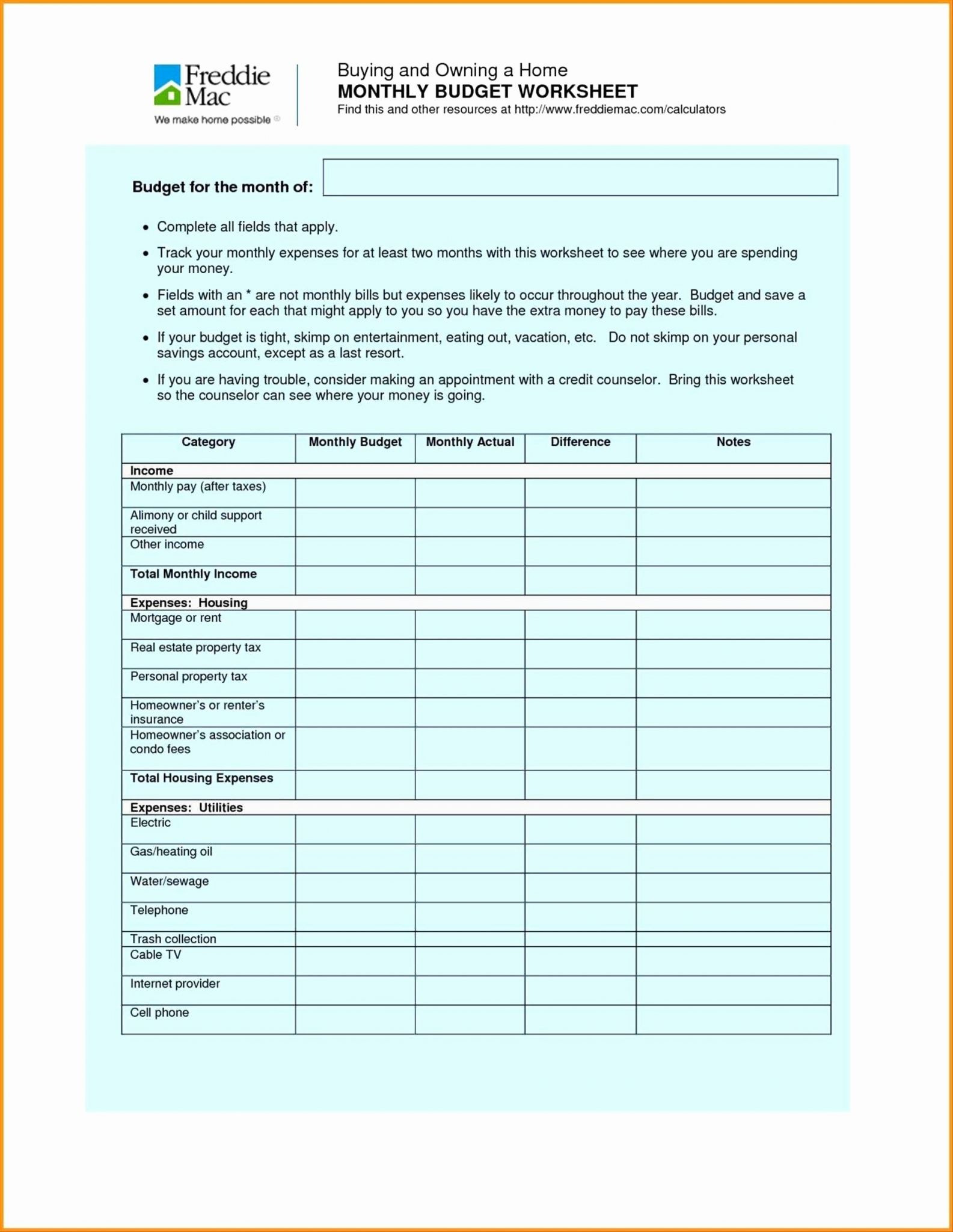

Capital Gains Under House Plan The capital gains tax rates in the tables above apply to most assets but there are some noteworthy exceptions Long term capital gains on so called collectible assets can be taxed at a

