How Long Can Property Taxes Go Unpaid In Ohio Property owner enters into a delinquent tax contract with the county treasurer as described below If the overdue amount is paid within ten days after the due date the penalty equals 5

If you don t pay your property taxes Your costs go up Interest and penalties continue to add up the longer the taxes go unpaid You risk losing your home to foreclosure Foreclosure is the Missing a property tax payment in Ohio can lead to a tax lien being placed on your property This lien represents a legal claim against your property for the amount of unpaid

How Long Can Property Taxes Go Unpaid In Ohio

How Long Can Property Taxes Go Unpaid In Ohio

https://i.ytimg.com/vi/7ozUQvlv2t4/maxresdefault.jpg

How Much Can Property Taxes Go Up In A Year In New York YouTube

https://i.ytimg.com/vi/bn0qZ3n9pI4/maxresdefault.jpg

Blog Tax Ease

https://taxease.com/wp-content/uploads/2022/10/image-how-long-can-you-go-without-paying-property-taxes-1.jpg

Answer If you fail to pay your property taxes on time you may be charged penalties and interest Continued non payment can result in a tax lien being placed on your property and if the taxes Not paying property tax in Ohio can lead to several significant consequences including the accrual of interest and penalties the placement of a tax lien on your property the

Interest and penalties continue to add up the longer the taxes go unpaid You are at greater risk of foreclosure If you don t pay your property taxes within 60 days of the date they are certified How can I avoid property taxes in Ohio If you are 65 years old or older you may qualify for an exemption of the first 25 000 of your home s taxable value Your annual

