Deduction For Taxes On Second House In Republican Tax Plan The bill would revive three business tax breaks favored by Republicans that have expired or started to phase out bonus depreciation research and development expensing and the net interest deduction

Some House Republicans who represent affluent districts in New York and New Jersey say they won t back the plan unless House leaders agree to fully restore the IRS deduction for state and local WASHINGTON The House Ways and Means Committee voted 40 3 on Friday to approve a bipartisan tax package that includes an expansion of the child tax credit and a series of breaks for businesses

Deduction For Taxes On Second House In Republican Tax Plan

Deduction For Taxes On Second House In Republican Tax Plan

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

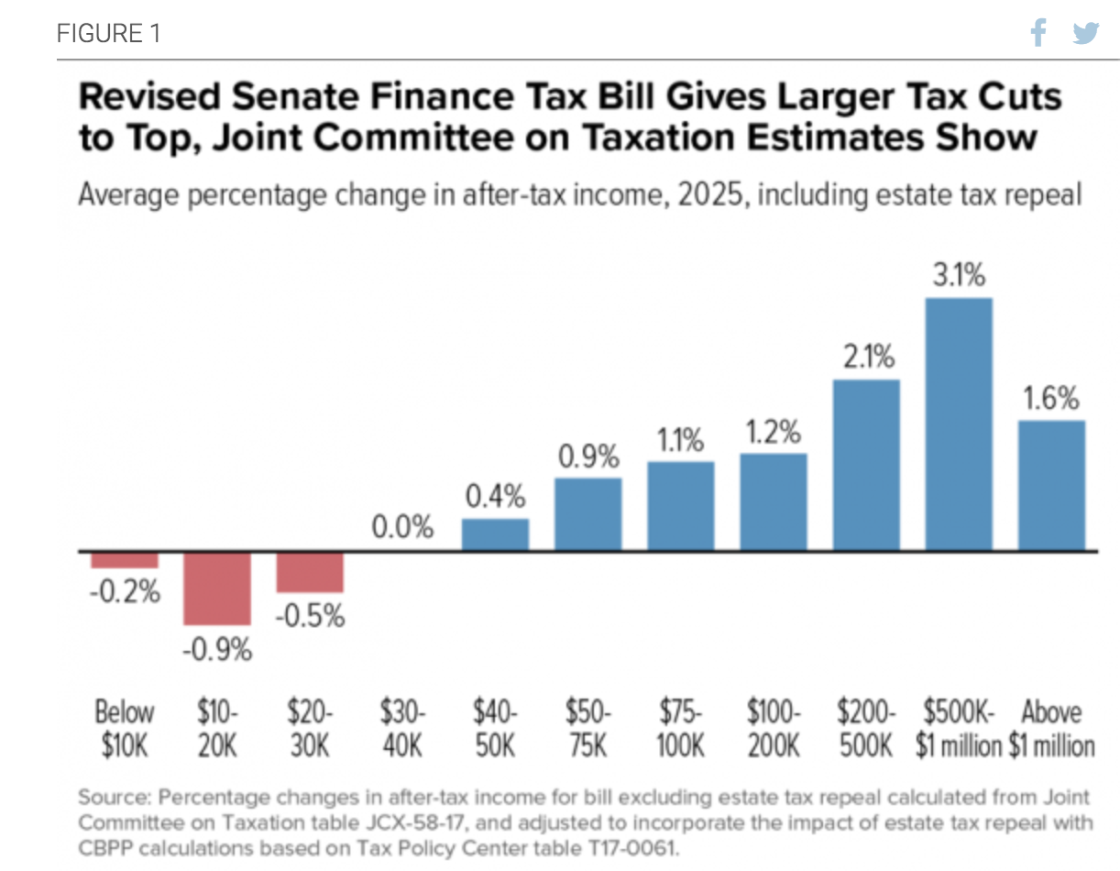

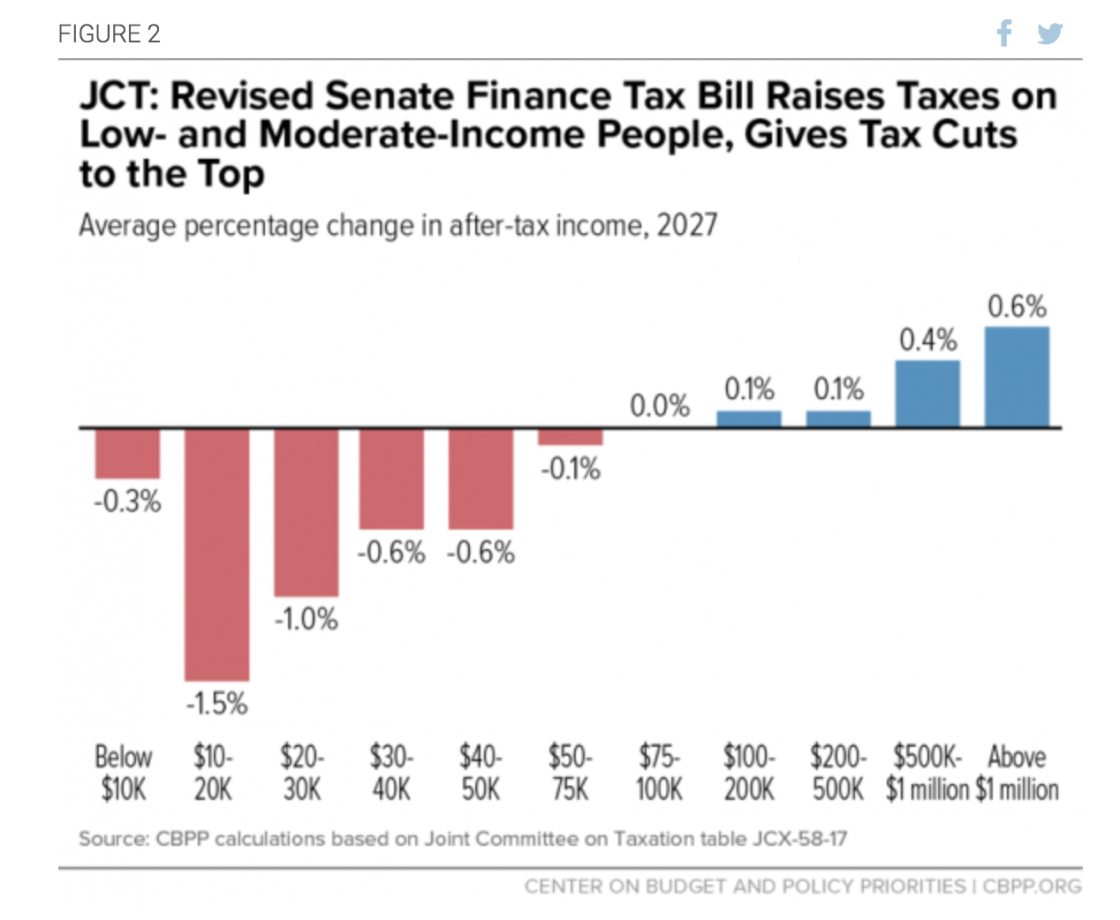

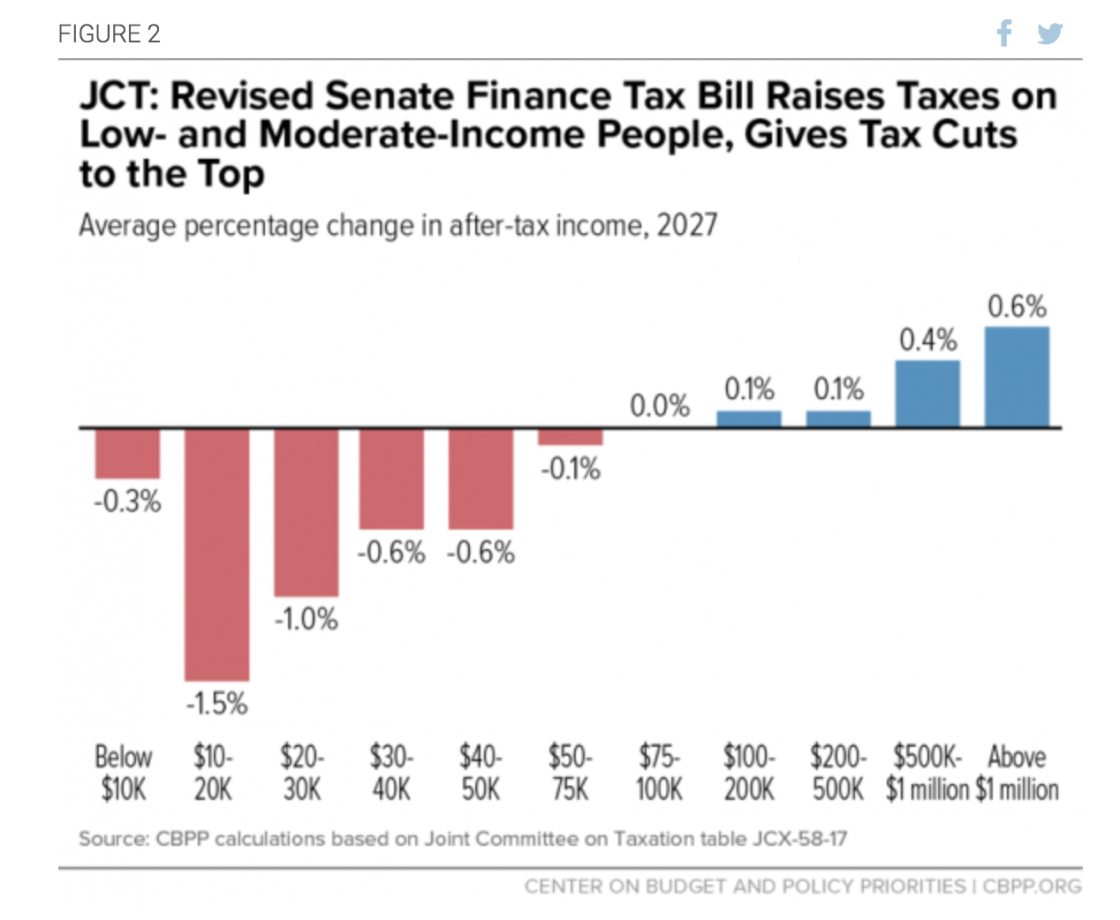

The Republican Tax Plan

https://www.bruegel.org/sites/default/files/styles/wysiwyg_full_image_desktop/public/wysiwyg_images/229610-figure-1a.png?itok=KFySu4b6

