Comparison Of House And Senate Tax Plans Top tax rate The Senate plan would have a top tax rate of 38 5 percent while the House would leave it at 39 6 percent Both top rates start at income of 500 000 for single filers and

Under current law the child tax credit is phased out beginning at income levels of 75 000 for single filers and 110 000 for joint filers The House plan would raise these amounts to 115 000 and 230 000 respectively The Senate plan would increase the child tax credit to 1 650 The Senate bill would establish seven tax brackets at 10 percent 12 percent 22 5 percent 25 percent 32 5 percent 35 percent and 38 5 percent for the nation s highest income earners The

Comparison Of House And Senate Tax Plans

Comparison Of House And Senate Tax Plans

https://thenextfind.com/wp-content/uploads/2022/10/difference-between-house-senate.png

Kansas Commission Recommends Raising Annual Base Salary Of State

https://kansasreflector.com/wp-content/uploads/2023/10/Legislature-compensation-panel-1-scaled.jpg

Comparing The House And Senate Tax Plans Texas Public Policy Foundation

https://www.texaspolicy.com/wp-content/uploads/2023/05/House-v.-Senate-3.jpg

Comparing the House and Senate Tax Reform Proposals Both plans have similar themes but the details have many differences Both the House and Senate have passed tax reform plans titled Tax Cuts and Jobs Act But how do they compare to each other and to the laws in place today December 4 2017 The Senate keeps seven but lowers them all 10 12 22 5 25 32 5 35 and 38 5 Child tax credit Increases from 1 000 to 1 600 in House bill 1 650 in Senate bill per child

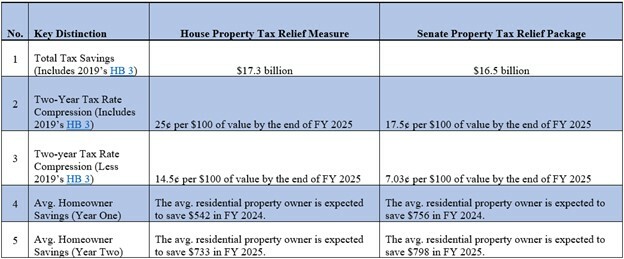

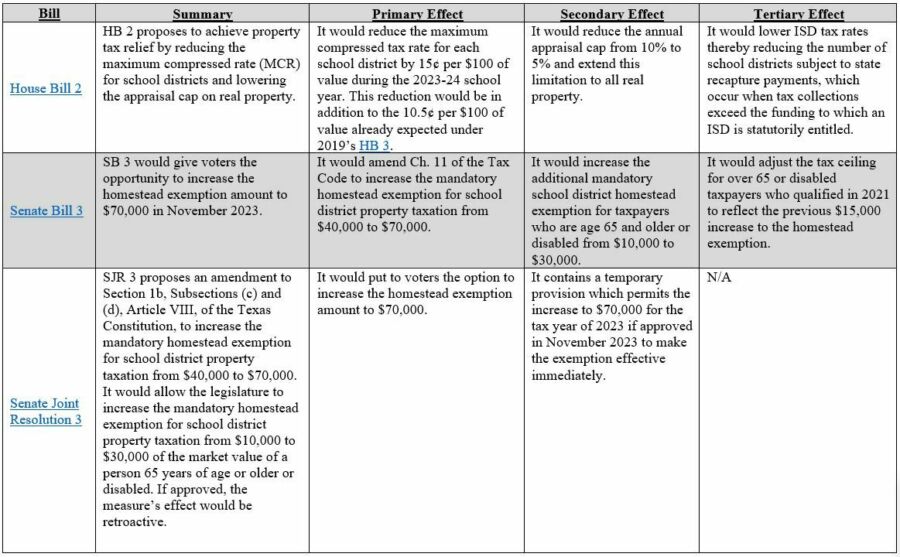

Comparing the House and Senate Tax Plans By James Quintero May 5 2023 Taxes Spending Texans are eager for massive property tax relief and policymakers appear ready to deliver However while there is broad agreement on the need for relief and the political will to see it through there are competing visions on how to get it done Here are some of the key differences Individual tax Income tax brackets The House version compresses seven income tax brackets into four keeping the top marginal rate at 39 6 per cent

