How Much Is My Property Tax Enter the county and state where your property is located and the estimated property value to see the average property tax rate and monthly or yearly costs Compare your property tax rate with the top 50 metros in the US and learn

This service allows you to calculate the amount of Local Property Tax due on your property for any period Use PropertyChecker s free property tax calculator tool to find and estimate taxes on any property in any state by zip code or address with history of tax assessment change and tax rate

How Much Is My Property Tax

How Much Is My Property Tax

https://i.ytimg.com/vi/shRcspxac7g/maxresdefault.jpg

E Receipts Of Property Tax I How To Download Property Tax E Receipts I

https://i.ytimg.com/vi/R2edEBmmzcI/maxresdefault.jpg

Pcmc Property Tax Online Payment How To Pay Property Tax Online

https://i.ytimg.com/vi/s4jnhbIwcpI/maxresdefault.jpg

Estimate your property tax based on median property taxes in your area by choosing the state and county and entering the appraised value of your property Access detailed property tax statistics and information for your area or visit the Your state and local governments determine how your property taxes are calculated Generally this is done by multiplying your home s assessed value by the local property tax rate

Estimate your property taxes based on your home value and location using SmartAsset s free tool Learn how property taxes are assessed calculated and levied by local governments across the U S Use the property tax calculator to estimate your real estate taxes

