Can You Roll A Traditional Ira Into A Solo 401k If you want to roll over an IRA into a Self Directed 401 k you need not worry You can usually roll over an IRA into a Self Directed Solo 401 k This includes rollovers of a

In the world of retirement account rollovers there s one type that doesn t get much love the IRA to 401 k You can roll your IRA investments over into a 401 k In this guide we ll explain how and why

Can You Roll A Traditional Ira Into A Solo 401k

Can You Roll A Traditional Ira Into A Solo 401k

https://www.investors.com/wp-content/uploads/2019/12/wFAP-contribution-122719.jpg

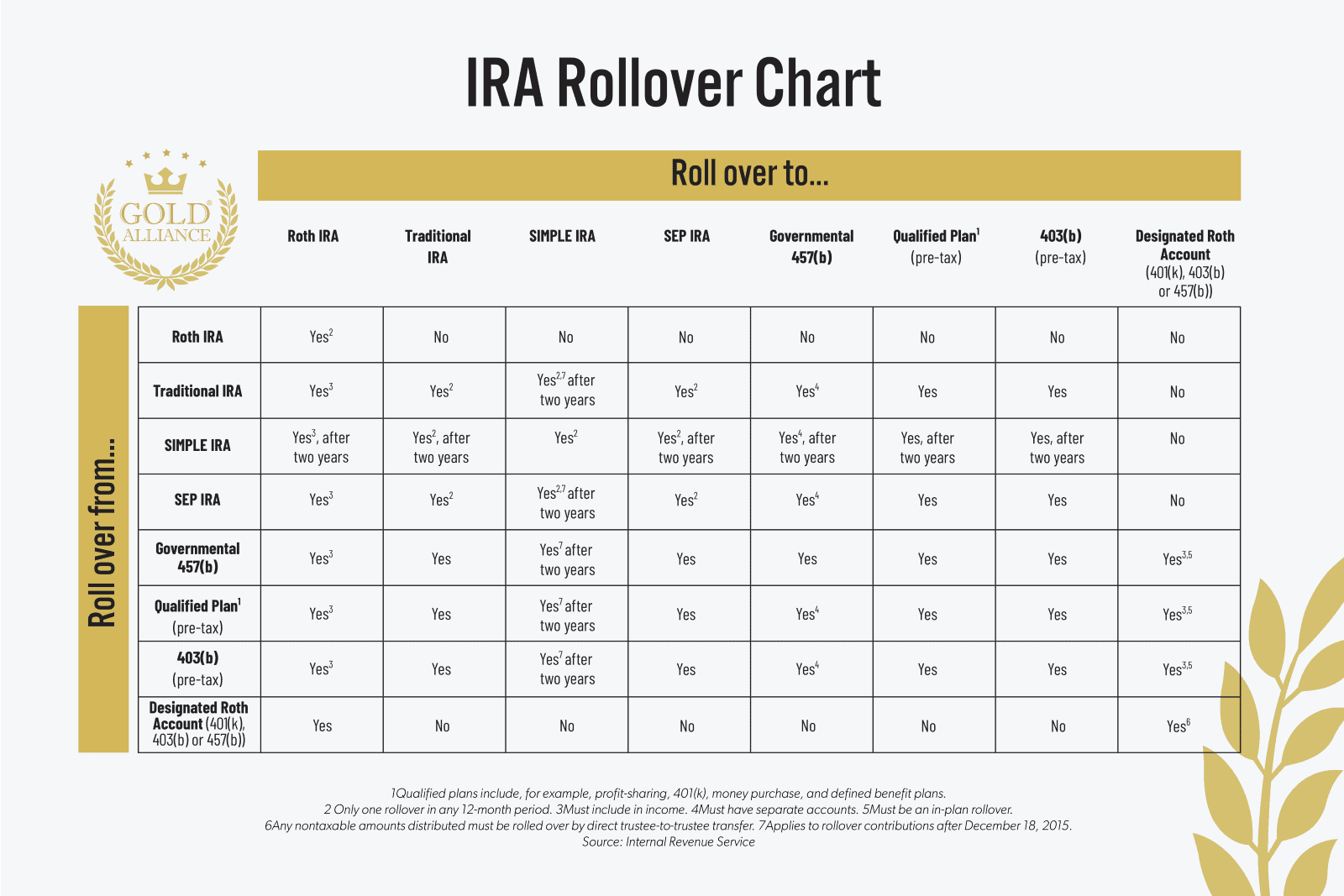

Ira Rollover Rules Choosing Your Gold IRA

https://goldalliance.com/wp-content/uploads/2022/03/image.png

Retirement Comparison Chart

https://www.moneylend.net/wp-content/uploads/retirement_compare.jpg

In preparation for converting my non deductible IRA contributions to Roth IRA I m rolling over the pre tax portion of my traditional IRA to my solo 401k I set up the solo 401k last You can rollover almost any type of retirement plan into the Solo 401k including a traditional IRA another 401k plan 403b pension plan TSP etc The only retirement plan that cannot roll into a Solo 401k is a Roth IRA as per IRS rules

