House Tax Plan The House Build Back Better tax plan reduces economic output by reducing the after tax return to investment opportunities for firms and the incentive to work through higher tax rates on labor income

The House tax plan would not go as far as President Joe Biden initially hoped The president had called for a 28 corporate tax and a 39 6 capital gains rate Biden has promised not to raise WASHINGTON House Democrats on Monday presented a plan to pay for their expansive social policy and climate change package by raising taxes by more than 2 trillion largely on wealthy

House Tax Plan

House Tax Plan

https://www.dcfpi.org/wp-content/uploads/2017/11/house-tax-plan-1.png

The Good And The Bad In The House Tax Plan

https://www.policymattersohio.org/files/research/chart1itephousetax2019.jpg

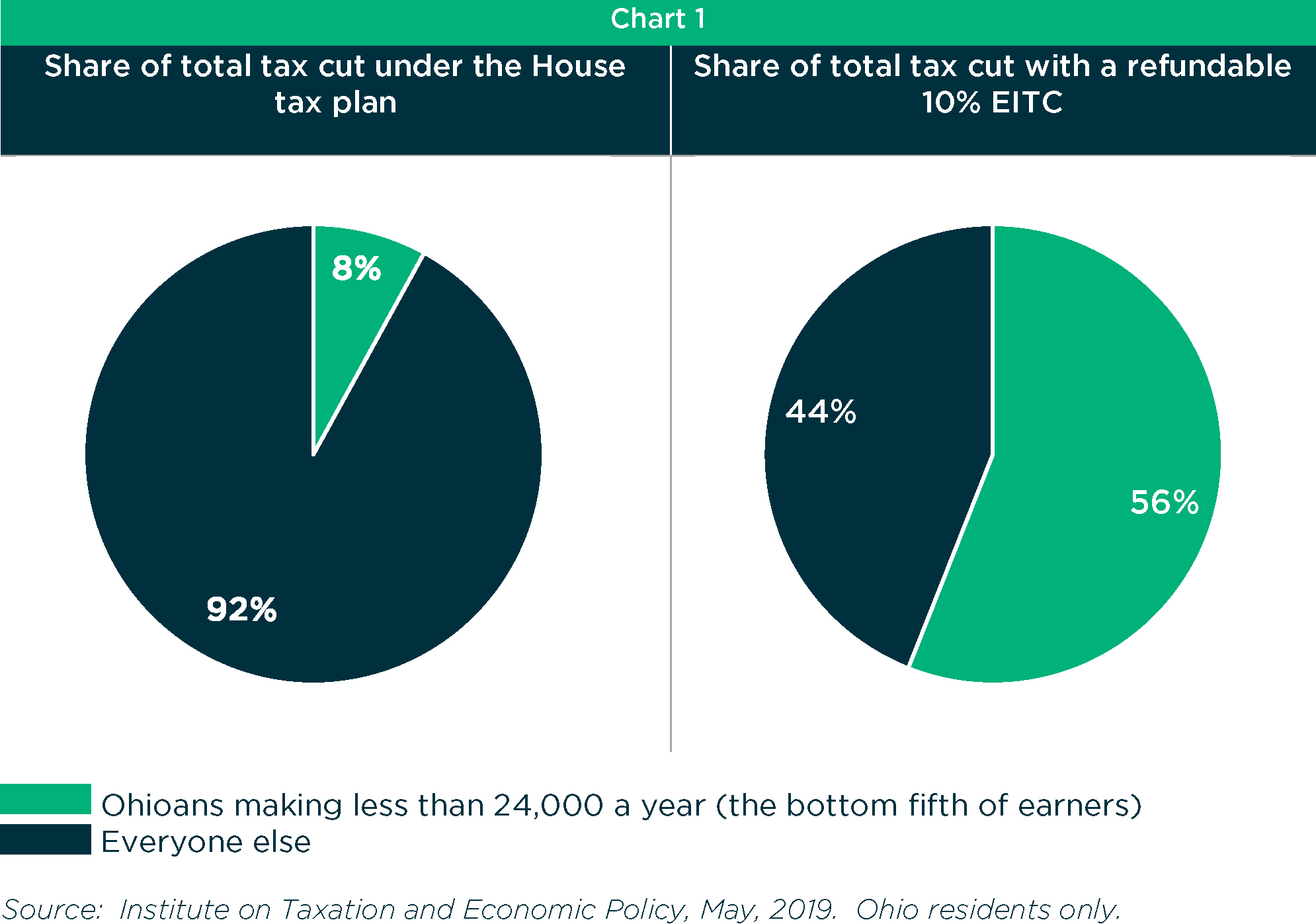

The Good And The Bad In The House Tax Plan