Understanding Capital Gains and the Biden Tax Plan Biden proposed raising the top capital gains tax from 20 to 39 6 before a joint session of Congress on April 28 This will affect long term and short term capital gains since both would be taxed as ordinary income in the highest bracket Your basis when you sell the property will be the cost basis when you bought the property plus the cost of improvements Remember you may qualify for a 250 000 capital gain exclusion 500 000

Capital Gains Under House Plan

Capital Gains Under House Plan

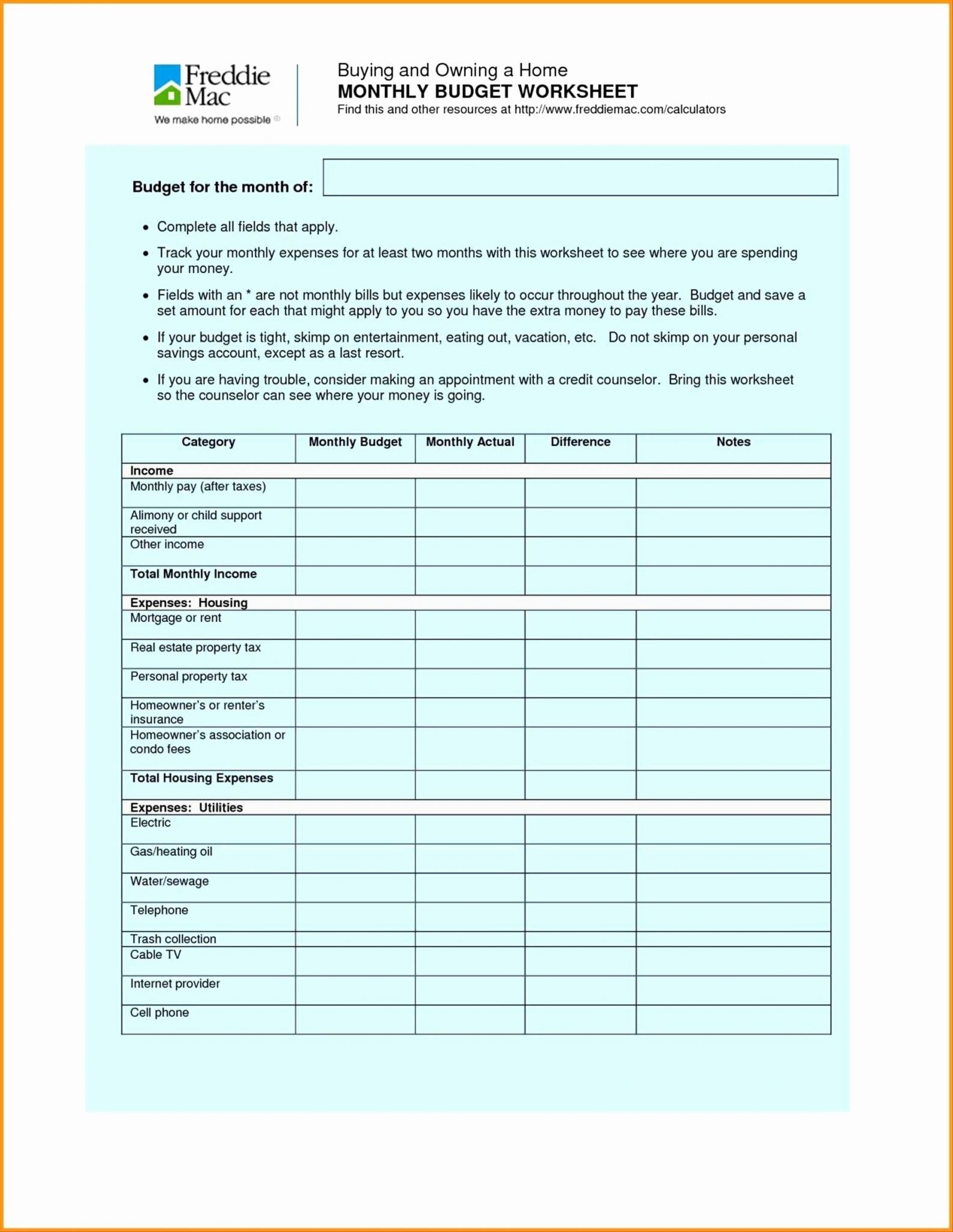

https://db-excel.com/wp-content/uploads/2019/09/rental-property-capital-gains-tax-worksheet-1.jpg

