How Many Years Can You Claim Residential Energy Credit How long does a taxpayer have to claim the credit added Jan 17 2025 A2 The credit is allowed for a taxable year for certain amounts a taxpayer pays or incurs during such taxable year

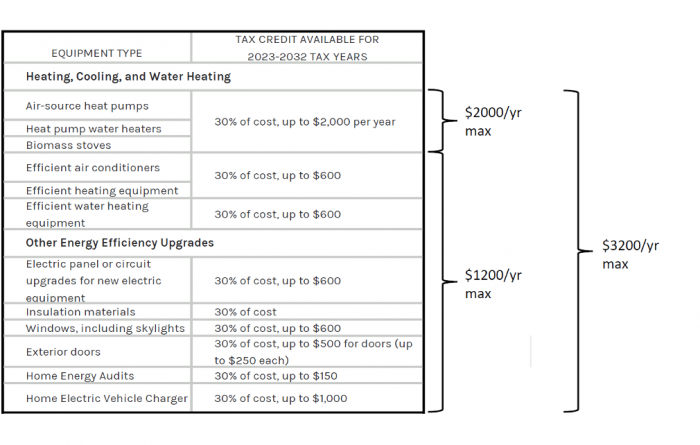

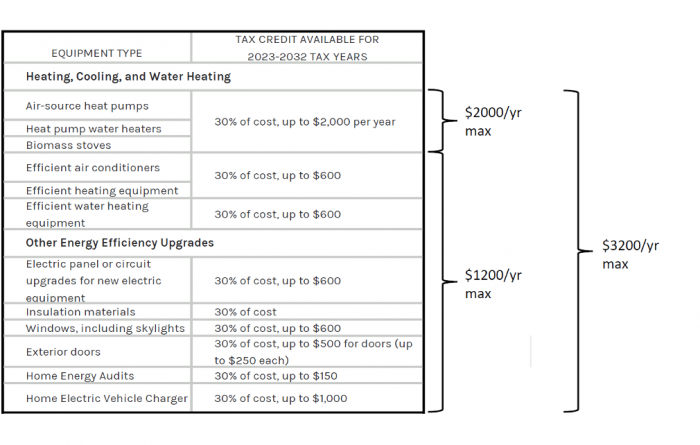

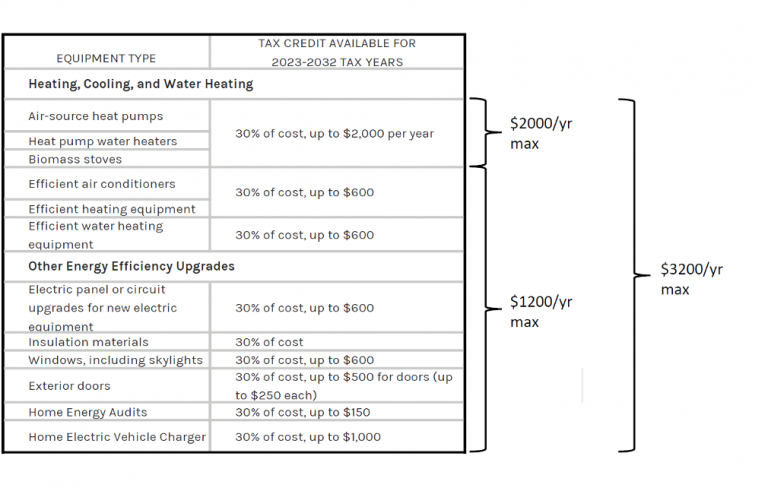

The maximum credit you can claim each year is 1 200 for energy efficient property costs and certain energy efficient home improvements with limits on exterior doors 250 per door and 500 total exterior windows and skylights 600 and home energy audits 150 The residential energy credit includes a carryforward provision allowing taxpayers to apply unused portions of the credit in future tax years This feature benefits those whose credits exceed their tax liability in the year of claim

How Many Years Can You Claim Residential Energy Credit

How Many Years Can You Claim Residential Energy Credit

https://i.ytimg.com/vi/xVAZkSMucWE/maxresdefault.jpg

No Claim Certificate

https://cdn.slidesharecdn.com/ss_thumbnails/noclaimcertificate-200916103902-thumbnail-4.jpg?cb=1662487200

2025 Tax Credits For Eva Lydia Hope

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/03/irs_form_5695_featured_image.png

The duration for which you can carry forward the residential energy credit depends on the specific tax rules and regulations set by the IRS Currently the residential energy credit can be carried forward for up to five years The residential energy credit isn t a one time claim As long as you make qualifying improvements you can claim the credit each year However there are annual limits on the amount you can claim It s essential to check the current IRS guidelines for specific limits and qualifying criteria Energy Credit Carryforward What if your credit

Previously individuals were allowed a personal tax credit known as the residential energy efficient property REEP credit for solar electric solar hot water fuel cell small wind energy geothermal heat pump and biomass fuel property installed in homes in years before 2023 IRC Secs 25D a and 25D h Beginning in 2023 taxpayers can claim a credit of up to 1 200 per year and there is no lifetime limit on the credit The credit is 30 of the cost of qualified expenses and there are limits on the amount of credit taxpayers can claim each year The following expenditures are eligible for the Energy Efficient Home Improvement Credit 1

More picture related to How Many Years Can You Claim Residential Energy Credit

Home Energy Credits 2025 Lanni Modesta

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Does A New Roof Qualify For Residential Energy Credit

https://er55hxiqhrv.exactdn.com/wp-content/uploads/2023/08/featured-47.jpg

Energy Credits 2024 Cary Marthe

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

This means you can claim a maximum total yearly energy efficient home improvement credit amount up to 3 200 The Residential Clean Energy RCE Credit is a renewable energy tax credit extended and expanded by the 2022 Inflation Reduction Act The credit is worth 30 of certain qualified expenses for residential clean energy property Both offer a 30 tax credit on qualifying energy efficient home expenditures and both are valid each tax year toward improvements made through 2032 Luckily the same form IRS Form 5695

[desc-10] [desc-11]

Residential Energy Credit Application 2025 ElectricRate

https://www.electricrate.com/wp-content/uploads/2021/04/non-business-energy-property-credit.png.png

Irs 2024 Energy Credits Golda Kandace

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

https://www.irs.gov › credits-deductions › frequently...

How long does a taxpayer have to claim the credit added Jan 17 2025 A2 The credit is allowed for a taxable year for certain amounts a taxpayer pays or incurs during such taxable year

https://www.irs.gov › credits-deductions › energy...

The maximum credit you can claim each year is 1 200 for energy efficient property costs and certain energy efficient home improvements with limits on exterior doors 250 per door and 500 total exterior windows and skylights 600 and home energy audits 150

IRS Form 5695 Residential Energy Credits Forms Docs 2023

Residential Energy Credit Application 2025 ElectricRate

2024 Tax Credits For Energy Efficient Windows Pat Layney

TaxprepSmart How To Claim Residential Energy Credits

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar

Residential Energy Tax Credits GreenBuildingAdvisor

Residential Energy Tax Credits GreenBuildingAdvisor

Residential Energy Tax Credits GreenBuildingAdvisor

Residential Energy Tax Credits GreenBuildingAdvisor

Claim Medical Expenses On Your Taxes Health For CA

How Many Years Can You Claim Residential Energy Credit - Previously individuals were allowed a personal tax credit known as the residential energy efficient property REEP credit for solar electric solar hot water fuel cell small wind energy geothermal heat pump and biomass fuel property installed in homes in years before 2023 IRC Secs 25D a and 25D h