Income Guidelines For Hud Senior Housing For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by The beneficial owner has to calculate the amount of income from these securities transactions and include it in income for the calendar year shown on the T5008 slip The beneficial owner

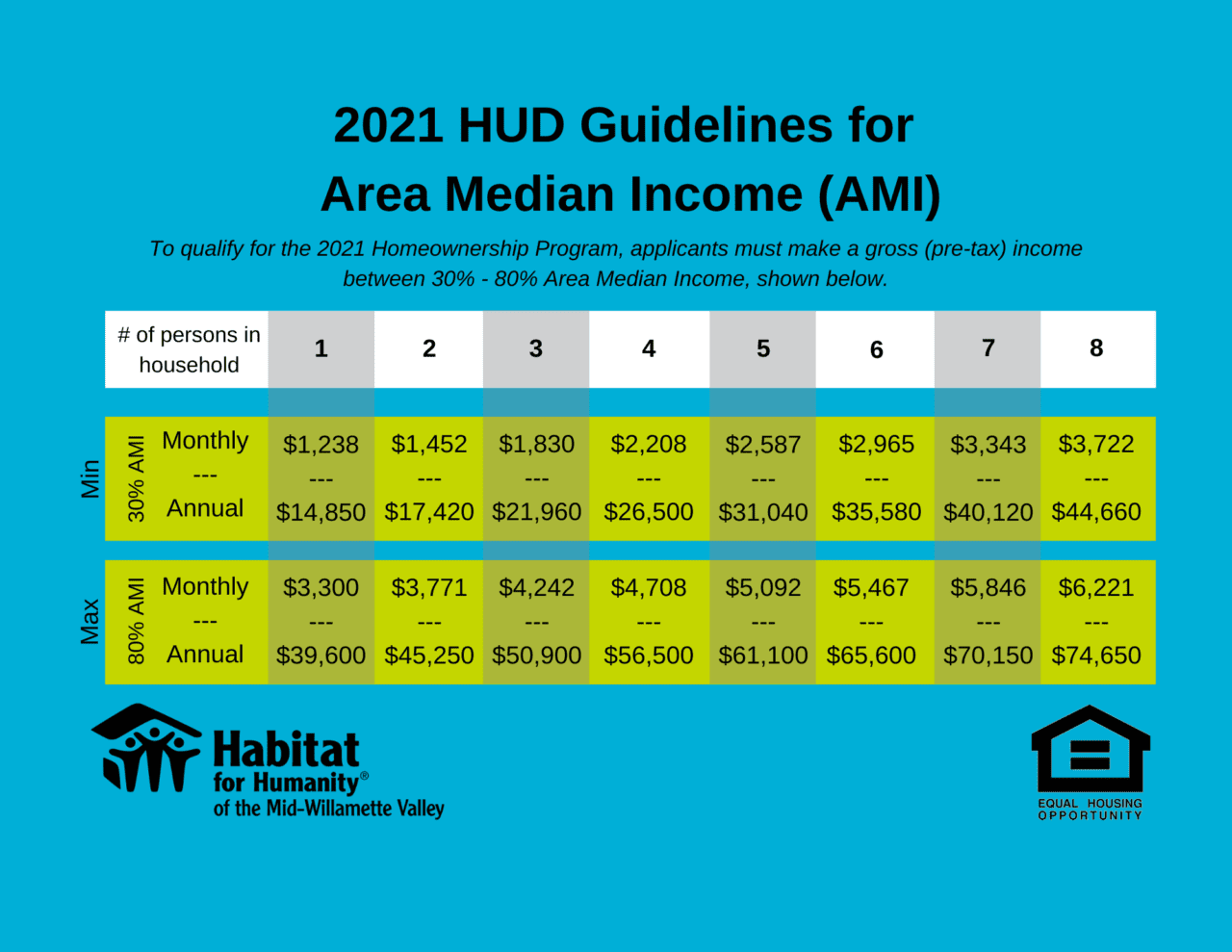

Income Guidelines For Hud Senior Housing

Income Guidelines For Hud Senior Housing

https://greatsenioryears.com/wp-content/uploads/2023/04/How-Do-I-Qualify-As-Low-Income-for-HUD-Senior-Housing_-850x425-1.png

