Current House Tax Plan Married Deduction If you plan to make more or less money or change your circumstances including getting married starting a business or having a baby consider adjusting your withholding or tweaking your

The 2023 standard deduction for tax returns filed in 2024 is 13 850 for single filers 27 700 for joint filers or 20 800 for heads of household People 65 or older may be eligible for a A tax deduction also sometimes called a tax write off provides a smaller benefit by allowing you to deduct a certain amount from your taxable income Another consideration with tax

Current House Tax Plan Married Deduction

Current House Tax Plan Married Deduction

https://loanscanada.ca/wp-content/uploads/2023/05/Property-Tax-Assessment.png

Property Tax What Is Property Tax And How It Is Calculated

https://homefirstindia.com/app/uploads/2022/11/Your-paragraph-text-2.png

2023 Tax Brackets Prestige Wealth Management Group Wealth

https://static.twentyoverten.com/5bfc50ed9c0397157a3b1154/wEnl9RYsK-/2023-tax-bracket-1.jpg

New for 2024 Starting in calendar year 2023 the Inflation Reduction Act reinstates the Hazardous Substance Superfund financing rate for crude oil received at U S refineries and petroleum products that entered into the United States for consumption use or warehousing 2024 Tax Brackets Rate Married Filing Jointly Single Individual Head of Household Married Filing Separately 10 23 200 or less 11 600 or less 16 500 or less

The 2023 standard deduction for couples married filing jointly is 27 700 up 1 800 from 25 900 in tax year 2022 For those filing head of household the standard deduction will be 20 800 for tax year 2023 up 1 400 from 19 400 amount for tax year 2022 Standard deduction amounts increased between 750 and 1 500 from 2023 Here are the amounts for 2024 Married Filing Jointly and Surviving Spouses 29 200 Increase of 1 500 from the 2023

More picture related to Current House Tax Plan Married Deduction

Budget 2023 Income Tax Slabs Savings Explained New Tax Regime Vs Old

https://static.toiimg.com/thumb/msid-97531244,width-1070,height-580,imgsize-103792,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

