Buying A House With Your Pension Plan The short answer is not really While it s not illegal there are stringent rules around including residential property within a Self Invested Personal Pension SIPP If an investment is deemed to be residential you lose all the usual tax advantages that come with a SIPP tax wrapper

The average interest rate for a 30 year mortgage has dipped below 3 prompting many Americans to consider buying a home while rates are low Some people might even contemplate withdrawing money 50 000 When you take out a 401 k loan you do not incur the early withdrawal penalty nor do you have to pay income tax on the amount you withdraw You have to repay the loan with interest

Buying A House With Your Pension Plan

Buying A House With Your Pension Plan

https://financialgroup.com/wp-content/uploads/2020/03/Retirement-Plan.jpg

The Secret To Successful Retirement Choosing The Right Pension Plan

https://catalystforbusiness.com/wp-content/uploads/2019/02/pension-plan.jpg

Buying A House With Student Loans Getting A Mortgage With Student

https://i.ytimg.com/vi/oqIBrij5z78/maxresdefault.jpg

The first 25 900 will be taxed at 15 percent 77 200 will be taxed at 25 percent 80 250 will be taxed at 28 percent and 16 650 will be taxed at 33 percent What I call stealth taxes should be Should You Withdraw From an IRA to Buy a House When you open an IRA the account is established to help you save for the future Normally you ll need to wait until you are age 59 1 2 to

One way you can improve your chances of getting a home loan is by putting at least 20 down at the time of purchase For existing homeowners like me coming up with a 20 down payment usually Retirees have plenty of options all with their own pros and cons 1 Downsizing your current home If you currently own a home you may want to sell it to move into something smaller and more manageable Downsizing may allow you to use equity to buy something less expensive

More picture related to Buying A House With Your Pension Plan

Using Years Of Service To Calculate Your Pension Plan Your Federal

https://plan-your-federal-retirement.com/wp-content/uploads/2022/11/FFFC-11162022.jpg

How To Pick The Right Pension Plan

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2019/07/16/849047-retirement-istock-050819.jpg

Mortgage Insurance 101 Buying A House With PMI YouTube

https://i.ytimg.com/vi/dW3dgcSihOM/maxresdefault.jpg

If you qualify as a first time homebuyer you can withdraw up to 10 000 from your traditional IRA and use the money to buy build or rebuild a home Even though you ll avoid the 10 early But it can also extend to the cost of maintenance utilities and homeowners association HOA fees To qualify for a mortgage after retirement make sure your PITI is less than 28 of your total

Author Victoria Araj Your income is one of the first things that lenders look at when they consider whether to extend you a loan Many retirees assume that if they live on a fixed income it s impossible to buy a home However the truth is that you could buy a home without a job as a retiree as long as your income meets your lender s standards Make sure to plan out how much house you can actually afford if your cash flow will see a change during retirement Buying a house where you can t age in place If you re 40 or 50 years old you probably aren t even considering buying a house with easily accessible showers no stairs etc If you develop mobility issues as you age your

Divorce And Your Pension Plan Your Federal Retirement

https://plan-your-federal-retirement.com/wp-content/uploads/2022/10/FFFC-10192022.png

Buying A House With A Personal Injury Trust Taxoo

https://www.taxoo.co.uk/wp-content/uploads/2023/02/buying-a-house-with-a-personal-injury-trust-.jpg

https://moneytothemasses.com/saving-for-your-future/pensions/buying-property-with-your-pension-everything-you-need-to-know

The short answer is not really While it s not illegal there are stringent rules around including residential property within a Self Invested Personal Pension SIPP If an investment is deemed to be residential you lose all the usual tax advantages that come with a SIPP tax wrapper

https://www.cnbc.com/2020/09/09/why-using-your-retirement-savings-to-buy-a-house-probably-isnt-worth-it.html

The average interest rate for a 30 year mortgage has dipped below 3 prompting many Americans to consider buying a home while rates are low Some people might even contemplate withdrawing money