Things You Need To Know About Capital Gains Tax Lumina Homes

https://www.lumina.com.ph/assets/news-and-blogs-photos/4-Things-you-Need-to-Know-about-Capital-Gains-Tax-before-Buying-a-New-Property/4-Things-you-Need-to-Know-about-Capital-Gains-Tax-before-Buying-a-New-Property.webp

Things You Need To Know About Capital Gains Tax Lumina Homes

https://www.lumina.com.ph/assets/news-and-blogs-photos/4-Things-you-Need-to-Know-about-Capital-Gains-Tax-before-Buying-a-New-Property/OG-4-Things-you-Need-to-Know-about-Capital-Gains-Tax-before-Buying-a-New-Property.webp

You earn a capital gain when you sell an investment or an asset for a profit When you realize a capital gain the proceeds are considered taxable income The amount you owe in capital If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3 000 1 500 if married filing separately or your total net loss shown on line 16 of Schedule D Form 1040 Capital Gains and Losses Claim the loss on line 7 of your Form 1040 or Form 1040 SR

Instead of a 20 maximum tax rate long term gains from the sale of collectibles can be hit with a capital gains tax as high as 28 If your ordinary tax rate is lower than 28 then that rate Consider your specific situation first Long term capital gains taxes can be no more than 20 federally and may be as low as 0 if you are in a certain range of income making capital gains not