Rental Property Tax Deductions A Comprehensive Guide Credible Tax

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

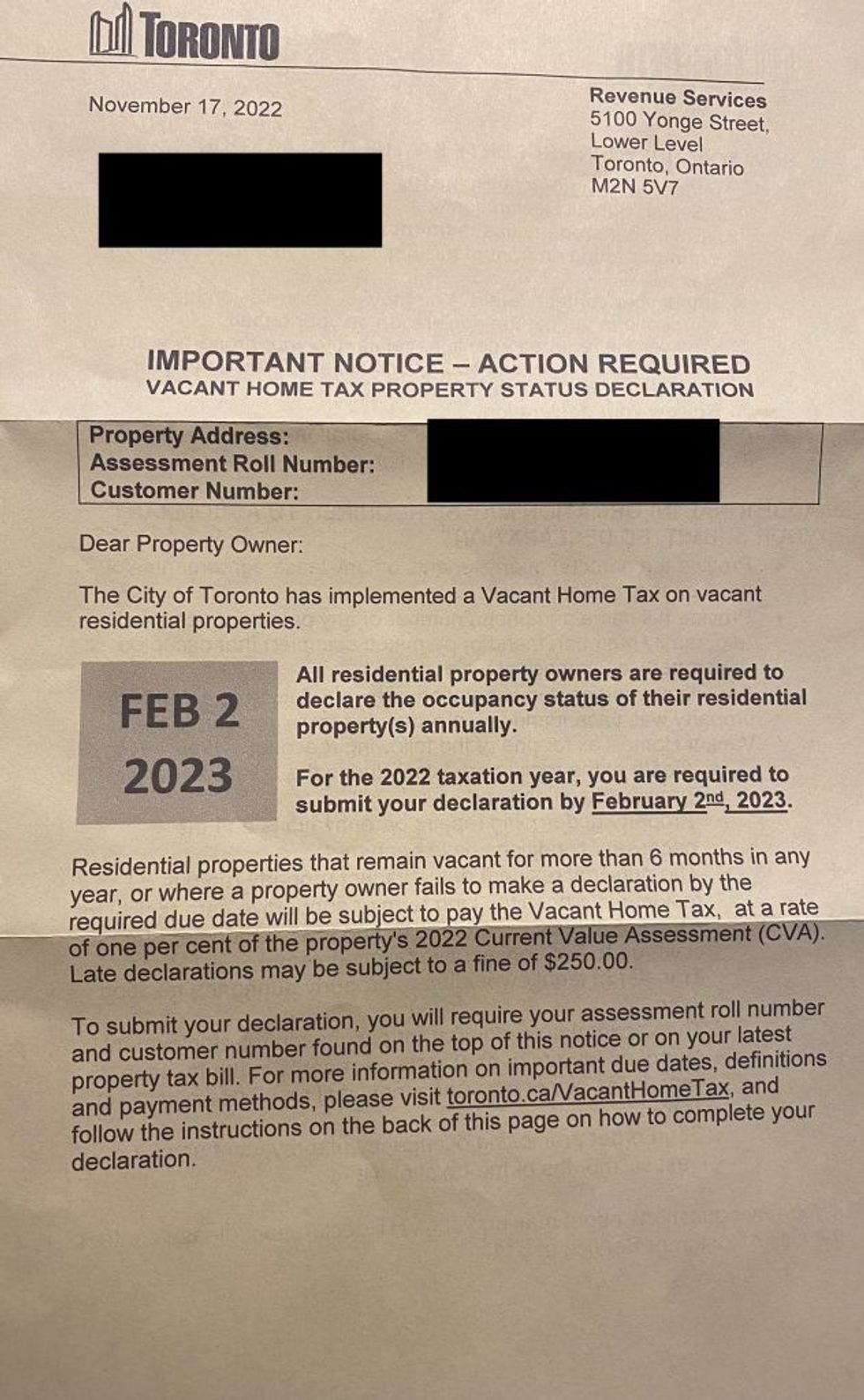

Toronto s Vacant Home Tax Is Coming Forcing Homeowners To Declare

https://storeys.com/wp-content/uploads/2022/12/Vacant-Home-Tax-Declaration-Form-2023-632x1024.jpeg

There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539 900 for single filers and above 693 750 for married couples filing jointly The standard deduction for married couples filing jointly for tax year 2021 rises to 25 100 up 300 from the prior year For single taxpayers and married individuals filing separately the standard deduction rises to 12 550 for 2021 up 150 and for heads of households the standard deduction will be 18 800 for tax year 2021 up 150

The federal income tax has seven tax rates in 2024 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 609 350 for single filers and above 731 200 for married couples filing jointly Tax Rate Single filers Married filing jointly or qualifying surviving spouse Married filing Rental property income Credits deductions and income reported on other forms or schedules for audited individual returns filed with TurboTax for the current 2023 tax year and for individual non business returns for the past two tax years 2022