IRS Inflation Adjustments Taxed Right

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

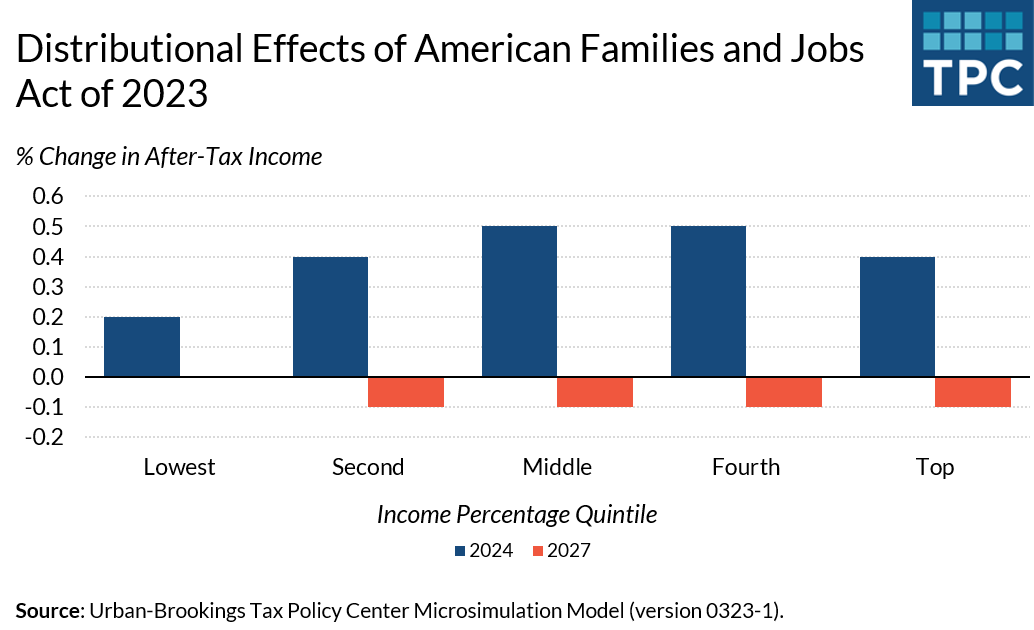

House GOP leaders are moving forward with a 78 billion bipartisan tax package even as some Republicans express reservations over the deal which includes an expansion of the popular child tax credit a top Democratic priority Speaker Mike Johnson said at a private event on Monday that the bill which also restores some business tax breaks that are favored by Republicans will come An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to

