Chapter 13 Repayment Plan House September 13 2023 15 min read Is it possible to buy a home during Chapter 13 If you filed for Chapter 13 bankruptcy or were recently discharged you might wonder whether you qualify for a

Your Chapter 13 repayment plan is an essential part of your bankruptcy It details which debts will get paid and the amount your creditors will receive During a Chapter 13 bankruptcy you ll make monthly payments to a bankruptcy trustee appointed to your case The trustee will pay your creditors according to the repayment plan Chapter 13 bankruptcy is a great tool for avoiding foreclosure If you can stick to your Chapter 13 repayment plan you may be able to repay missed mortgage payments your mortgage arrears over the life of the repayment plan typically three to five years

Chapter 13 Repayment Plan House

Chapter 13 Repayment Plan House

https://ascend-images-e065c94a.s3.amazonaws.com/1666733579922.jpeg

Chapter 13 Bankruptcy A Look At Repayment Plans TR Spencer Law Office

https://trspencer.com/images/blog/chapter-13-bankruptcy-a-look-at-repayment-plans.jpg

What Is A Chapter 13 And How Does It Work

https://limbockerlawfirm.com/wp-content/uploads/2020/04/chapter-13-bankruptcy.jpg

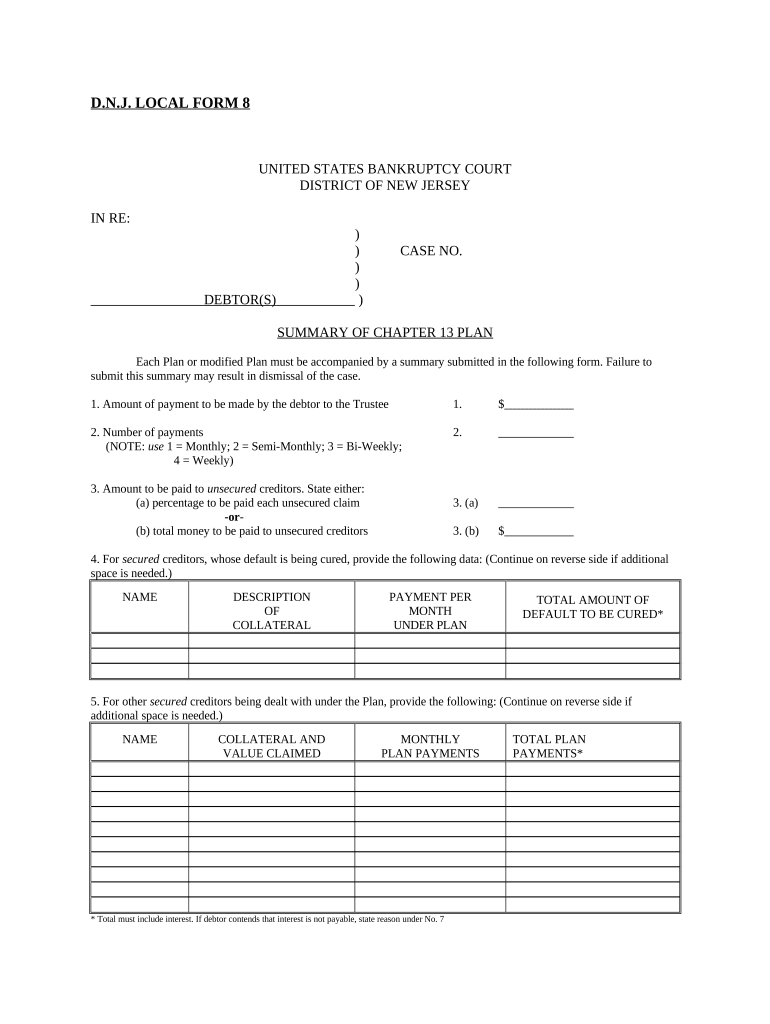

The Chapter 13 plan is the crux of a Chapter 13 bankruptcy case The plan lays out how much each creditor will get paid how long the plan will last the values of the debtor s property and more The plan must be confirmed by the bankruptcy court in order for the case to proceed Background A chapter 13 bankruptcy is also called a wage earner s plan It enables individuals with regular income to develop a plan to repay all or part of their debts Under this chapter debtors propose a repayment plan to make installments to creditors over three to five years

