Corporate Deductions Under The House Tax Plan Corporate Integration Taxes in House Plan Emphasizes Need For It Home Blog Higher Taxes Under House Ways and Means Plan Emphasize Need for Corporate Integration Higher Taxes Under House Ways and Means Plan Emphasize Need for Corporate Integration October 13 20218 min read By Alex Durante

Business Tax Savings Businesses would get lots of tax savings under the House GOP plan Firms could write off more asset purchases The proposal would revive 100 first year bonus depreciation Interest Treatment in the House GOP Tax Plan July 1 20165 min read By Alan Cole One of the most important provisions in the new House GOP tax plan is the disallowance of the business deduction for net interest expense

Corporate Deductions Under The House Tax Plan

Corporate Deductions Under The House Tax Plan

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

Income Tax Deductions While Filling ITR In India RJA

https://carajput.com/blog/wp-content/uploads/2017/03/Income-Tax-Deductions-Financial-Year-2020-21..jpg

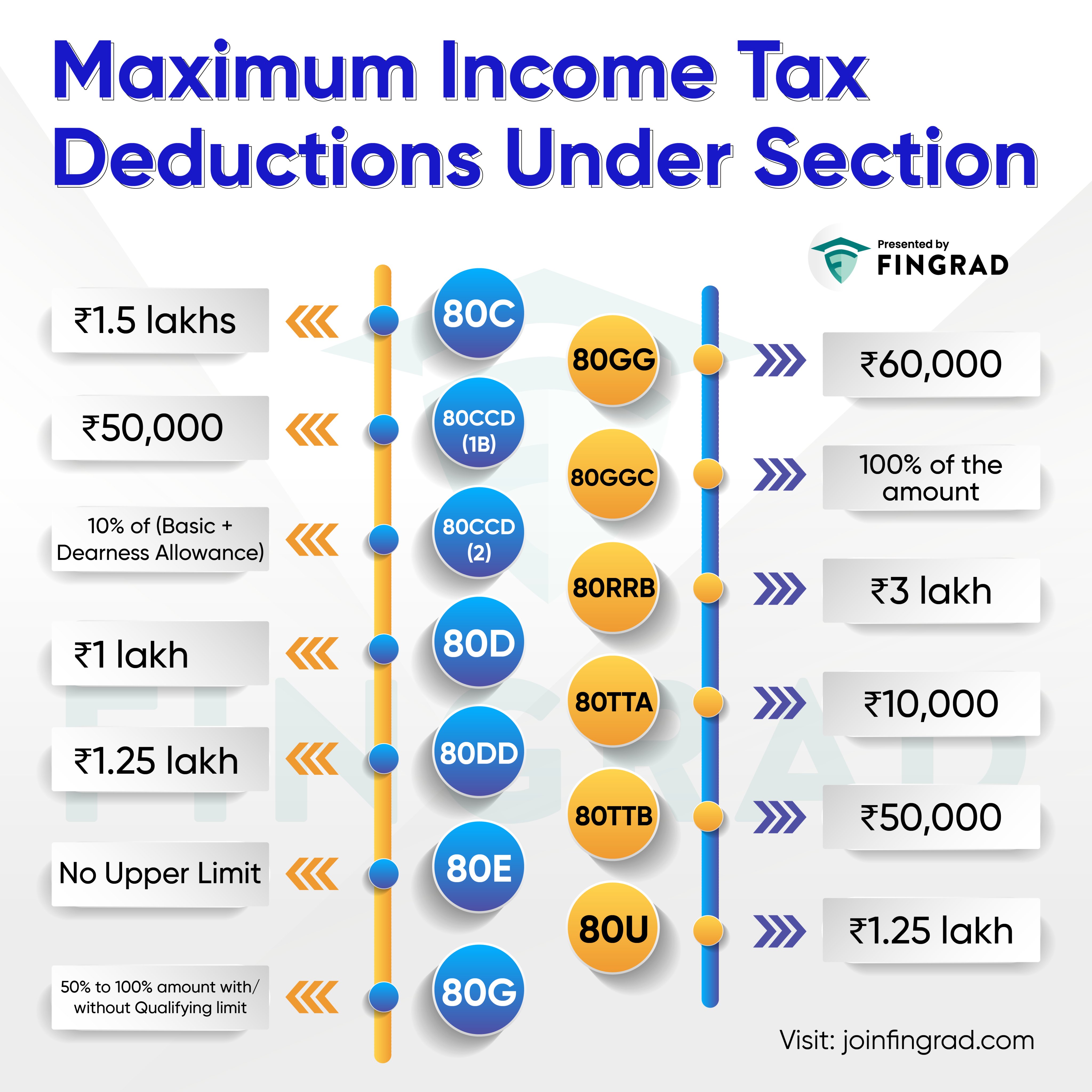

Trade Brains On Twitter Maximum Income Tax Deductions Under Different

https://pbs.twimg.com/media/F0LGwgIXgAEm9Hb?format=jpg&name=4096x4096

Image credit Getty Images Imposing a Surtax on Wealthy Americans Negotiations over how to pay for the planned social spending provisions were contentious at times There always seemed to be Business Deductions New Tax Plan Explained 5 Min Read Business Deductions New Tax Plan Explained Hub Expenses December 19 2023 In late 2017 the Trump Administration introduced the Tax Cuts and Jobs Act also known as TCJA The act introduced a universal corporate tax rate of 21 for American businesses

