How To Roll Your 401k Into A Self Directed Ira Rolling over a 401 k into an IRA is easy Just take the following five steps 1 Choose a good brokerage to hold your account Factors to consider

By following a few simple steps you can move your 401 k funds into an SDIRA and begin your self directed investing journey If you run into any issues completing your How to roll over your money from a 401 k to an IRA By moving your money from a 401 k to an IRA you may be able to avoid potential tax penalties There are two ways you can move your money a direct rollover and

How To Roll Your 401k Into A Self Directed Ira

How To Roll Your 401k Into A Self Directed Ira

https://bp-v-newproduction.s3.amazonaws.com/uploads/uploaded_images/normal_1460168548-Solo401k.jpg

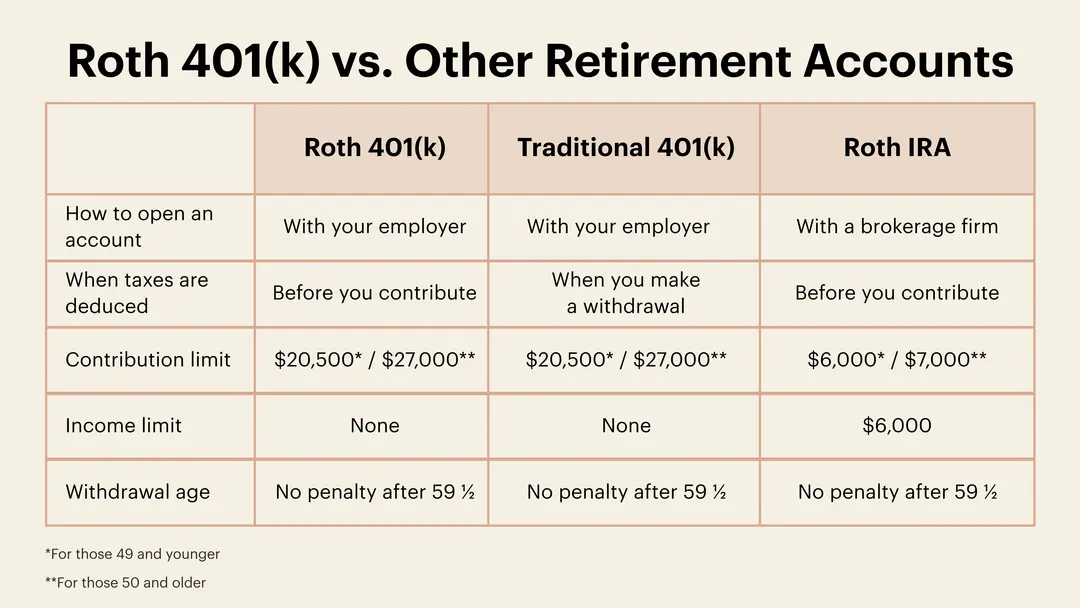

What Is A Roth 401 k Here s What You Need To Know TheSkimm

https://www.theskimm.com/_next/image?url=https://images.ctfassets.net/6g4gfm8wk7b6/6C2dwsIzDhqx0ZlHlJbPdm/8bfbea89445676b07e35a62db8c3c548/Roth_401k.png&w=3840&q=75

What Is A Roth 401 k Here s What You Need To Know TheSkimm

https://www.theskimm.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2F6g4gfm8wk7b6%2F6C2dwsIzDhqx0ZlHlJbPdm%2F8bfbea89445676b07e35a62db8c3c548%2FRoth_401k.png&w=1080&q=75

Rolling over a 401k into an IRA is simple and is essentially a three step process 1 Open an IRA If you do not already have an IRA opening one is a simple matter If you choose a firm that specializes in Self Directed Depending on your financial circumstances needs and goals you may choose to roll over to an IRA or convert to a Roth IRA roll over an employer sponsored plan from your old job to your new employer take a distribution or

Ideally you want a direct rollover in which your old 401 k plan administrator transfers your savings directly to your new IRA account This helps you avoid accidentally incurring taxes In this article we will explore the process of rolling a 401K into a self directed IRA We will discuss the benefits eligibility requirements steps to take and important considerations before making such a move

More picture related to How To Roll Your 401k Into A Self Directed Ira

Roth 401 K

https://m.foolcdn.com/media/dubs/images/roth-401k-vs-roth-ira-retirement-plans-infogra.width-880.png

Choosing Individual 401k Plans All That Glitters Is Not Gold

https://www.sensefinancial.com/wp-content/uploads/2016/11/Solo-401-kprocess-1024x899.png

