Can You Claim Electricity On Rental Property The energy credits you are thinking of are found in Section 25C and Section 25D These only apply to someone who uses the property as their residence For section 25C

If the rent you charge covers services like water or council tax you ll need to count the rent you charge the tenant within your income but you can claim the costs you pay as an expense Some examples of allowable expenses you can Landlords can often deduct utility expenses for rental properties if they meet specific IRS criteria Deductible utilities typically include electricity water gas and trash collection as

Can You Claim Electricity On Rental Property

Can You Claim Electricity On Rental Property

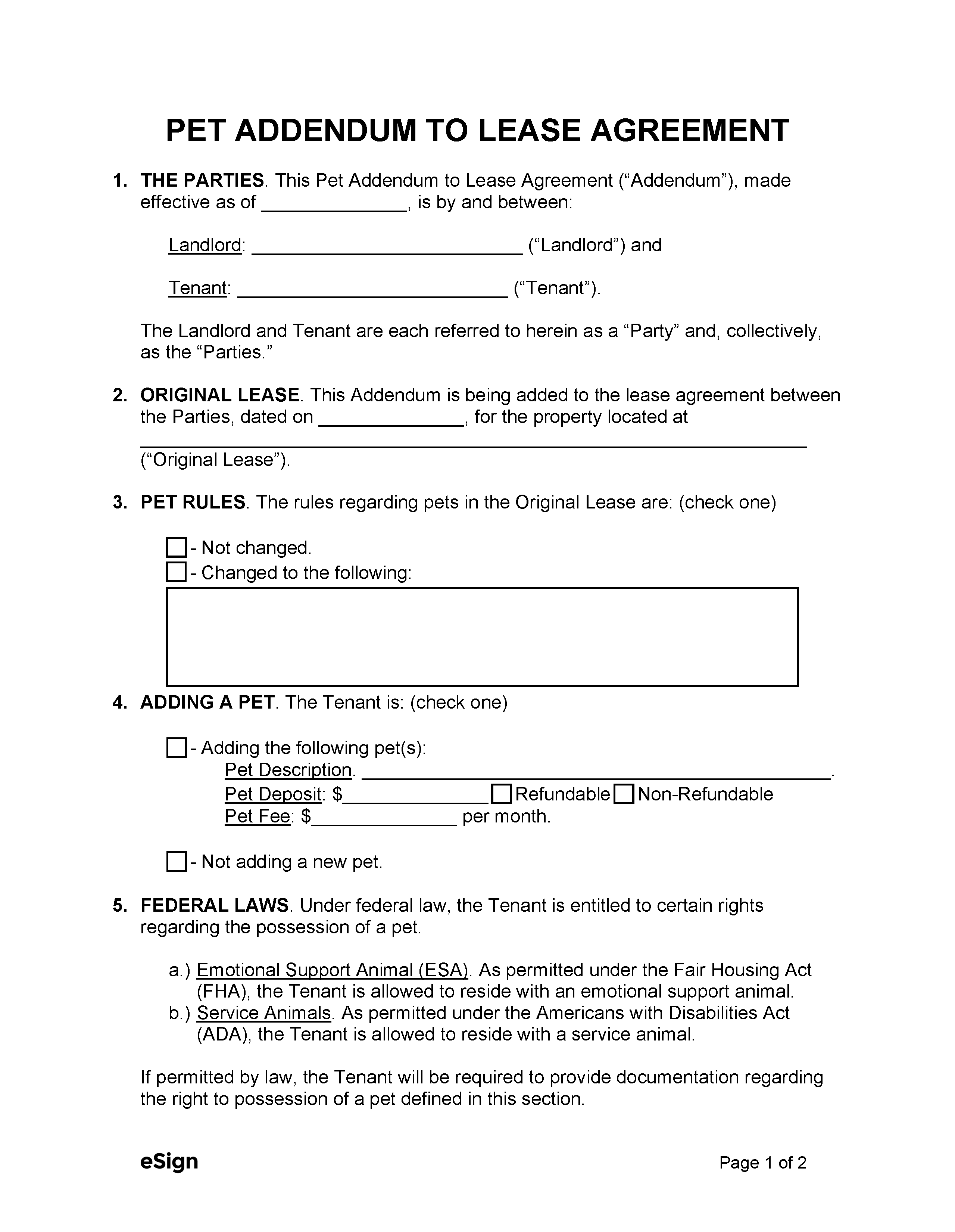

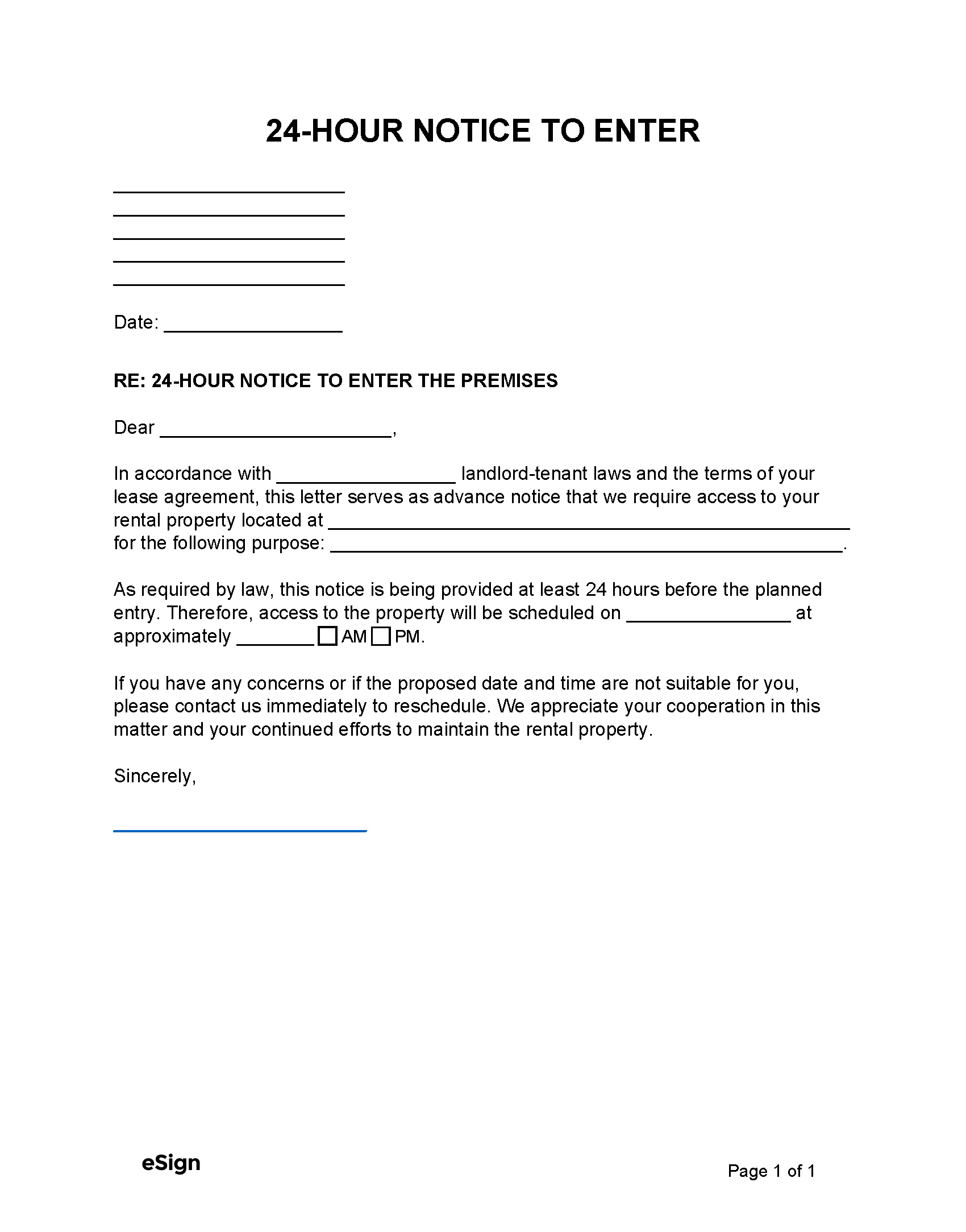

https://esign.com/wp-content/uploads/Pet-Addendum-to-Lease-Agreement.png

Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=922794369859511

Linkedin Youtube

https://www.civdivonline.com/uploads/b/756d64bcfa60874be07a3618a3334017d803f35b6cecdbef3d80a8aa2f07329e/IMG_5436_1715386448.png

A taxpayer may claim the credit for a home energy audit of a home the taxpayer rents Due to the principal residence requirement a taxpayer may not claim the credit for a Landlords can deduct most ordinary and necessary expenses related to the renting of residential property This includes rental property tax deductions for use of a car cleaning costs mortgage interest payments