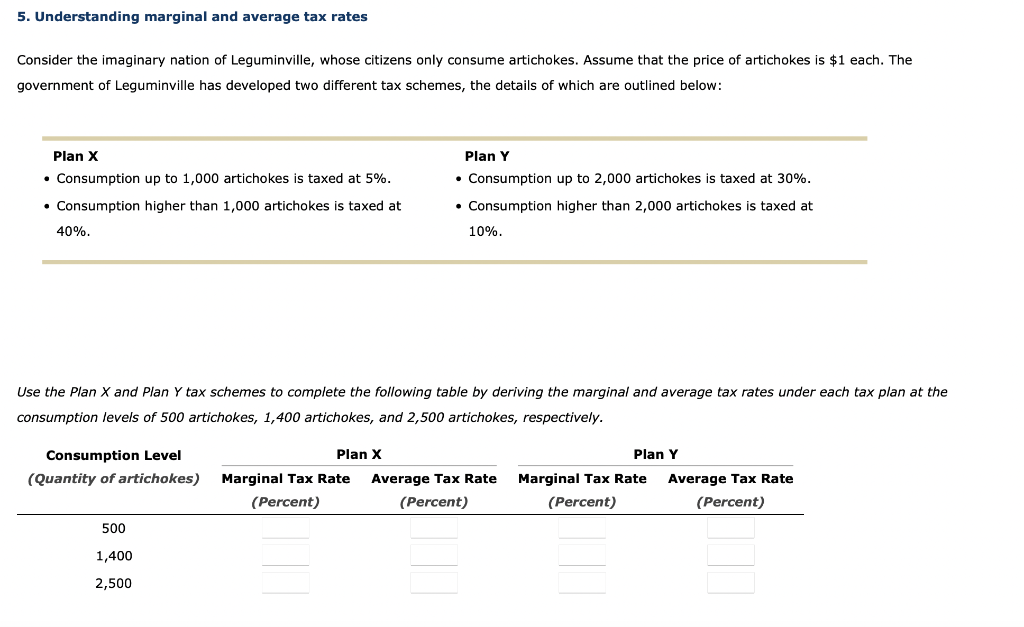

Solved 5 Understanding Marginal And Average Tax Rates Chegg

https://media.cheggcdn.com/media/2fa/2fa820ef-77bf-41ed-8451-5ce6719d9b53/phplEXMQl

What Are The New Irs Tax Brackets For 2023 Review Guruu Images And

https://boxelderconsulting.com/wp-content/uploads/2022/11/Screen-Shot-2022-11-17-at-12.20.59-PM-1024x469.png

https://www.forbes.com/sites/kellyphillipserb/2023/11/09/irs-announces-2024-tax-brackets-standard-deductions-and-other-inflation-adjustments/

If you plan to make more or less money or change your circumstances including getting married starting a business or having a baby consider adjusting your withholding or tweaking your

https://www.nerdwallet.com/article/taxes/standard-deduction

The 2023 standard deduction for tax returns filed in 2024 is 13 850 for single filers 27 700 for joint filers or 20 800 for heads of household People 65 or older may be eligible for a