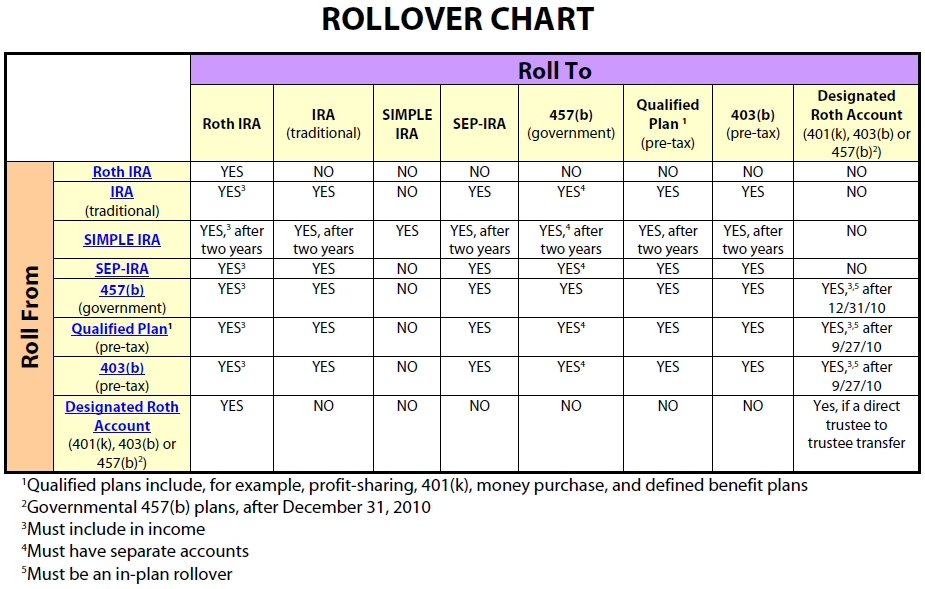

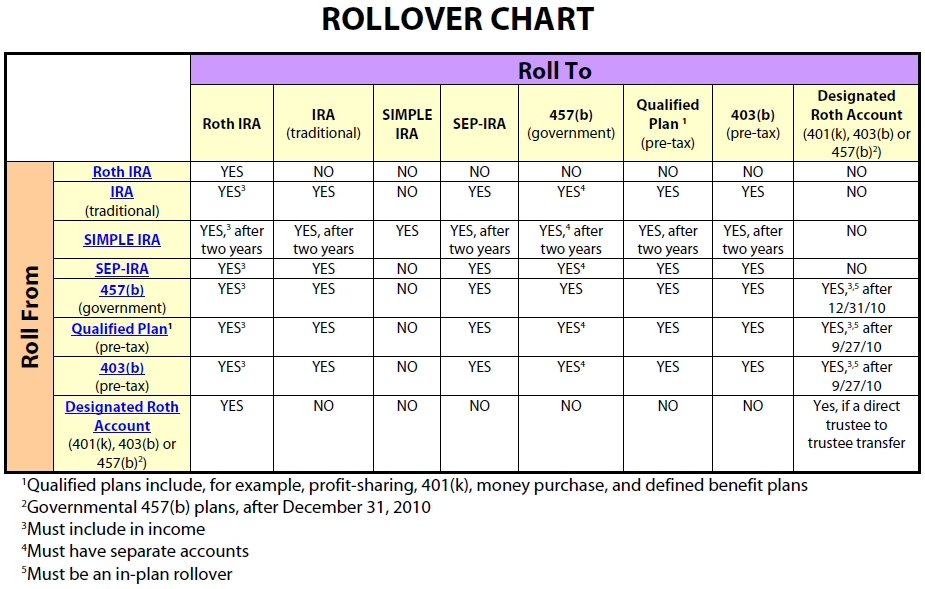

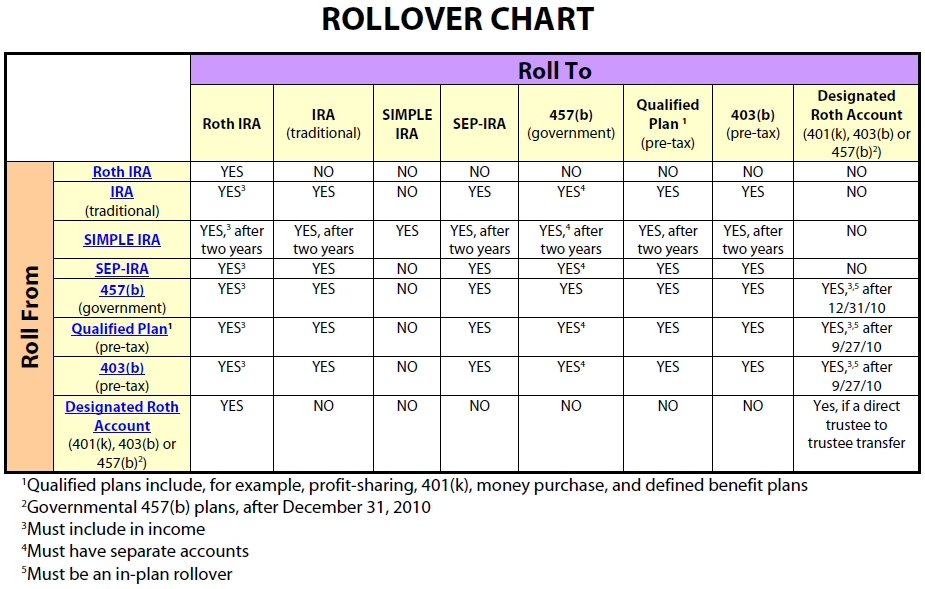

Roth 401k Rollover

https://m.foolcdn.com/media/dubs/images/401k-vs-Roth-401k-retirement-plans-infographic.width-880.png

