Do You Pay Sales Tax On Manufactured Homes When you purchase a mobile home you ll encounter two primary types of taxes sales tax and property tax Each serves a different purpose and applies at different stages of ownership Sales tax is a one time tax paid at the

Understand the nuances of sales tax on mobile homes including classifications exemptions and calculation methods for informed purchasing decisions Additionally manufactured homes subject to local property taxation are exempt from any sales or use tax upon resale Therefore you may enhance the marketability of your manufactured

Do You Pay Sales Tax On Manufactured Homes

Do You Pay Sales Tax On Manufactured Homes

https://i.ytimg.com/vi/6xmRkgnRgr0/maxresdefault.jpg

How To Collect And Pay Sales Tax In QuickBooks Desktop YouTube

https://i.ytimg.com/vi/kY4ol9zoMLA/maxresdefault.jpg

How To Calculate Sales Tax On Used Cars In Pakistan YouTube

https://i.ytimg.com/vi/qrWHgF85NWs/maxresdefault.jpg

Mobile homes usually are exempt from sales and use taxes if the home is permanently affixed on real property and is subject to local property taxes Sales taxes paid on a mobile home are tax deductible on your federal income tax If you are selling a manufactured or mobile home there are two taxes for you to pay attention to Sales tax or use tax during the resale or sale of the mobile home

The sale of a used factory manufactured home is exempt from the sales tax if the taxpayer shows that someone paid Tennessee sales tax on it in a prior transaction A gain on the sale of the mobile home is treated as a capital gain and subject to the laws for taxation of capital gains You will need to determine your tax basis in the mobile

More picture related to Do You Pay Sales Tax On Manufactured Homes

Kanesha Wilbur

https://www.charlottecountyfl.gov/core/fileparse.php/408/urlt/AV-345.jpg

Tax Letter Template Format Sample And Example In PDF Word

https://bestlettertemplate.com/wp-content/uploads/2020/10/IRS-Tax-exempt-Letter.png

Nationwide Fairer Share Payment TeresaViviane

https://img.money.com/2023/01/News-2023-National-Sales-Tax.jpg

Manufactured homes are subject to sales tax whether buying a new or pre owned home Mobile homes are also subject to property taxes which the owner of the home must pay Generally sales and use tax do not apply to the sale of used mobile homes that are considered real property in California and would otherwise be subject to property taxes

If Governor Ron DeSantis signs the bill into law the state tax on manufactured home sales will fall from 6 to 3 This means that Florida homebuyers will see reduced taxes when buying a manufactured home if the Manufacturers of industrialized housing and manufactured homes collect manufactured housing sales tax upon the first sale of a new manufactured home in Texas The person to whom or for

Mnsshp 2024 Prices Meaning Betsy Collette

https://www.disneyfoodblog.com/wp-content/uploads/2023/08/2023-wdw-mk-mnsshp-map-6.jpg

Shutterstock 1930187015 1200x1200 jpg v 1684365662

http://nuggetstacker.com/cdn/shop/articles/shutterstock_1930187015_1200x1200.jpg?v=1684365662

https://www.tinyhouse.com › post › sales-ta…

When you purchase a mobile home you ll encounter two primary types of taxes sales tax and property tax Each serves a different purpose and applies at different stages of ownership Sales tax is a one time tax paid at the

https://accountinginsights.org › sales-tax-on-mobile...

Understand the nuances of sales tax on mobile homes including classifications exemptions and calculation methods for informed purchasing decisions

Tax Brackets 2025 25 Richard D Hart

Mnsshp 2024 Prices Meaning Betsy Collette

.png)

Minnesota Tax Rates 2025 Bella Yasmin

Is It Better To Buy Or Lease A Car TaxAct Blog

How To Reduce Car Payments Soupcrazy1

Consultantion Slots Registration Form what Do You Pay Sales Tax On In

Consultantion Slots Registration Form what Do You Pay Sales Tax On In

Vehicle Buying Do You Pay Sales Tax For The State You Buy From Or Live In

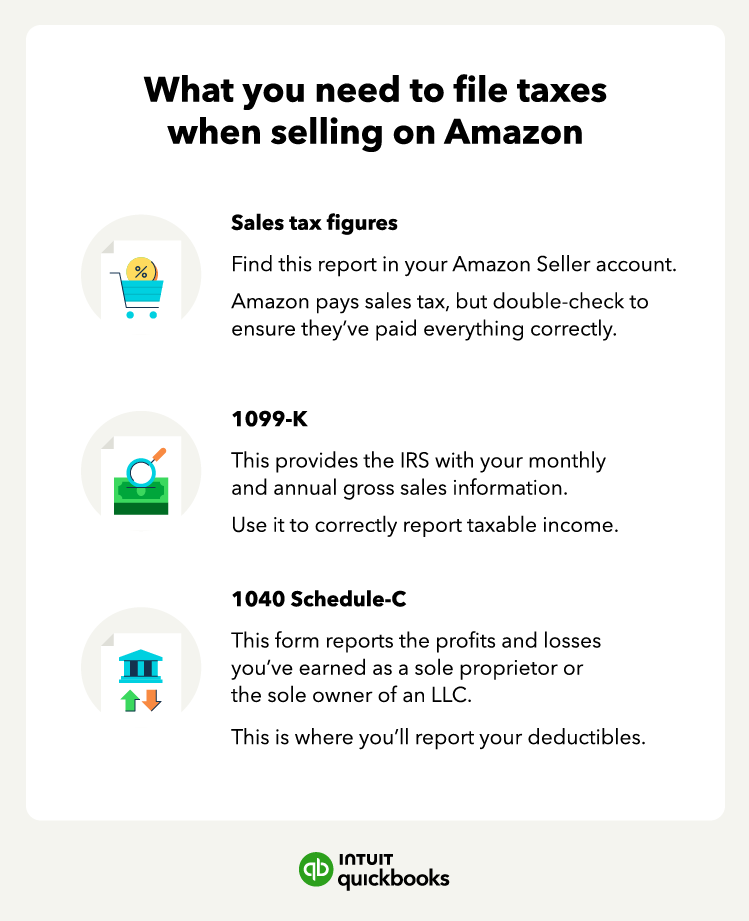

Amazon Sales Tax

How To Figure Sales Tax On A Car Car Sale And Rentals

Do You Pay Sales Tax On Manufactured Homes - The sale of a used factory manufactured home is exempt from the sales tax if the taxpayer shows that someone paid Tennessee sales tax on it in a prior transaction