How Often Are Property Taxes Assessed In Texas Texas Property Tax Basics March 2024 Property Tax Administration Many parties play a role in administering the property tax system including property owners appraisal districts ap

Understanding the property tax process in Texas is crucial for homeowners and taxpayers From property valuation to tax rate determination and collection each step plays a vital role in funding local services How often are properties assessed in Texas Properties in Texas are generally assessed every year by the local appraisal district What is the homestead exemption in Texas The

How Often Are Property Taxes Assessed In Texas

How Often Are Property Taxes Assessed In Texas

https://i.ytimg.com/vi/SgEzmDNZ2CQ/maxresdefault.jpg

How Often Are Property Taxes Paid In NYC YouTube

https://i.ytimg.com/vi/j3bvnT5uTNo/maxresdefault.jpg

How Often Are Property Taxes Due In Florida YouTube

https://i.ytimg.com/vi/1Zqo2IsoZGU/maxresdefault.jpg

How often do they assess property taxes Depending on where you live anywhere between one and seven years You pay property taxes every year but how often property Property taxes assessed are calculated on the valuation of the property you own In some cases your property is worth half as much as your neighbor s after any exemptions that apply Your tax bill should reflect the

Texas law requires your property to be appraised at market value as of January 1st by the county assessor The market value is the price at which the property would transfer on the open Property tax taxing units may also impose levy and collect other taxes and fees as authorized by law Exhibit 1 shows that local property tax remains the largest tax assessed in Texas

