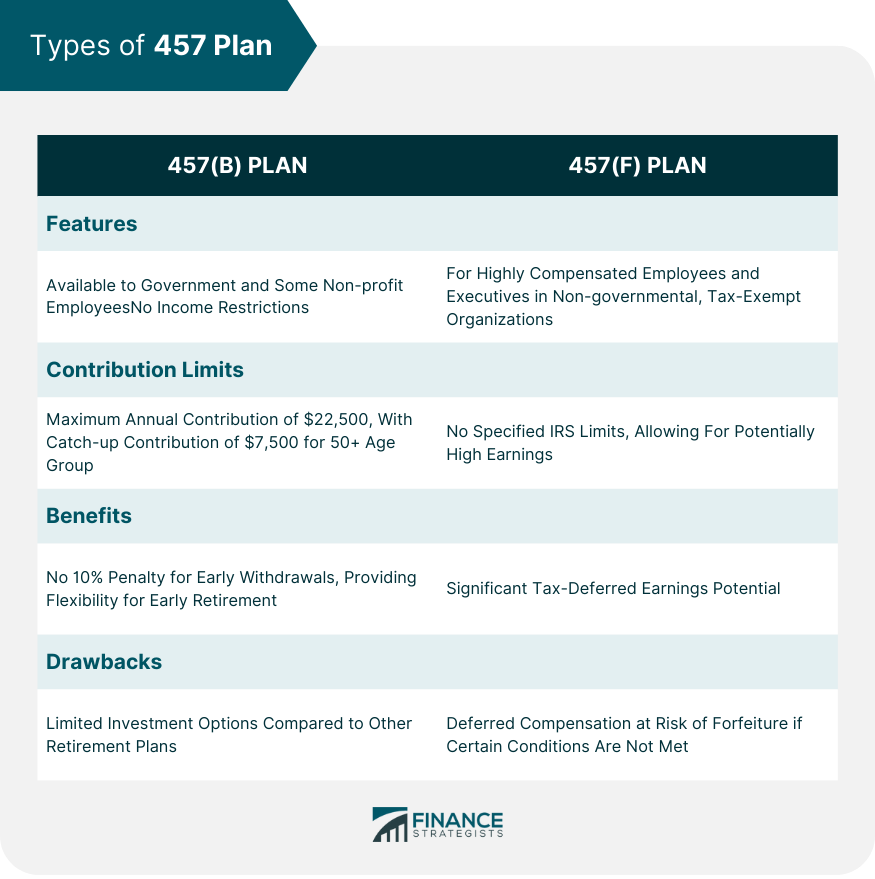

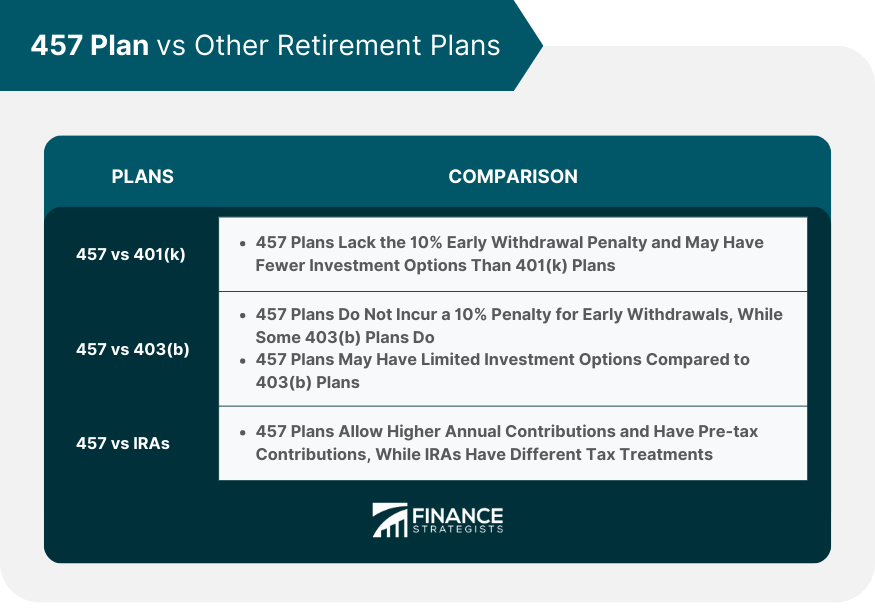

457 Plan Definition Types Benefits Drawbacks Strategies

https://www.financestrategists.com/uploads/457-Plan-vs-Other-Retirement-Plans.png

Possible advantages of borrowing from your 457 b Compared to traditional lenders applying for a plan loan is remarkably quick and easy Applications can usually be completed online by filling out a form Once your loan is approved you will usually have the funds deposited directly into your bank account within days What is the Best Way to Borrow from 457 Retirement Plan Jason Wutzke Poster Menifee CA Posted 7 years ago My Mom 63 has a 457 retirement plan that she would like to borrow 20 000 from with the intent of lending me the money so I can invest in my first real estate property

