Business Mileage Deductions Under House Plan Home Everything You Need to Know About Claiming a Mileage Tax Deduction Drive for business charity or medical appointments Here are the details about claiming mileage on taxes By

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later However if you use the car for both business and personal purposes you may deduct only the cost of its business use Leased vehicles must use the standard mileage rate method for the entire lease period including renewals if the standard mileage rate is chosen Notice 2023 03 PDF contains the optional 2023 standard mileage rates as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate FAVR plan In addition

Business Mileage Deductions Under House Plan

Business Mileage Deductions Under House Plan

https://media.graphassets.com/KPnZDG1WRh6RYVctbjAz

How To Claim Mileage On Taxes In Five Easy Steps

https://storage.googleapis.com/driversnote-marketing-pages/US-infographic-how-to-deduct-mileage-landscape.png

Concept 20 House Plan Drive Under Garage

https://assets.architecturaldesigns.com/plan_assets/324991045/original/uploads_2F1483626804741-ovmyyf47txv0gzfb-ce98b1ba0c05eecfc31ee9e62ef24707_2F69649am_1483627371.jpg?1506336213

Standard mileage rate For 2022 the standard mileage rate for the cost of operating your car for business use is 58 5 cents 0 585 per mile from January 1 June 30 and 62 5 cents 0 625 per mile from July 1 December 31 The business mileage deduction is a tax break small business owners can claim for business miles driven Mileage deduction rates apply to those who are self employed Due to the Tax Cuts and Jobs Act of 2017 your employees cannot claim the deduction However you can continue or start providing mileage reimbursement to your employees

