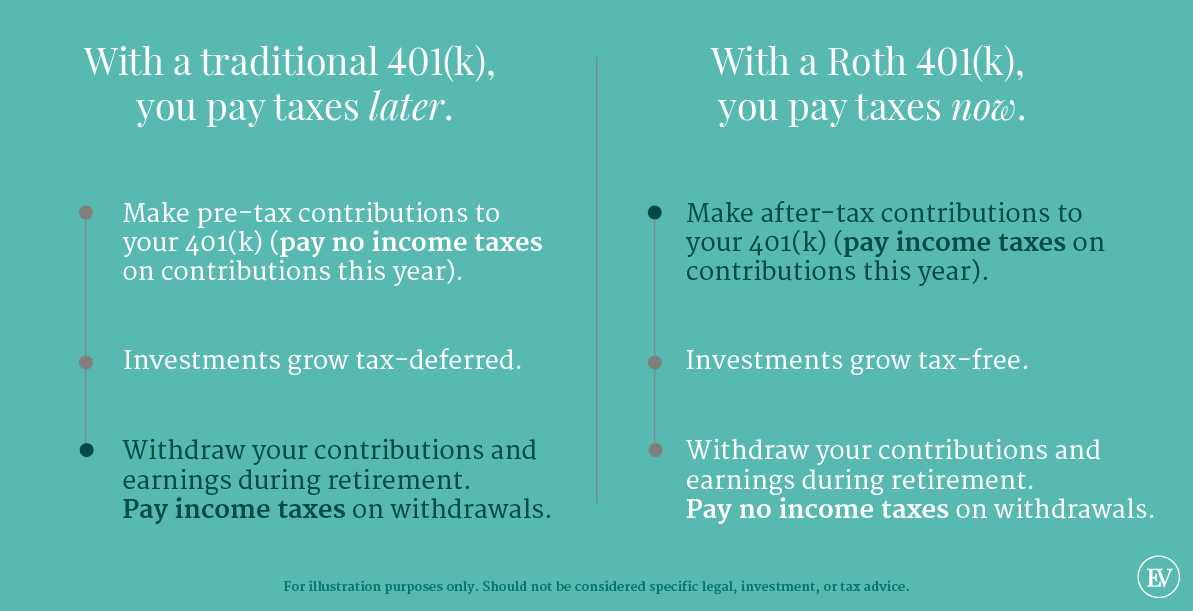

Does Traditional Ira Count Towards 401k Limit The simple answer is yes and many people do Using a traditional IRA and 401 k plan could provide tax deferred savings for retirement and offer some tax breaks for contributing

In 2025 you can contribute up to 23 500 to a 401 k retirement plan and up to 7 000 to a traditional or Roth individual retirement account IRA People 50 years of age and older can add catch up contributions of 7 500 to IRAs and 401 k s can be traditional or Roth A traditional retirement account means you can generally deduct what you contribute each year from your taxable income invest your

Does Traditional Ira Count Towards 401k Limit

Does Traditional Ira Count Towards 401k Limit

https://www.theskimm.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2F6g4gfm8wk7b6%2F6C2dwsIzDhqx0ZlHlJbPdm%2F8bfbea89445676b07e35a62db8c3c548%2FRoth_401k.png&w=1080&q=75

Fsa Maximum Contribution 2025 Karen Klein

https://www.advantaira.com/wp-content/uploads/2023/11/2024-contribution-limits.png

Roth 401 K

https://images.ctfassets.net/mgl1kxuxn1e1/3InbjxiZX2UGyyGc42QA6e/2742f98dad38b0cc1cd520f69c4f296f/TraditionalvsRoth401kExplainer.png