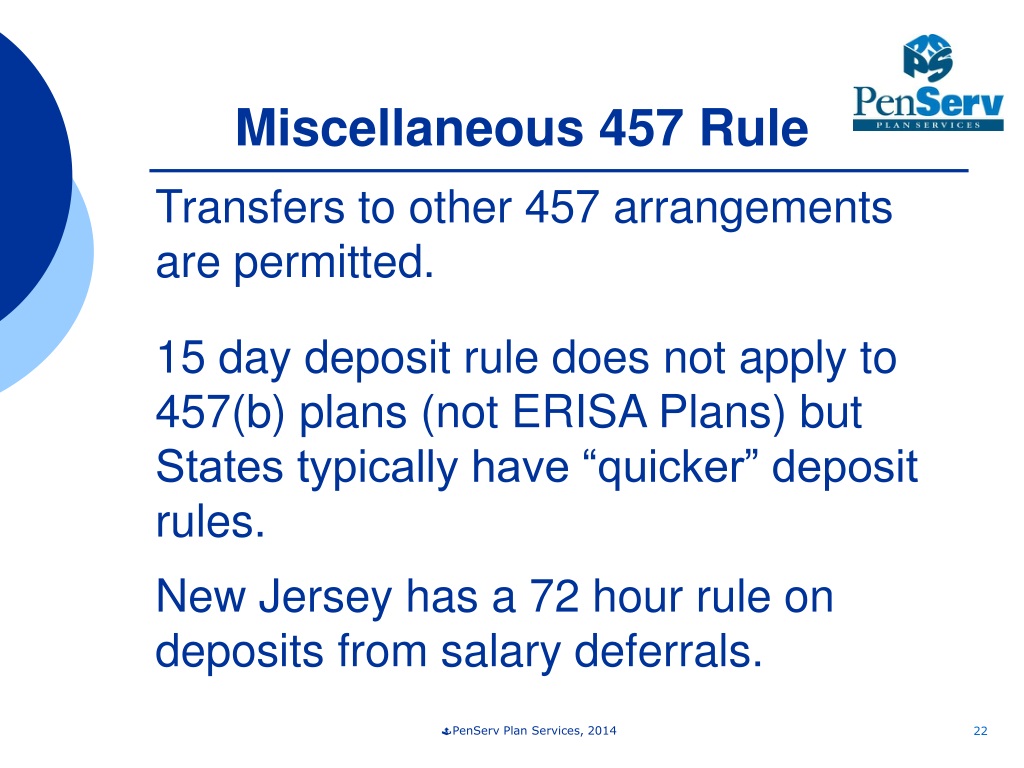

A plan sponsor is not required to include loan provisions in its plan Profit sharing money purchase 401 k 403 b and 457 b plans may offer loans Plans based on IRAs SEP SIMPLE IRA do not offer loans To determine if a plan offers loans check with the plan sponsor or the Summary Plan Description See Retirement Topics Loans Although borrowing from your plan reduces your plan balance only temporarily you could miss out on investment returns that you might have earned if you had left the money in the account Those returns could potentially exceed the interest you will have to pay yourself on the loan