To qualify for Chapter 13 bankruptcy You must have regular income Your unsecured debt cannot exceed 419 275 and your secured debt cannot exceed 1 257 850 You must be current on tax filings Here are a few Catch Up on Payments and Keep a House or Car If you re in foreclosure and don t want to lose your home Chapter 7 won t help However the payment plan in Chapter 13 gives you time to catch up on past due payments so you can keep a house car or other secured property that would go back to the lender if you didn t pay as agreed

More picture related to Chapter 13 Repayment Plan House

File A Chapter 13 Repayment Plan

https://robert-russell.com/wp-content/uploads/2021/05/File-a-Chapter-13-Repayment-Plan.jpg

How Biden s New Student Loan Payment Plan May Help Borrowers Money

https://img.money.com/2022/11/College-Newest-Income-Repayment-Plan.jpg?quality=85

What Is A Repayment Plan In A Chapter 13 Bankruptcy In Nevada

https://www.freedomlegalteam.com/wp-content/uploads/2020/03/shutterstock_301760453-scaled.jpg

The Chapter 13 Repayment Plan The Chapter 13 repayment plan is the crux of your Chapter 13 bankruptcy case Through the plan which lasts from three to five years you pay off some debts in full other types of debts are paid in full or part depending on how much disposable income you have Putting together a plan that the court will confirm Chapter 13 bankruptcy can provide filers the chance to restructure debt into a repayment plan that lasts up to five years To qualify you ll need monthly income and your qualifying debt can t exceed certain limits After filing your credit will take a hit but you ll get a chance to keep important assets like your home

If you re thinking about filing a Chapter 13 Bankruptcy you ll need to propose a repayment plan This article describes the basic conditions under which your plan should be confirmed Pursuant to 11 U S C 1325 a the Chapter 13 plan shall be confirmed if the following conditions are met Chapter 13 Repayment Plan Example Credit Card Reduction Example Household family of 4 with mounting credit card debt and medical bills due to a temporary income interruption during a medical leave Both spouses are back to work but debt has become overwhelming

Rebuilding Credit During Chapter 13 Bankruptcy Repayment Plan YouTube

https://i.ytimg.com/vi/20Cs3LhSpKM/maxresdefault.jpg

An Overview Of The Chapter 13 Repayment Plan

https://static.wixstatic.com/media/bb3bc8_a3627d821dfa4fc1a41c5ecf004c3cc5~mv2.jpeg/v1/fill/w_980,h_648,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/bb3bc8_a3627d821dfa4fc1a41c5ecf004c3cc5~mv2.jpeg

https://themortgagereports.com/23259/mortgage-approval-with-chapter-13-bankruptcy

September 13 2023 15 min read Is it possible to buy a home during Chapter 13 If you filed for Chapter 13 bankruptcy or were recently discharged you might wonder whether you qualify for a

https://www.alllaw.com/articles/nolo/bankruptcy/chapter-13-bankruptcy-repayment-plan.html

Your Chapter 13 repayment plan is an essential part of your bankruptcy It details which debts will get paid and the amount your creditors will receive During a Chapter 13 bankruptcy you ll make monthly payments to a bankruptcy trustee appointed to your case The trustee will pay your creditors according to the repayment plan

What You Need To Know If You Can t Finish Your Chapter 13 Repayment

Rebuilding Credit During Chapter 13 Bankruptcy Repayment Plan YouTube

Repayment Plan In Chapter 13 Bankruptcy

Chapter 13 Bankruptcy The Repayment Plan

What To Do If You Can t Meet Your Chapter 13 Repayment Plan Craft Law

Chapter 13 Budget Worksheet Fill Out Sign Online DocHub

Chapter 13 Budget Worksheet Fill Out Sign Online DocHub

Chapter 13 Plan Sample Doc Template PdfFiller

What To Know About The New Student Loan Repayment Plan The New York Times

Understanding Chapter 13 Repayment Plans Parker DuFresne

Chapter 13 Repayment Plan House - It is designed to protect a debtor operating under a chapter 13 individual repayment plan case by insulating him from indirect pressures from his creditors exerted through friends or relatives that may have cosigned an obligation of the debtor