https://www.policymattersohio.org/files/research/chart2itephousetax2019.jpg

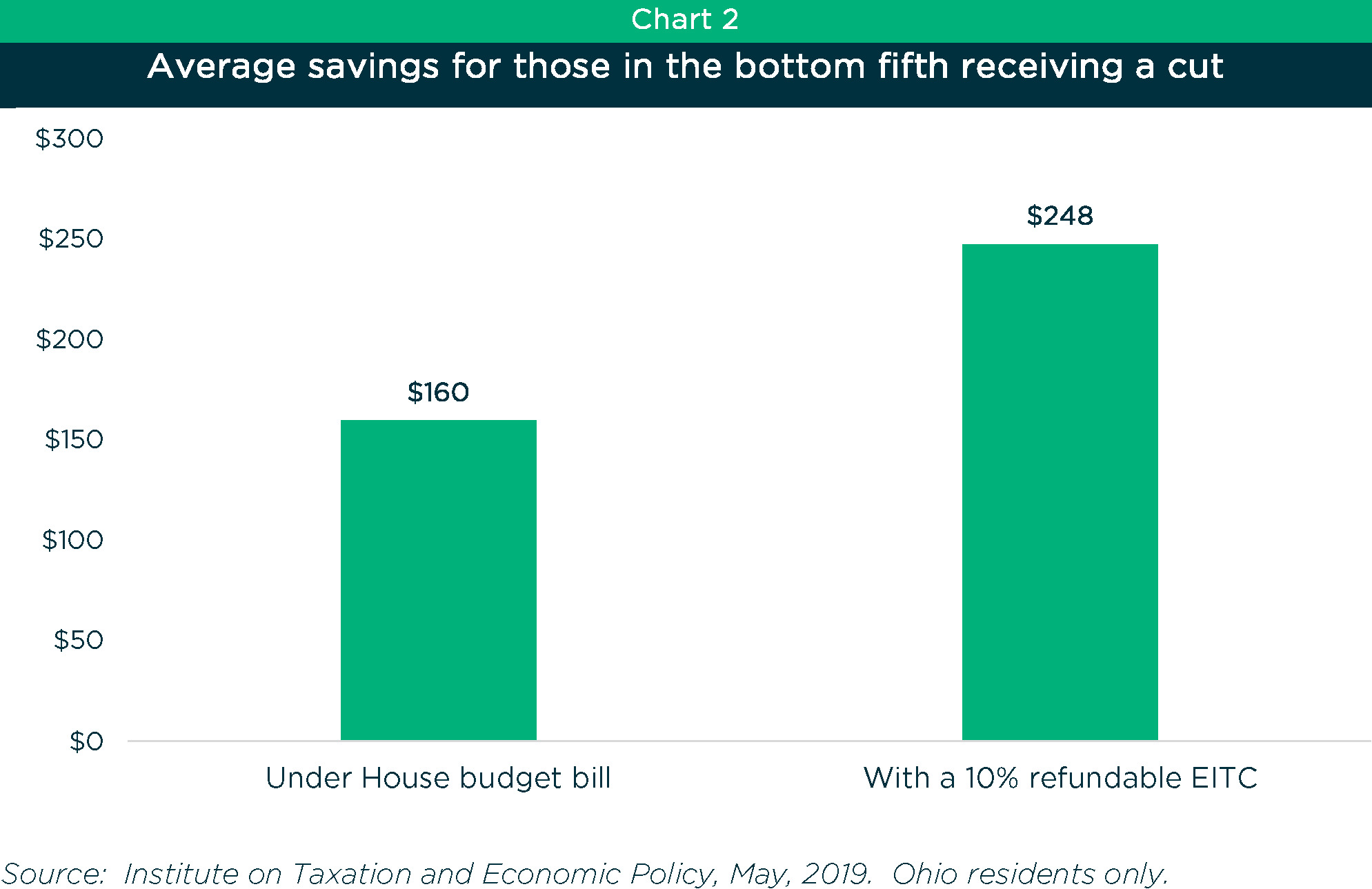

House Republicans want to spend hundreds of billions of dollars on tax cuts for big corporations and undermine efforts to tax the profits of the largest multinational companies while The new child tax credit policy would benefit about 16 million kids in low income families according to an analysis by the liberal leaning Center on Budget and Policy Priorities The expansion

The House plan is less aggressive than those of the White House and the Senate in other ways including when it comes to taxing inheritances Some top Senate Democrats want to tax inherited assets House Democrats are also considering an increase to the top marginal income tax rate to 39 6 percent from 37 percent for households that report taxable income over 450 000 and for unmarried