More picture related to How Much Is My Property Tax

FAQs

https://giga.com.sg/img/CATDIVE.gif?418

Login Now Legal Verdicts

https://www.legalverdicts.com/images/LegalVerdicts_Logos_SocialMedia.png

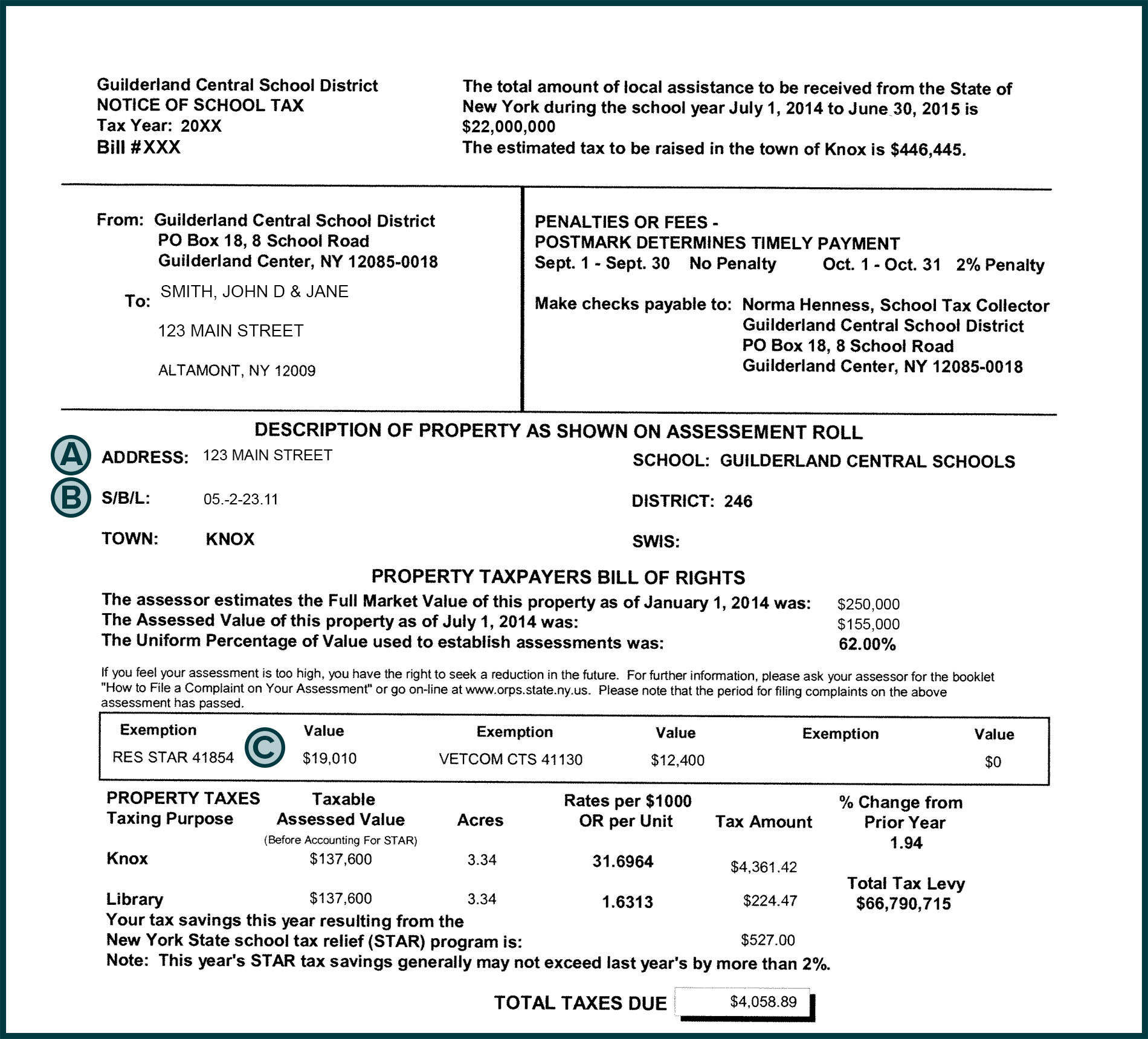

What s My Property s Tax Identification Number

http://www.mywoodlot.com/images/supporting_information/whats_my_woodlots_tax_id_number/sample_property_tax_bill.jpg

Calculate property taxes including California property taxes Most annual property taxes include a computation based on a percentage of the assessed value States such as California increase the assessment value by up to 2 per year This calculator is an estimating tool and does not include all taxes that may be included in your bill Assessed Council tax map Find out how much your tax will rise as nine in 10 areas face maximum increase Just 15 councils are planning increases below 4 99 per cent

Input monthly or yearly amounts for property tax homeowners insurance private mortgage insurance PMI and HOA fees if applicable These contribute to the total monthly payment and give a realistic view of financial In general you can expect your home s assessed value to amount to about 80 to 90 of its market value You can check your local assessor or municipality s website or call the tax office

How Much Is R22 Freon A Pound Best Selling Americanprime br

https://atlasacrepair.com/wp-content/uploads/2021/10/r-22-and-410a-refrigerant-scaled.webp