Childcare tax deduction Rep Lauren Daniel R Locust Grove is spearheading a bill to increase the child tax deduction by 1 000 per child raising it from 3 000 to 4 000 Lawmakers Strike Tax Deal but It Faces Long Election Year Odds in Congress A 78 billion package to revive an expansion of the child tax credit and expired business breaks has drawn bipartisan

More picture related to Deduction For Taxes On Second House In Republican Tax Plan

Fair Tax Act 2023 What Would Happen If IRS And Taxes Were Abolished

https://phantom-marca.unidadeditorial.es/9ee1d11a1f665692e8bbb44c0ae81a41/crop/0x0/1060x706/resize/1320/f/jpg/assets/multimedia/imagenes/2022/10/16/16659058079446.png

Tax Policy Center On Twitter A House GOP Tax Plan Would Raise The

https://pbs.twimg.com/media/FzFN1NEWAAEucja.png

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/04xx.jpeg

The legislation Republicans plan to consider would increase those limits further so that up to 2 5 million could be invested by companies that invest up to 4 million in a single year Tags Child Tax Credit Corporate Tax Watch House Republicans are reportedly considering a proposal to keep the SALT deduction in place for taxpayers with incomes of up to 400 000 though the final cap could be closer to 250 000

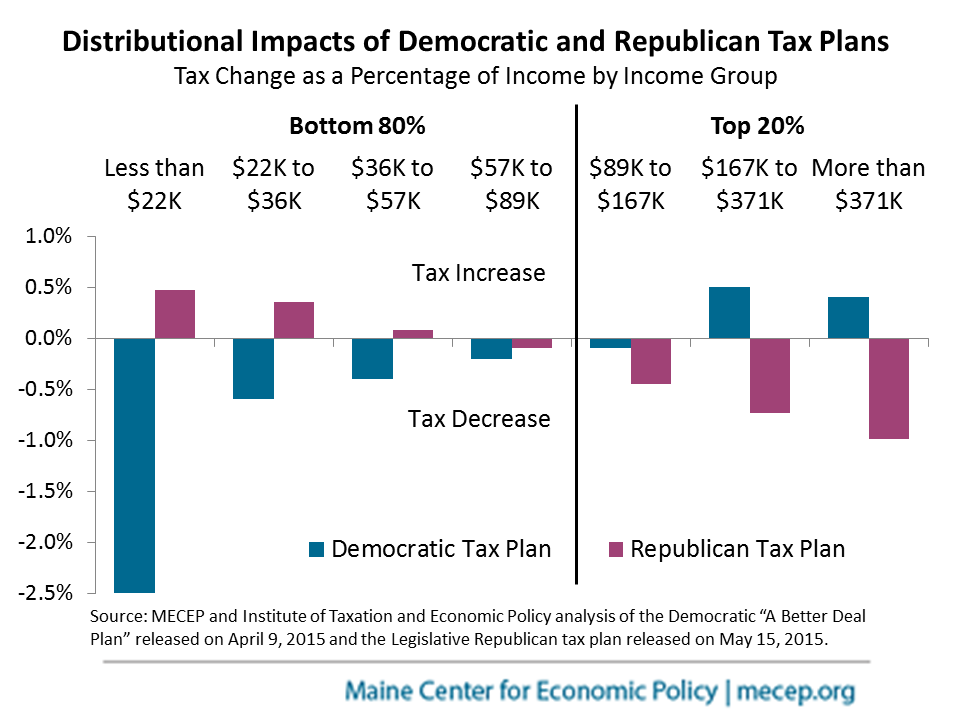

House Republican plans to temporarily raise the standard deduction and restore more generous business tax deductions would result in modest tax cuts for most households in 2024 according to a new Tax Policy Center analysis However after some of the largest cuts expire most households would face a small tax hike due to the proposed repeal of clean energy tax breaks If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married filing

