Energy Efficient Home Improvement Credit For Roof What energy efficiency requirements must be met to qualify for the credit updated Jan 17 2025 A1 To qualify for the credit certain property must meet certain energy efficiency requirements Exterior windows and skylights must meet Energy Star most efficient certification requirements

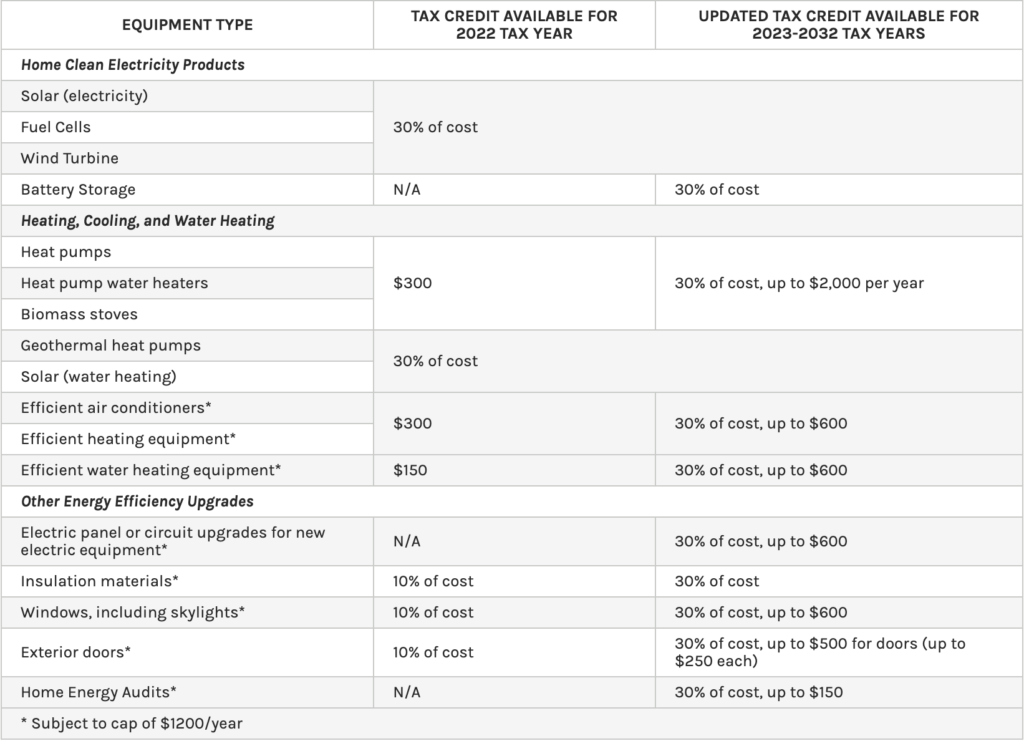

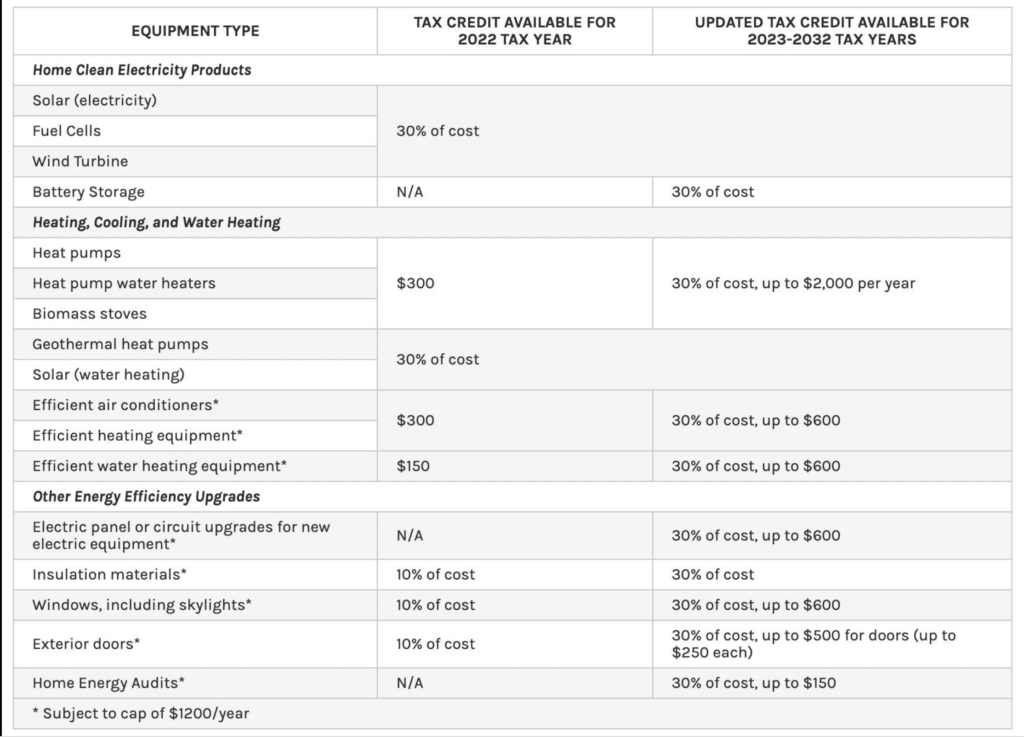

Beginning January 1 2023 the amount of the credit is equal to 30 of the sum of amounts paid by the taxpayer during the taxable year for 1 qualified energy efficiency improvements installed during the taxable year 2 residential energy property expenditures and 3 home energy audits For tax years prior to 2023 certain roofs were eligible for the tax credit See IRS Form 5695 Instructions 2022 on page 2 under Qualified energy efficiency improvements https www irs gov pub irs prior i5695 2022 pdf

Energy Efficient Home Improvement Credit For Roof

Energy Efficient Home Improvement Credit For Roof

https://i.ytimg.com/vi/DkeBEyVjirw/maxresdefault.jpg

AMT Exemption Worksheet Walkthrough IRS Form 6251 Line 5 YouTube

https://i.ytimg.com/vi/4f-f8Ex578w/maxresdefault.jpg

Verduurzaming EXTRA Bouwen

https://extrabouwen.nl/wp-content/uploads/2023/02/Subsidie-EXTRA-Bouwen-Installatie-Verduurzamen-1-scaled.jpeg

You may qualify for energy tax credits if you made renewable energy upgrades or energy efficient improvements to your home like solar or geothermal equipment Learn more about the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit and find out whether you re eligible to claim these write offs to save on your taxes Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

The cost of increasing the insulation and reducing air leaks in a home may be eligible for a federal tax credit when the improvements meet the 2021 International Energy Conservation Code IECC The 2021 IECC provides guidance to ensure the energy efficient construction of new residential buildings and building retrofits Homeowners who install qualified energy efficient roofing materials may be eligible for federal tax credits under the Inflation Reduction Act IRA which extends the Energy Efficient Home Improvement Credit through 2032

More picture related to Energy Efficient Home Improvement Credit For Roof

5695 Form 2025 Brynn Ingeborg

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/03/irs_form_5695_part_ii_bottom.png