More picture related to Comparison Of House And Senate Tax Plans

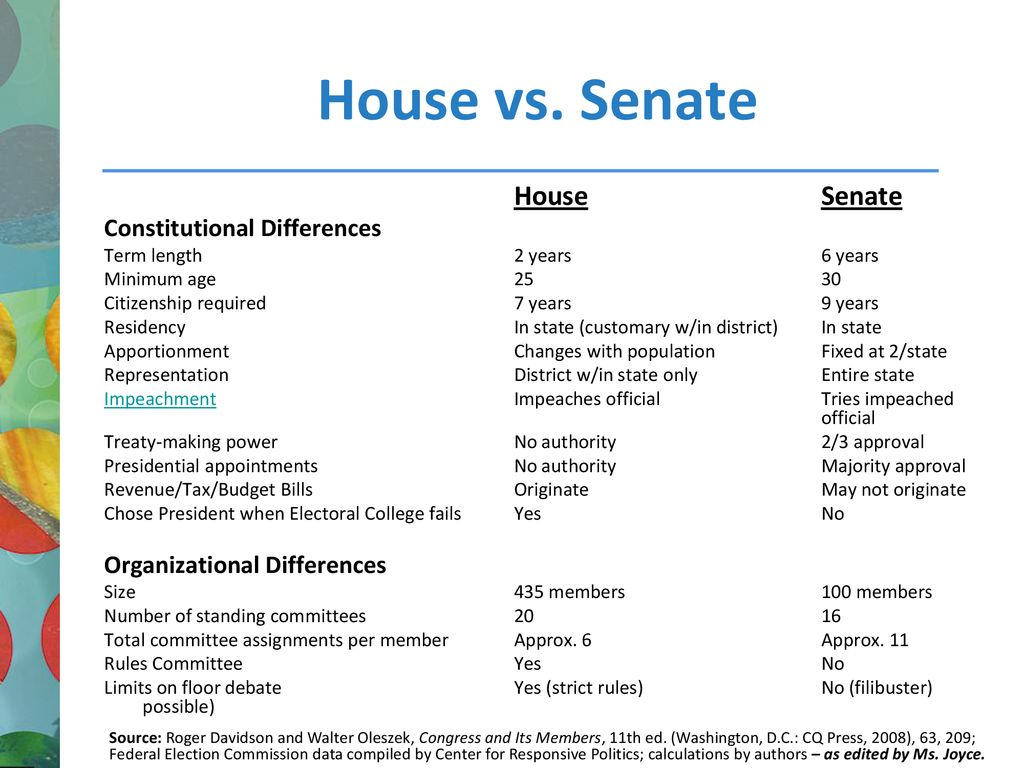

House And Senate Differences Chart

https://slideplayer.com/slide/16120033/95/images/7/House+vs.+Senate+Constitutional+Differences+Organizational+Differences.jpg

Comparing The House And Senate Tax Plans Texas Public Policy Foundation

https://www.texaspolicy.com/wp-content/uploads/2023/05/House-v.-Senate-1.jpg

Comparing The House And Senate Tax Plans Texas Public Policy Foundation

https://www.texaspolicy.com/wp-content/uploads/2023/05/House-v.-Senate-2-900x557.jpg

The Senate plan keeps seven tax brackets as under current law while the House plan consolidates them down to four 12 percent 25 percent 35 percent and 39 6 percent The Senate s lowest House and Senate on a path to make housing unaffordable Sen Cantwell 4 12 PM ET Thu 9 Nov 2017 03 34 Senate Republicans unveiled a tax plan Thursday which chops taxes on businesses and makes

WRAL News provides a quick comparison of the leading House and Senate tax reform plans along with related documents Posted 2013 05 30T15 31 35 00 00 Updated 2013 05 30T19 55 19 00 00 A comparison of the major provisions of the bills is below Individual Senate Keeps current seven tax bracket structure Lowers top rate to 38 5 and raises income threshold to 500 000 for individuals and 1 million for joint filers Also includes 35 32 5 25 22 5 12 and 10 brackets

Benefit Revolution Key Differences In The House And Senate Tax Plans

https://2.bp.blogspot.com/-2AwqS-hQZ0I/WiWRoCrkUkI/AAAAAAAAXUw/zh27fObdOro5PH0_f8zfvfUQ6xmOpPE-ACLcBGAs/s640/Side%2BBy%2BSide.jpg

Create A Venn Diagram Comparing How The House And Senate Conduct

https://us-static.z-dn.net/files/d6c/0e063f5fb8010c35014ed968d13c5ce4.png

https://news.yahoo.com/compare-senate-house-gop-tax-222035069.html

Top tax rate The Senate plan would have a top tax rate of 38 5 percent while the House would leave it at 39 6 percent Both top rates start at income of 500 000 for single filers and

https://www.tbccpa.com/resources/articles/compare-and-contrast-the-house-and-senate-tax-bills/

Under current law the child tax credit is phased out beginning at income levels of 75 000 for single filers and 110 000 for joint filers The House plan would raise these amounts to 115 000 and 230 000 respectively The Senate plan would increase the child tax credit to 1 650

The Senate Parliamentary Education Office

Benefit Revolution Key Differences In The House And Senate Tax Plans

House Vs Senate Comparing Political Terms 7ESL

The House And Senate Still Have Very Different Tax Bills Here s How

/GettyImages-139828013-ec630e016d184bbf8b6fa46c79106e22.jpg)