More picture related to House Tax Plan

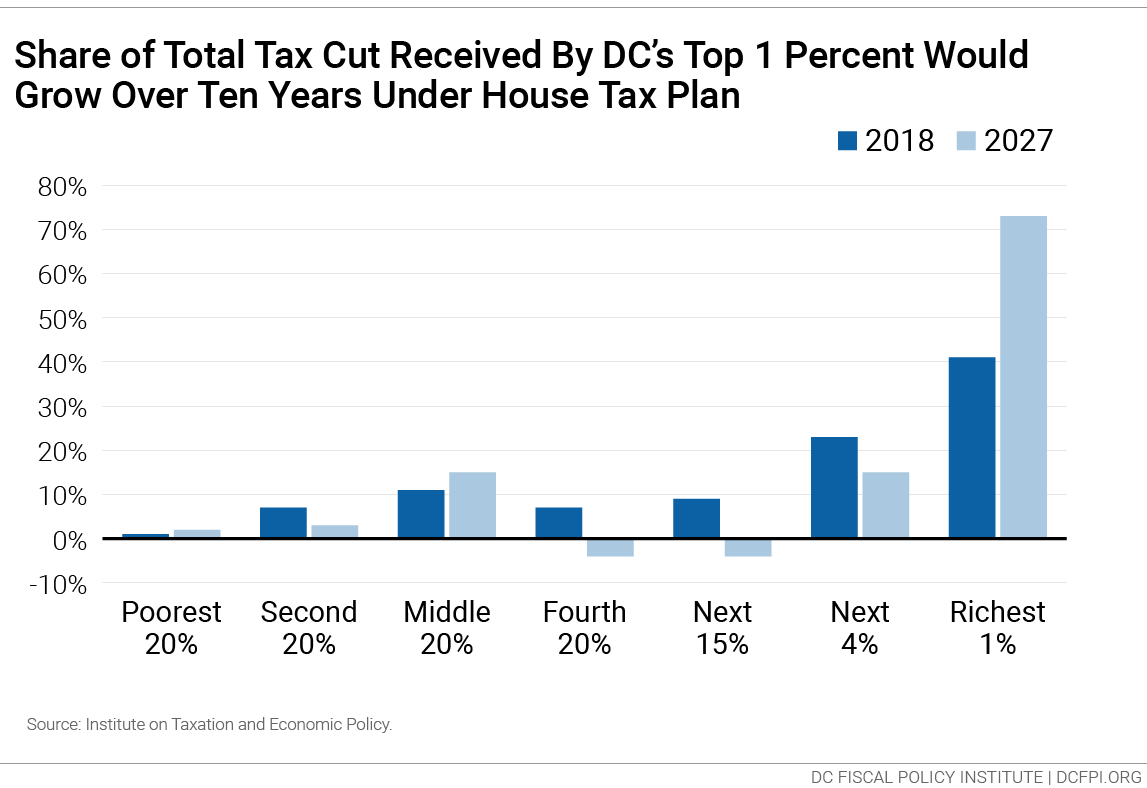

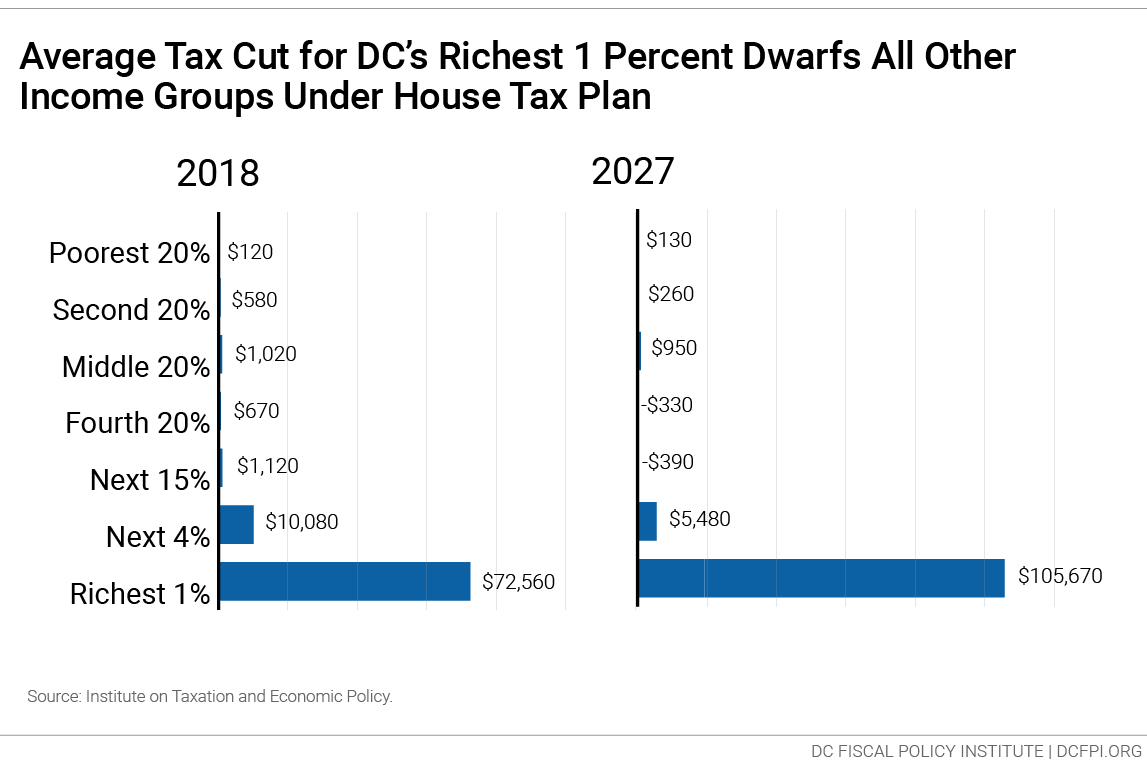

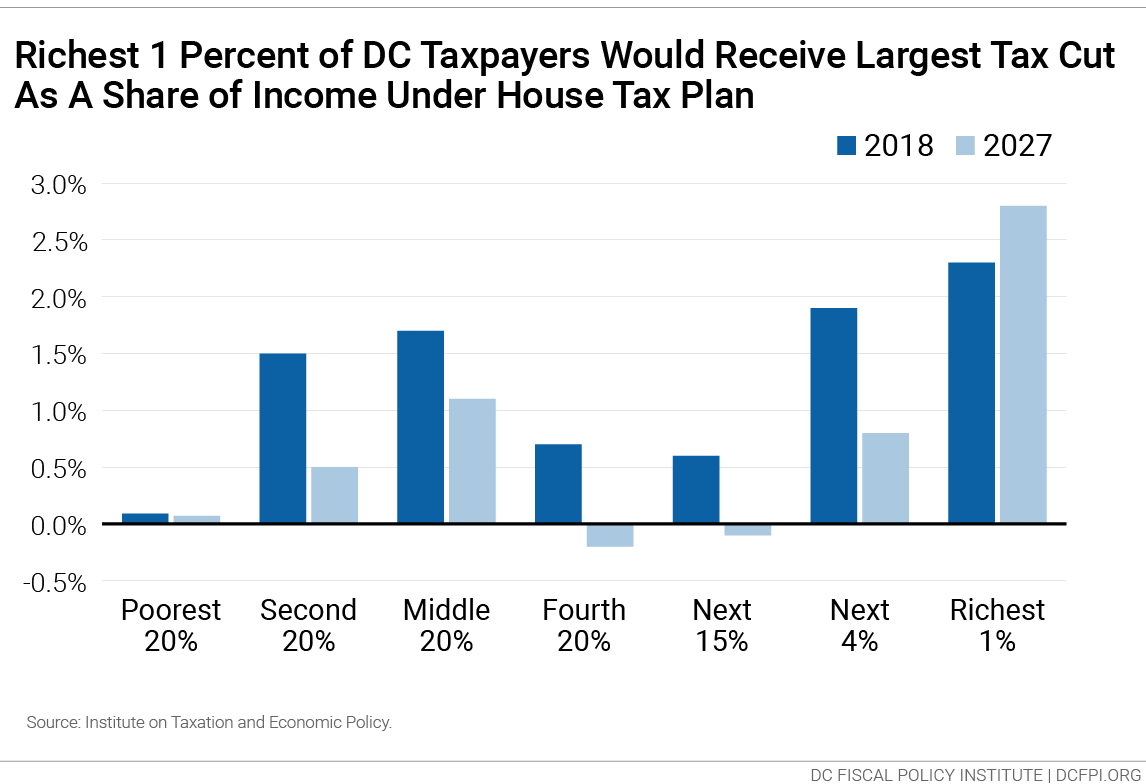

House Tax Plan Largest Share Of Tax Cuts Go To DC s Richest 1 Percent Little Benefit For The

https://www.dcfpi.org/wp-content/uploads/2017/11/house-tax-plan-2.png

House Tax Plan May Shift Use Of Corporate Debt The New York Times

https://static01.nyt.com/images/2017/04/06/business/06DB-DEBT1/06DB-DEBT1-videoSixteenByNineJumbo1600.jpg?year=2017&h=900&w=1600&s=cc107c1c92e248fb5daa94ddf61447849ec607eb7e814abd0ca1a0cb039191f3&k=ZQJBKqZ0VN&tw=1

House Tax Plan Largest Share Of Tax Cuts Go To DC s Richest 1 Percent Little Benefit For The

https://www.dcfpi.org/wp-content/uploads/2017/11/House-tax-plan-3.png

The current cap for the refundable child tax credit is 1 600 Under the bill it would lift the amount to 1 800 in tax year 2023 1 900 in tax year 2024 and 2 000 in tax year 2025 and begin 06 09 2023 02 00 PM EDT Just days after Washington s bitter fight over raising the debt limit House Republicans are calling for billions in new tax cuts GOP lawmakers unveiled a plan Friday

House Democrats are proposing to raise the top personal income tax rate to 39 6 from 37 That higher rate would reverse a cut signed into law by Trump The committee also proposed a 3 surtax In 2025 many of the changes in Republicans 2017 tax law will expire leading to a big tax increase on everyone unless Congress acts This package shows House Republicans priorities While the House GOP tax plan trends in the right direction it could be better For example lawmakers should permanently allow businesses to deduct the full

