Deductions Under House And Senate Tax Plans The refundable portion of the child tax credit would increase to 1 800 for tax year 2023 1 900 for 2024 and 2 000 for 2025 and a new calculation would expand access The current

01 29 2024 10 06 PM EST House Speaker Mike Johnson said he intends to put a bipartisan tax package on the floor for a vote that would need a two thirds majority to pass moving business breaks An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to

Deductions Under House And Senate Tax Plans

Deductions Under House And Senate Tax Plans

https://www.gannett-cdn.com/presto/2021/12/16/NBCC/812ec0de-68bc-43fb-9a05-265edd01294a-image.jpeg?crop=1859,1046,x0,y85&width=1859&height=1046&format=pjpg&auto=webp

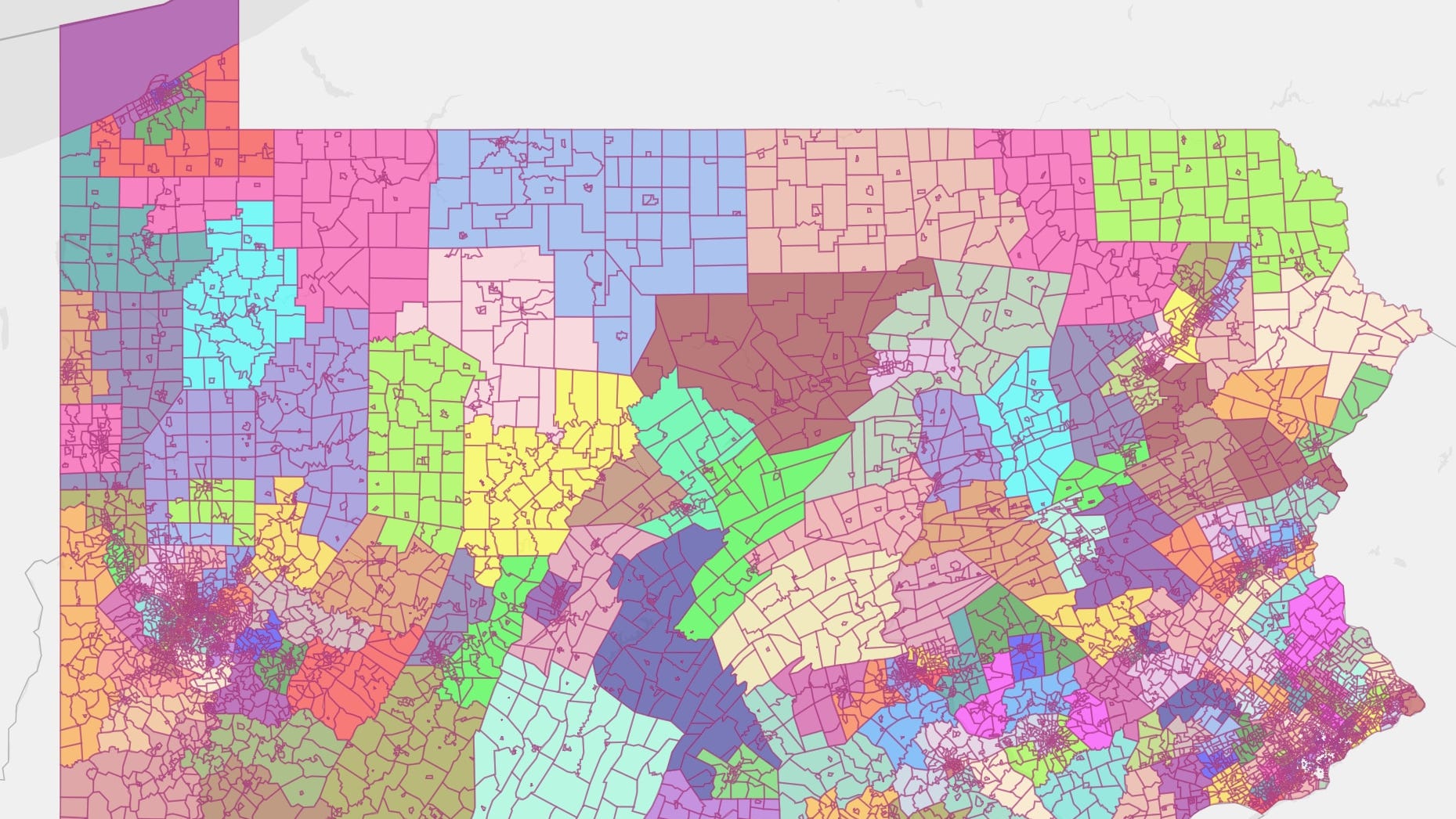

2022 Midterm Election Results Map Live Updates From Across US

https://nypost.com/wp-content/uploads/sites/2/2022/11/new-us-election-map12.gif?w=1024

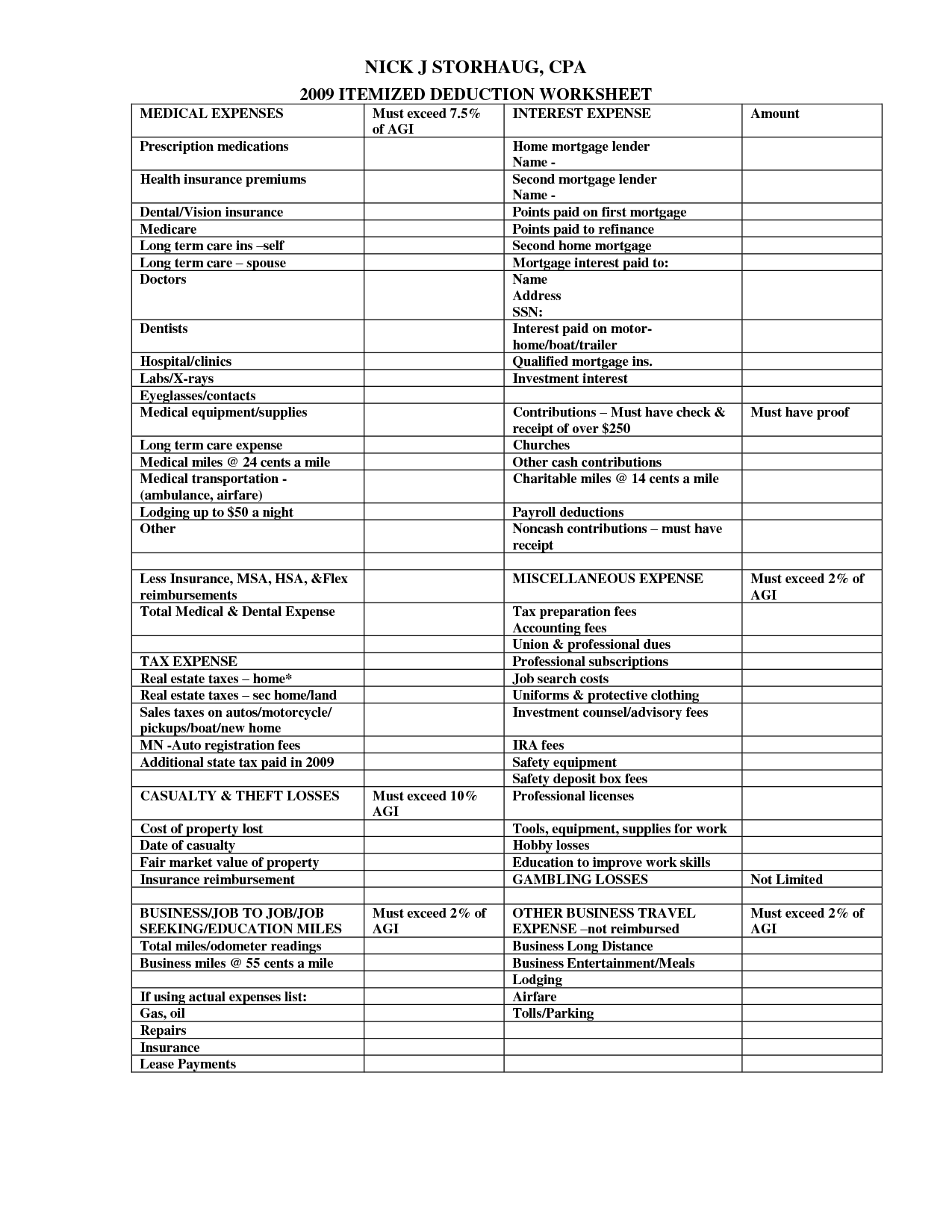

Deductions Available Under The Income Tax Act

https://media.licdn.com/dms/image/D4D12AQG3tq_7ygpzSQ/article-cover_image-shrink_720_1280/0/1680440688066?e=2147483647&v=beta&t=NYDSXvbyYVA4A1Ct6jLA_c0o-TUxxhAYd1BbxYdLSFQ