Yes as long as your rental was available for renting during the year you claim power and water as utility expenses on your rental property even though it was vacant Just For example landlords can never use these credits for improvements made to any homes they rent out but do not use as a residence themselves However if a taxpayer is renting a home as their principal residence and makes eligible

More picture related to Can You Claim Electricity On Rental Property

Pension Credit DennaFranki

https://www.ageuk.org.uk/globalassets/age-uk/media/ia-guide-covers/pension-credit-cover.jpg

Laundry And Uniform Expenses The Accountants

https://theaccountants.au/wp-content/uploads/2024/03/portrait-of-a-woman-with-glasses-in-bike-shop-RBN8CF4-2-1024x1024.jpg

Sophie TI Accountancy Ltd

https://www.tiaccountancy.co.uk/wp-content/uploads/2023/06/Sophie-1152x1536.jpg

Utility Bills Electricity water and gas costs can be claimed if these services are active during marketing or maintenance periods Insurance Premiums Landlord insurance remains deductible even when the property is not occupied Utilities Landlords can deduct the cost of utilities paid for rental properties including electricity water gas and trash removal Insurance Premiums Insurance premiums

Most of the following cannot be claimed Landlords can t claim for their own time either operating as a landlord or doing repairs All claims must be backed by a legitimate invoice As an owner of a rental property you are entitled to claim tax deductions for some of the expenses you incur while your property is rented or available for rent To work out what you

Can You Claim Parking On Tax

https://d2mcx4odt2tts0.cloudfront.net/vite/assets/recording-en-au-CntVHmvW.png

Children s Time June 29 2024 Children s Time June 29 2024 By First

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=770939138564093&get_thumbnail=1

https://ttlc.intuit.com › community › tax-credits...

The energy credits you are thinking of are found in Section 25C and Section 25D These only apply to someone who uses the property as their residence For section 25C

https://www.which.co.uk › money › tax › income-tax › tax...

If the rent you charge covers services like water or council tax you ll need to count the rent you charge the tenant within your income but you can claim the costs you pay as an expense Some examples of allowable expenses you can