More picture related to Capital Gains Under House Plan

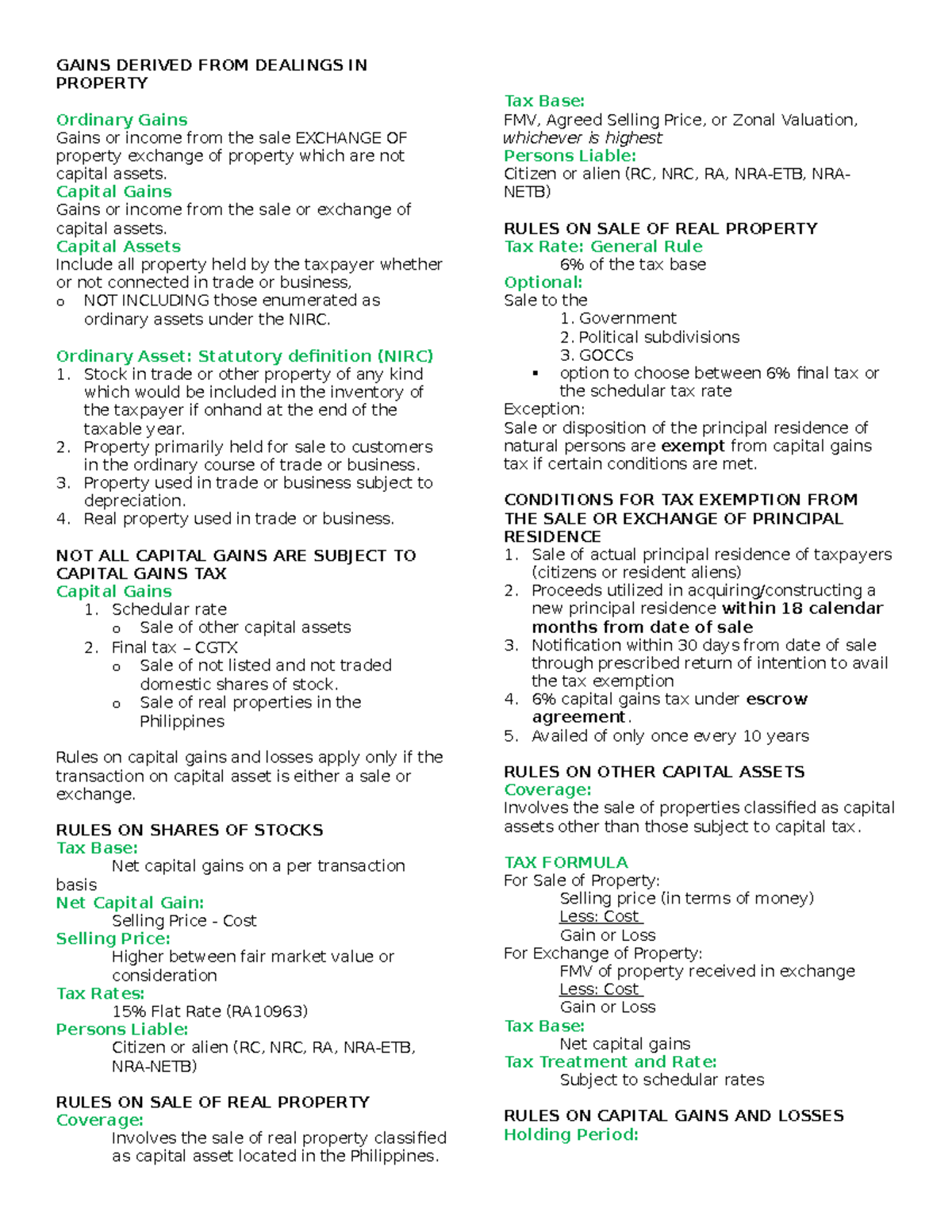

Capital Gains Tax Notes GAINS DERIVED FROM DEALINGS IN PROPERTY

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1a0e4eecba5b33f671dc664db53d473d/thumb_1200_1553.png

Are Dividends Capital Gains Differences Deciding Which Is Better

https://www.carboncollective.co/hs-fs/hubfs/Dividends_vs._Capital_Gains.png?width=2880&height=1620&name=Dividends_vs._Capital_Gains.png

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)

Capital Gains Definition Rules Taxes And Asset Types 2023

https://www.investopedia.com/thmb/7lgVTwV_8orWVzN3kOsup-hL478=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg

The home s total basis would be 606 000 which is 456 000 plus 150 000 If you sold the house for 912 000 your capital gain could be 306 000 which would be well below the 500 000 The long term capital gains tax rates for the 2023 and 2024 tax years are 0 15 or 20 The higher your income the more you will have to pay in capital gains taxes The rate is 0 for

Capital gains taxes simply are taxes levied on profits from selling an investment So if you buy 10 000 in stock and sell those shares five years later for 20 000 you will likely owe taxes A capital gain is the increase in a capital asset s value and is realized when the asset is sold Capital gains apply to any type of asset including investments and those purchased for

