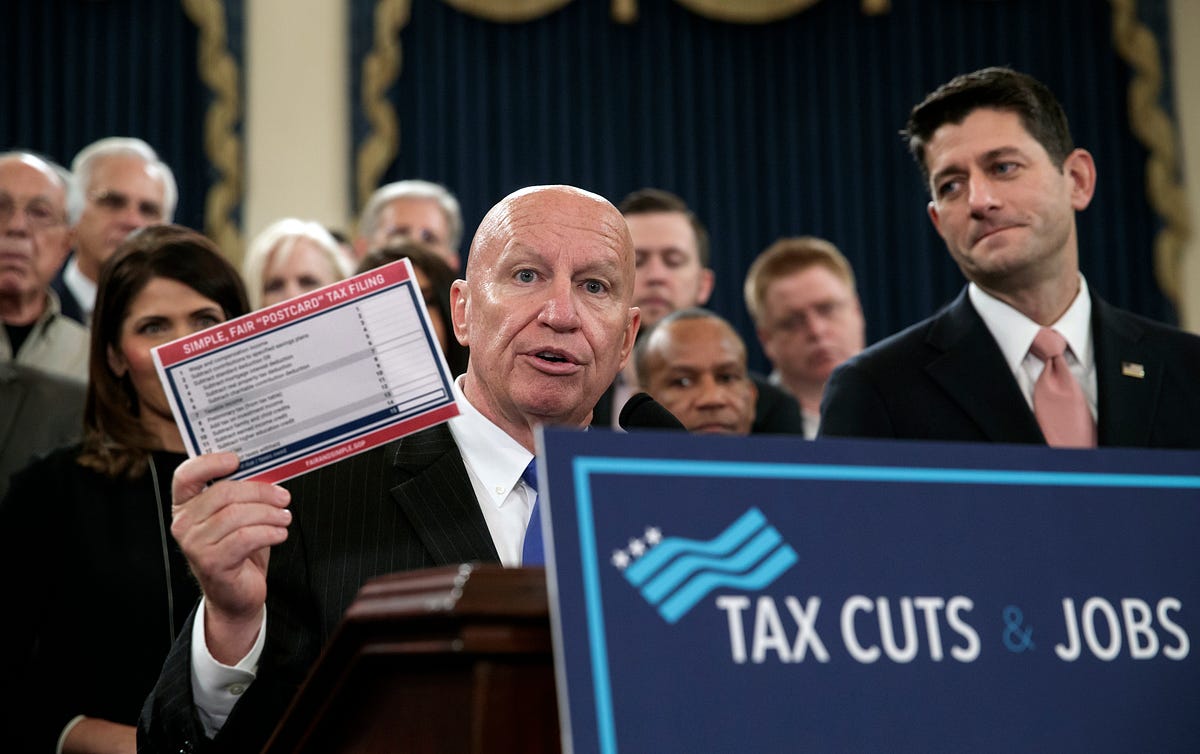

House Of Representatives Tax Plan The House of Representatives Ways and Means Committee approved the measure in a 40 3 vote just three days after its Republican chairman announced the deal with his Democratic Senate counterpart

The federal estate tax 40 is imposed on amounts over the federal estate tax exemption In 2024 the federal estate tax exemption for decedents dying is 13 610 000 per person up from U S Senate Finance Committee Chairman Ron Wyden D OR and House Ways and Means Committee Chairman Jason Smith R MO today released a bipartisan framework for proposed tax legislation To be introduced as the Tax Relief for American Families and Workers Act of 2024 the plan would address scheduled changes in business taxation under the Tax Cuts and Jobs Act among other things

House Of Representatives Tax Plan

House Of Representatives Tax Plan

https://miro.medium.com/max/1200/1*M1uE_2l-YIqypx1UYrOpvw.jpeg

Romualdez House To Explore Ways To Speed Up Priority Bills Nat l Budget Passage Inquirer News

https://newsinfo.inquirer.net/files/2022/11/house-of-representatives-filephoto-112922.png