An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to The House GOP tax plan would consolidate the regular s tandard deduction additional standard deductions for age or blindness and the personal exemption for tax filers into new standard deduction amounts of 12 000 for single filers 18 000 for head of

More picture related to Corporate Deductions Under The House Tax Plan

Deductions Available Under The Income Tax Act

https://media.licdn.com/dms/image/D4D12AQG3tq_7ygpzSQ/article-cover_image-shrink_720_1280/0/1680440688066?e=2147483647&v=beta&t=NYDSXvbyYVA4A1Ct6jLA_c0o-TUxxhAYd1BbxYdLSFQ

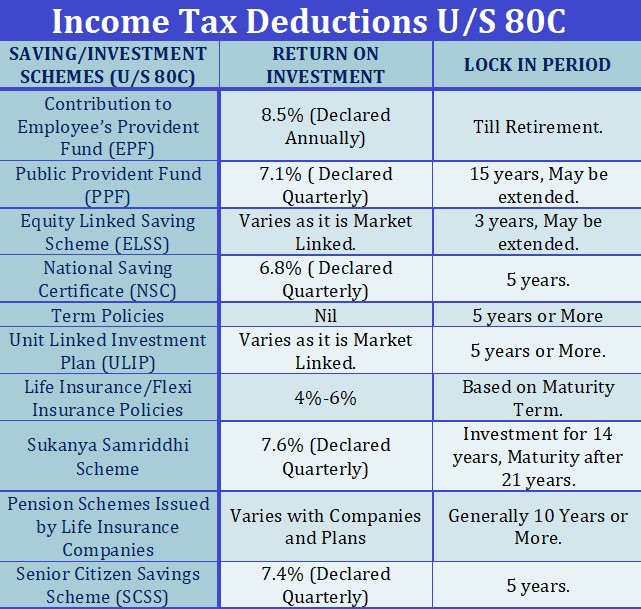

Deductions U S 80C Under Schedule VI Of Income Tax IFCCL

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

Legal Aspects On The Deductions From Income From Business And

https://blog.ipleaders.in/wp-content/uploads/2020/11/Tax-Deduction-blog-1.jpg

Press Release Today Congresswoman Rosa DeLauro CT 03 released two fact sheets on the tax deal The first fact sheet examines the differences between the American Rescue Plan and the Wyden Smith Tax Deal The second fact sheet outlines which corporations pay little to no federal income tax The tax deal fails on equity said As 2024 begins it s an ideal time for manufacturers to assess their tax planning Below are six key tax planning considerations for the new year Interest deductions The deduction for net interest expense is generally limited to 30 of adjusted taxable income ATI under Section 163 j Previously ATI was similar to earnings before

S enate and House tax experts met Wednesday as they pushed to strike a tax deal that could reinstate business deductions in exchange for an enlargement of the child tax credit CTC After House Republican plans to temporarily raise the standard deduction and restore more generous business tax deductions would result in modest tax cuts for most households in 2024 according to a new Tax Policy Center analysis However after some of the largest cuts expire most households would face a small tax hike due to the proposed repeal of clean energy tax breaks

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

https://taxfoundation.org/blog/corporate-integration-tax-reform/

Corporate Integration Taxes in House Plan Emphasizes Need For It Home Blog Higher Taxes Under House Ways and Means Plan Emphasize Need for Corporate Integration Higher Taxes Under House Ways and Means Plan Emphasize Need for Corporate Integration October 13 20218 min read By Alex Durante

https://www.kiplinger.com/taxes/business-tax-savings-under-house-gop-plan-kiplinger-tax-letter

Business Tax Savings Businesses would get lots of tax savings under the House GOP plan Firms could write off more asset purchases The proposal would revive 100 first year bonus depreciation