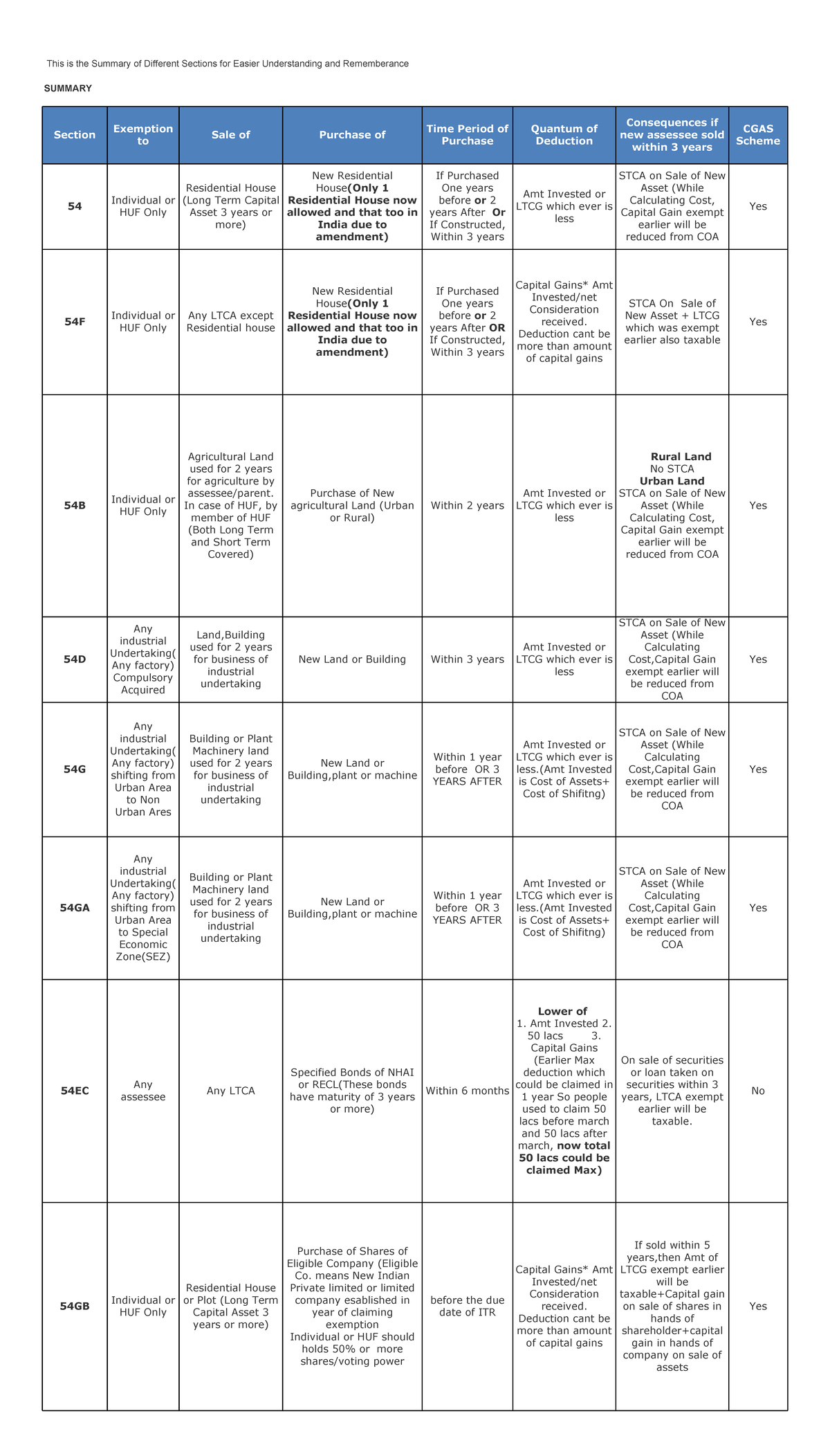

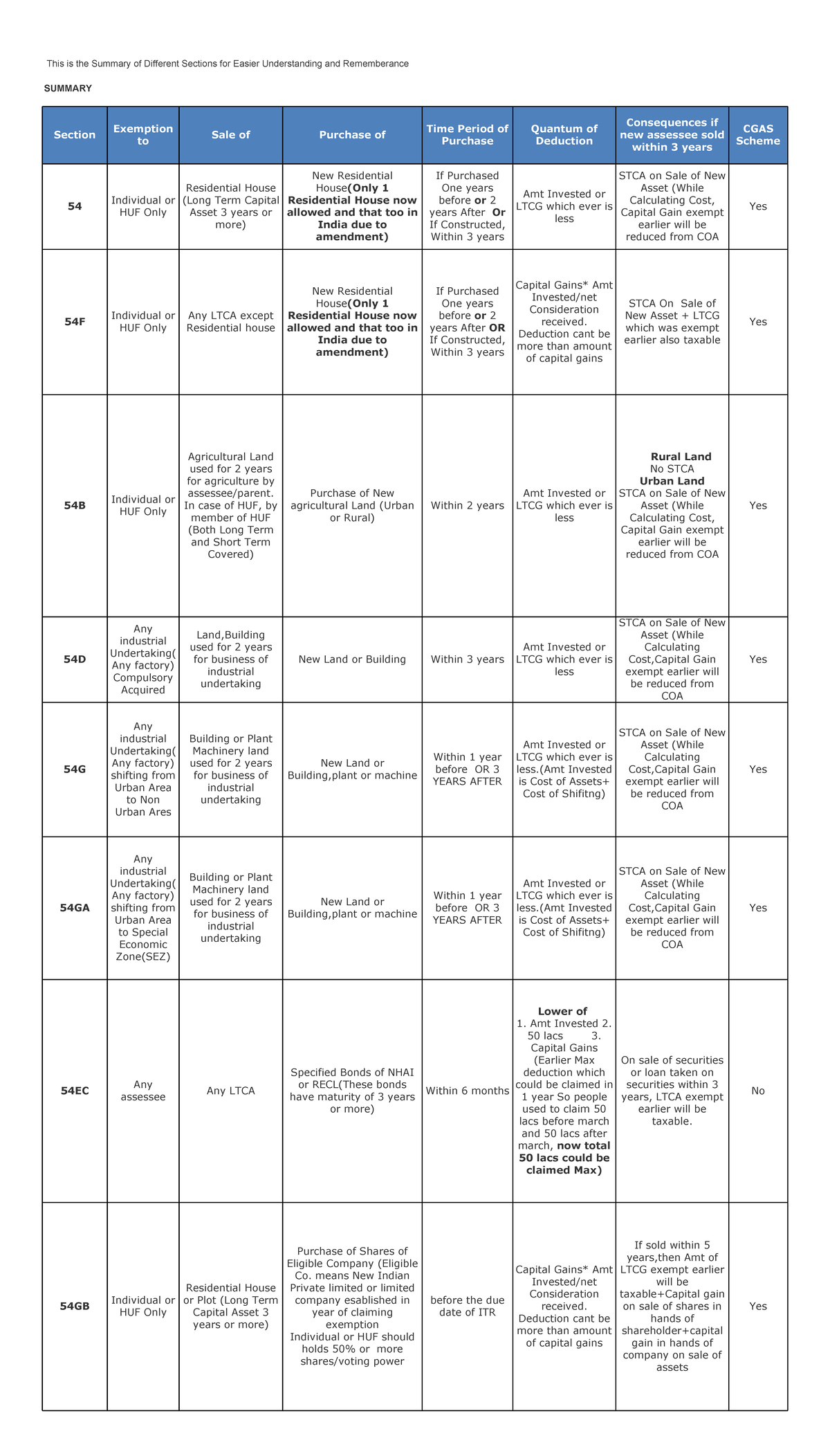

Capital Gains Section 54 Chart This Is The Summary Of Different

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0705a0da705ed3ee7384515928e14196/thumb_1200_2104.png

Capital Gains Under Income Tax Act 1961 Chandan Agarwal Chartered

https://cachandanagarwal.com/wp-content/uploads/2020/11/Capital-Gains.jpg

https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates

The capital gains tax rates in the tables above apply to most assets but there are some noteworthy exceptions Long term capital gains on so called collectible assets can be taxed at a

https://smartasset.com/taxes/biden-capital-gains-tax

Understanding Capital Gains and the Biden Tax Plan Biden proposed raising the top capital gains tax from 20 to 39 6 before a joint session of Congress on April 28 This will affect long term and short term capital gains since both would be taxed as ordinary income in the highest bracket

Long Term Capital Gains Tax Exemption List Of Exemptions As Per IT Act

Capital Gains Section 54 Chart This Is The Summary Of Different

Capital Gains Deduction 2024 Jesse Lucilia

CAPITAL GAINS UNDER IT ACT CALCULATE STCG LTCG CPAITAL GAINS

Drive Under House Plans Home Designs With Garage Below

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term And Long Term Capital Gains Tax Rates By Income

American Funds 2024 Capital Gains Vanda Jackelyn

How To Disclose Capital Gains In Income Tax Return

Section 111A Tax On Short Term Capital Gains In Case Of Equity

Capital Gains Under House Plan - Consider your specific situation first Long term capital gains taxes can be no more than 20 federally and may be as low as 0 if you are in a certain range of income making capital gains not