More picture related to How Long Can Property Taxes Go Unpaid In Ohio

Channels Zello Support

https://support.zello.com/hc/theming_assets/01HZH386XHC2G0ASNBS35PM6NN

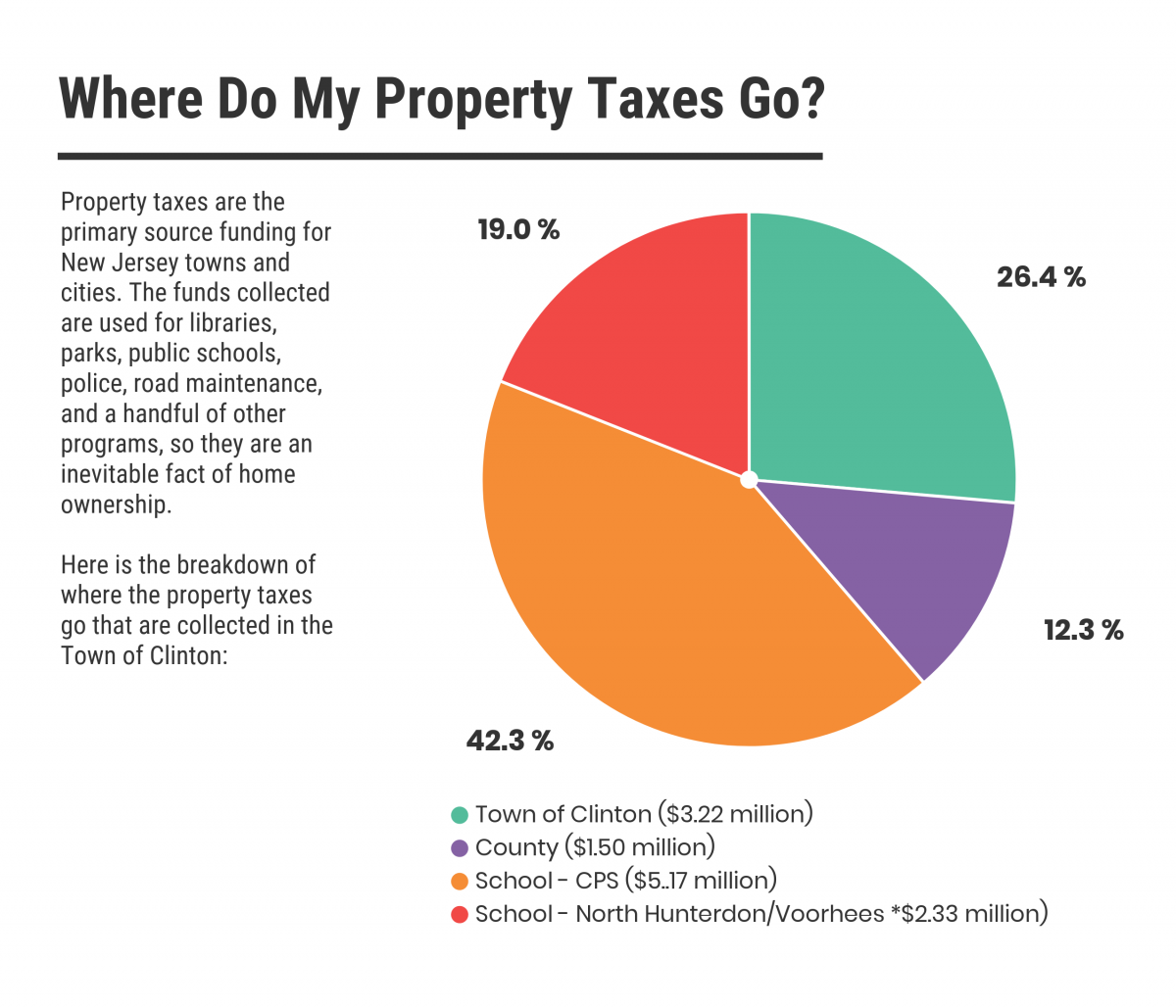

Where Do My Taxes Go Clinton NJ

https://www.clintonnj.gov/sites/g/files/vyhlif411/f/imce/town_of_clinton_2019_propoerty_taxes_hd.png

What You Should Know Before Buying Desiolens Help Center

https://theme.zdassets.com/theme_assets/14858020/bbf428822728221dca0fad0a30eb141cb12a56f1.png

Current taxes that are not paid within 10 calendar days of the close of the tax collection will be assessed a 10 penalty The Annual Interest Rate for delinquent real estate taxes is 12 per How Long Can You Go Without Paying Your Property Taxes Exactly how long you can go without paying your property taxes varies significantly by jurisdiction Generally

If the total amount of all the taxes is not paid on or before the twentieth day of June next thereafter or on or before the last day for payment as extended pursuant to section Although it comes at the same time twice a year your property tax bill likely surprises you Like countless others in Ohio that often unplanned for expense will either