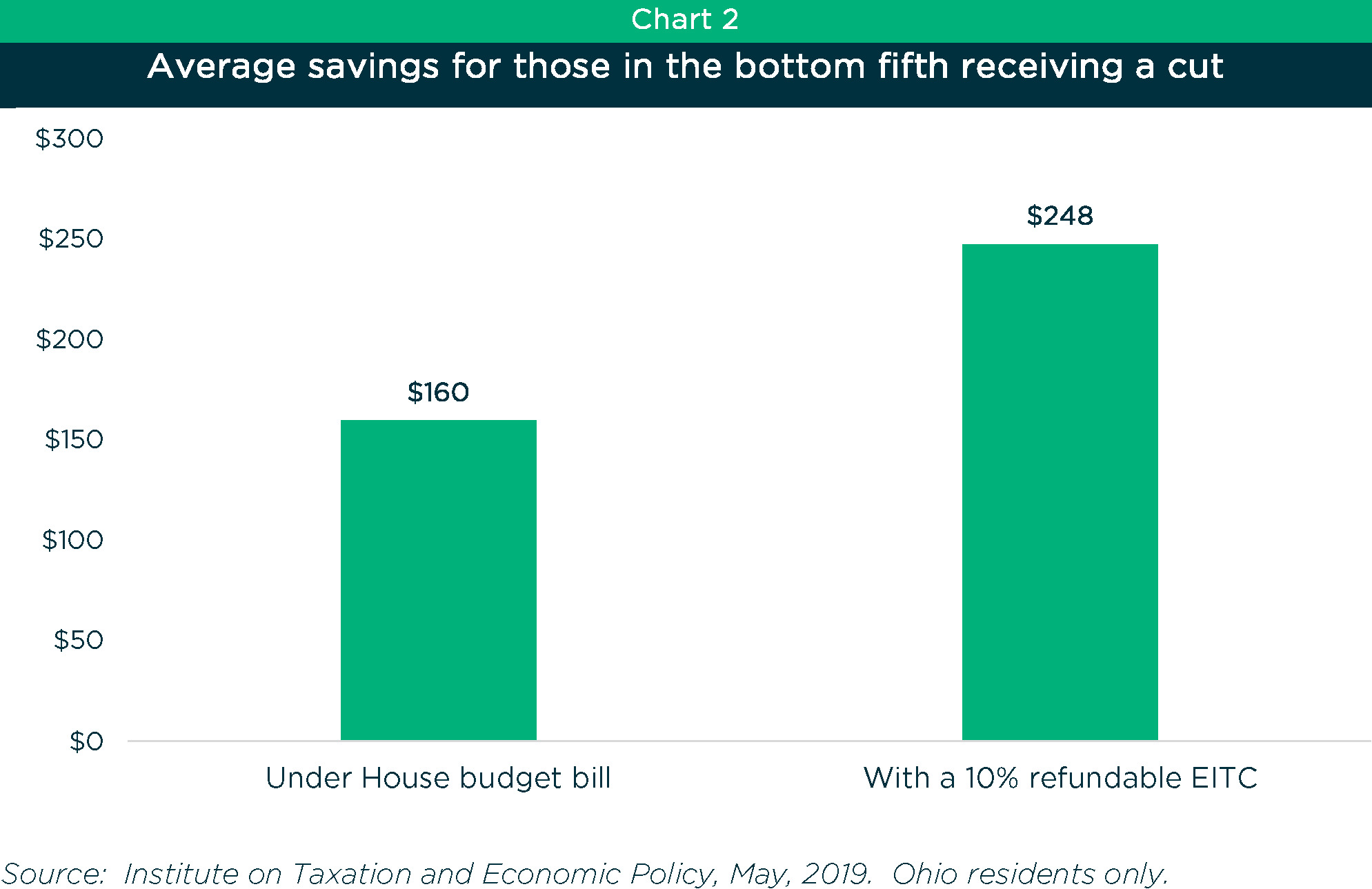

This Month In Fiscal News August 2016

http://www.pgpf.org/sites/default/files/House-of-Representatives-Floor.png

Latest Analysis Inflation Reduction Act Democratic lawmakers in the House of Representatives have advanced updated legislation containing the tax elements of President Biden s Build Back Better agenda The House bill may differ from the Senate s version of the legislation The Build It In America Act HR 3938 addresses business taxpayer concerns regarding rising interest expense rates and deduction limitations on research and experimental expenditures which could