Solved 5 Understanding Marginal And Average Tax Rates Chegg

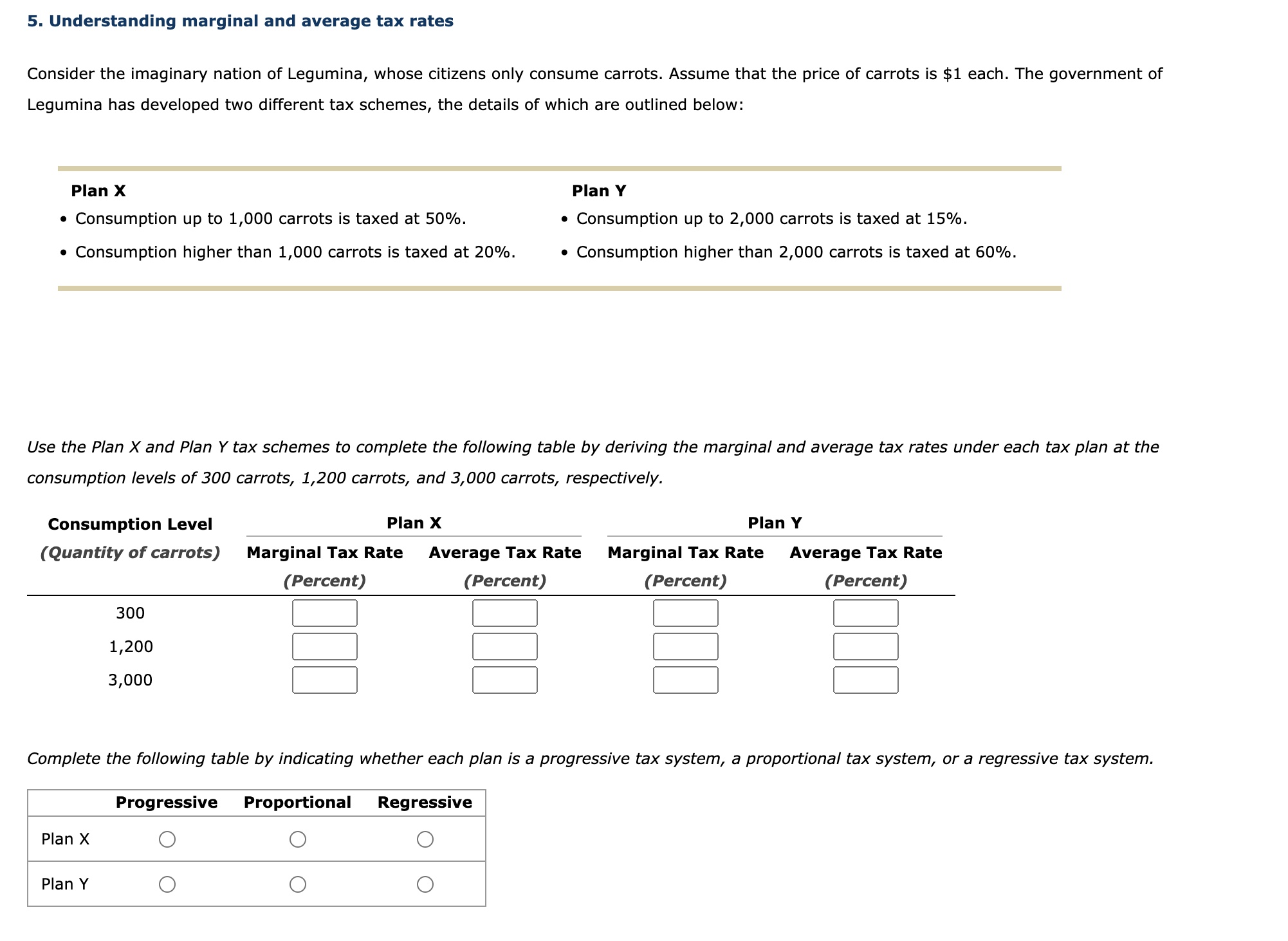

Solved 5 Understanding Marginal And Average Tax Rates Chegg

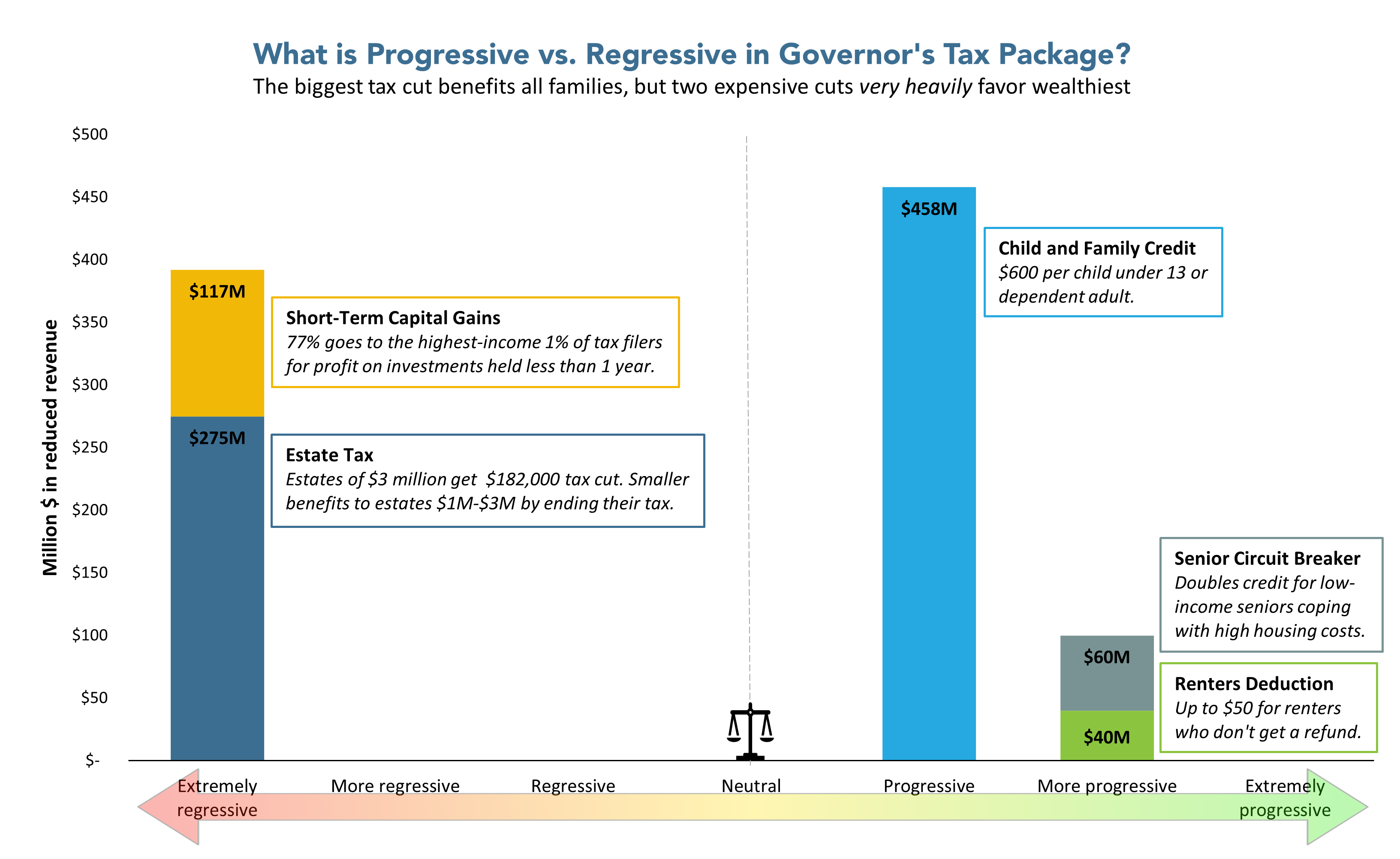

Taking Measure Of The Governor s Tax Plan Mass Budget And Policy Center

Home Loan Tax Exemption Check Tax Benefits On Home Loan

2024 Standard Deduction Over 65 Anett Blinnie

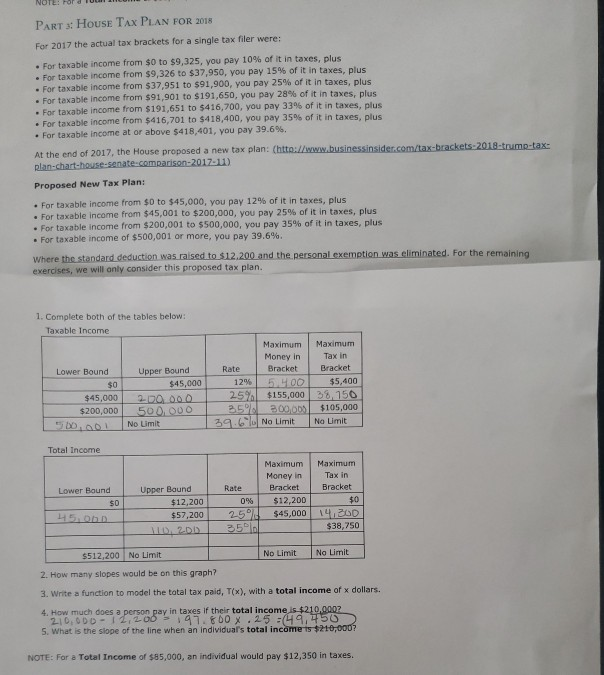

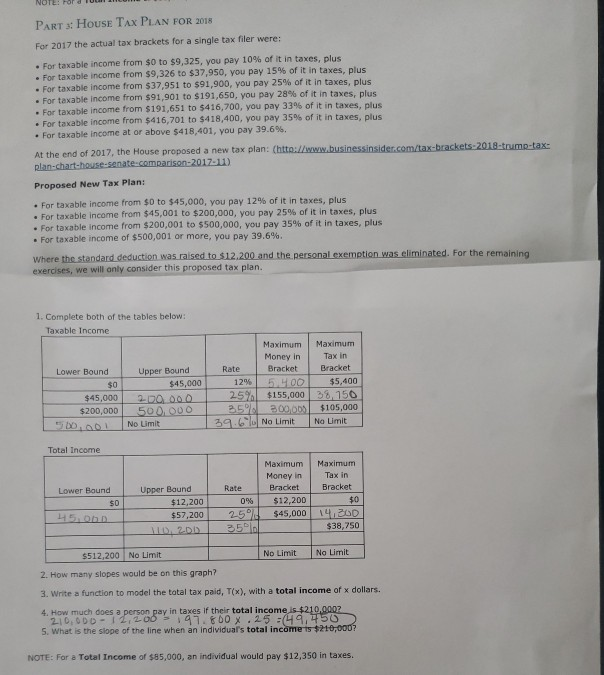

PART 3 HOUSE TAX PLAN FOR 2018 For 2017 The Actual Chegg

PART 3 HOUSE TAX PLAN FOR 2018 For 2017 The Actual Chegg

Standard Deduction For 2021 22 Standard Deduction 2021

Claim Of Deduction U s 54F Of Income Tax Act Not Allowable If Assessee

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Current House Tax Plan Married Deduction - New for 2024 Starting in calendar year 2023 the Inflation Reduction Act reinstates the Hazardous Substance Superfund financing rate for crude oil received at U S refineries and petroleum products that entered into the United States for consumption use or warehousing