How Do Retirement Accounts Work In Divorce It s an acronym for qualified domestic relations order which is used in a divorce proceeding to instruct a retirement plan to pay a spouse or a former spouse his or her community property

In a divorce or legal separation individual retirement accounts IRAs are divided using a process known as transfer incident to divorce while 403 b and qualified plans such as 401 Understanding how retirement accounts are handled during a divorce whether it s a 401 k IRA or military pension is crucial to protecting your financial future By working with experienced legal and financial professionals

How Do Retirement Accounts Work In Divorce

How Do Retirement Accounts Work In Divorce

https://i.ytimg.com/vi/HfIg65ICbyA/maxresdefault.jpg

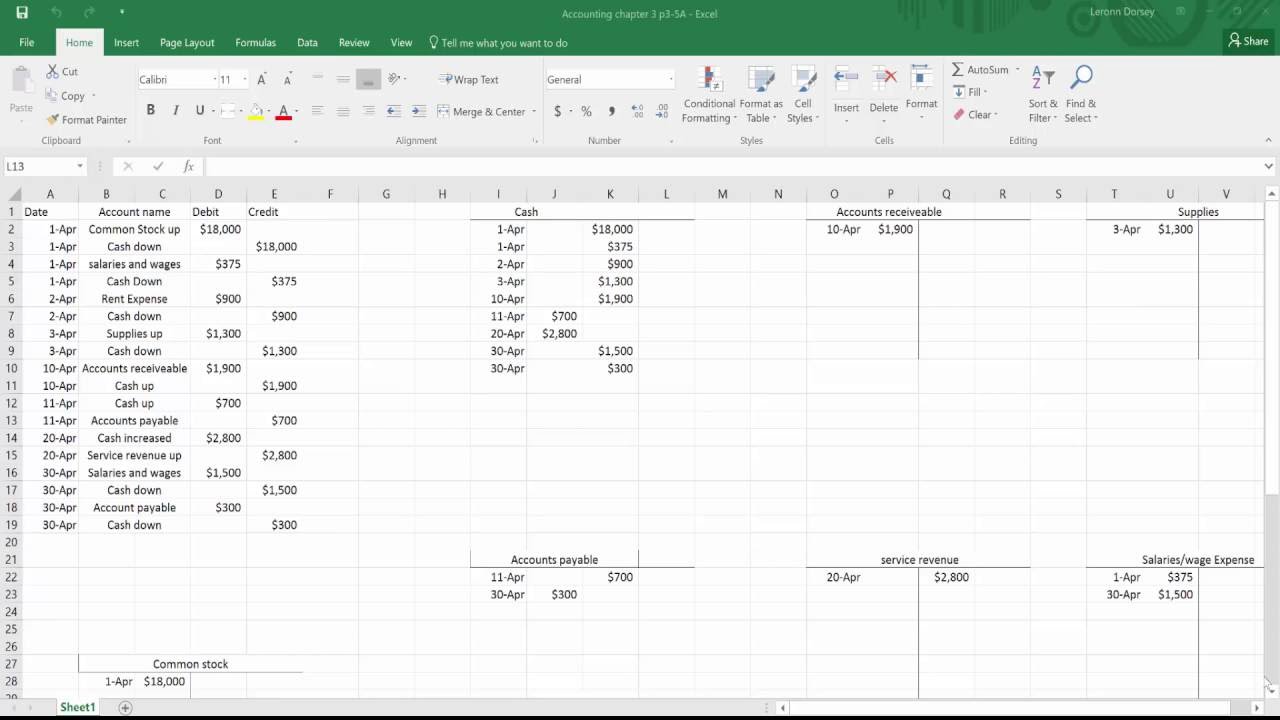

Job Order Costing A Walkthrough Using T Accounts YouTube

https://i.ytimg.com/vi/4olHXnGwmAk/maxresdefault.jpg

Gecko Bank Home

https://gecko-bank.com/natfundb.png

Dividing retirement accounts and pensions in a divorce is a complex process that requires careful planning and legal knowledge From understanding Qualified Domestic Learn how retirement accounts are divided in divorce how to protect your 401 k and whether you can cash out a 401 k during divorce

