How Are Property Taxes Calculated In Harris County Texas Harris County Municipal Utility District No 284 Harris County MUD 284 wants residents to understand how property taxes are calculated in Texas Your property s value is assessed each year on January 1st by the appraisal district and used to calculate your tax bill

Harris County calculates the property tax due based on the fair market value of the home or property in question as determined by the Harris County Property Tax Assessor Property taxes are local taxes Local officials value your property set your tax rates and collect your taxes However Texas law governs how the process works In Harris County property taxes are based on tax rates set by the various local governments taxing units that levy a tax and on the value of the property

How Are Property Taxes Calculated In Harris County Texas

How Are Property Taxes Calculated In Harris County Texas

https://i.ytimg.com/vi/u-chntTWjps/maxresdefault.jpg

How Are Property Taxes Calculated YouTube

https://i.ytimg.com/vi/3G2FUj4T574/maxresdefault.jpg

How Are Property Taxes Calculated YouTube

https://i.ytimg.com/vi/0HOIA_Xnr5w/maxresdefault.jpg

Our Harris County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States Harris County property owners should know the basics of property taxes to ensure effective financial and property management This guide will help explain how property taxes are determined important tax dates and some essential tips for property tax delinquency

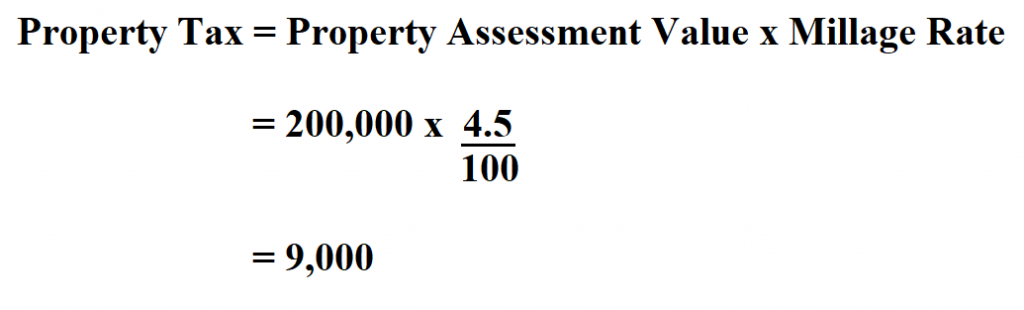

How Are Harris County Property Taxes Calculated Under Texas law property taxes are what is known as an ad valorem tax which means that the amount of tax you pay is based on the market value of the property for which the tax is being paid In this video we will answer the Frequently Asked Questions FAQs about property taxes particularly in the Harris County area The following questions are How is my tax bill calculated

More picture related to How Are Property Taxes Calculated In Harris County Texas

Property Taxes Harris County How Are Property Taxes Calculated In

https://i.ytimg.com/vi/YLlXILtlMxw/maxresdefault.jpg

State property tax rates The Arizona Ground Game

https://azgroundgame.org/wp-content/uploads/2021/03/state-property-tax-rates.png

How To Calculate Property Tax

https://www.learntocalculate.com/wp-content/uploads/2020/06/propertyy-tax-2-1024x310.png

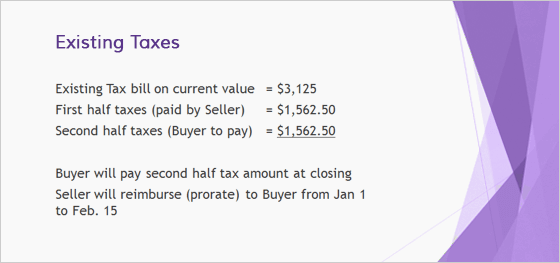

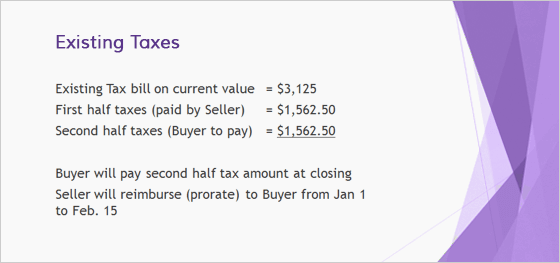

Here s what you need to know about how property taxes are calculated in Texas and how you can lower your tax bill In Texas property taxes are determined by the local taxing authorities including school districts cities counties and special districts Once tax assessors have determined your property s taxable value and individual levy rates they ll calculate your total Harris County property tax bill You receive your bill and payment is due January 31st Payment is due following the end of the tax year

How Do Property Taxes Work in Harris County Assessment As a property owner in Harris County the value of your property will be assessed based on its location condition and the current price of comparable homes in your area The Harris County Appraisal District evaluates properties regularly to determine their taxable value Every year all property tax rates go through a recalculation process This recalculation happens after all appraisals are completed for the county The rate is based on the total revenue needed and the present property value In short property taxes are a percentage of the home s appraised value

Texas Counties Total Taxable Value For County Property Tax Purposes

https://txcip.org/tac/census/data_texas.php?MORE=1028

Property Taxes West Des Moines IA

https://www.wdm.iowa.gov/home/showpublishedimage/10510/637190136381430000

https://www.hcmud284.com › posts › how-are-my-taxes-calculated

Harris County Municipal Utility District No 284 Harris County MUD 284 wants residents to understand how property taxes are calculated in Texas Your property s value is assessed each year on January 1st by the appraisal district and used to calculate your tax bill

https://www.tax-rates.org › texas › harris_county_property_tax

Harris County calculates the property tax due based on the fair market value of the home or property in question as determined by the Harris County Property Tax Assessor

Harris County TX Almanac

Texas Counties Total Taxable Value For County Property Tax Purposes

Property Tax Education Campaign Texas REALTORS

Understanding Your Property Taxes Jackson County IL

These States Have The Highest Property Tax Rates TheStreet

California Property Taxes Viva Escrow 626 584 9999

California Property Taxes Viva Escrow 626 584 9999

Property Tax Calculator And Complete Guide

San Diego Real Estate How Are Your Property Taxes Calculated

Texas Department Of Public Safety Inventory Log For Damien Thaddeus

How Are Property Taxes Calculated In Harris County Texas - Harris County WCID 119 HC WCID 119 wants residents to understand how property taxes are calculated in Texas Your property s value is assessed each year on January 1st by the appraisal district and used to calculate your tax bill