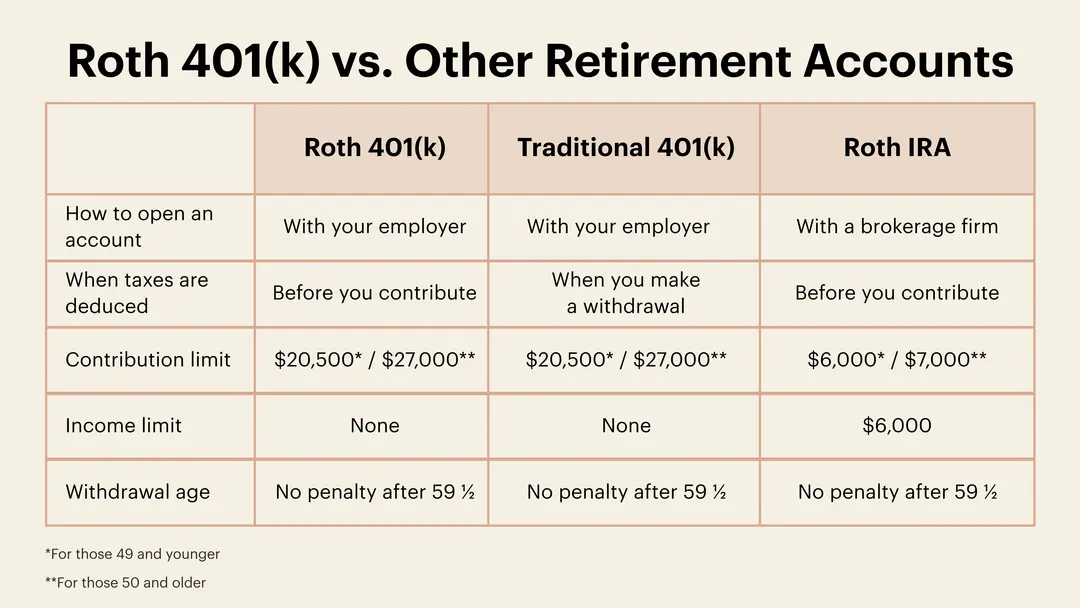

There s a big difference in the maximum annual contributions allowed to a 401 k or an IRA regardless of whether it s a Roth or a traditional account So while you can divide your contributions across a traditional 401k and a Roth 401k the combined contribution across both plans cannot exceed the IRS annual maximum Their are

Employer matching contributions do not count toward the individual s annual limit In 2025 the individual contribution limit for a traditional 401 k is 23 500 with a 7 500 catch For 2025 the annual contribution limits on IRAs remains 7 000 Those aged 50 and older can contribute an additional 1 000 as a catch up contribution the same

More picture related to Does Traditional Ira Count Towards 401k Limit

Roth 401 K

https://districtcapitalmanagement.com/wp-content/uploads/2021/05/DCM-Infographic-3.jpg

Irs 401k Limit 2025 Oscar Hayden

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits-1024x1024.png

401k 2025 Contribution Limit Diane F Sholar

https://www.carboncollective.co/hs-fs/hubfs/2021_and_2022_Roth_IRA_Income_Limits.png?width=3372&name=2021_and_2022_Roth_IRA_Income_Limits.png

Individuals can contribute to both a 401 k and an IRA although income limits and existing retirement plans may affect tax deduction eligibility for traditional IRA contributions The limit on employee elective deferrals for traditional and safe harbor plans is 23 000 22 500 in 2023 20 500 in 2022 19 500 in 2021 and 2020 and 19 000 in 2019

Rolling over a 401 k to an IRA can yield some tax benefits Learn how a 401 k rollover can affect your ability to contribute to an IRA If your employer chooses to fund your 401 k too their contributions will not count toward your limit With that said total contributions from you and your employer cannot be

2019 IRA 401k And Roth IRA Contribution Limits Roth IRA Eligibility

http://begintoinvest.com/wp-content/uploads/2019/01/2019-ira-401k-roth-ira-limits.png

The IRS Announced Its Roth IRA Income Limits For 2022 Personal

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits-1024x1024.png

https://www.nerdwallet.com › article › investing

The simple answer is yes and many people do Using a traditional IRA and 401 k plan could provide tax deferred savings for retirement and offer some tax breaks for contributing

https://www.experian.com › blogs › ask-experian

In 2025 you can contribute up to 23 500 to a 401 k retirement plan and up to 7 000 to a traditional or Roth individual retirement account IRA People 50 years of age and older can add catch up contributions of 7 500 to

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Roth Ira Rules 2024 2024 Over 50 Kaila Mariele

2019 IRA 401k And Roth IRA Contribution Limits Roth IRA Eligibility

2025 Roth 401k Limit Vally Isahella

What Is The Ira Contribution Limit For 2025 Alex I Soubeiran

2025 Irs 401k Limit Chart John J Albers

Last Day To Contribute To Roth Ira 2025 Robert Lane

Last Day To Contribute To Roth Ira 2025 Robert Lane

401k 2025 Contribution Limit Irs Over 50 Alyss Bethany

Roth Ira Income Limits 2025 Tax Carol Williams

401k Vs IRA Traditional Vs Roth The Basics Retirement Savings 101

Does Traditional Ira Count Towards 401k Limit - There s a big difference in the maximum annual contributions allowed to a 401 k or an IRA regardless of whether it s a Roth or a traditional account