More picture related to How Often Are Property Taxes Assessed In Texas

How Are Property Taxes Assessed In Los Angeles Watch This To Better

https://i.ytimg.com/vi/EYp3jlkdiws/maxresdefault.jpg

How Often Are Property Taxes Due In Texas YouTube

https://i.ytimg.com/vi/-D10uqwhWmo/maxresdefault.jpg

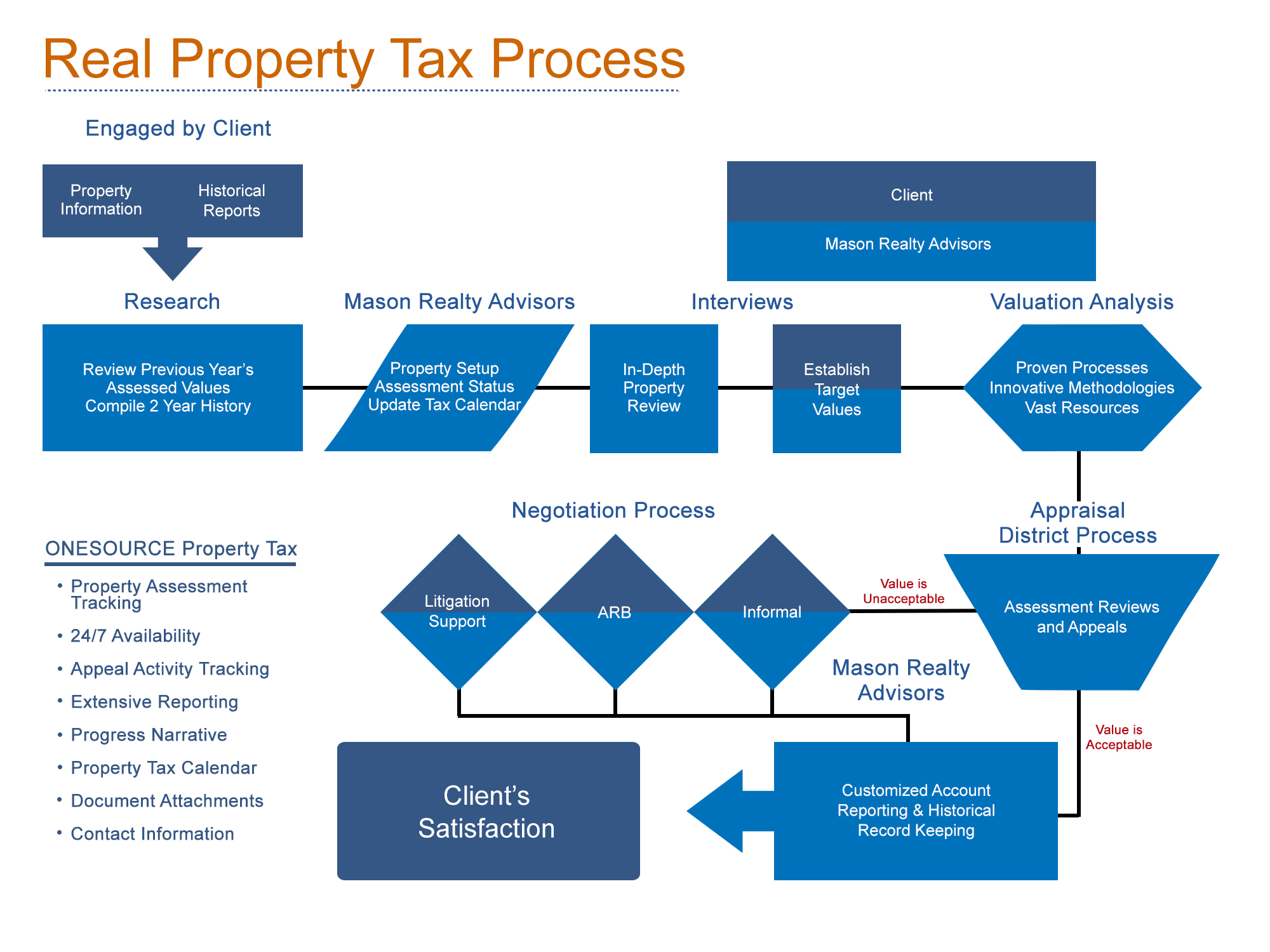

Property Tax Services

https://www.masoncompanyrealtors.com/wp-content/uploads/2015/03/flowchartMASON.jpg

Property Taxes are BIG Despite all previous efforts to reverse course property taxes remain the largest tax assessed in Texas In fact for fiscal year FY 2022 property tax revenues reached 80 8 billion which Texas property taxes are composed of several elements School District Taxes Typically the largest portion of your tax bill often 40 60 Subject to homestead exemptions

School district tax Often a substantial portion of the bill used for funding public education Special district taxes Certain areas have hospital districts utility districts or other Property tax bills go out and collection starts around October 1 Taxpayers have until the following January 31 to pay their taxes Penalties and interest begin February 1 The Texas property tax

Understanding Property Taxes

https://static.wixstatic.com/media/f48228_6929e74060eb4eb0a8eca09c0fe3da6b~mv2.png/v1/fill/w_1000,h_750,al_c,usm_0.66_1.00_0.01/f48228_6929e74060eb4eb0a8eca09c0fe3da6b~mv2.png

How Often Are U S Federal Census Taken

https://static.cocotrivia.com/questions/61eb067a8628d2db73eb3e43.jpeg

https://comptroller.texas.gov › taxes › property-tax › docs

Texas Property Tax Basics March 2024 Property Tax Administration Many parties play a role in administering the property tax system including property owners appraisal districts ap

https://www.texaspolicyresearch.com › und…

Understanding the property tax process in Texas is crucial for homeowners and taxpayers From property valuation to tax rate determination and collection each step plays a vital role in funding local services

Commentary How Property Taxes Work Texas Scorecard

Understanding Property Taxes

California Property Taxes Complete Guide

Property Taxes Maple Grove MN

Understanding Your Property Taxes Jackson County IL

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)

Ad Valorem Tax Definition

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)

Ad Valorem Tax Definition

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

These States Have The Highest Property Tax Rates TheStreet

How High Are Property Taxes In Your State American Property Owners

How Often Are Property Taxes Assessed In Texas - Property taxes assessed are calculated on the valuation of the property you own In some cases your property is worth half as much as your neighbor s after any exemptions that apply Your tax bill should reflect the