Capital Investment Deductions Under House Senate Tax Plans New bipartisan legislation the Tax increasing the amount of investment that a small business can immediately write off to 1 29 million from the 1 million cap enacted in 2017 Senate

Published January 20 2021 President Biden s Build Back Better social spending and tax bill is slowly working its way through Congress It was recently passed by the House of Representatives The interest expense limitation allowed is 30 of adjusted taxable income plus floor plan financing interest For taxable years beginning before January 1 2022 taxpayers were allowed to add back

Capital Investment Deductions Under House Senate Tax Plans

Capital Investment Deductions Under House Senate Tax Plans

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_ca/blog/images/sbseg-business-investment-deductions.jpg

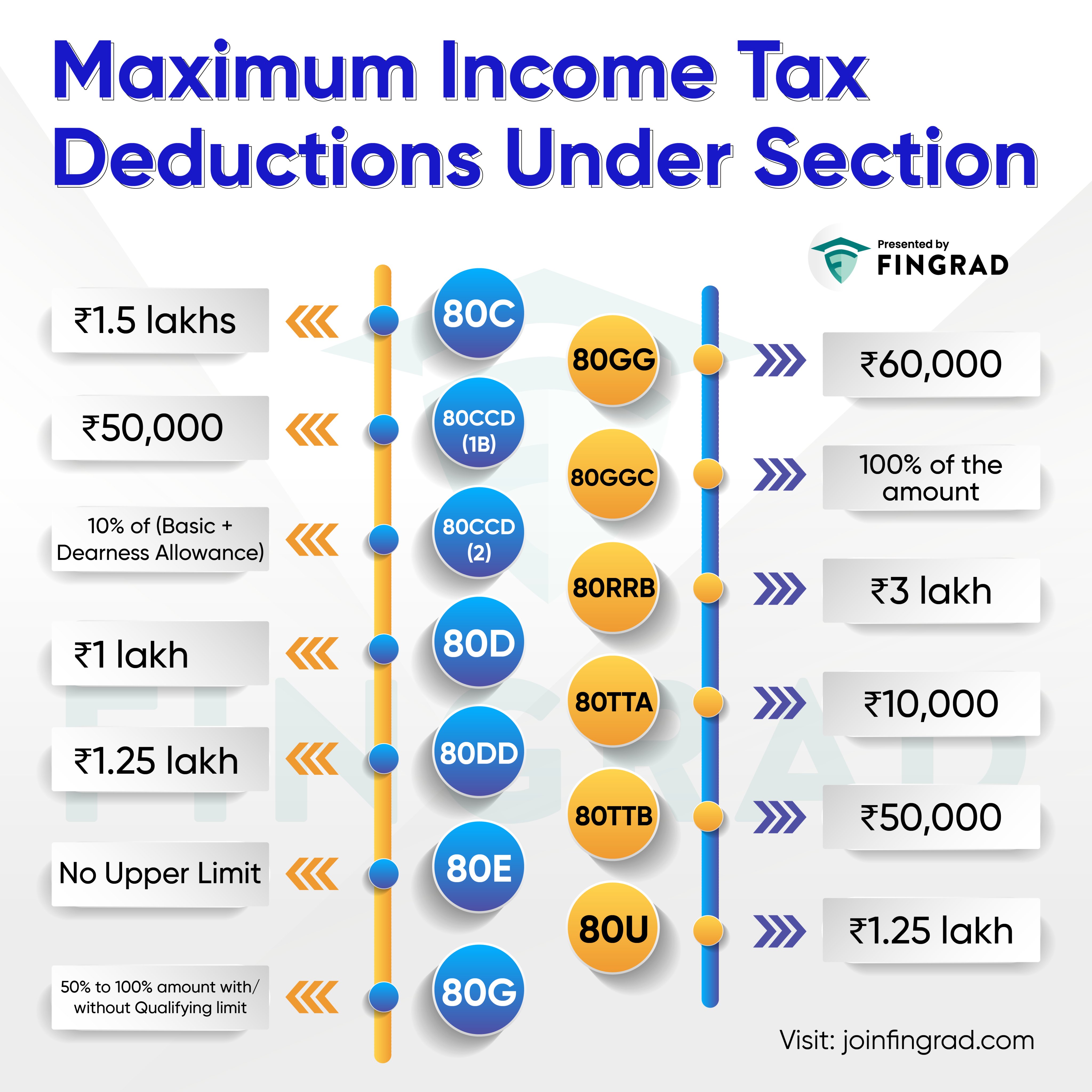

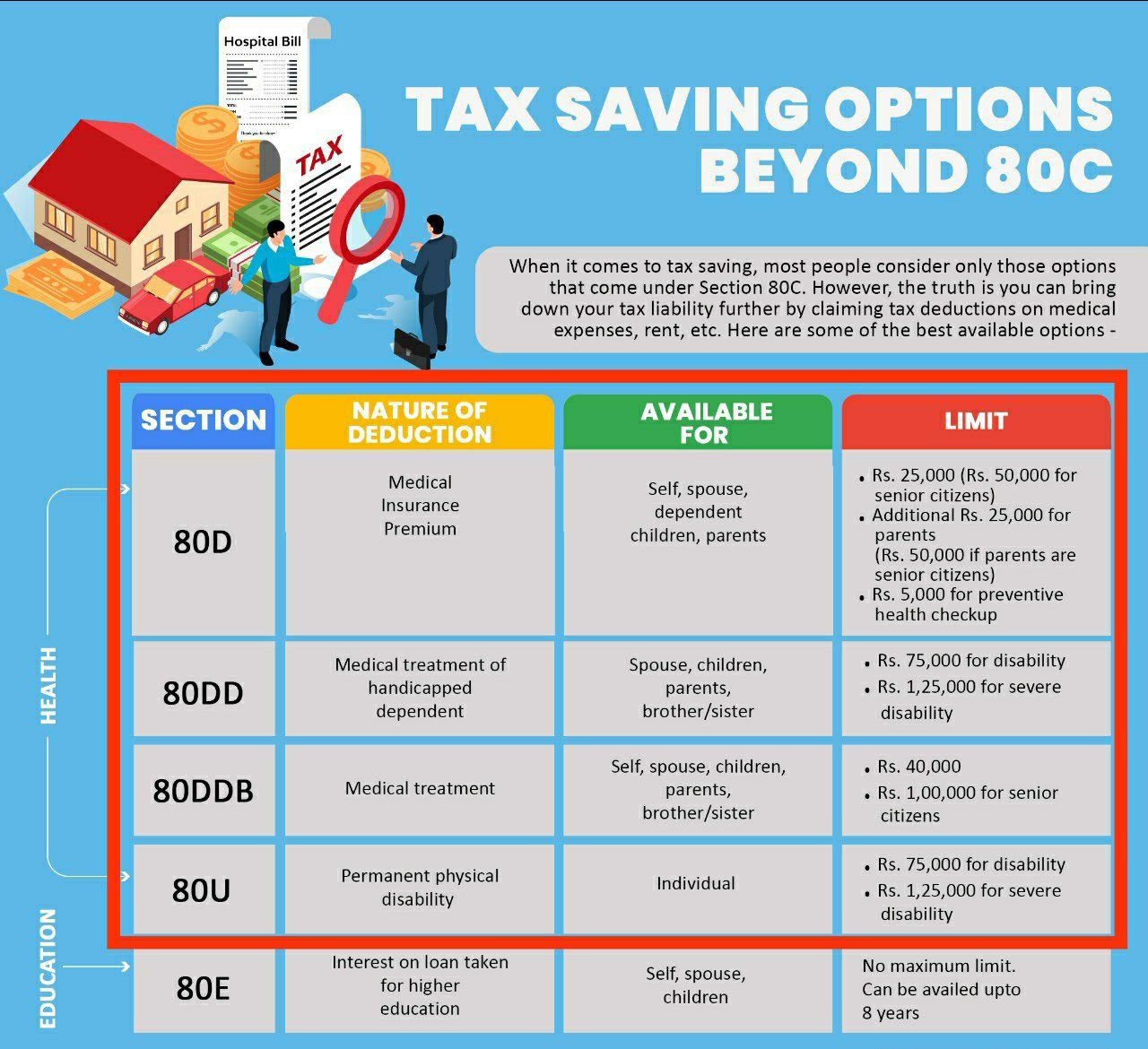

Section 80C Deductions List Save Income Tax With Section 80C Options

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

How Could A Tax Change Affect You This Is What The Senate And House

https://static01.nyt.com/images/2017/11/10/business/10TAXDEDUCTIONS1/10TAXDEDUCTIONS1-superJumbo.jpg?quality=75&auto=webp

One thing that is not in the Senate version is any change in the current through 2025 cap on itemized deductions of state and local taxes under Sec 164 b The House version would increase the current 10 000 limit to 80 000 40 000 for married taxpayers filing separately and trusts and estates Insights KPMG report Initial impressions of tax proposals in Biden Administration s FY 2024 budget March 9 2023 The Biden Administration today released an updated set of proposals related to the president s tax plan The Green Book PDF 2 1 MB General Explanations of the Administration s Fiscal Year 2024 Revenue

Their plan would raise the top marginal income tax rate to 39 6 percent from 37 percent impose a new 3 percent surtax on people making more than 5 million and raise the capital gains rate Expected Individual and Capital Gains and Dividend Tax Rate Increases Capital gains and dividend tax rates are proposed by the House to increase for certain higher income taxpayers from their current level of 23 8 percent a 20 percent tax rate plus the 3 8 percent tax on net investment income to as high as 31 8 percent a 25 percent capital

More picture related to Capital Investment Deductions Under House Senate Tax Plans