Retirement Planning Service India

Divorce And Your Pension Plan Your Federal Retirement

Free Editable Retirement Budget Worksheet By Template Designer Issuu

How To Mix An SWP From An Equity Mutual Fund With A Pension Plan In

Pension Plan Viren Business Solutions

Workplace Pension Re enrolment Tax Hints Tips Galley Tindle

Workplace Pension Re enrolment Tax Hints Tips Galley Tindle

Pension Plan What Is It Types Benefits Vs 401K

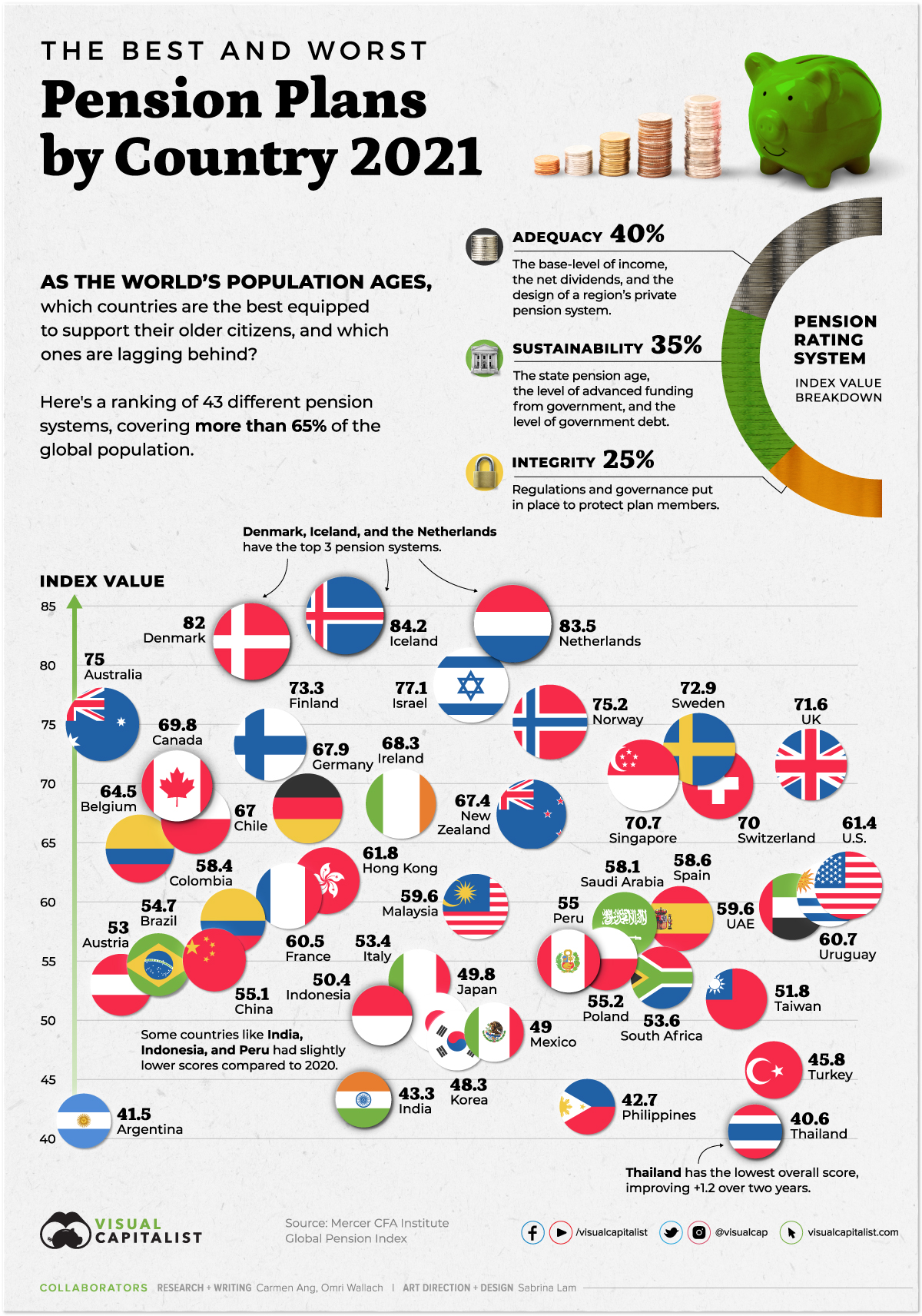

Ranked The Best And Worst Pension Plans By Country

Pensions How To Take Control Of Your Retirement The Printing Charity

Buying A House With Your Pension Plan - Published December 4th 2020 Updated December 13th 2022 Table of Contents Key Takeaways If you have a 401 k account you can take a loan from that account but you ll have to pay it back with interest IRA accounts don t allow loans but first time homebuyers can withdraw from them