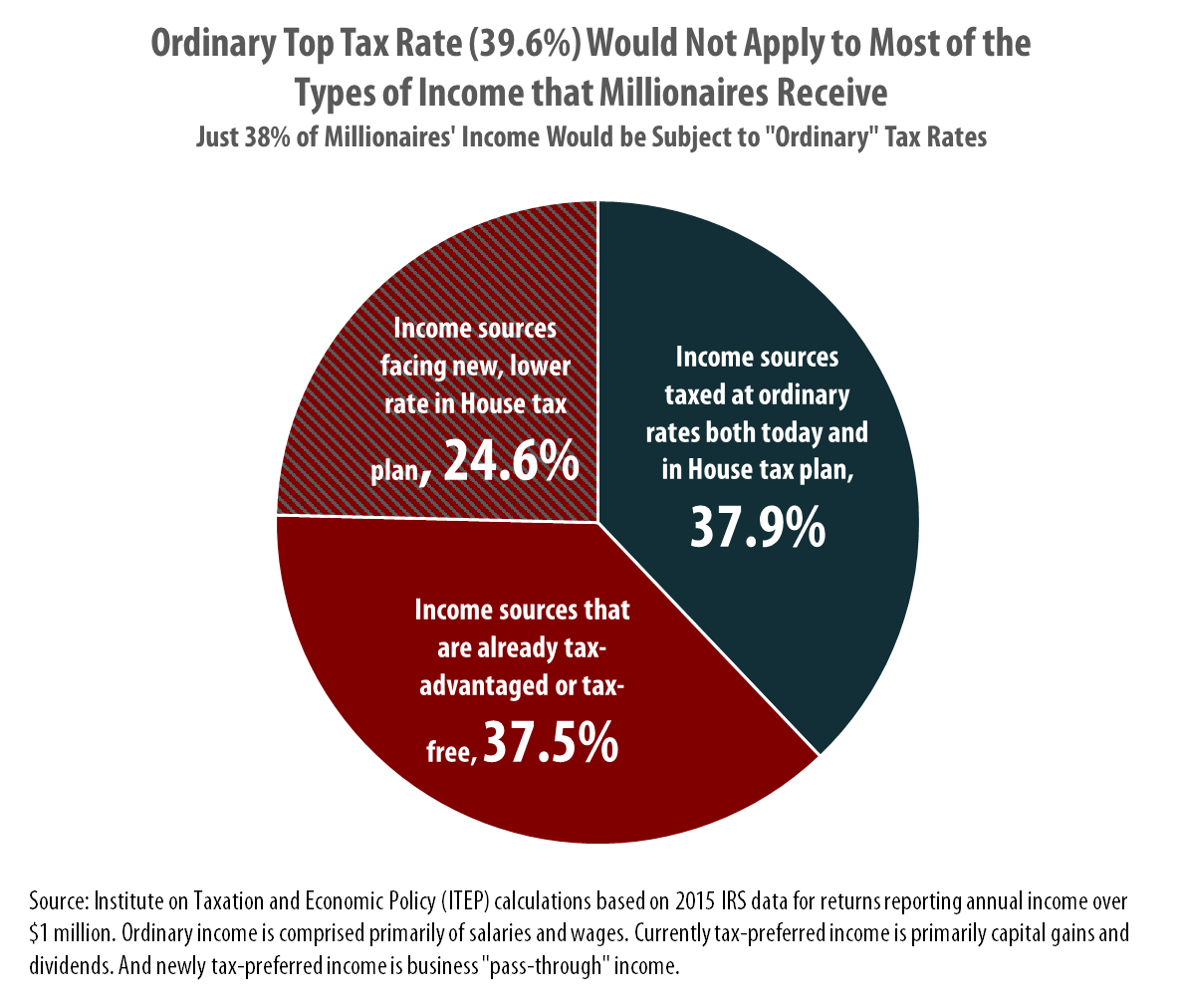

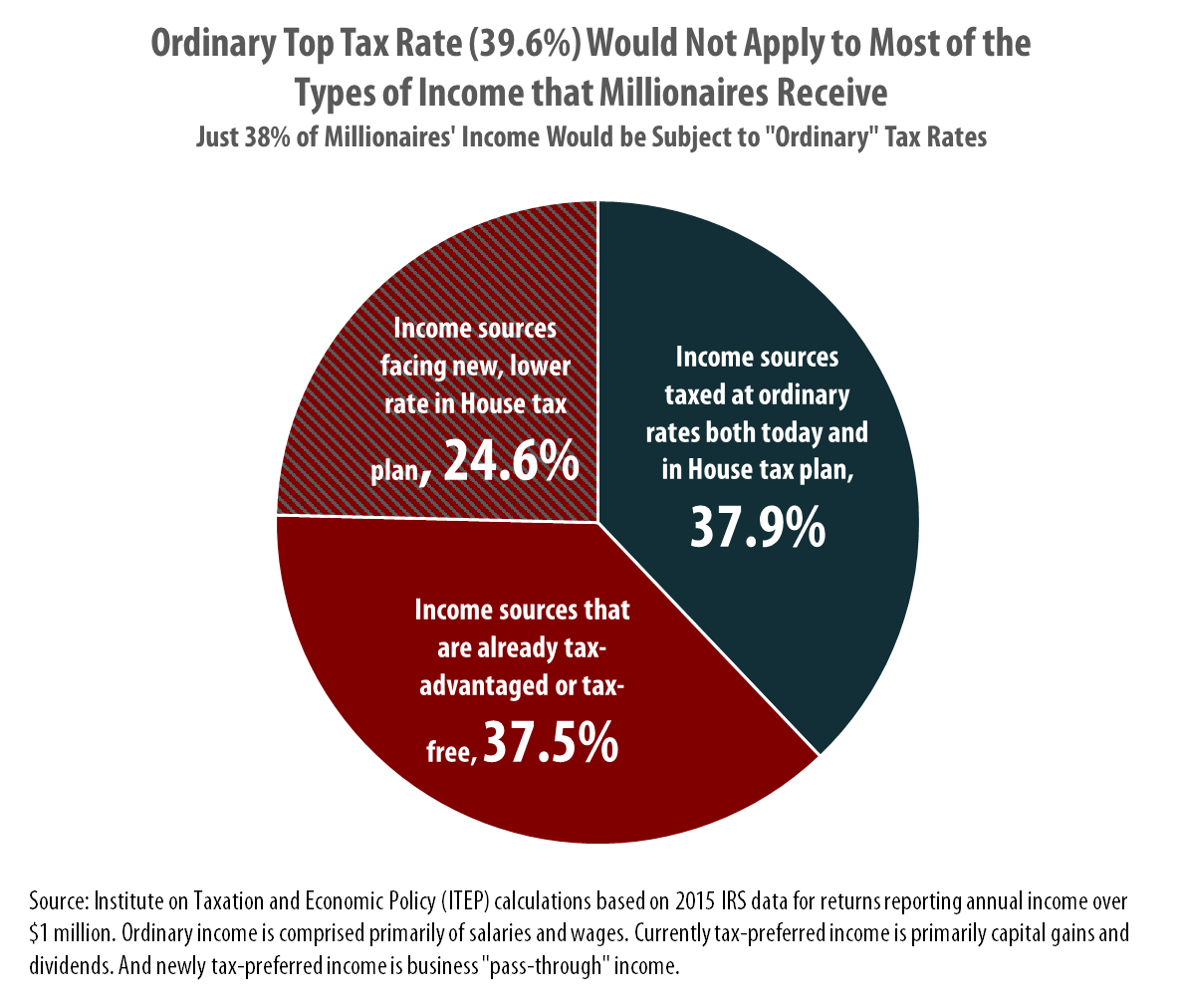

House Tax Plan Will Keep 39 6 Top Rate But That Won t Matter For Most Types Of Income Going To

https://itep.sfo2.digitaloceanspaces.com/fed-top-rate-blog-pie.png

House Tax Plan Builds On Healey Approach CommonWealth Magazine

https://commonwealthmagazine.org/wp-content/uploads/2023/04/Unknown-4.jpeg

https://taxfoundation.org/blog/house-tax-plan-impact/

The House Build Back Better tax plan reduces economic output by reducing the after tax return to investment opportunities for firms and the incentive to work through higher tax rates on labor income

https://www.cnbc.com/2021/09/13/house-democrats-propose-tax-increases-in-3point5-trillion-budget-bill.html

The House tax plan would not go as far as President Joe Biden initially hoped The president had called for a 28 corporate tax and a 39 6 capital gains rate Biden has promised not to raise

