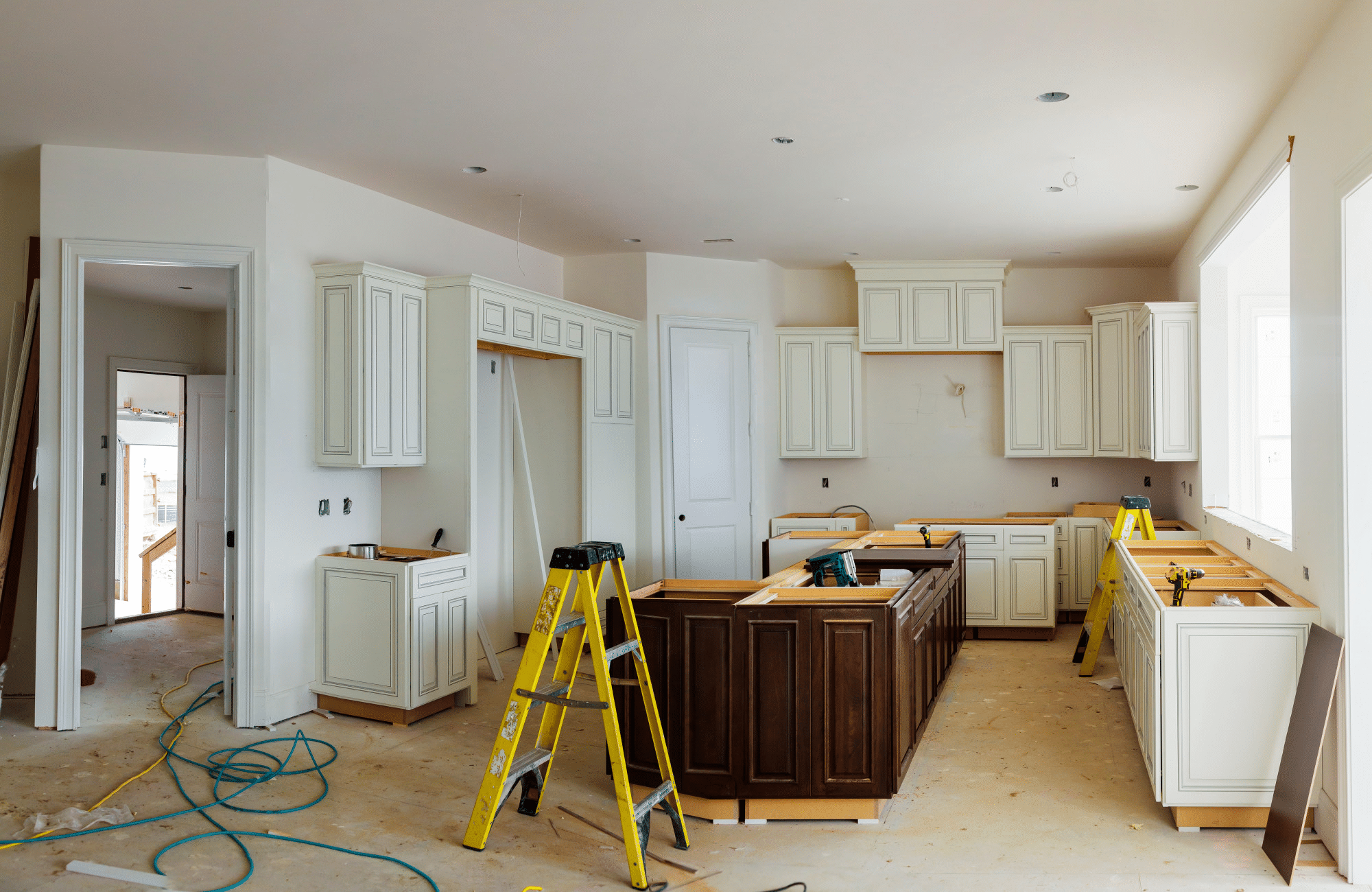

Can I Write Off Home Renovations On My Taxes Home improvements that qualify as capital improvements are tax deductible but not until you sell your home Before you start a huge home renovation project make sure you

When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost in the year you spend the money But if you keep track of those expenses they may help you While you can t write off home improvements as an item on your income tax return some home renovations will qualify as capital

Can I Write Off Home Renovations On My Taxes

Can I Write Off Home Renovations On My Taxes

https://i.ytimg.com/vi/xp96iJCUpa8/maxresdefault.jpg

Fall Home Renovations Henderson Properties

https://www.hendersonproperties.com/wp-content/uploads/2022/09/fall-home-renovations.jpg

Taxes You Can Write Off When You Work From Home INFOGRAPHIC

https://i.pinimg.com/originals/68/31/b1/6831b1b3ded591f70d81bbb733756dbc.jpg

Here are eight ways you can claim a tax deduction or tax credit for home improvements Energy Efficient Improvements The federal government offers tax credits for specific energy efficient home improvements such as the These tax deductible home renovations can save you money in several ways Find out what you need to know to reap the best benefits

Although you can t write off home improvements on your taxes there are several ways you can get tax breaks for home renovations Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks However some known as capital improvements may raise the value of your home