Home Energy Tax Credits Incentives Northwest Energy Collaborative

https://images.squarespace-cdn.com/content/v1/62b6178450b5841171c5b7ea/a62195db-7c28-411c-8a00-5793dd25bf18/Energy+Efficient+Home+Improvement+Credit.png

Does A New Roof Qualify For Residential Energy Credit

https://er55hxiqhrv.exactdn.com/wp-content/uploads/2023/08/featured-47.jpg

Roofing and air circulating fans are not allowed as qualifying items Qualifying home improvements must meet certain updated energy efficiency standards to take advantage of this tax credit Announcement 2024 19 provides that amounts received from the Department of Energy DOE home energy rebate programs funded through the IRA will be treated as a reduction in the purchase price or cost of property for eligible upgrades and projects

[desc-10] [desc-11]

Energy Credits 2024 Cary Marthe

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

5695 Form 2025 Mariam Skye

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/03/irs_form_5695_part_ii_top-1024x814.png

https://www.irs.gov › credits-deductions › frequently-asked-questions...

What energy efficiency requirements must be met to qualify for the credit updated Jan 17 2025 A1 To qualify for the credit certain property must meet certain energy efficiency requirements Exterior windows and skylights must meet Energy Star most efficient certification requirements

https://www.irs.gov › credits-deductions › frequently-asked-questions...

Beginning January 1 2023 the amount of the credit is equal to 30 of the sum of amounts paid by the taxpayer during the taxable year for 1 qualified energy efficiency improvements installed during the taxable year 2 residential energy property expenditures and 3 home energy audits

Energy Star Tax Credits 2024 Calculator Gwen Pietra

Energy Credits 2024 Cary Marthe

What Is An Energy Efficient House Image To U

.png)

Inflation Reduction Act Energy Cost Savings

Residential Energy Efficient Property Credit Limit Worksheet

Energy Efficient Home Improvement Credit Holsinger PC

Energy Efficient Home Improvement Credit Holsinger PC

Making Our Homes More Efficient Clean Energy Tax Credits For Consumers

New 2023 Energy Tax Credits For Homeowners ULTRA GLAZE

2024 Tax Credits For Home Improvements Dael Mickie

Energy Efficient Home Improvement Credit For Roof - Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent