Deductions Under House And Sentate Tax Plans For 2023 the 100 write off fell to 80 It drops to 60 in 2024 40 in 2025 and so forth Interest deductions on business debts of large companies The 2017 tax law limited many big businesses

The nonpartisan Tax Policy Center puts the average tax benefit for households making 50 000 to 75 000 at 850 The U S median household income is around 59 000 If you re taking the The House would gives singles a standard deduction of 12 200 while the Senate would give 12 000 Households and joint filers would get a standard deduction of 18 300 and 24 400 in the House

Deductions Under House And Sentate Tax Plans

Deductions Under House And Sentate Tax Plans

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

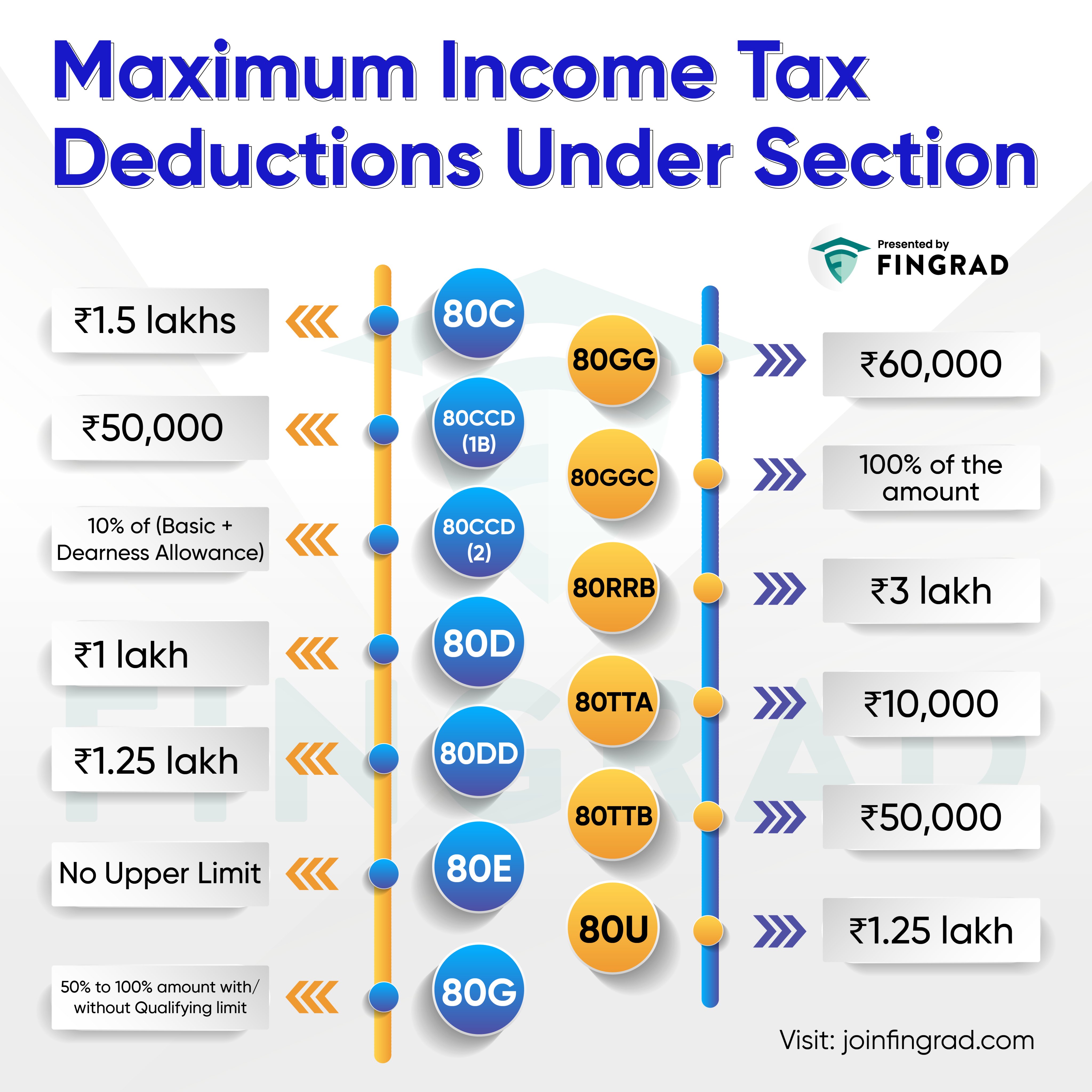

Trade Brains On Twitter Maximum Income Tax Deductions Under Different

https://pbs.twimg.com/media/F0LGwgIXgAEm9Hb?format=jpg&name=4096x4096

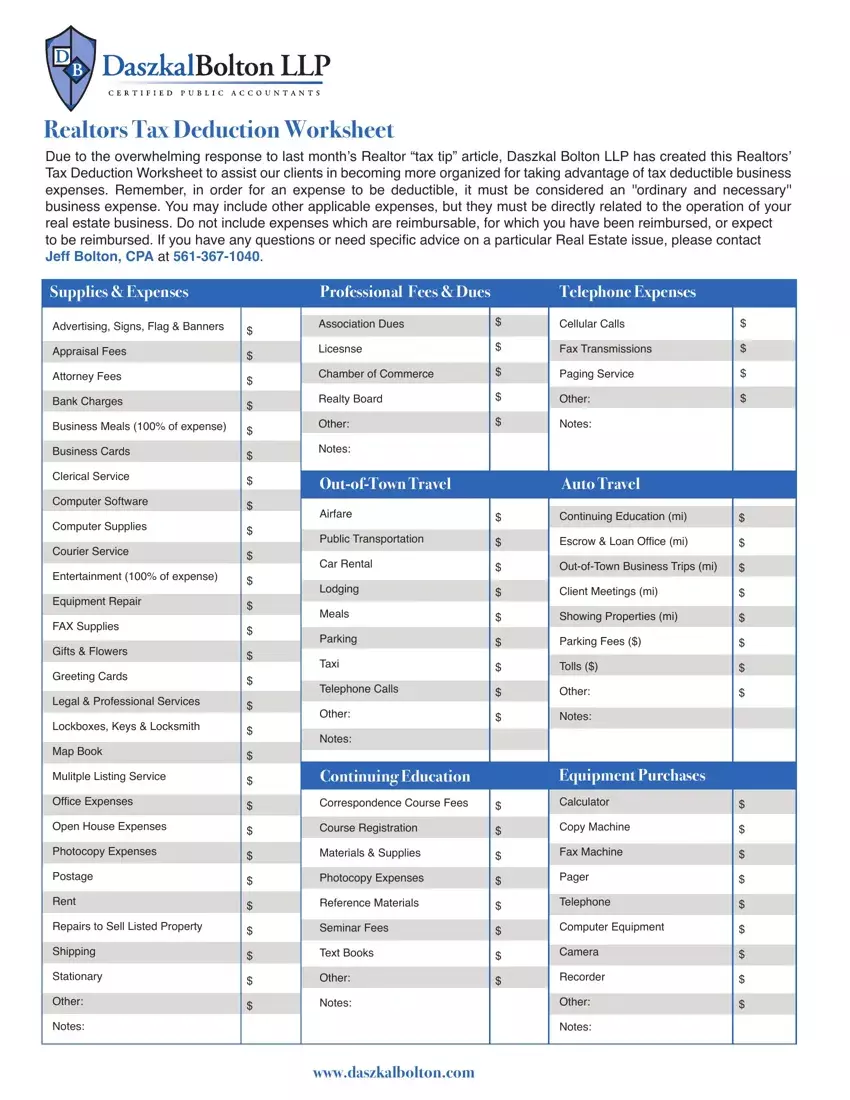

Real Estate Tax Deduction Worksheet Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/real-estate-tax-deduction/real-estate-tax-deduction-preview.webp