Some House Republicans who represent affluent districts in New York and New Jersey say they won t back the plan unless House leaders agree to fully restore the IRS deduction for state and local Under the Senate plan the standard deduction for individuals would be 12 000 slightly less than the 12 200 proposed by the House The current deduction for individuals is 6 350

Jan 19 2024 8 31 PM UTC By Sahil Kapur and Scott Wong WASHINGTON The House Ways and Means Committee voted 40 3 on Friday to approve a bipartisan tax package that includes an expansion of Experts say the tax deal is closer to happening now in the wake of a 1 66 trillion top line spending agreement announced over the weekend and a flurry of House and Senate meetings IRS

More picture related to Deductions Under House And Senate Tax Plans

Deductions U S 80C Under Schedule VI Of Income Tax IFCCL

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

House And Senate Agree To A Two part Continuing Resolution Until March

https://wex-s3.s3.us-east-1.amazonaws.com/wp-content/uploads/2023/12/ap23347085894155-scaled.jpg

Who Will Control The House And Senate Here s What We Can Say At 4 30 A

https://fivethirtyeight.com/wp-content/uploads/2022/11/senate-balance-of-power.4-20.png

Here Are Some Answers Families with dependents In addition to benefiting from a higher standard deduction families whose income qualifies them for a child tax credit would get more per In the Senate plan the lowest rate would be 10 percent starting at 9 525 for single filers and 19 050 for joint filers That s slightly higher than what s in place today Top tax rate The Senate plan would have a top tax rate of 38 5 percent while the House would leave it at 39 6 percent Both top rates start at income of 500 000 for

Lawmakers Strike Tax Deal but It Faces Long Election Year Odds in Congress A 78 billion package to revive an expansion of the child tax credit and expired business breaks has drawn bipartisan Essentially doubles the standard deduction to 24 000 for married couples filing jointly from 12 700 currently Eliminates deduction for state and local income or sales taxes Caps state and local property tax deduction at 10 000 Tweaks from the Senate bill that impact the standard deduction vs itemizing decision

Exemptions Allowances And Deductions Under Old New Tax Regime

https://www.taxhelpdesk.in/wp-content/uploads/2023/06/EXEMPTIONS-ALLOWANCES-DEDUCTIONS-AVAILABLE-UNDER-THE-OLD-NEW-TAX-REGIME-1.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

https://www.cnbc.com/2024/01/24/how-the-proposed-child-tax-credit-changes-could-affect-2023-taxes.html

The refundable portion of the child tax credit would increase to 1 800 for tax year 2023 1 900 for 2024 and 2 000 for 2025 and a new calculation would expand access The current

https://www.politico.com/news/2024/01/29/johnson-bipartisan-tax-package-house-floor-00138490

01 29 2024 10 06 PM EST House Speaker Mike Johnson said he intends to put a bipartisan tax package on the floor for a vote that would need a two thirds majority to pass moving business breaks

Legislative Review TVW

Exemptions Allowances And Deductions Under Old New Tax Regime

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Abbott Vetoes Bills As House And Senate Remain Divided On Property Tax

Section 80C Deductions List To Save Income Tax FinCalC Blog

PAMAC On Twitter This November 8th Marks An Important Midterm

PAMAC On Twitter This November 8th Marks An Important Midterm

Deductions Under Section 80C Benefits Works Myfinopedia

List Of Deductions Under Chapter Via

16 Insurance Comparison Worksheet Worksheeto

Deductions Under House And Senate Tax Plans - Under the Senate plan the standard deduction for individuals would be 12 000 slightly less than the 12 200 proposed by the House The current deduction for individuals is 6 350