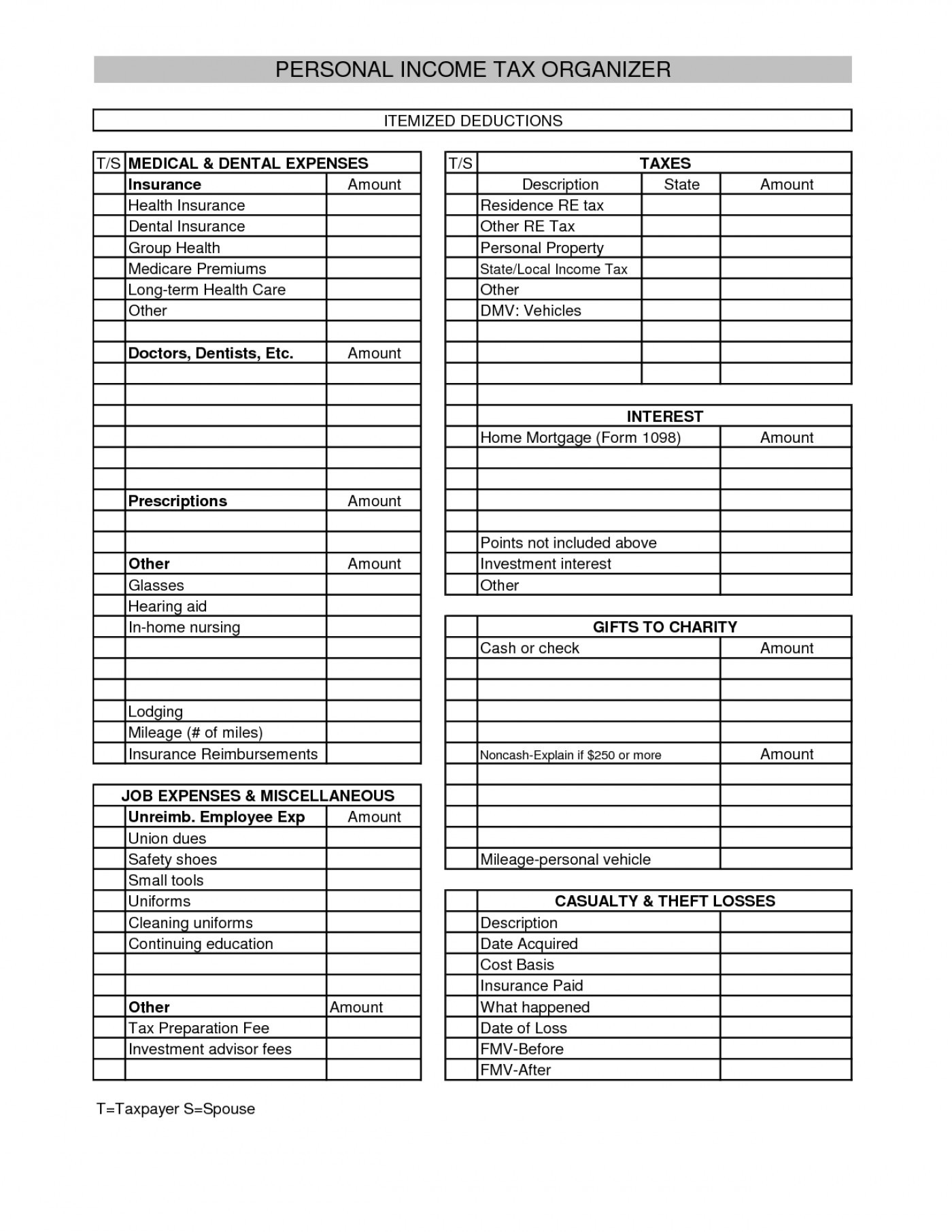

What Car Expenses Can I Deduct Keep Good Records Photo Images By Tang Ming Tung Getty Images If you operate your business from your home you can deduct business related car expenses for travel back and forth from home to business locations for business purposes The following cover three steps for effective mileage deduction for business owners plus two common pitfalls and a bonus tax strategy 1 Track mileage and expenses The first step in deducting

More picture related to Business Mileage Deductions Under House Plan

/GettyImages-83665581-5a5e595fb39d03003787d7a1.jpg)

Business Mileage Deductions FAQs

https://www.thebalancesmb.com/thmb/s1sILzSREyHOgj3nWNEKFifGrH4=/5120x3413/filters:fill(auto,1)/GettyImages-83665581-5a5e595fb39d03003787d7a1.jpg

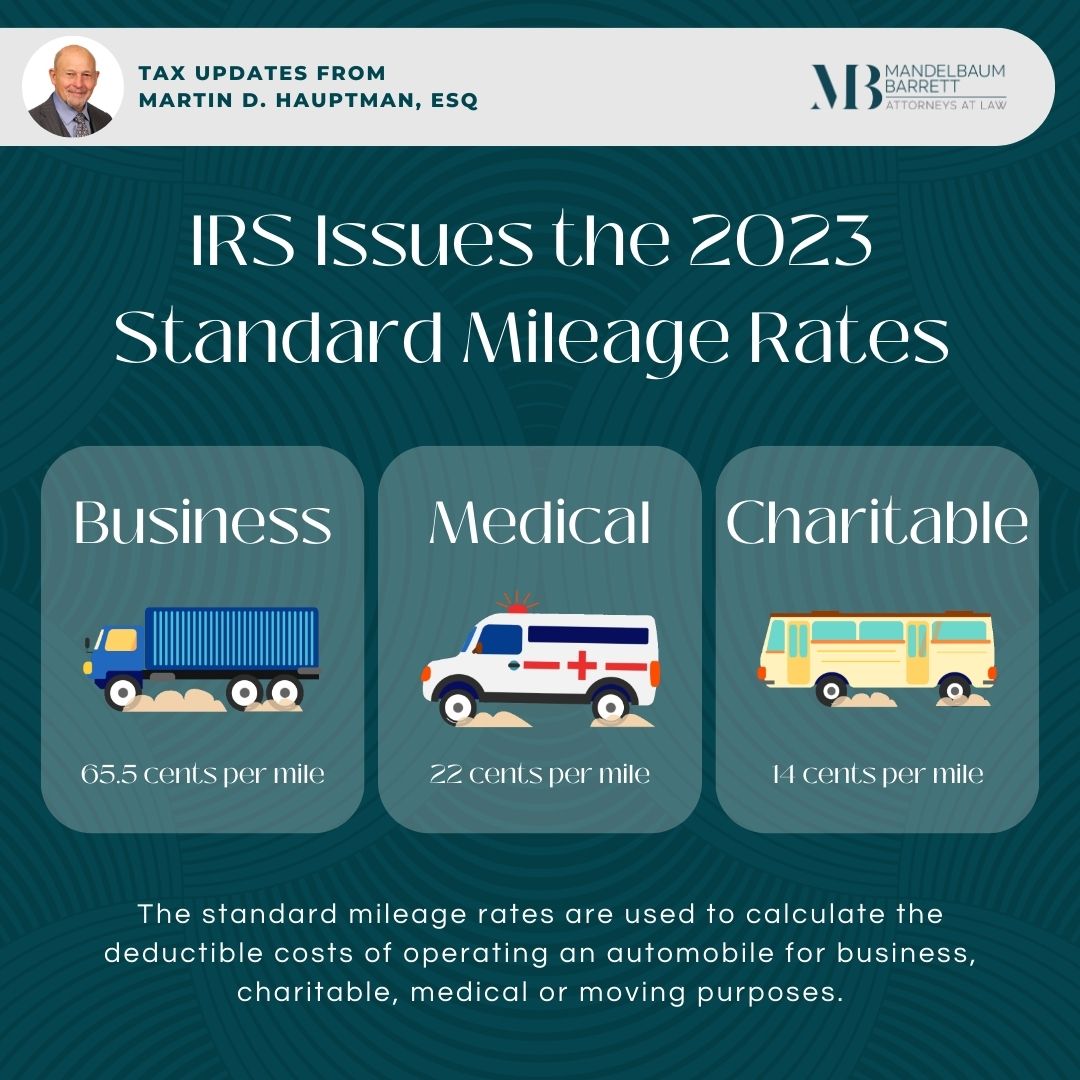

IRS Issues Standard Mileage Rates For 2023 Mandelbaum Barrett PC

https://www.mblawfirm.com/wp-content/uploads/2023/01/Marty-Mileage-Rates.jpg

Audit Proof Your Business Mileage The Power Of A Mileage Log Www

https://www.steadfastbookkeeping.com/wp-content/uploads/sites/5584/2023/06/socialsquares_brightsummerstock9-1-1024x1024.jpg