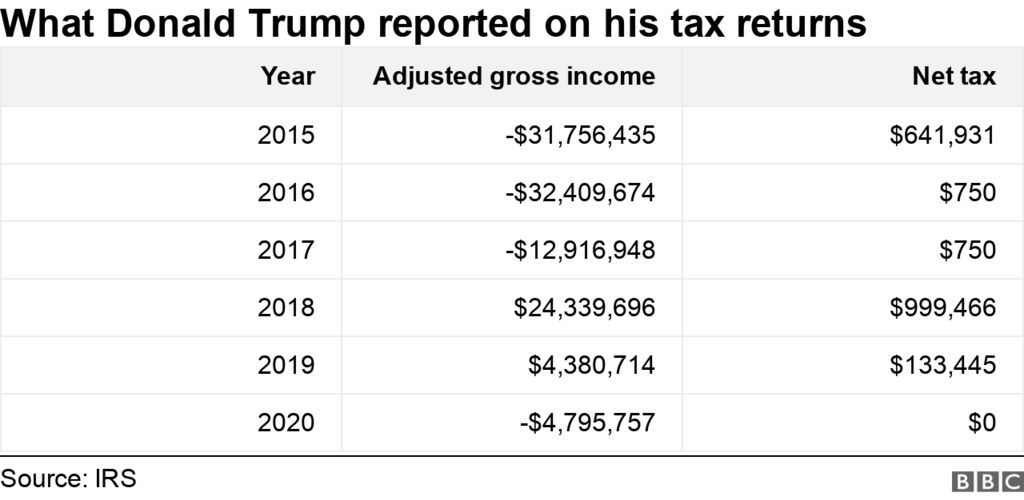

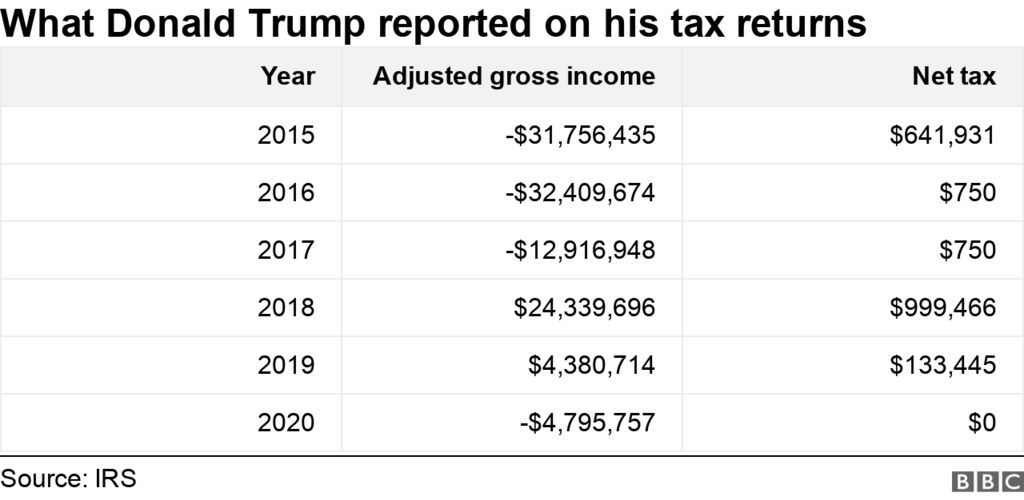

Trump s Tax Returns Reveal President s Foreign Bank Accounts BBC News

https://ichef.bbci.co.uk/news/1024/cpsprodpb/3CA6/production/_128162551_588d82ce-5b56-4d54-a7ac-679ff126fa65-6.png

2023 Contribution Limits And Standard Deduction Announced Day Hagan

https://images.squarespace-cdn.com/content/v1/5e68f47ca0d8573682071426/db14bc39-72bb-4656-9ad5-416374313bf0/2023-retirement-account-contribution-limits-announced-10.25.2022.JPG

https://www.washingtonpost.com/politics/2024/01/30/republicans-press-forward-with-bipartisan-tax-bill/

The bill would revive three business tax breaks favored by Republicans that have expired or started to phase out bonus depreciation research and development expensing and the net interest deduction

https://www.latimes.com/politics/story/2024-01-26/new-expanded-child-tax-credits-are-back-and-they-may-actually-pass-congress

Some House Republicans who represent affluent districts in New York and New Jersey say they won t back the plan unless House leaders agree to fully restore the IRS deduction for state and local

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Trump s Tax Returns Reveal President s Foreign Bank Accounts BBC News

Everything You Need To Know About The Democratic And Republican Tax

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

Tax Rates Archives Conner Ash

The Republican Tax Plan

The Republican Tax Plan

Tax The Rich And Pay Their Fair Share Demands Unreasonable

Why The Opposition To The Republican Tax Plan Wasn t Enough

What Documents Do You Need To File Taxes Experian

Deduction For Taxes On Second House In Republican Tax Plan - Childcare tax deduction Rep Lauren Daniel R Locust Grove is spearheading a bill to increase the child tax deduction by 1 000 per child raising it from 3 000 to 4 000