Generate Electricity From Motor

Can You Claim Parking On Tax

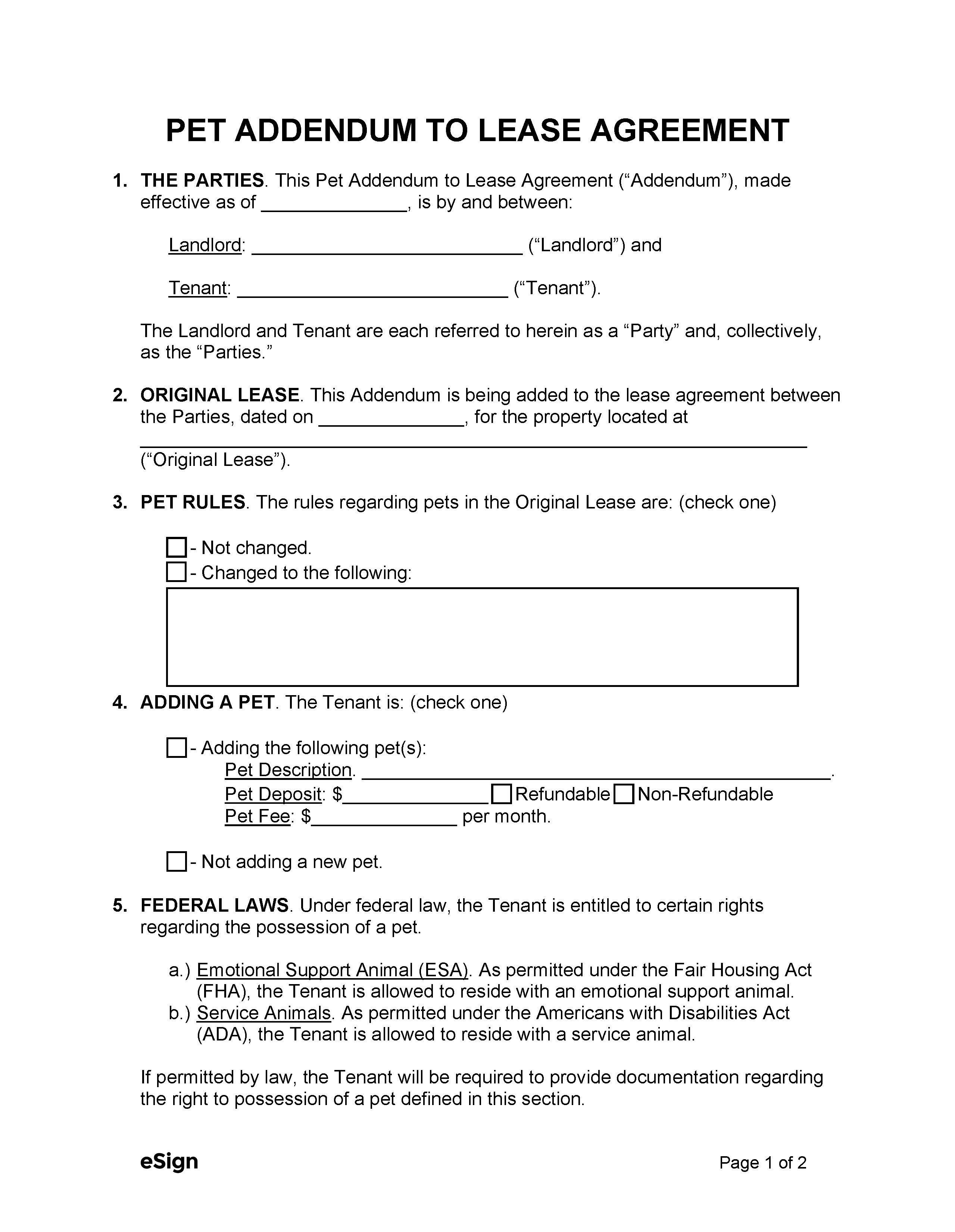

Free Property Damage Claim Letter Template Edit Online Download

Home Renovation Taxes In Canada Everything To Know Quasar