Hur Fylls Senatens Lediga Platser

Pennsylvania ERA Applies To Abortion Restrictions Says State Supreme

Pennsylvania ERA Applies To Abortion Restrictions Says State Supreme

What s The Difference It s A Big One In House And Senate Tax Proposals

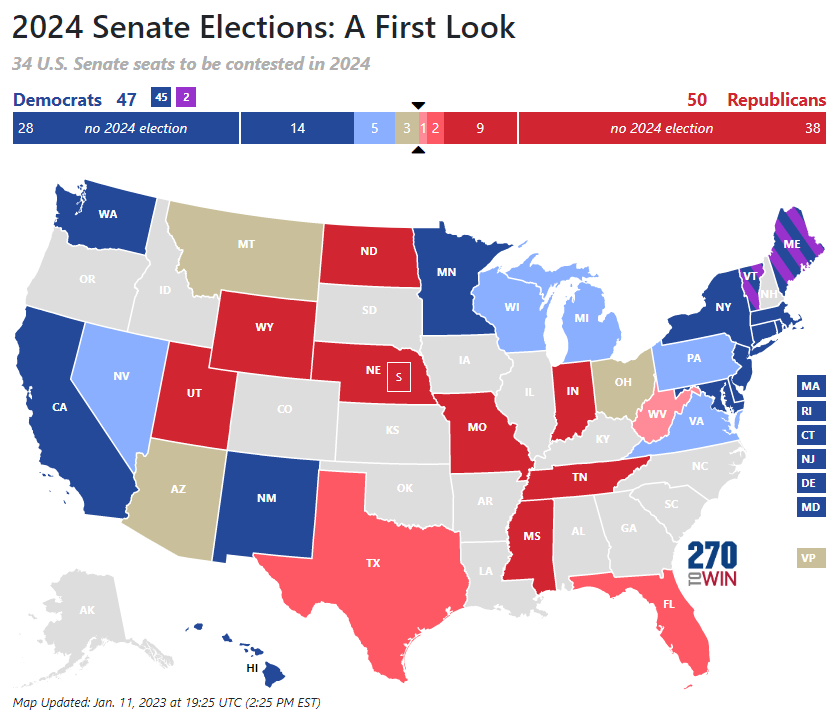

Introducing The 2024 Senate Interactive Map 270toWin

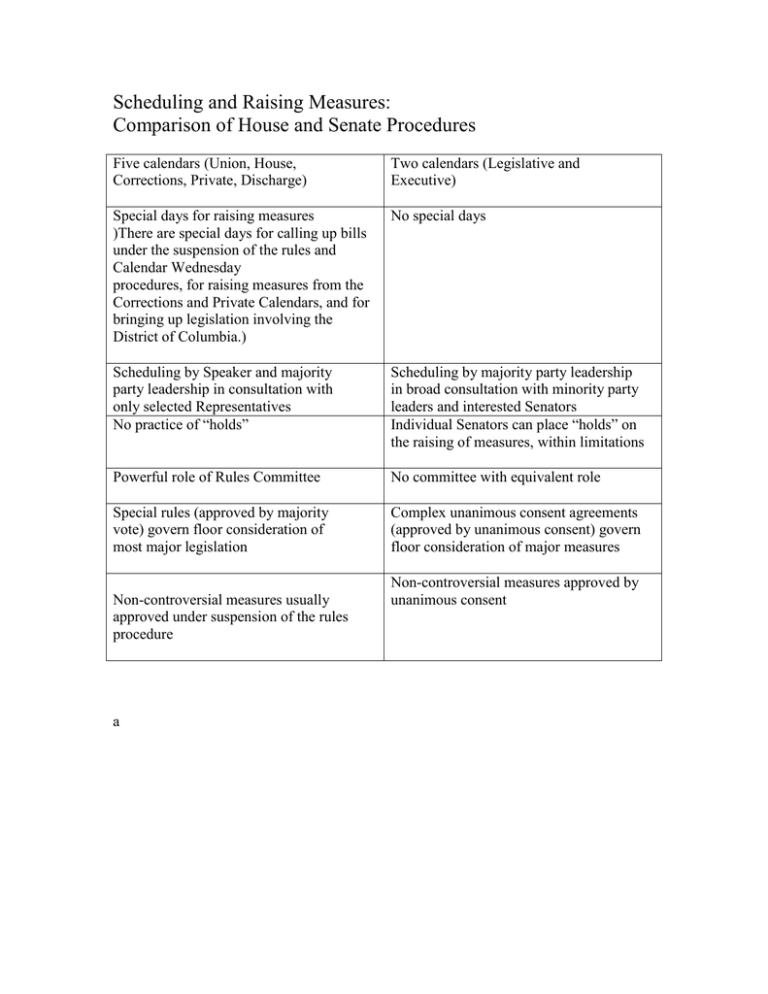

Scheduling And Raising Measures Comparison Of House And Senate Procedures

Comparison Of House And Senate Tax Plans - Homeowners would fare better under the Senate tax plan than the House tax plan according to a Texas Tribune analysis Under the House plan the owner of a 340 000 home the typical price of a