Carter S Housing Plan Lead To Financial Crisis By Mark Thoma January 10 2017 5 30 AM EST MoneyWatch One story of the housing crisis goes like this Government programs that helped low income households purchase houses led to widespread

In response to rent payments soaring across the country in recent years the Biden administration unveiled new actions Wednesday to protect tenants make renting more affordable and improve Understanding the Great Recession The U S economy had been in a state of growth for several years by the turn of the century The housing market had seen its share of ups and downs but in 2001

Carter S Housing Plan Lead To Financial Crisis

Carter S Housing Plan Lead To Financial Crisis

https://i.ytimg.com/vi/a1zIoki9XjA/maxresdefault.jpg

Will US Debt Default Lead To Financial Catastrophe YouTube

https://i.ytimg.com/vi/8sxSSDJjNas/maxresdefault.jpg

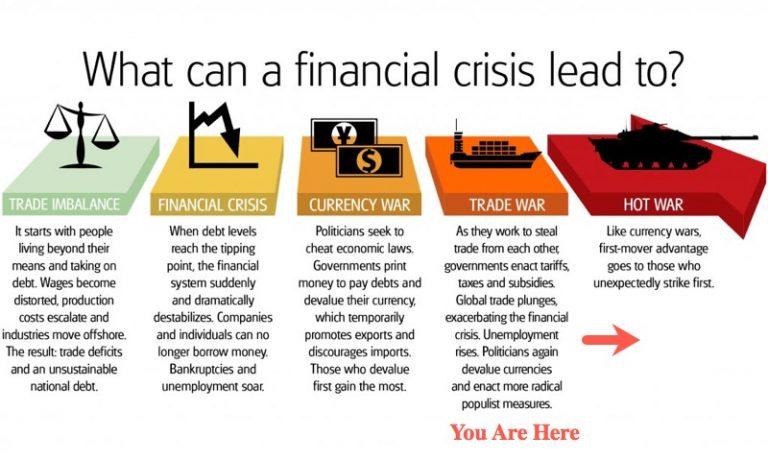

Infographic What Can A Financial Crisis Lead To Alpha Ideas

https://alphaideas.in/wp-content/uploads/2018/06/8bpsgpc74g_file-768x461_0.jpg

The Clinton Era Roots of the Financial Crisis Affordable housing goals established in the 1990s led to a massive increase in risky subprime mortgages By Phil Gramm and Mike Solon Simply put the financial crisis of 2008 was caused by a lot of banks making a lot of loans to a lot of people who either could not or would not pay the money back The economy is booming The stock market regularly hits new all time highs Unemployment is at record lows Aside from a small recent downturn the housing market is as hot as ever In many ways the world has moved on from the cataclysmic 2008 financial crisis triggered when sloppy mortgage lending popped the massive U S housing bubble

The Emergency Economic Stabilization Act of 2008 also known as the bank bailout of 2008 or the Wall Street bailout was a United States federal law enacted during the Great Recession which created federal programs to bail out failing financial institutions and banks The bill was proposed by Treasury Secretary Henry Paulson passed by the 110th United States Congress and was signed The U S subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2007 It was characterized by a rise in subprime mortgage delinquencies and foreclosures and the resulting decline of securities backed by said mortgages Several major financial institutions collapsed in September 2008 with significant disruption in the

More picture related to Carter S Housing Plan Lead To Financial Crisis

Growth In Irish Economy Forecast By Central Bank But Core Inflation Won

https://imengine.public.prod.sbp.infomaker.io/?uuid=9442428f-e88c-5f3d-af5f-701d3963a919&function=cropresize&type=preview&source=false&q=75&crop_w=0.99999&crop_h=0.84375&x=0&y=0&width=5760&height=3240

Meet Our Team Clayton Financial

https://irp.cdn-website.com/fa27527e/dms3rep/multi/GFG-Financial-Planners-St-Louis-MO5Chris-Michalak.jpg

Maximizing Your Wealth And Health Strategies For A Prosperous

https://facet.com/wp-content/uploads/2024/02/health-and-wealth-hero-scaled.jpg

Affordable housing goals established in the 1990s led to a massive increase in risky subprime mortgages By Phil Gramm And Mike Solon Aug 12 2013 6 55 pm ET Simply put the financial crisis Impressively for a government agency the GSEs hit their targets by June 30 2008 57 percent of the 55 million mortgages in the financial system were non traditional meaning either subprime or otherwise of low quality As these goals were continuously raised the GSEs found it harder and harder to find creditworthy borrowers

Sections The subprime mortgage crisis of 2007 10 stemmed from an earlier expansion of mortgage credit including to borrowers who previously would have had difficulty getting mortgages which both contributed to and was facilitated by rapidly rising home prices Historically potential homebuyers found it difficult to obtain mortgages if The root cause of ballooning homelessness seen in high cost cities over the past few decades is rising housing prices Housing insecurity is a fact of life but tent cities springing up in Los

Can The Chinese Economy Avoid Japanification Aviva Investors

https://www.avivainvestors.com/content/dam/aviva-investors/main/assets/views/aiq-investment-thinking/2022/11/debt-demand-and-demographics-can-the-chinese-economy-avoid-japanification/debt-demand-demographics-chinese-economy-japanification.jpg

Economist Who Predicted The 2008 Housing Crash Says Home Prices Will

https://cdn.gobankingrates.com/wp-content/uploads/2023/02/housing-market-crash-illustration-art-iStock-1154599236.jpg

https://www.cbsnews.com/news/heres-what-really-caused-housing-crisis/

By Mark Thoma January 10 2017 5 30 AM EST MoneyWatch One story of the housing crisis goes like this Government programs that helped low income households purchase houses led to widespread

https://www.cnn.com/2023/01/25/homes/biden-tenant-protection-renters/index.html

In response to rent payments soaring across the country in recent years the Biden administration unveiled new actions Wednesday to protect tenants make renting more affordable and improve

Opinion NIMBYs Threaten A Plan To Build More Suburban Housing The

Can The Chinese Economy Avoid Japanification Aviva Investors

Kinsale Cracker Is The Height Of Elegance On Ireland s Riviera

Financial Engagement For The New Healthcare Consumer A Best Practices

Silicon Valley Bank Collapse May Lead To 1 00 000 Layoffs Impact

Manufacturing Processes Manufacturing ERP System Inixion

Manufacturing Processes Manufacturing ERP System Inixion

The Global Financial Crisis 1 Comparing The Great Depression With The

Financial Problem Astrologerliveresult Financial Problem A Flickr

Can Forex Trading Make You Rich Forex

Carter S Housing Plan Lead To Financial Crisis - The U S subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2007 It was characterized by a rise in subprime mortgage delinquencies and foreclosures and the resulting decline of securities backed by said mortgages Several major financial institutions collapsed in September 2008 with significant disruption in the