How To Rent Guide 2025 Pdf Isabelle Diaz

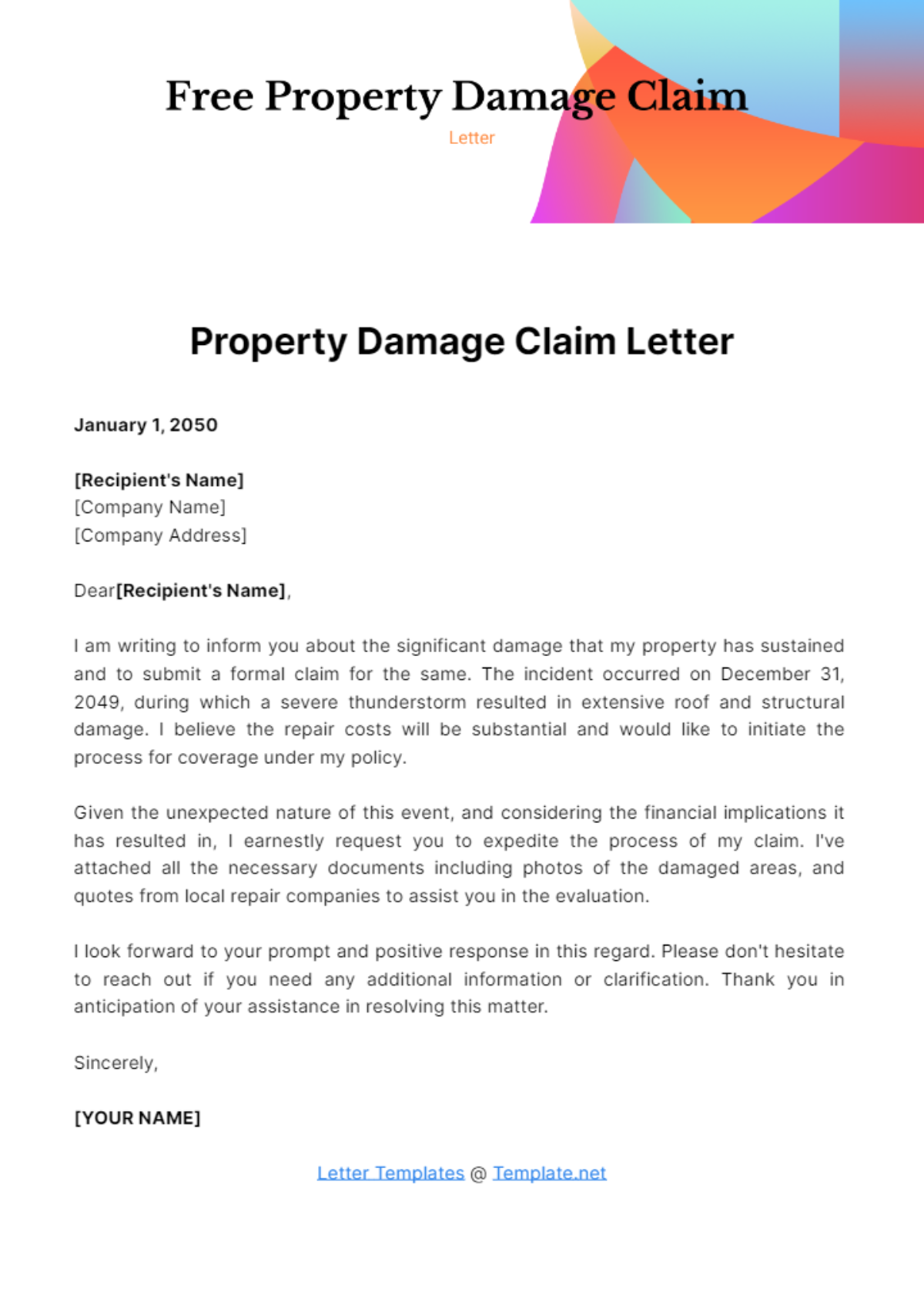

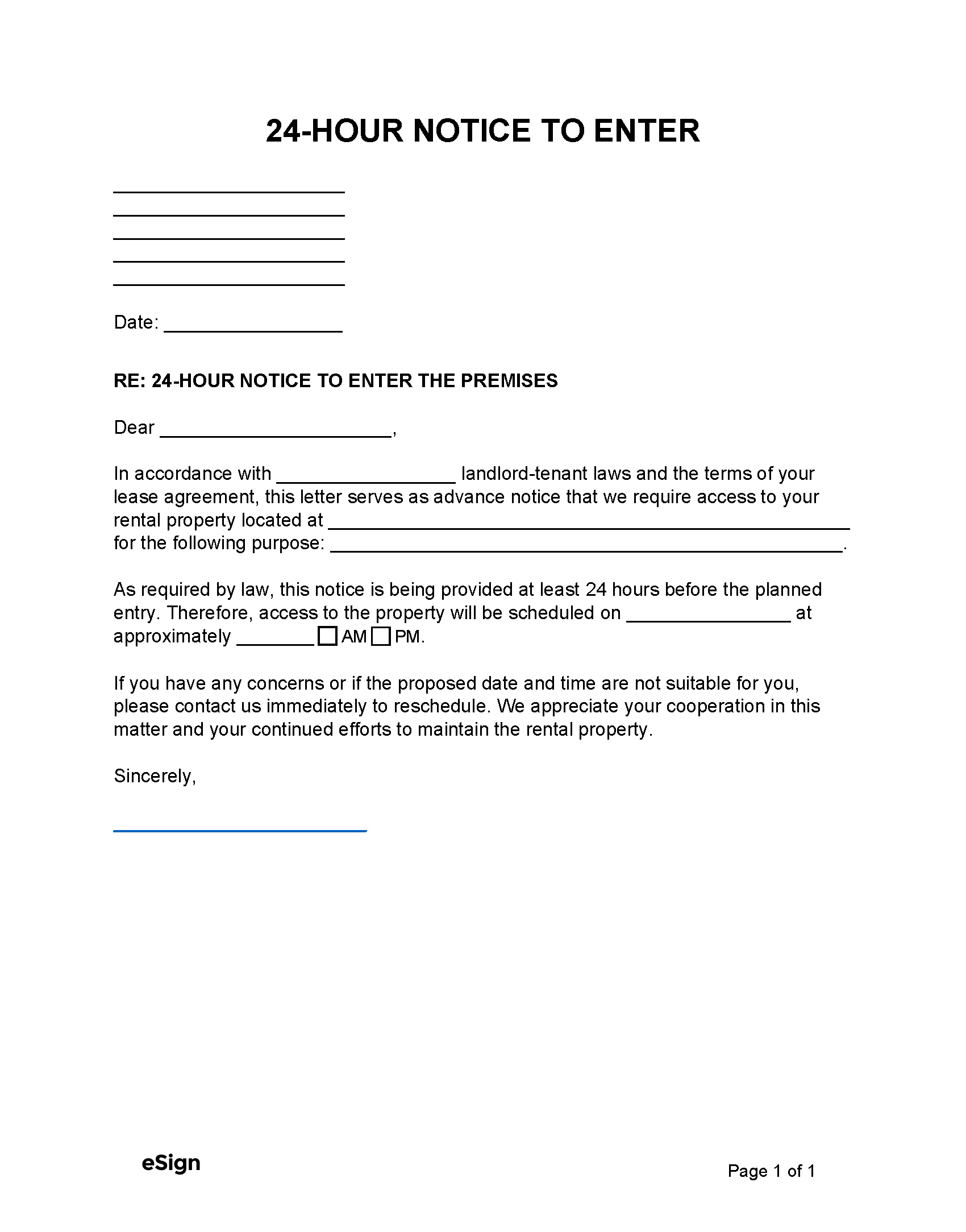

Free Landlord Notice To Enter 24 Hour PDF Word

Free Landlord Notice To Enter 24 Hour PDF Word