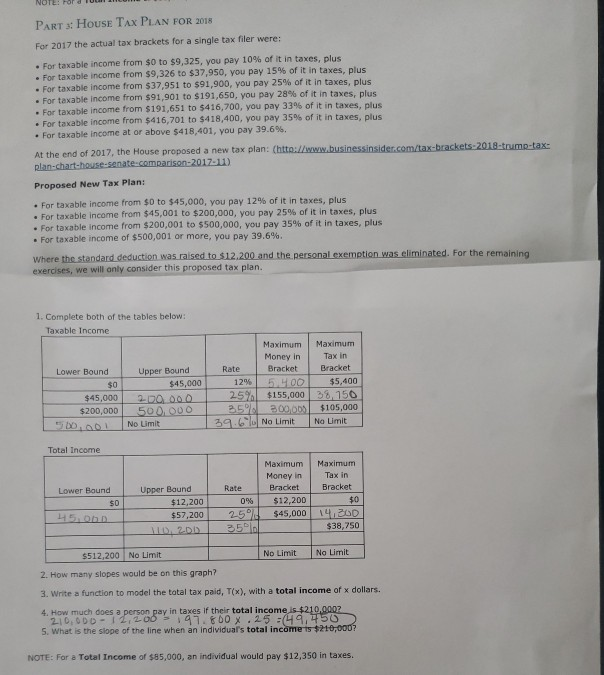

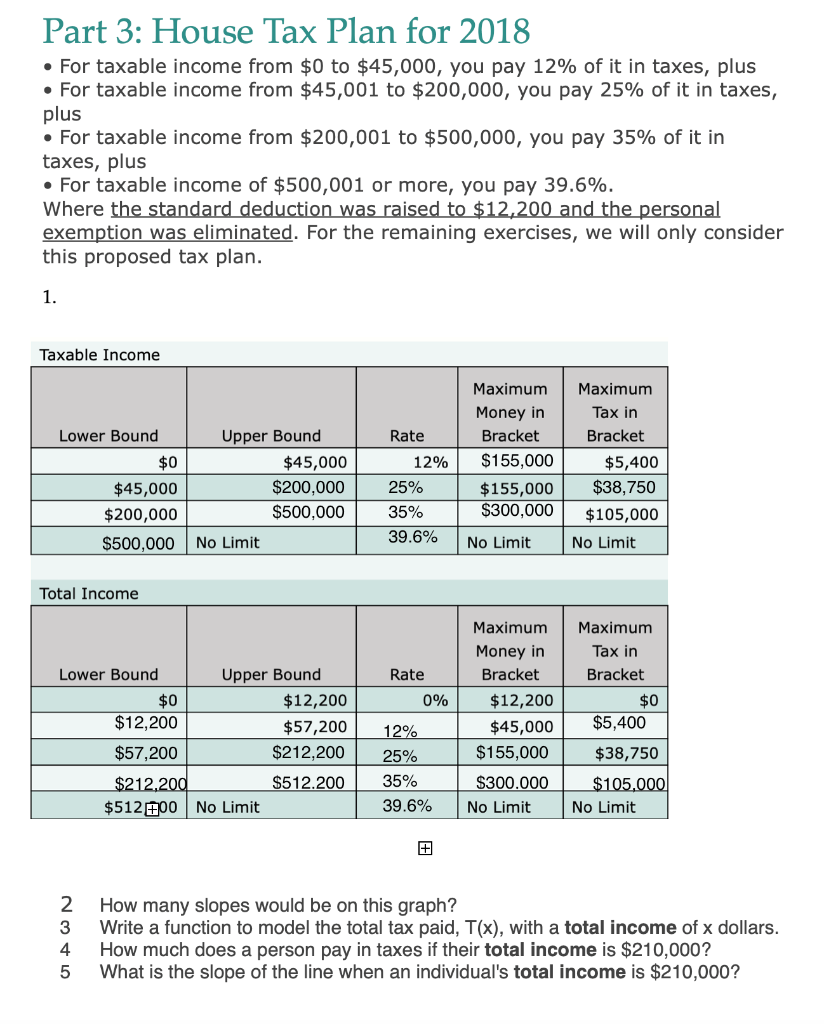

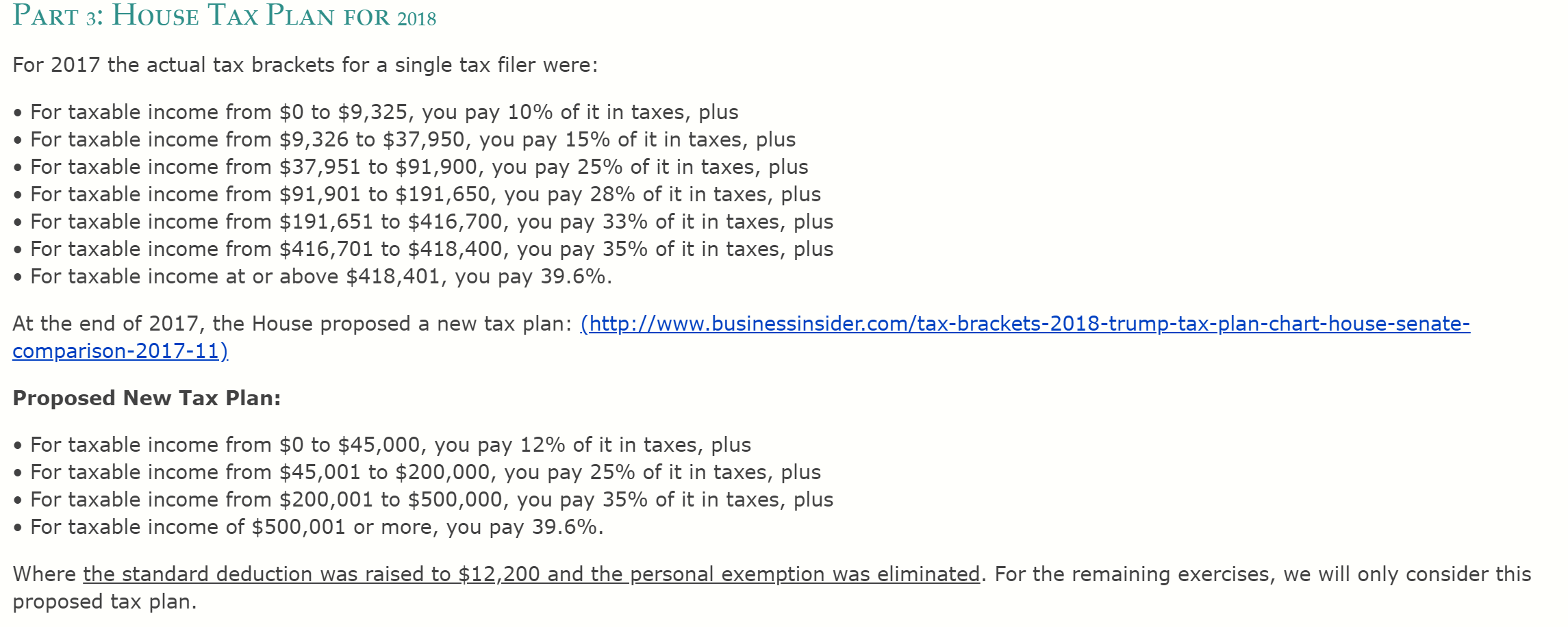

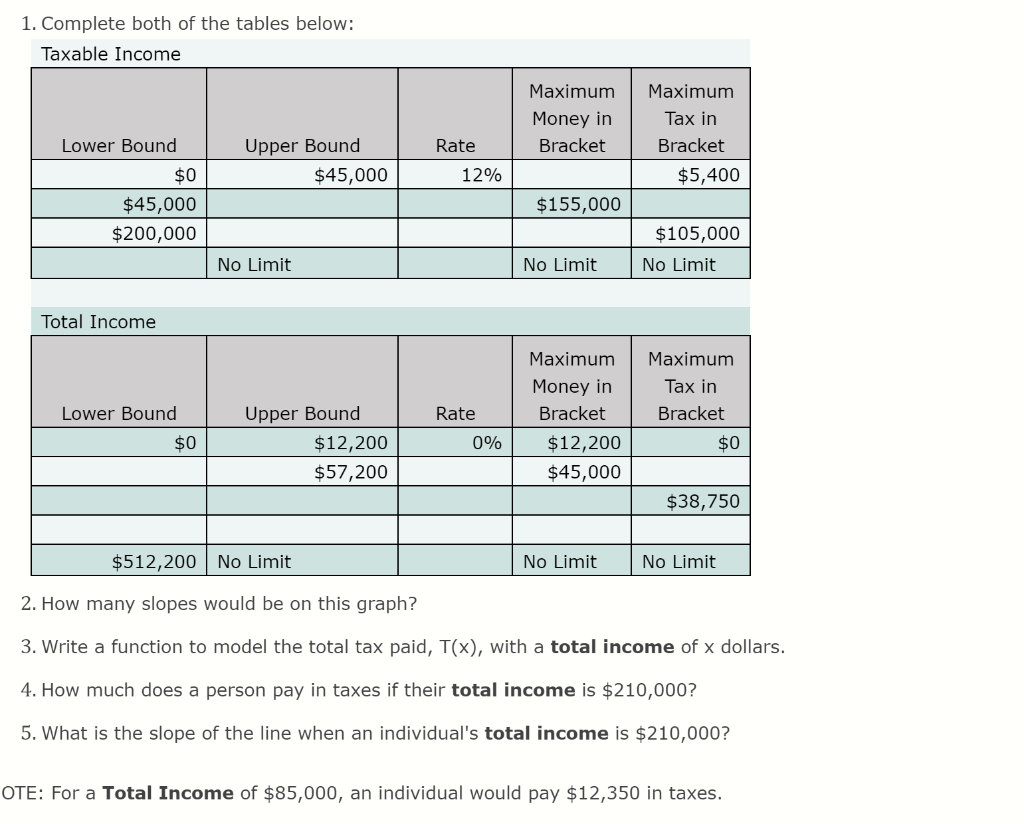

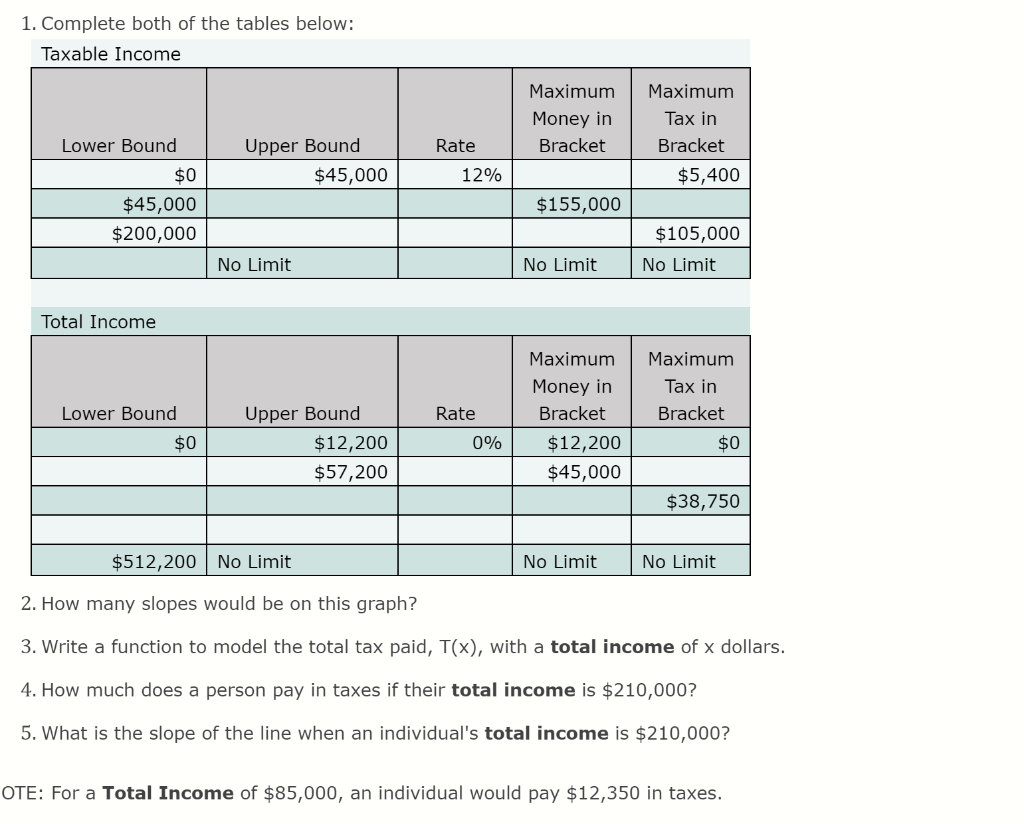

PART 3 HOUSE TAX PLAN FOR 2018 For 2017 The Actual Chegg

House Tax Plan Will Keep 39 6 Top Rate But That Won t Matter For Most Types Of Income Going To

Part 3 House Tax Plan For 2018 For Taxable Income Chegg

Solved PART 3 HOUSE Tax PLAN FOR 2018 For 2017 The Actua Chegg

How The House Tax Plan Could Kill Trump s Infrastructure Plans The Hill

Solved PART 3 HOUSE Tax PLAN FOR 2018 For 2017 The Actua Chegg

Solved PART 3 HOUSE Tax PLAN FOR 2018 For 2017 The Actua Chegg

Senate Tax Plan Vs House Tax Plan

House Tax Plan Build Your Own House How To Plan Floor Plans

The Better Way House Tax Plan An Economic Analysis EveryCRSReport

House Tax Plan - House Republicans want to spend hundreds of billions of dollars on tax cuts for big corporations and undermine efforts to tax the profits of the largest multinational companies while