Capital Gains Tax When Selling Your Home Mechanic Associates Inc

10 Business Tax Deductions Worksheet Worksheeto

Tax Savings Deductions Under Chapter VI A Learn By Quicko

10 2014 Itemized Deductions Worksheet Worksheeto

8 Tax Itemized Deduction Worksheet Worksheeto

List Of Deductions Under Chapter Via

List Of Deductions Under Chapter Via

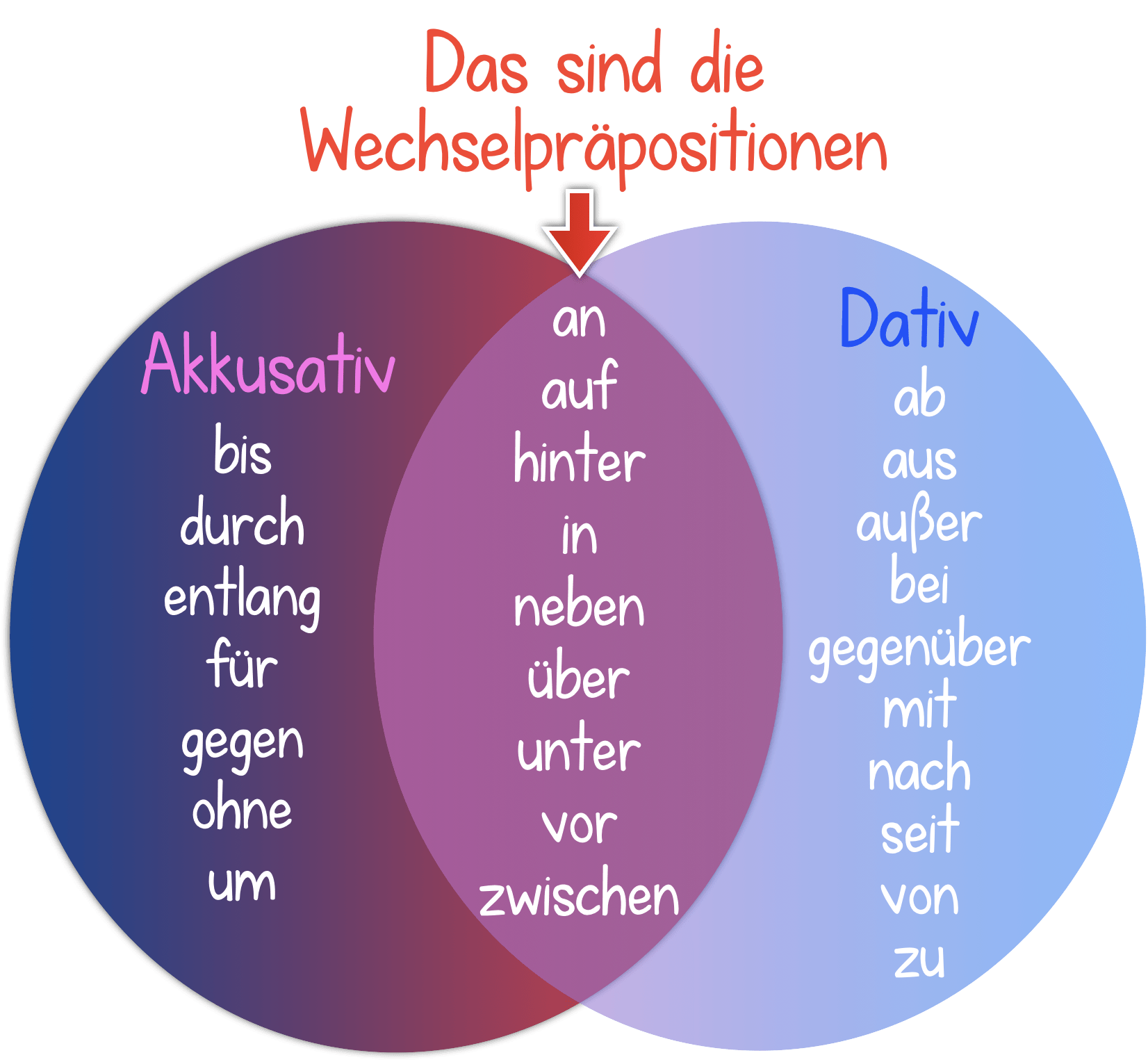

Die Wechselpr positionen German Island

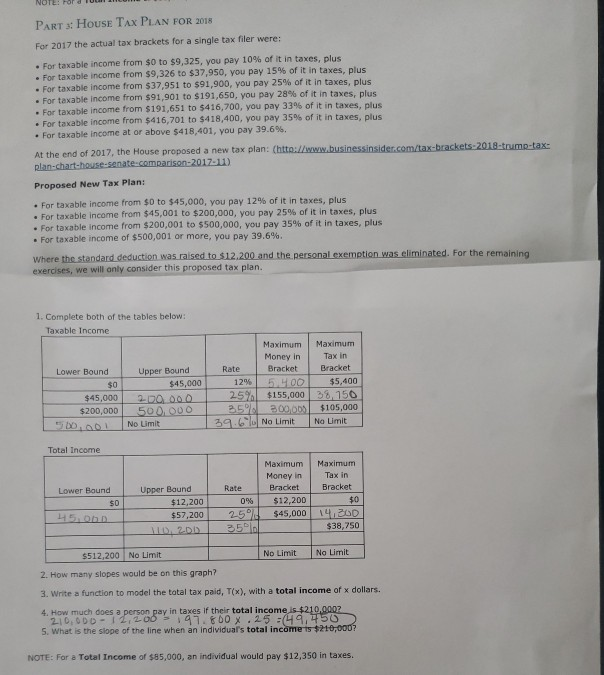

PART 3 HOUSE TAX PLAN FOR 2018 For 2017 The Actual Chegg

5 Tax Deductions Small Business Owners Need To Know

Corporate Deductions Under The House Tax Plan - The House GOP tax plan would consolidate the regular s tandard deduction additional standard deductions for age or blindness and the personal exemption for tax filers into new standard deduction amounts of 12 000 for single filers 18 000 for head of