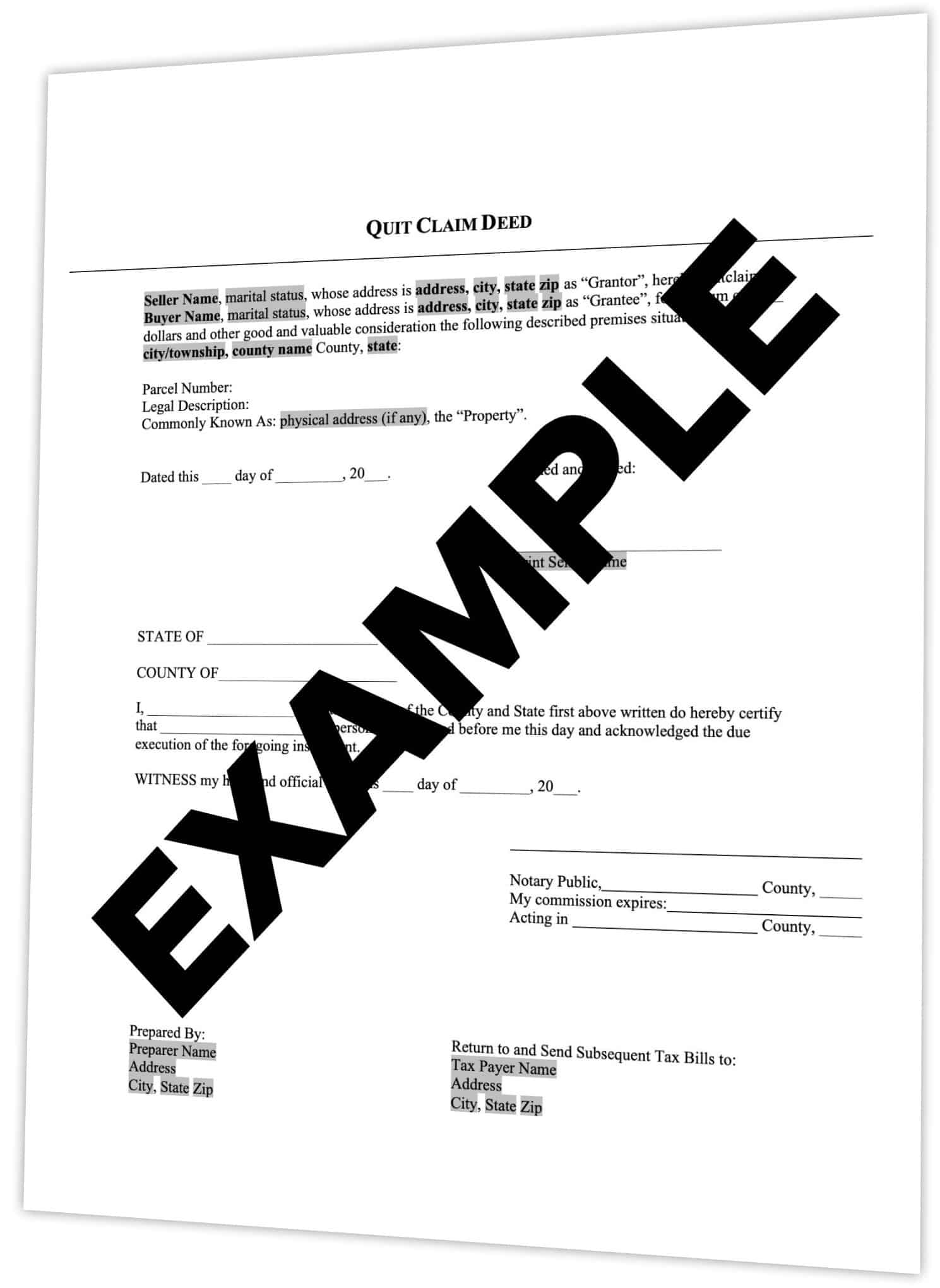

What Is A Quit Claim Deed REtipster

Child Care Expenses Shajani CPA

/smart-energy-meter-184304902-dccbbb1442504be1a8ffdb07a7b471bd.jpg)

Pros And Cons Smart Electric Meters

Can You Claim Electricity On Rental Property - As a basic rule of thumb when it comes to self employed income tax deductions you can claim any costs that have been incurred exclusively for the purpose of running your