WASHINGTON June 9 Reuters Republicans in the U S House of Representatives on Friday unveiled a series of new tax breaks aimed at businesses and families while proposing to reverse Key Points House Democrats have unveiled tax legislation that would raise the top marginal income tax rate to 39 6 from 37 It would kick in for single filers with income over 400 000

More picture related to House Of Representatives Tax Plan

House Of Representatives Votes To Have Seniors Subsidize The Wealthiest 1 APWU

https://can2-prod.s3.amazonaws.com/uploads/data/000/131/256/original/EPI_chart.png

Opinion Should We Expand The House Of Representatives The New York Times

https://static01.nyt.com/images/2018/11/09/opinion/expanded-house-representatives-size-1541821808195/expanded-house-representatives-size-1541821808195-videoSixteenByNineJumbo1600.png?year=2018&h=900&w=1600&s=ba6211364a1b6e99107be6f7f76849f232614a5aa2b23ee33031a20a8c418457&k=ZQJBKqZ0VN&tw=1

The Good And The Bad In The House Tax Plan

https://www.policymattersohio.org/files/research/chart2itephousetax2019.jpg

In 2018 Congress temporarily raised the amount of tax credits allocated to each state by 12 5 but that expansion expired in 2021 the current tax deal seeks to restore the increase The House Democrats are proposing to raise the top personal income tax rate to 39 6 from 37 That higher rate would reverse a cut signed into law by Trump The committee also proposed a 3

Key Points House Democrats outlined tax increases they aim to use to offset up to 3 5 trillion in spending on the social safety net and climate policy The proposal includes top corporate and The Trump cuts were projected to add up to 2 trillion to the national debt over 10 years And indeed federal revenues plummeted immediately corporate tax revenue fell 31 in the first year

Thunder Outreach Honored By House Of Representatives

https://thunderoutreach.com/wp-content/uploads/2015/04/house-representatives-seal.png

Breaking Down The Democrats Prospects For 2018 Pacific Standard

https://psmag.com/.image/t_share/MTQ4NjgyOTM0NjUwNDE0Nzcx/gettyimages-83951850.jpg

https://www.usnews.com/news/top-news/articles/2024-01-19/us-house-panel-advances-78-billion-tax-break-bill-in-strong-bipartisan-vote

The House of Representatives Ways and Means Committee approved the measure in a 40 3 vote just three days after its Republican chairman announced the deal with his Democratic Senate counterpart

https://www.forbes.com/sites/kellyphillipserb/2024/01/21/one-tax-deal-advances-in-house-as-republicans-introduce-new-tax-proposal/

The federal estate tax 40 is imposed on amounts over the federal estate tax exemption In 2024 the federal estate tax exemption for decedents dying is 13 610 000 per person up from