You also can roll over multiple old orphan retirement plans e g SEP IRA SIMPLE IRA Traditional IRA etc into your Solo 401k Any of these funds can be rolled over in full or partially to your Solo 401k Yes you can roll an IRA into a 401 k if the plan allows it and doing so correctly lets you move your retirement savings without taxes or penalties Rolling an IRA into a 401 k

More picture related to Can You Roll A Traditional Ira Into A Solo 401k

Solo 401k Process Flowchart

https://bp-v-newproduction.s3.amazonaws.com/uploads/uploaded_images/normal_1460168548-Solo401k.jpg

The Ultimate Roth IRA Guide District Capital Management

https://districtcapitalmanagement.com/wp-content/uploads/2022/01/Roth-401k-vs-Roth-IRA.jpg

Roth 401 K

https://m.foolcdn.com/media/dubs/images/roth-401k-vs-roth-ira-retirement-plans-infogra.width-880.png

Typically most IRAs including Traditional SEP and SIMPLE IRAs can be rolled into a Solo 401 k without triggering taxes This option provides a seamless way to ROLLOVER CHART 1Qualified plans include for example profit sharing 401 k money purchase and defined benefit plans 2 Only one rollover in any 12 month period 3Must

You can transfer a Rollover IRA Traditional IRA SEP IRA Simple IRA Keogh and Defined Benefit Plan IRS rules do not permit a Roth IRA to be rolled over into the Individual Roth If you re considering rolling funds into a Solo 401 k the IRS permits transfers from most types of tax advantaged accounts These include Traditional IRAs SEP IRAs

Roth 401k Rollover

https://m.foolcdn.com/media/dubs/images/401k-vs-Roth-401k-retirement-plans-infographic.width-880.png

Catch Up 2025 401k Anthony M Guenther

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits-1536x1536.png

https://broadfinancial.com

If you want to roll over an IRA into a Self Directed 401 k you need not worry You can usually roll over an IRA into a Self Directed Solo 401 k This includes rollovers of a

https://www.nerdwallet.com › ...

In the world of retirement account rollovers there s one type that doesn t get much love the IRA to 401 k

Maximum Sep Contribution For 2025 Archer Rhodes

Roth 401k Rollover

Roth Iras Napkin Finance

Ira Income Contribution Limits 2025 Kaito Dekooij

2025 Roth Ira Contribution Income Limits Leila Sophia

Roth Contribution Limits 2024 Salary Range Roxie Leeann

Roth Contribution Limits 2024 Salary Range Roxie Leeann

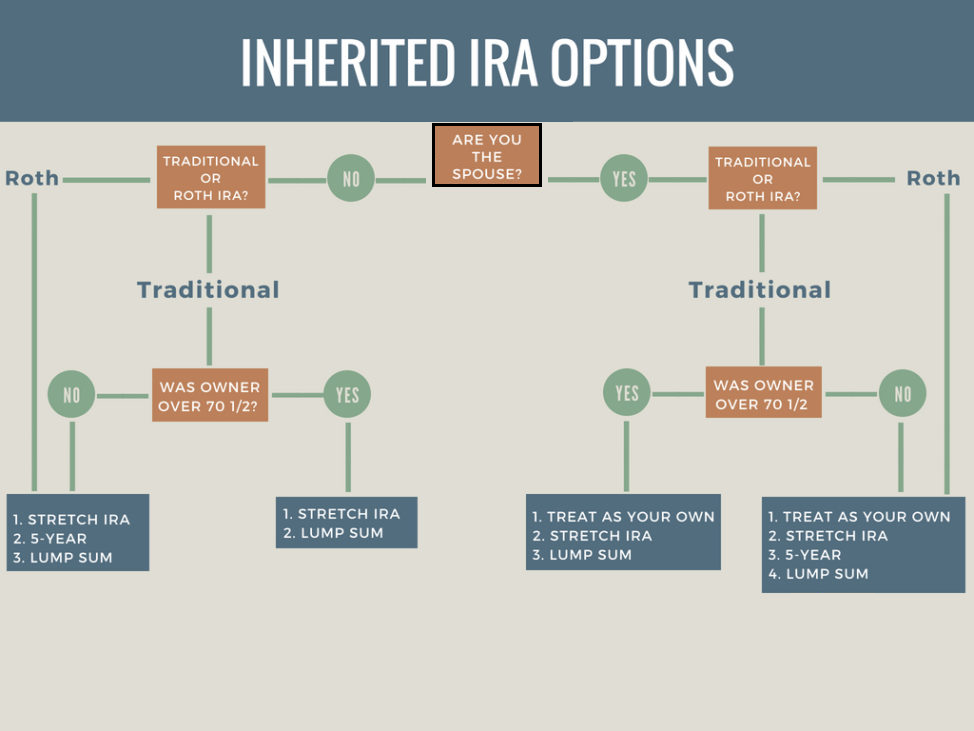

New Inherited Ira Rules 2025 Zane Noor

Spouse Inherited Ira Rules 2025 Jasper R Kirkwood

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Roth Ira Rules 2024 Rollover Windy Bernadine

Can You Roll A Traditional Ira Into A Solo 401k - Rolling over assets into an IRA would get you more investment options than a 401 k You can opt for a traditional or Roth IRA depending on whether your 401 k is a traditional