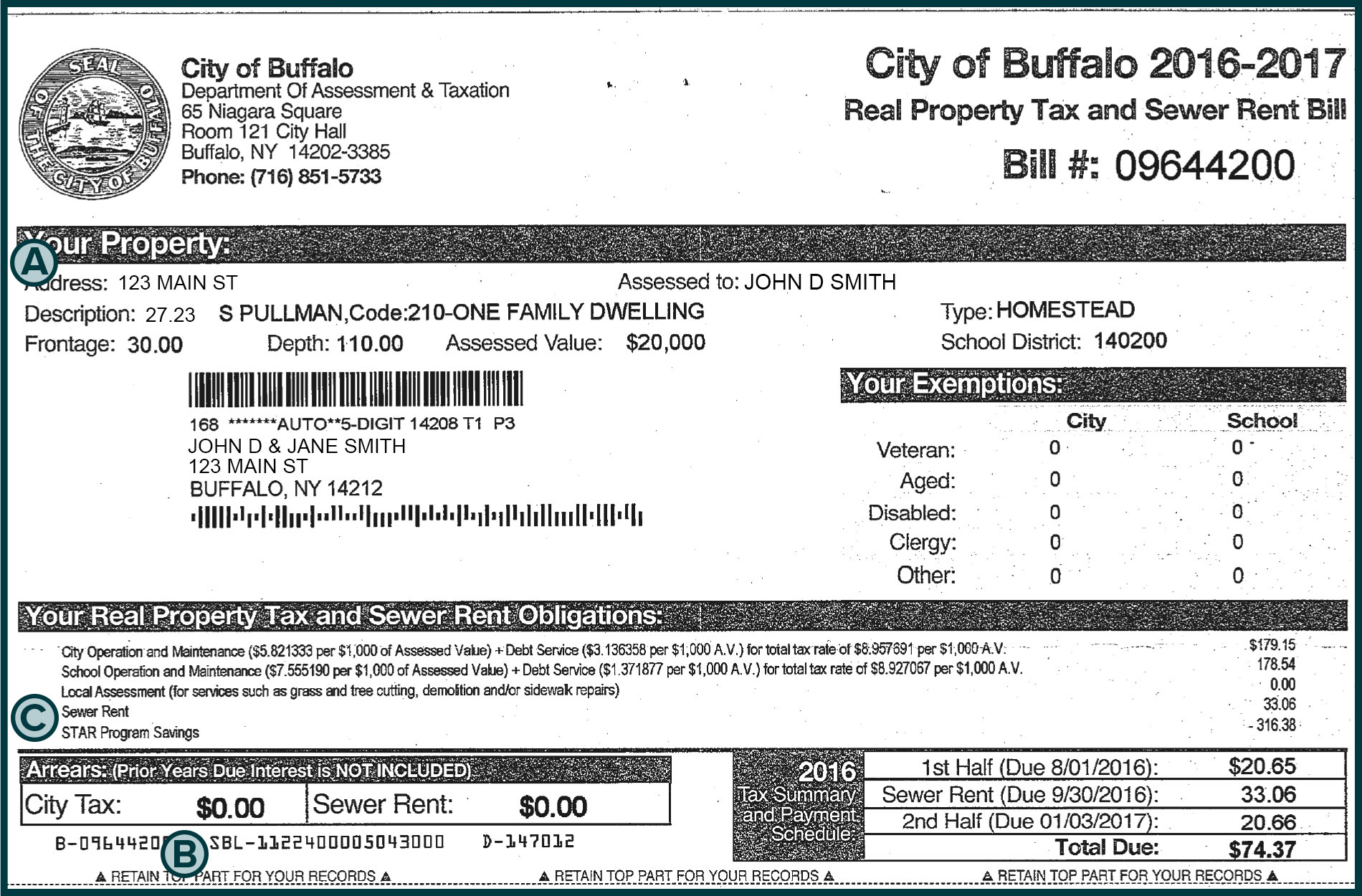

Buffalo County Real Estate Taxes Discount Head hesge ch

https://www.tax.ny.gov/images/orpts/proptaxbills/buffalo.jpg

https://www.zillow.com › ... › property-t…

Enter the county and state where your property is located and the estimated property value to see the average property tax rate and monthly or yearly costs Compare your property tax rate with the top 50 metros in the US and learn

https://lpt.revenue.ie › lpt-web › reckoner › lpt.html

This service allows you to calculate the amount of Local Property Tax due on your property for any period