More picture related to Borrowing From A 457 Plan To Buy A House Penalty

What Is A 457 b State Local Government Retirement Plans Explained YouTube

https://i.ytimg.com/vi/4ngbKm7ayCw/maxresdefault.jpg

:max_bytes(150000):strip_icc()/457plan.asp-final-f27170b983d0496e86a246a0c1cb4602.png)

457 Plan

https://www.investopedia.com/thmb/S1lp4vKskF2NDwKfF2294Mj1uuA=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/457plan.asp-final-f27170b983d0496e86a246a0c1cb4602.png

Understanding 457 Plans Scarlet Oak Financial Services

https://scarletoakfs.com/wp-content/uploads/2022/01/Understanding-457-plans-2023.gif

The 457 b retirement plan offers many advantages to government workers including tax deferred growth of their savings but these plans do come with some drawbacks Here s how the 457 b Just like a 401 k or 403 b retirement savings plan a 457 plan allows you to invest a portion of your salary on a pretax basis The money grows tax deferred waiting for you to decide

May 11 2023 at 2 15 p m Getty Images Use the following criteria to help decide whether to use your IRA to buy a house If you re shopping for a new home you may be looking for ways to You can also roll over 457 b funds to a qualified retirement plan such as a traditional IRA Roth IRA 401 k 403 b or another 457 b plan How 457 b plans work State and local governments as well as certain non governmental organizations may provide 457 k plans to allow employees to save for retirement The contributions made to the 457

457 Calculator 2023

https://images.surferseo.art/b777a694-7596-4463-aa23-4c1f29df65ed.png

What You Need To Know About 457 b Plans Inflation Protection

https://i.ytimg.com/vi/47JjA9RlDeE/maxresdefault.jpg

https://www.missionsq.org/products-and-services/457(b)-deferred-compensation-plans/457(b)-borrowing-rules-options.html

457 b Plan Loan Rules If your 457 b plan allows loans the minimum amount is 1 000 and the maximum can vary You can typically borrow up to 50 of your vested balance or up to 50 000 whichever is less Some plans have an exception to this limit If your vested balance is less than 10 000 you can borrow up to your full vested balance

https://wheretoinvest.money/understanding-457-withdrawal-rules-a-complete-guide/

For 2021 the maximum amount you can contribute to your 457 plan is 19 500 If you are 50 years or older you may be eligible to make catch up contributions of up to 6 500 for a total of 26 000 Keep in mind that these contribution limits apply to your total contributions for the year across all 457 plans you may have with different employers

What Is A 457 Plan Unlocking Secrets Of Deferred Compensation FlashFish

457 Calculator 2023

Wat Is Een 457 b Plan Hoe Werkt Het WealthKeel Westminster Portal

What Is A 457 b Plan How Does It Work WealthKeel

457 b Plan What Is It And Who Qualifies For One Women Who Money

What Is A 457 Retirement Plan Inflation Protection

What Is A 457 Retirement Plan Inflation Protection

What Is A 457 Plan

457 Plan For Teachers The Enterprising Educator

PPT Are You Ready For An IRS Audit Of Your 457 b Plan PowerPoint Presentation ID 9300521

Borrowing From A 457 Plan To Buy A House Penalty - A plan sponsor is not required to include loan provisions in its plan Profit sharing money purchase 401 k 403 b and 457 b plans may offer loans Plans based on IRAs SEP SIMPLE IRA do not offer loans To determine if a plan offers loans check with the plan sponsor or the Summary Plan Description See Retirement Topics Loans