Texas House Of Representatives District Map Printable Maps

Thunder Outreach Honored By House Of Representatives

19 Fresh House Of Representatives Tax Plan

Here s How Biden s Tax Plan Would Affect Each U S State Video

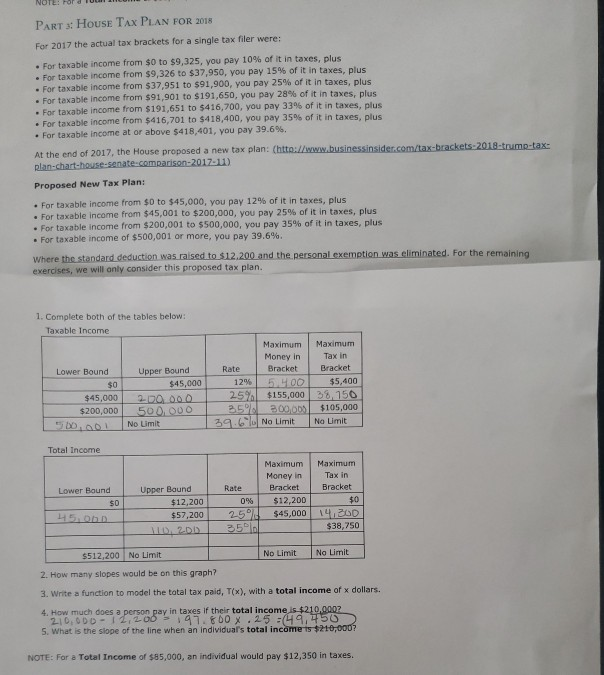

PART 3 HOUSE TAX PLAN FOR 2018 For 2017 The Actual Chegg

Senate Tax Plan Vs House Tax Plan

Senate Tax Plan Vs House Tax Plan

This Tax Plan Is Going To Cost A Lot More Than Advertised

Opinion A Congress For Every American The New York Times

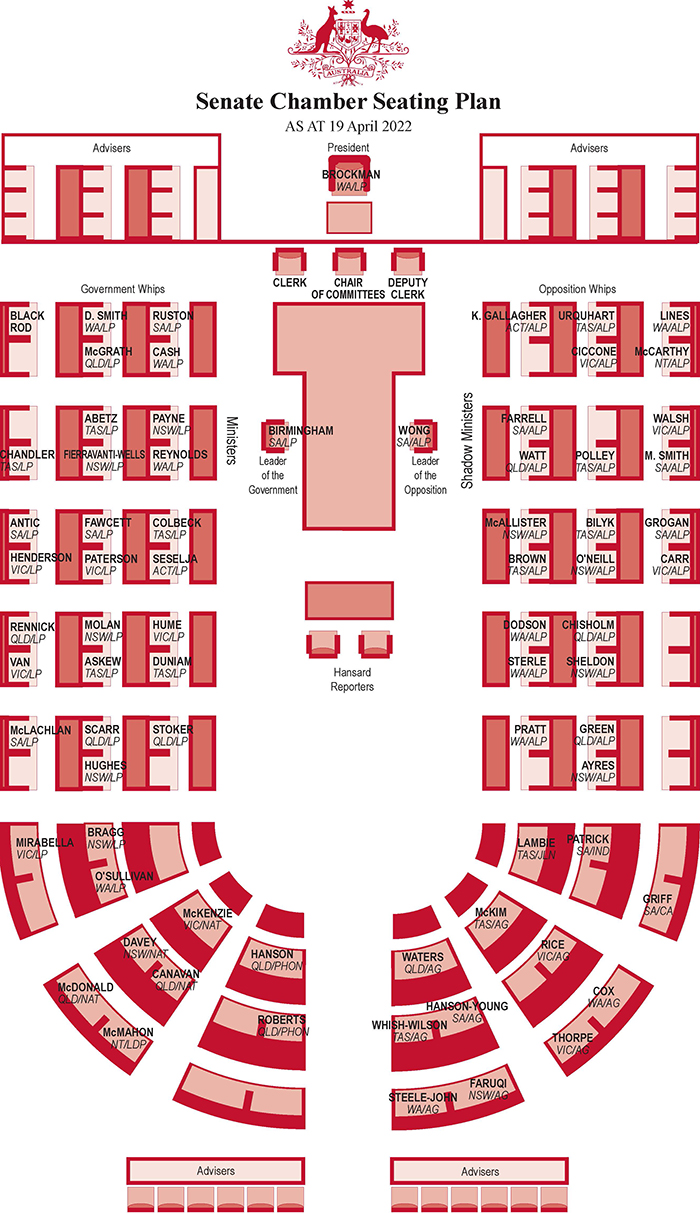

Us House Of Representatives Seating Plan

House Of Representatives Tax Plan - The Build It In America Act HR 3938 addresses business taxpayer concerns regarding rising interest expense rates and deduction limitations on research and experimental expenditures which could