Contract Revision The Sterling Firm

How Much Is R22 Freon A Pound Best Selling Americanprime br

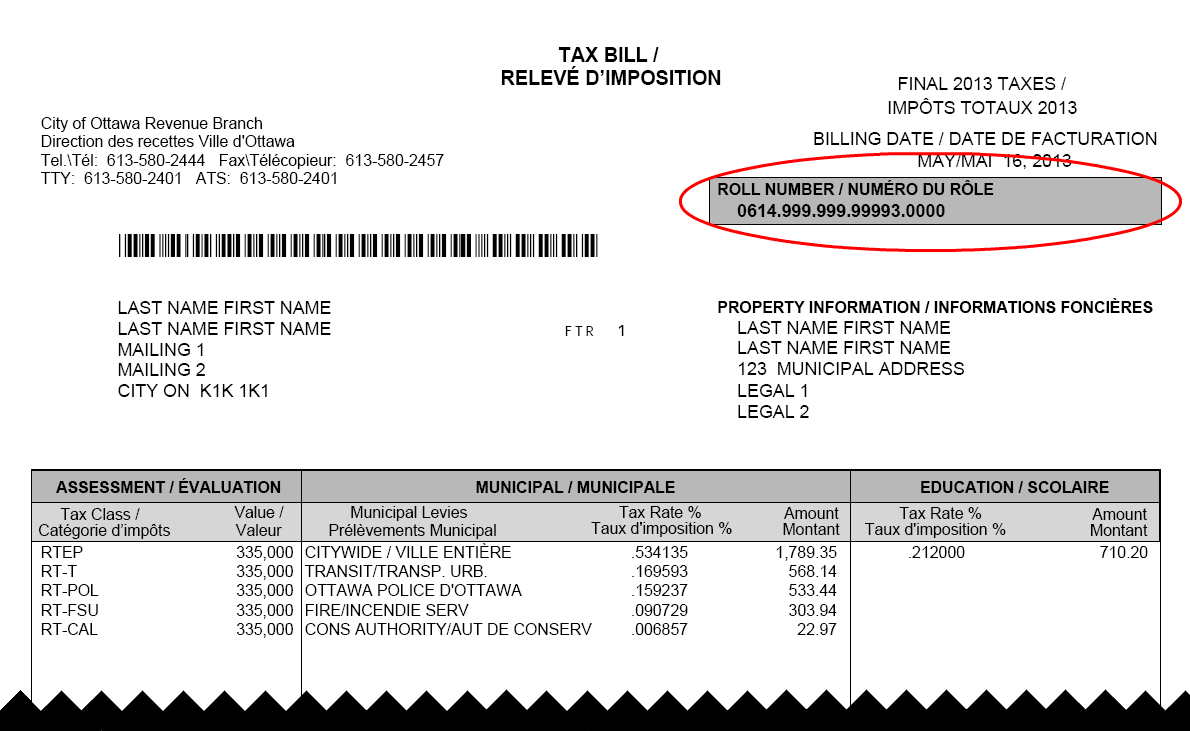

Property Tax Bill Examples

Payer En Ligne Avec Des Fausse Cartes

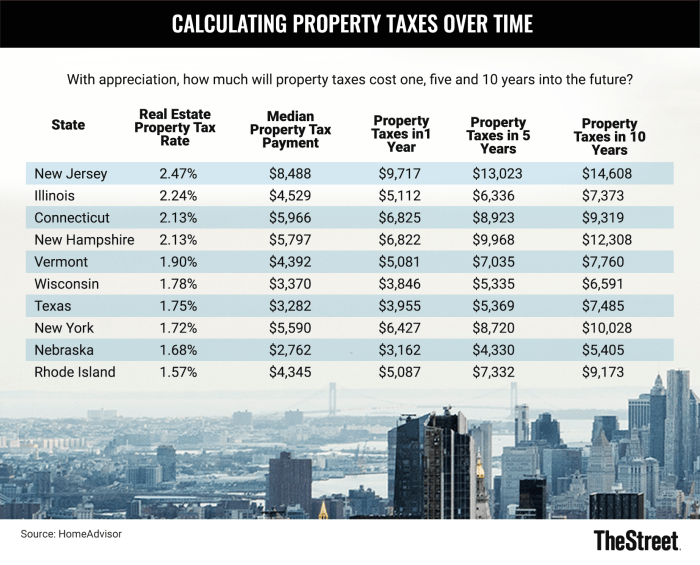

These States Have The Highest Property Tax Rates TheStreet

Osage County Oklahoma Plat

Osage County Oklahoma Plat

Neighbor Blocked My Driveway With His Construction Vehicles Without

Latin American Art Appraisal

Property Tax Information Sheet

How Much Is My Property Tax - Your state and local governments determine how your property taxes are calculated Generally this is done by multiplying your home s assessed value by the local property tax rate