Retirement accounts such as IRAs 401 k s and pensions may be divided between the spouses in a divorce The basic principles of dividing marital property apply Retirement accounts and pensions often represent a significant portion of a couple s marital assets When couples decide to divorce dividing these accounts can be

More picture related to How Do Retirement Accounts Work In Divorce

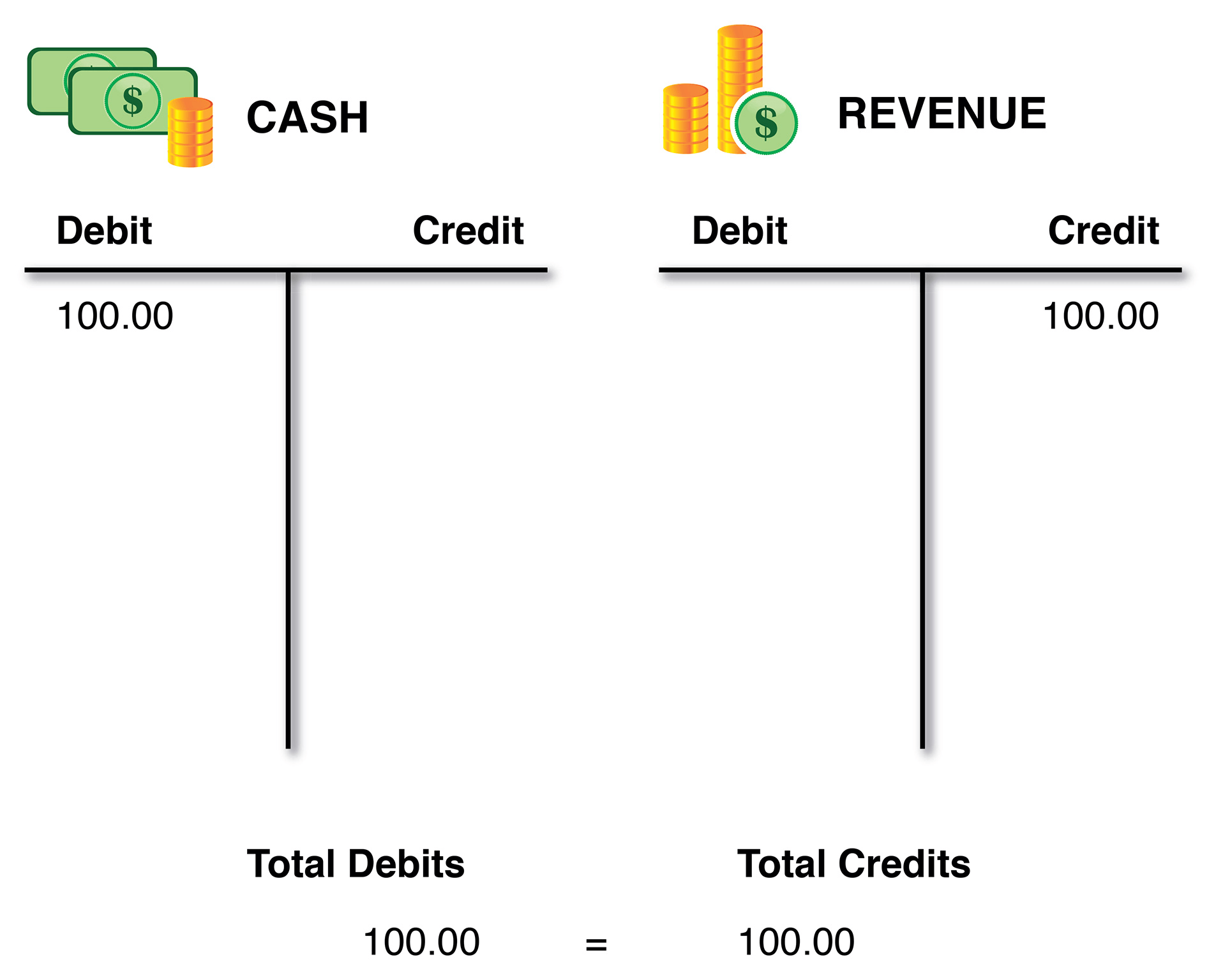

T Accounts Guide For Accounting Students

https://i.pinimg.com/736x/b1/55/7d/b1557db20e78041180a753bcb70230f7.jpg

Funny Retirement Quotes And Sayings With Image Quotes And Sayings

https://i.pinimg.com/originals/28/69/f2/2869f2759f9369f8c6a87ff217544240.jpg

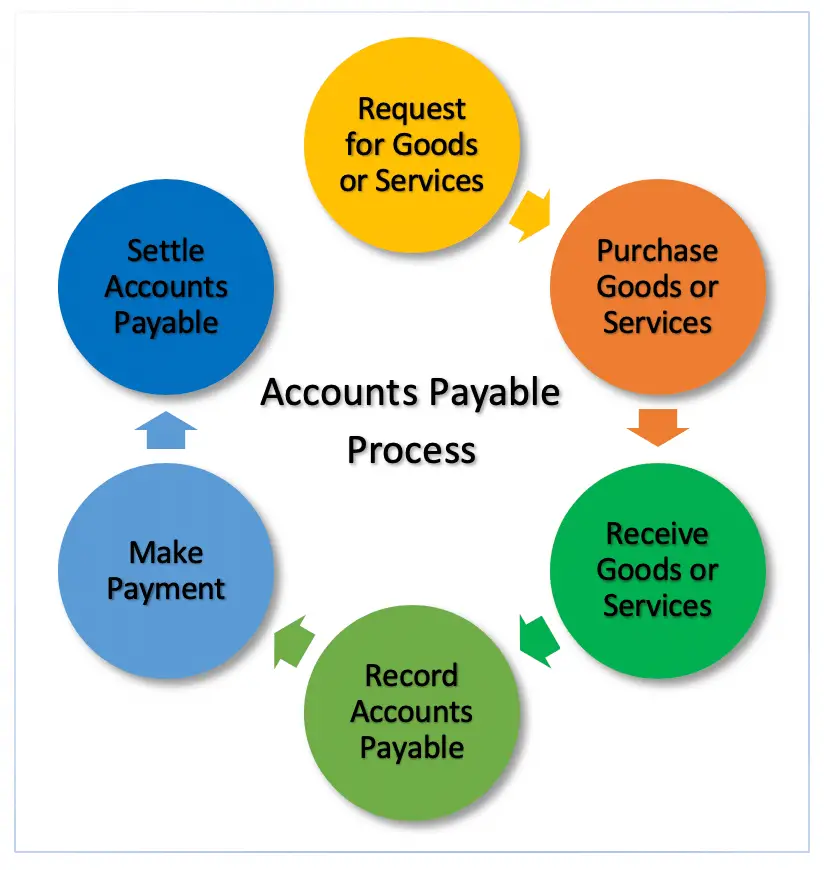

SAP Accounts Payable Process Flow Chart

https://accountinguide.com/wp-content/uploads/2020/01/Accounts-payable-process.png

Each type of account such as a pension plan a Roth IRA or a 401 k plan has its own set of transfer rules that must be considered to avoid unnecessary taxes and penalties Ensuring a Fair Division of Retirement Premarital retirement savings are considered separate property Your state of residency plays a major role in how retirement accounts are handled during a divorce Depending on where you live

If you are going through a divorce it is crucial that you do not neglect how you or your spouse s retirement assets are divided An individual s retirement accounts typically a pension and or an IRA individual retirement account or 401 k Compared to employer sponsored qualified retirement plans IRA assets are much simpler to divide in a divorce Once the court determines each spouse s share you can roll

Retirement Letter To Employer New Retirement Notice Letter Template

https://i.pinimg.com/originals/89/bb/ed/89bbed60fbd6d09bc46a1500e3649ba1.jpg

Do Retirement Accounts Need To Go Through Probate

https://www.dhtrustlaw.com/wp-content/uploads/2024/07/Do-Retirement-Accounts-Need-to-Go-Through-Probate-1-768x644.png

https://www.kiplinger.com › retirement › divorce-how...