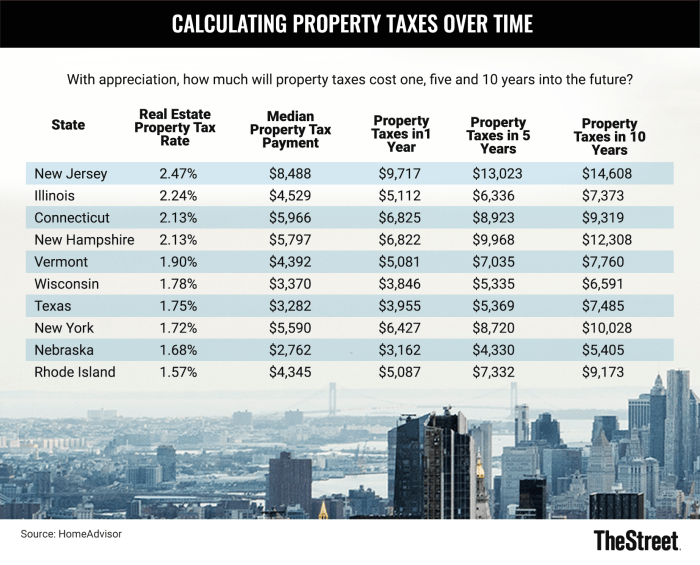

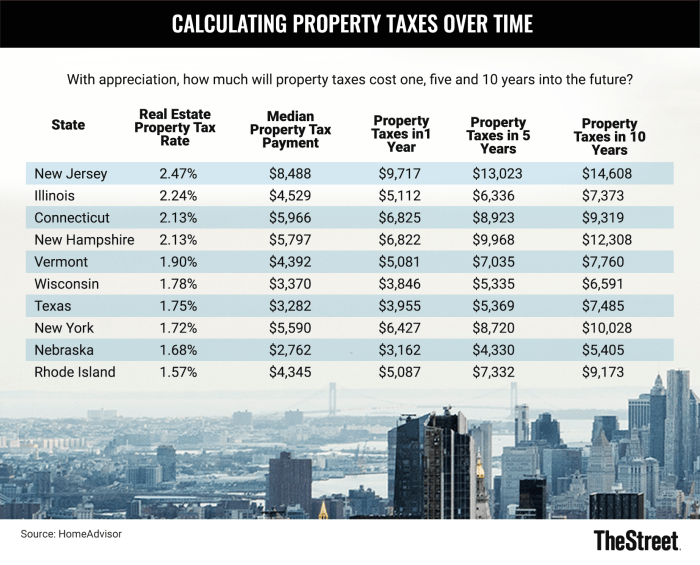

These States Have The Highest Property Tax Rates TheStreet

https://www.thestreet.com/.image/c_limit,cs_srgb,q_auto:good,w_700/MTkzMTM5Mzg2MDIyNDM4MjQ0/table-property-taxes-101922.png

Intro To Property Taxes StreetFins

https://streetfins.com/wp-content/uploads/2021/03/property-tax.jpeg

https://www.lsc.ohio.gov › assets › organizations › ...

Property owner enters into a delinquent tax contract with the county treasurer as described below If the overdue amount is paid within ten days after the due date the penalty equals 5

https://www.ohiolegalhelp.org › topic › property-taxes

If you don t pay your property taxes Your costs go up Interest and penalties continue to add up the longer the taxes go unpaid You risk losing your home to foreclosure Foreclosure is the