You can deduct mileage for business driving from a home based office just as you would for a separate office You must keep records contemporaneously in the moment for business driving expenses Estimates are not acceptable First you will need to determine how many of the miles you traveled were for your business Then you ll need to find what percent of your total miles that represents For example if you drove 10 000 miles in a year but only 5 000 were for business then 50 of your miles were business miles

Business miles can be deducted at a rate of 0 585 per mile for tax year 2022 You can deduct business miles in many more situations if you are self employed Changes to Mileage Deductions In previous tax years self employed people most businesses and even many individual taxpayers were able to deduct mileage for business purposes The IRS has announced the 2023 optional standard mileage rates used to calculate the deductible costs of operating a vehicle for business charitable medical or moving purposes Background If you use a vehicle for business driving you can generally deduct the actual expenses attributable to your business use This includes expenses such as gas oil tires insurance repairs licenses and

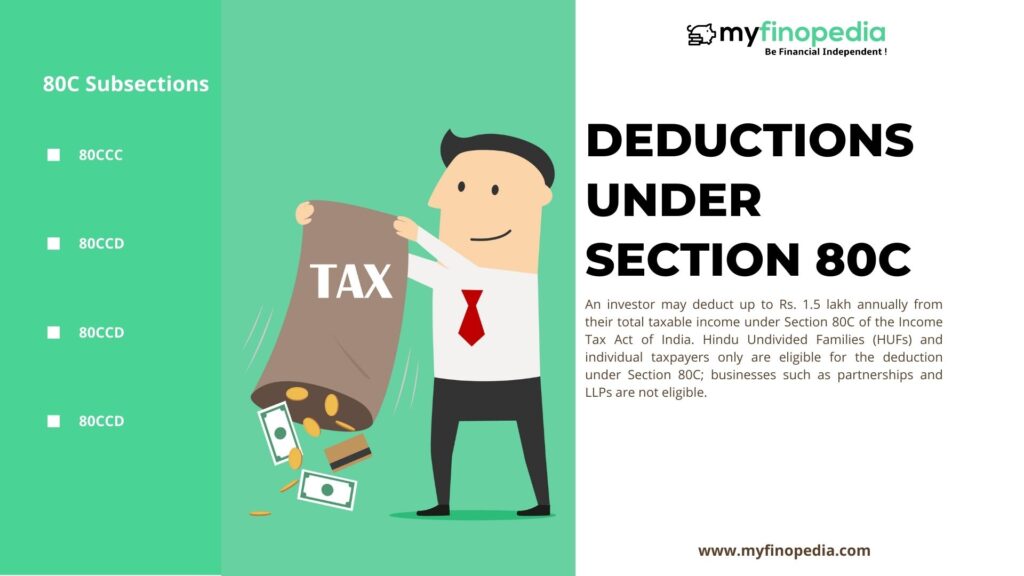

Deductions U S 80C Under Schedule VI Of Income Tax IFCCL

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

Deductions Under Section 80C Benefits Works Myfinopedia

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C-1024x576.jpg

https://money.usnews.com/money/personal-finance/taxes/articles/everything-you-need-to-know-about-claiming-a-mileage-tax-deduction

Home Everything You Need to Know About Claiming a Mileage Tax Deduction Drive for business charity or medical appointments Here are the details about claiming mileage on taxes By

https://www.irs.gov/taxtopics/tc510

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later However if you use the car for both business and personal purposes you may deduct only the cost of its business use

Mountain Home Plan With Drive Under Garage 35313GH Architectural

Deductions U S 80C Under Schedule VI Of Income Tax IFCCL

Sample 31 Printable Mileage Log Templates Free Templatelab Business

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Case Study How To Ensure You re Getting Your Business s Mileage

Tips To Maximize Your Mileage Deduction Continuum

Tips To Maximize Your Mileage Deduction Continuum

Itemized Deductions Worksheet Excel

Claiming Your Business Mileage Deductions ExpressMileage

Section 80C Deductions List To Save Income Tax FinCalC Blog

Business Mileage Deductions Under House Plan - The business mileage deduction is a tax break small business owners can claim for business miles driven Mileage deduction rates apply to those who are self employed Due to the Tax Cuts and Jobs Act of 2017 your employees cannot claim the deduction However you can continue or start providing mileage reimbursement to your employees