It s an acronym for qualified domestic relations order which is used in a divorce proceeding to instruct a retirement plan to pay a spouse or a former spouse his or her community property

https://www.investopedia.com › articles › retirement

In a divorce or legal separation individual retirement accounts IRAs are divided using a process known as transfer incident to divorce while 403 b and qualified plans such as 401

Control Accounts Double Entry Bookkeeping

Retirement Letter To Employer New Retirement Notice Letter Template

Do Retirement Accounts IRAs Go Through Probate In Virginia

Accounting T Chart Template

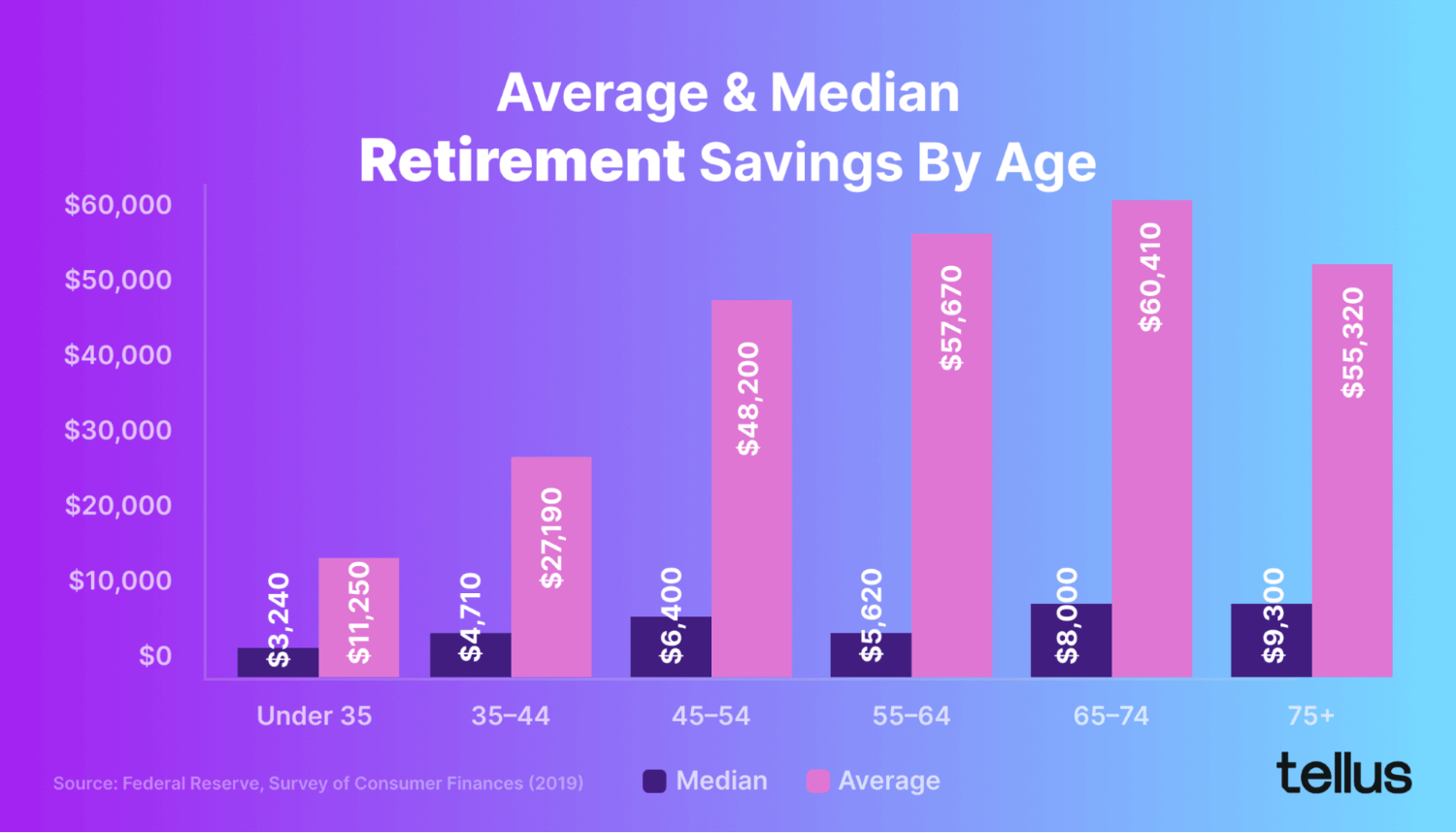

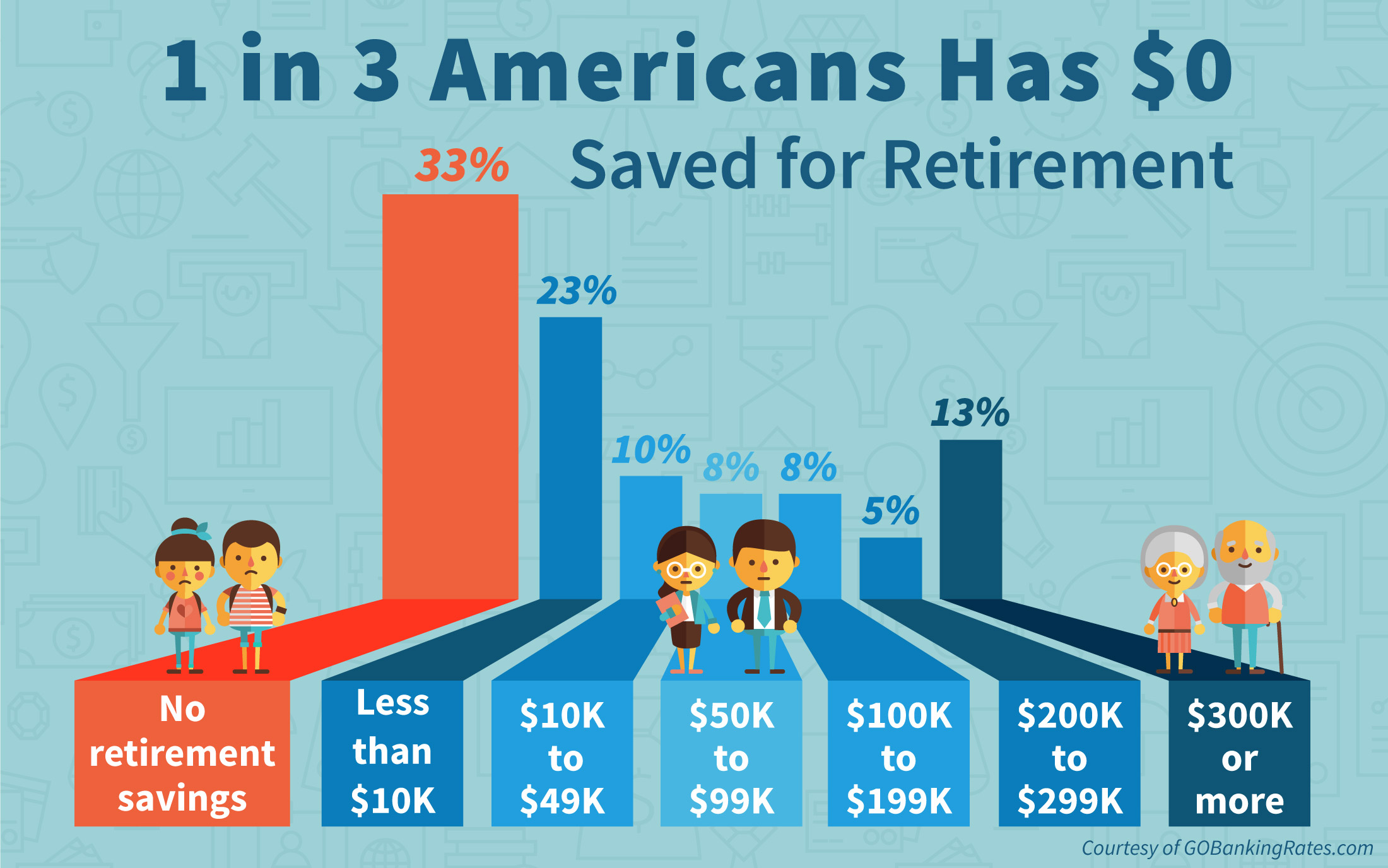

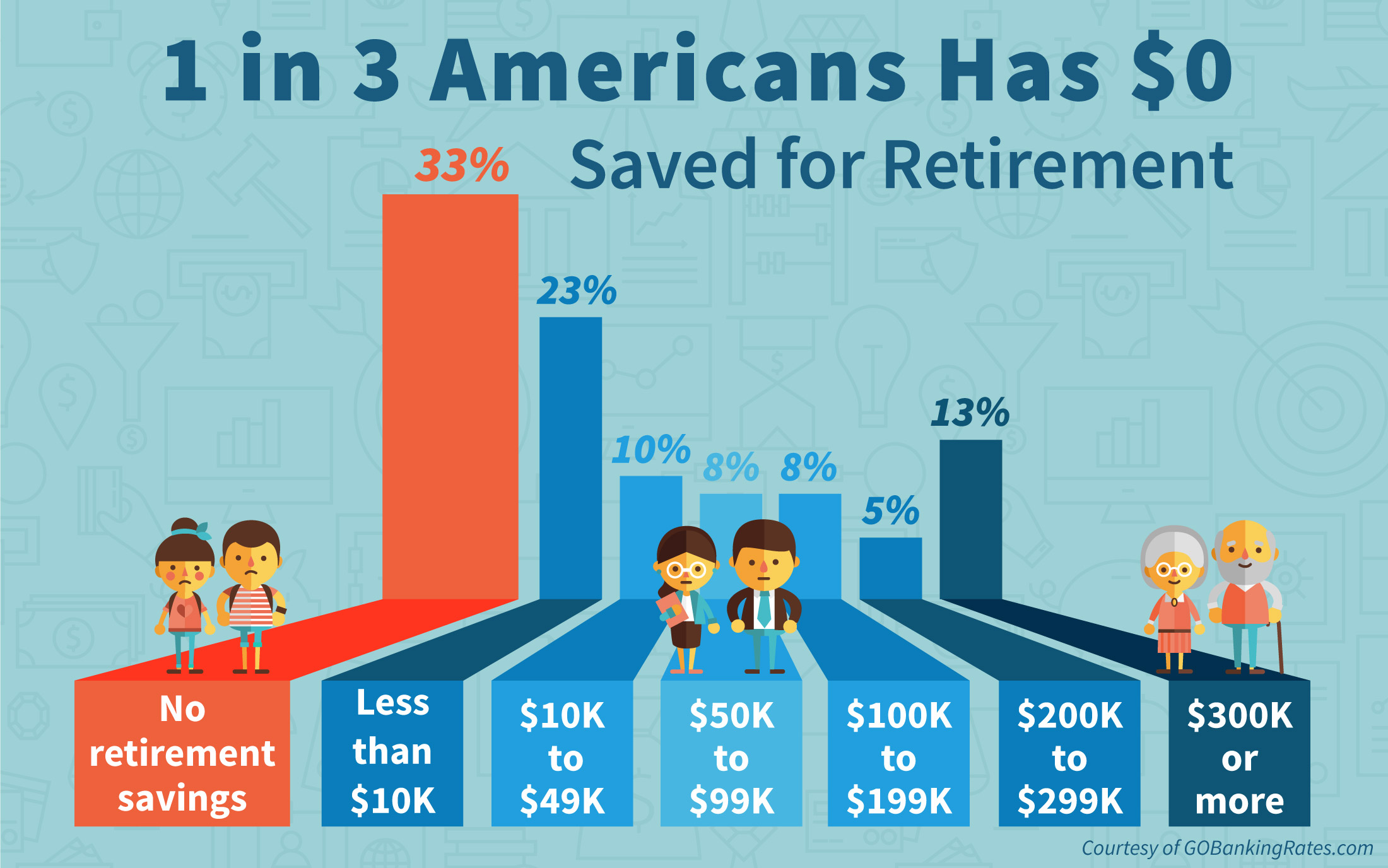

Average American Savings 2024 Abbe Lindsy

Average Retirement Savings

Average Retirement Savings

How To Do A Ledger In Word Bettabamboo

401k Contribution Limits 2025 Chart William K Taylor

Us Navy Pay Chart 2025 Grata Odelle

How Do Retirement Accounts Work In Divorce - Work with an attorney or QDRO professional to draft and file the QDRO properly Follow up with the court and plan administrator to ensure the process is completed Bottom