More picture related to Can I Write Off Home Renovations On My Taxes

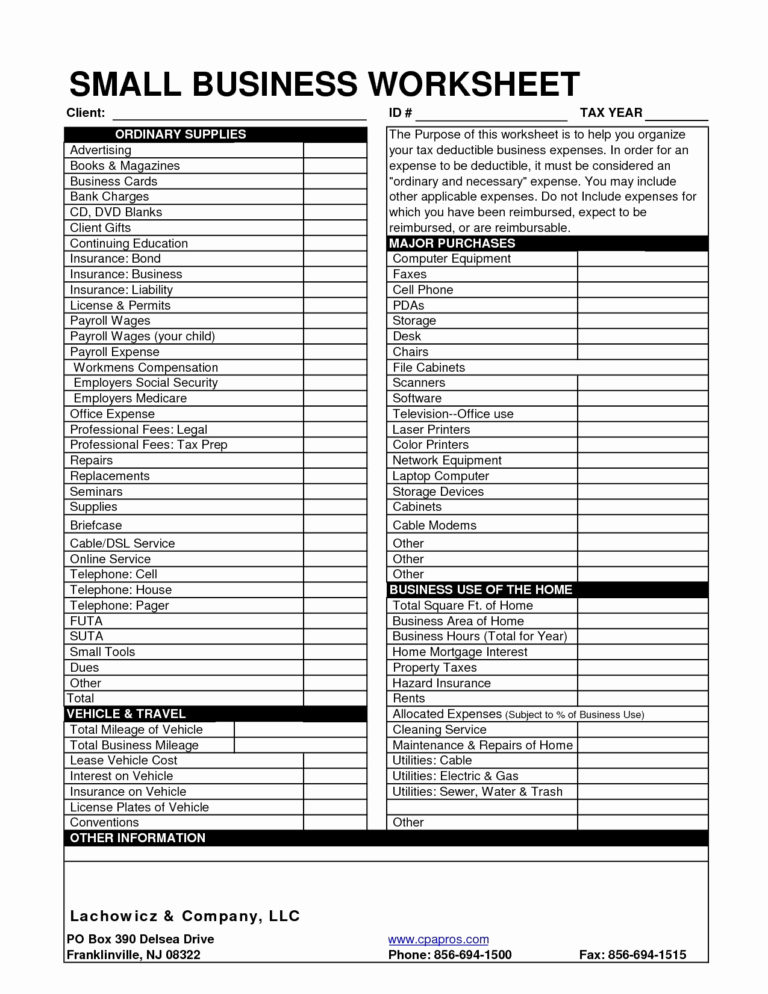

Small Business Tax Write Offs Imperfect Concepts Business Tax

https://i.pinimg.com/originals/db/02/59/db0259eeab534e2f8af7b5971c582070.jpg

101 Tax Write Offs For Business What To Claim On Taxes Small

https://i.pinimg.com/originals/cf/49/dd/cf49dd5c5ecb1e55b3c98f8cd9ff1acb.png

Home Renovation Logo Design Vector 11883518 Vector Art At Vecteezy

https://static.vecteezy.com/system/resources/previews/011/883/518/original/home-renovation-logo-design-vector.jpg

Utilizing home renovation tax deductions can significantly affect your financial planning By knowing what qualifies for deductions you re better positioned to maximize your However if you re a homeowner and you renovated or did some upgrades last year we have some good news for you You might be able to save some money on your taxes this year depending on the project Below we ll

Remodeling or renovation of your house is not usually a cost which can be deducted from your federal income taxes in 2024 and 2025 however there are many Learn how you can claim home repair tax deductions in 2024 and 2025 There are tax deductions and credits available that are applicable when you first purchase the home and

Tax Write Off Template Oldvictheatre

https://i.pinimg.com/originals/2b/2c/1d/2b2c1dd356d26e1eda369c9d8d444024.jpg

2021 Deductions Worksheets

https://db-excel.com/wp-content/uploads/2018/11/tax-expenses-durun-ugrasgrup-with-business-expense-deductions-spreadsheet-768x994.jpg

https://www.consumeraffairs.com › finance › what-home...

Home improvements that qualify as capital improvements are tax deductible but not until you sell your home Before you start a huge home renovation project make sure you

https://turbotax.intuit.com › tax-tips › hom…

When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost in the year you spend the money But if you keep track of those expenses they may help you

3 Budget Friendly Home Renovation Ideas Pure Home Improvement

Tax Write Off Template Oldvictheatre

What Can You Write Off On Your Taxes INFOGRAPHIC Tax Relief Center

Modern Bathroom Renovation Ideas

Home Office Expenses 2024 Australia Doria Gaylene

Realtors Tax Deductions Worksheet

Realtors Tax Deductions Worksheet

Economic Impact Payment 2025 Tax Return Form Alix Bernadine

Tax Deductions For Pet Sitting Business 2025 Joseph L Lewis

:max_bytes(150000):strip_icc()/write-off-4186686-FINAL-2-7eaa5af39eec457e898ccf77a0f6a4b9.png)

What Are Tax Write Offs

Can I Write Off Home Renovations On My Taxes - Tax deductions reduce taxable income lowering your tax bill Tax credits offer a direct reduction in the amount of taxes owed Most remodeling costs fall under capital improvements which