The House and the Senate taxA tax is a mandatory payment or charge collected by local state and national governments from individuals or businesses to cover the costs of general government services goods and activities bills restrict the deduction of business interest Each bill limits the deduction to 30 percent of modified income with carryover of the excess to later years Updated 09 14 2021 09 55 PM EDT House Democrats this week are moving forward with their long awaited plan to raise taxes to help pay for their next big spending package With more than 40

The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100 It would also quicken the phase in for taxpayers with multiple children and allow taxpayers an election to use The Senate bill would double the estate tax exemption for wealthy estates from 11 million to 22 million per couple or from 5 5 million to 11 million per individual while the House bill would

More picture related to Deductions Under House And Sentate Tax Plans

Sentate house 2 1 jpg Science And Technology Studies UCL

https://www.ucl.ac.uk/sts/sites/sts/files/sentate_house_2.1.jpg

Exemptions Allowances And Deductions Under Old New Tax Regime

https://www.taxhelpdesk.in/wp-content/uploads/2023/06/EXEMPTIONS-ALLOWANCES-DEDUCTIONS-AVAILABLE-UNDER-THE-OLD-NEW-TAX-REGIME-1.jpg

Deductions Under Section 80C Benefits Works Myfinopedia

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C.jpg

How House Democrats Plan to Raise 2 9 Trillion for a Safety Net Details of the legislation show higher taxes for companies and the wealthy but key elements differ from the Senate and White Standard Deduction The law raised the standard deduction in 2018 to 24 000 from 12 700 for married couples filing jointly 27 700 in the 2023 tax year 12 000 from 6 350 for single filers

State and local taxes The House bill would allow a deduction for up to 10 000 in property taxes but end deductions for income or sales taxes the Senate would eliminate all of them Student The new tax brackets which applied as of January 2018 have rates of 10 12 22 24 32 35 and 37 These are the rates that determine your tax bill and still apply in 2024 The table below breaks down the brackets for single and joint filers If you use have a different filing status make sure to read our full breakdown of the current

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

Kiwisim4 On Twitter Miss Judith Ward Has Been Under The Knife Once

https://pbs.twimg.com/media/FpE7S4qaAAAgZOM.jpg

https://www.kiplinger.com/taxes/tax-law/congress-tax-changes-may-be-coming

For 2023 the 100 write off fell to 80 It drops to 60 in 2024 40 in 2025 and so forth Interest deductions on business debts of large companies The 2017 tax law limited many big businesses

https://www.consumerreports.org/taxes/senate-tax-plan-winners-and-losers/

The nonpartisan Tax Policy Center puts the average tax benefit for households making 50 000 to 75 000 at 850 The U S median household income is around 59 000 If you re taking the

New Tax Regime Slabs Benefits Deductions Section 115BAC Old Vs

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Real Estate Deduction For Land Purchase Cost Without Sale IT Act

Tax Savings Deductions Under Chapter VI A Learn By Quicko

The Ultimate Guide To Tax Savings Section 80D And Medical Expenses

A Comprehensive Guide To Section 43B Of The Income Tax Act Ebizfiling

A Comprehensive Guide To Section 43B Of The Income Tax Act Ebizfiling

Rebate Limit New Income Slabs Standard Deduction Understanding What

Deductions Under Section 80D Of Income Tax Act 2024

What Expenses Are 100 Tax Deductible Leia Aqui What Tax Deductions

Deductions Under House And Sentate Tax Plans - Plan would toughen inversion limits to offset lost revenue Multinational companies would have some more flexibility in keeping their interest payments tax deductible under a new Senate Democratic version of President Joe Biden s tax plan The Finance Committee s plan released Saturday would also toughen limits on corporate tax inversions