Investment Property Tax Deductions Under The ATO Spotlight

https://www.etax.com.au/wp-content/uploads/2023/05/Investment-property-tax-deductions.jpg

Trade Brains On Twitter Maximum Income Tax Deductions Under Different

https://pbs.twimg.com/media/F0LGwgIXgAEm9Hb?format=jpg&name=4096x4096

Tax Deductions For Investment Property BMT Insider

https://s3-ap-southeast-2.amazonaws.com/bmt-insider/wp-content/uploads/2023/05/18091338/855_INS_AR_0123-table_Revised2.jpg

Each bill limits the deduction to 30 percent of modified income with carryover of the excess to later years Unfortunately the Senate definition of modified income is much lower than in the House bill and it undercuts the investment incentive provided by the expensing provision The House definition is basically gross income December 11 2021 2 29 PM PST New Senate Tax Plan Softens Proposed Interest Deduction Limit Michael Rapoport Senior Reporter Bloomberg Tax Alternate test would make it easier to keep interest deductions Plan would toughen inversion limits to offset lost revenue

The CTC expansion would increase the maximum credit per child to 2 000 from 1 600 through 2025 while restoring business deductions for research and development costs interest payments and The nonpartisan Tax Policy Center puts the average tax benefit for households making 50 000 to 75 000 at 850 The U S median household income is around 59 000 If you re taking the

Investment Property Tax Deductions What Can I Claim On Tax Homestar

https://homestarfinance.com.au/wp-content/uploads/2022/10/iStock-1346495722-scaled.jpg

Texas Legislature Senate House Divided Over Property Tax Cut Plans

https://www.statesman.com/gcdn/presto/2023/05/29/NAAS/951c76e3-5cb1-40d3-9c58-0a439f2d45bc-Sine_Die_mlc_00157.jpg?crop=1599,900,x0,y81&width=1599&height=900&format=pjpg&auto=webp

https://www.thinkadvisor.com/2024/01/29/tax-bill-with-100-bonus-depreciation-may-get-house-vote-this-week/

New bipartisan legislation the Tax increasing the amount of investment that a small business can immediately write off to 1 29 million from the 1 million cap enacted in 2017 Senate

https://www.kiplinger.com/taxes/602109/build-back-better-tax-passed-in-house

Published January 20 2021 President Biden s Build Back Better social spending and tax bill is slowly working its way through Congress It was recently passed by the House of Representatives

Deductions Available Under The Income Tax Act

Investment Property Tax Deductions What Can I Claim On Tax Homestar

Deductions U S 80C Under Schedule VI Of Income Tax IFCCL

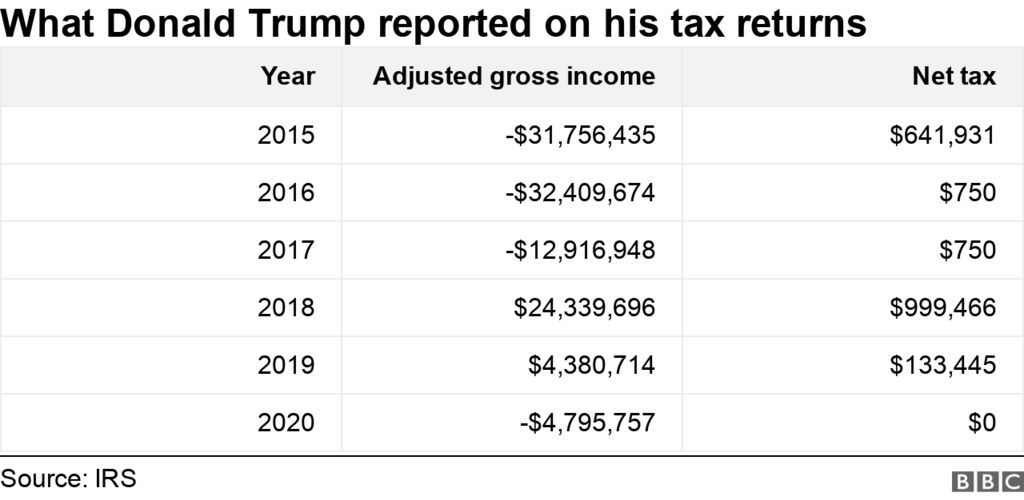

What Do Trump s Tax Returns Show MyJoyOnline

Investment Deductions YouTube

Texas Senate Passes New 18 Billion Property Tax Relief Plan

Texas Senate Passes New 18 Billion Property Tax Relief Plan

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Tax Deductions For Homeowners And Investment Property Owners ELIKA

Capital Investment Deductions Under House Senate Tax Plans - Insights KPMG report Initial impressions of tax proposals in Biden Administration s FY 2024 budget March 9 2023 The Biden Administration today released an updated set of proposals related to the president s tax plan The Green Book PDF 2 1 MB General Explanations of the Administration s Fiscal Year 2024 Revenue