Direct rollovers are the easiest and safest way to move your funds to a self directed IRA This is a trustee to trustee transfer that avoids any penalty You don t have to hold on to your funds as you wait for the transaction to occur The easiest and safest way to roll over your 401 k into an IRA is with a direct rollover from the financial institution that manages your 401 k plan to the one that will be

You re looking to move your money into a self directed IRA so you can invest however you d like excellent But how exactly do you move your money from your old 401 k or IRA Whether you have your funds in a A 401 k rollover simply allows you to transfer your retirement savings from a 401 k you had at a previous job into an IRA or another 401 k with your new employer And you

Roth 401k Rollover

https://images.squarespace-cdn.com/content/v1/608308a376f2e50e013293c3/1633588000921-4RCDF5HE0YGHDCL717BE/Screen+Shot+2021-10-06+at+10.21.10+PM.png

401k Limits 2025 Chart Bailey C Humphreys

https://www.irafinancialgroup.com/wp-content/uploads/2018/05/ira-rollover-chart.jpg

https://www.fool.com › retirement › plans

Rolling over a 401 k into an IRA is easy Just take the following five steps 1 Choose a good brokerage to hold your account Factors to consider

https://www.theentrustgroup.com › blog

By following a few simple steps you can move your 401 k funds into an SDIRA and begin your self directed investing journey If you run into any issues completing your

Sep Ira Contribution Limits 2024 Karyl Jorrie

Roth 401k Rollover

Irs Traditional Ira Contribution Limits 2025 Misu Flint

Roth Ira Contributions 2025 Mio Deven

401k Max Contribution 2025 Employer Timothy C Mann

401k Contribution Limits 2025 Chart Fidelity Mitchell P Adams

401k Contribution Limits 2025 Chart Fidelity Mitchell P Adams

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Roth Ira Rules 2024 2024 Over 50 Kaila Mariele

Irs Maximum 401k Contribution 2025 Barbara D Mendez

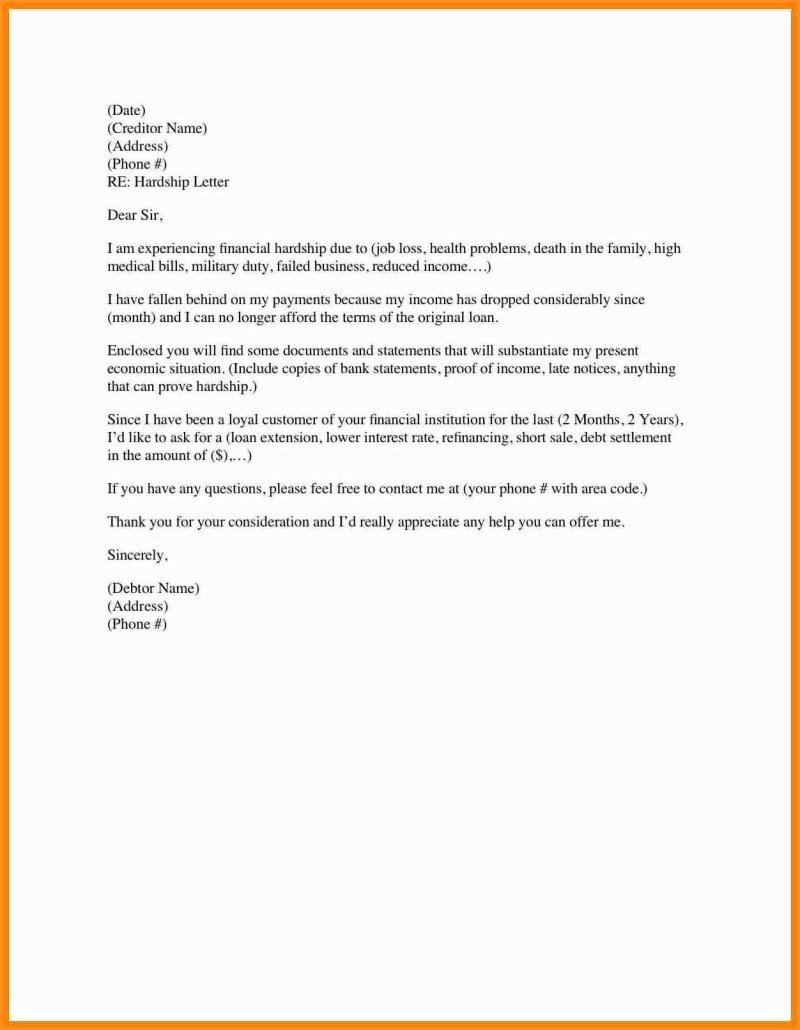

401k Hardship Letter Template Examples Letter Template Collection

How To Roll Your 401k Into A Self Directed Ira - Depending on your financial circumstances needs and goals you may choose to roll over to an IRA or convert to a Roth IRA roll over an employer sponsored plan from your old job to your new employer take a distribution or