Va Tax Day 2025 Judy D Ingram

These States Have The Highest Property Tax Rates TheStreet

Calcul Taxes Ontario 2024 Vanni Annalee

How To Write A Payment Demand Letter Printable Online

How Long Can Inoculated Agar Plates Be Kept At Room Temperature

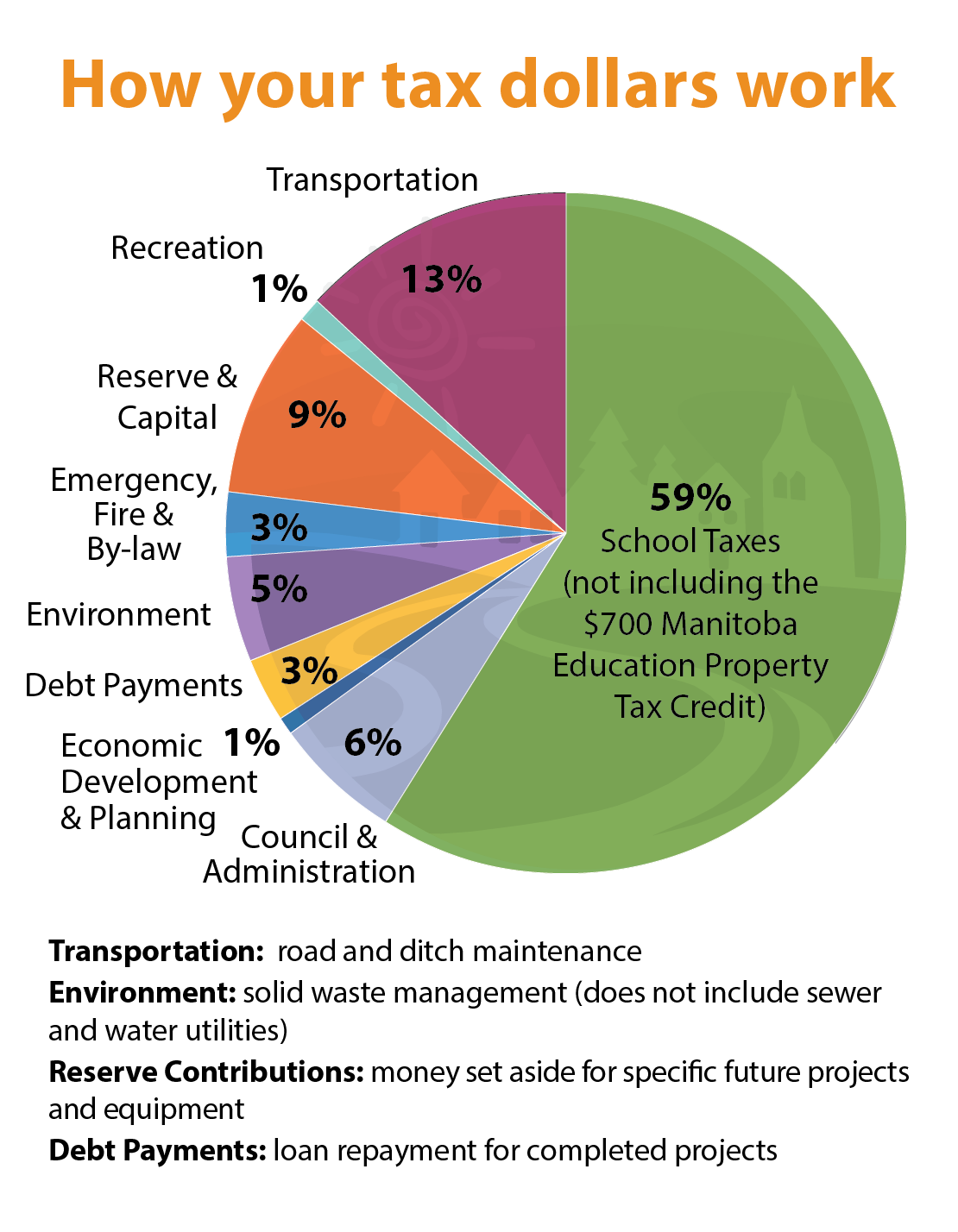

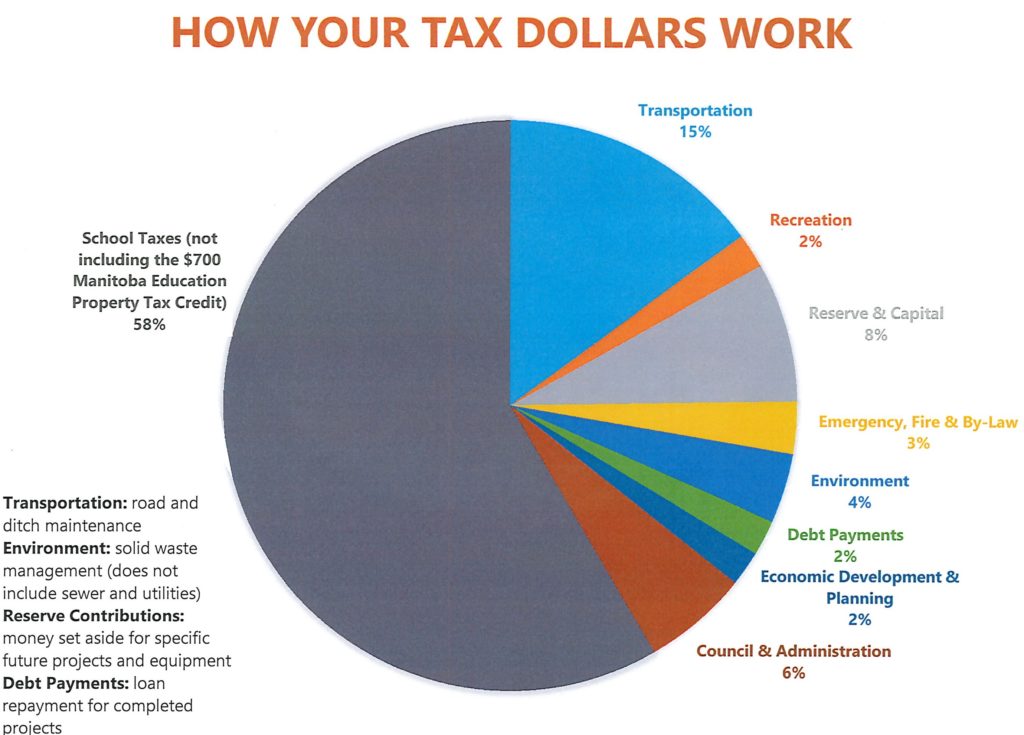

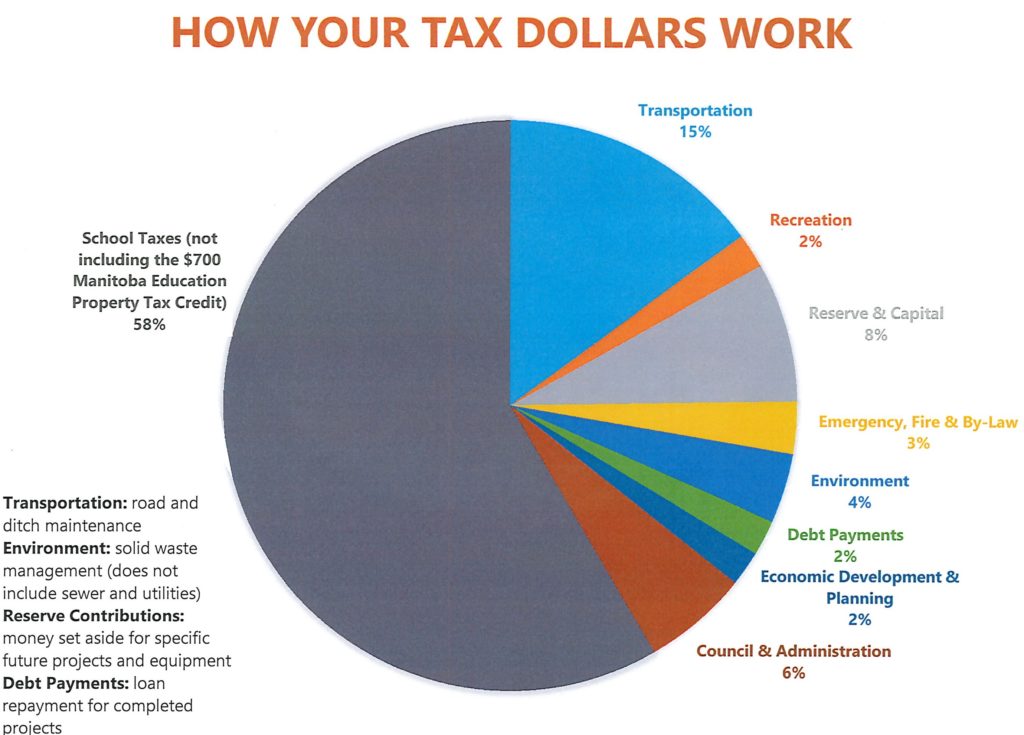

Property Tax Info Rural Municipality Of St Clements

Property Tax Info Rural Municipality Of St Clements

How Long Can One Expect Mushroom Capsules To Last Psychedelic

Tax And Interest Deduction Worksheets

North Carolina Tax Rates 2024

How Long Can Property Taxes Go Unpaid In Ohio - In the few months before your property is put on sale for unpaid taxes you ll often be hit with penalties and interest If you can t pay the tax debt within the allowed period you