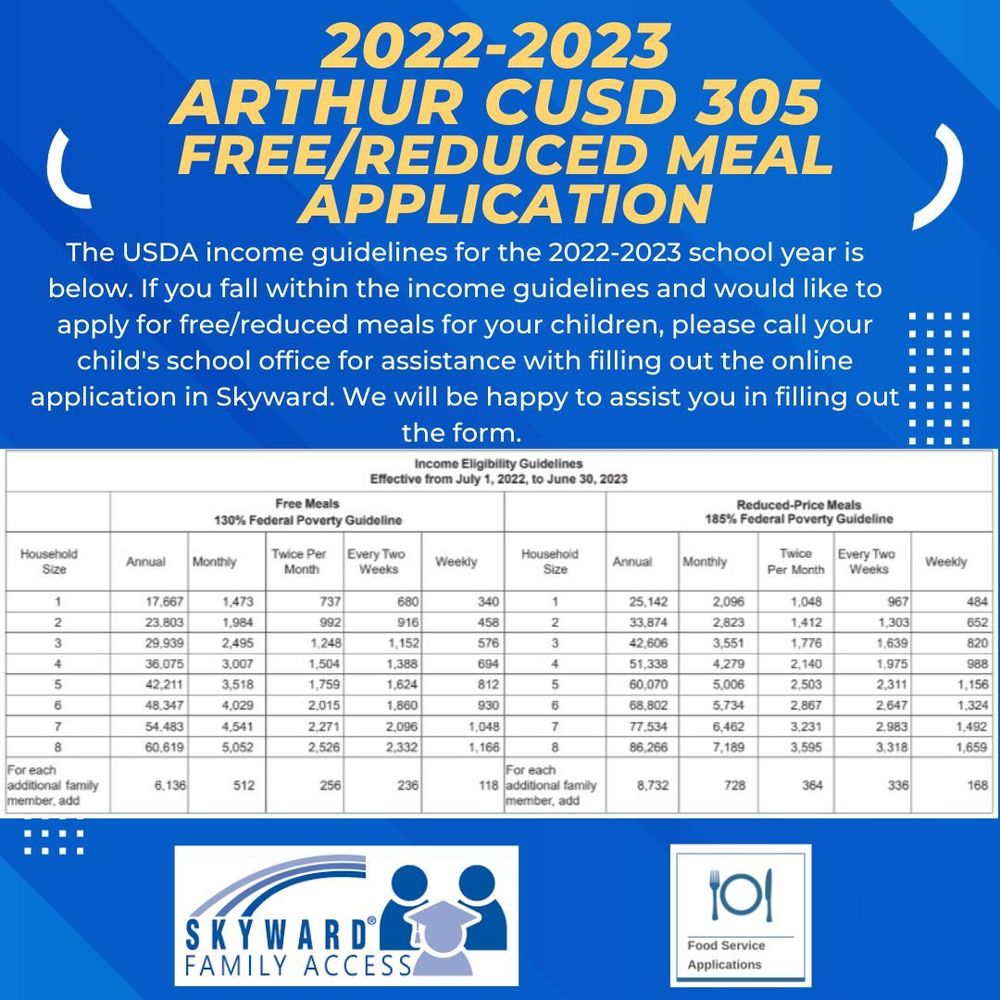

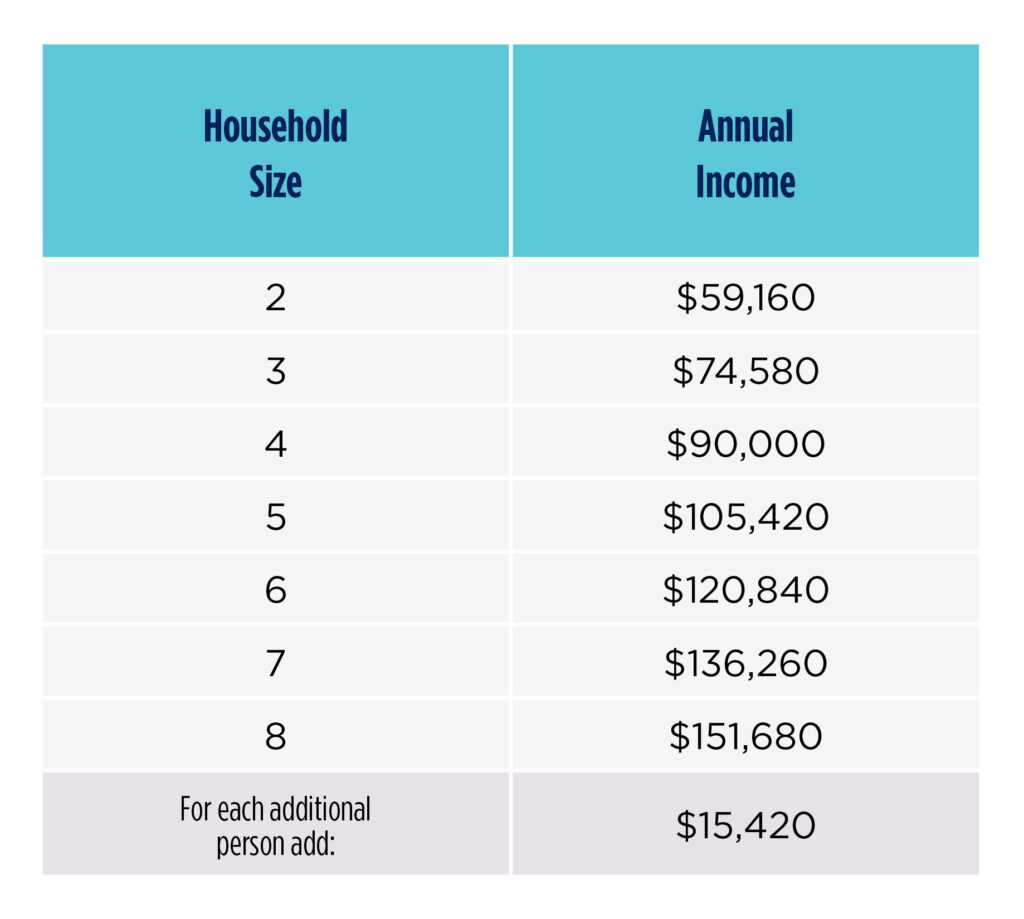

USDA Free Reduced Meal Income Guidelines Arthur CUSD 305

https://79ec2f1cc512589f9a3c-4a65bece92824c6a846a0c16dbd72596.ssl.cf1.rackcdn.com/article/image/large_08156ef9-44c6-44d0-8d98-6098056efa8f.jpg

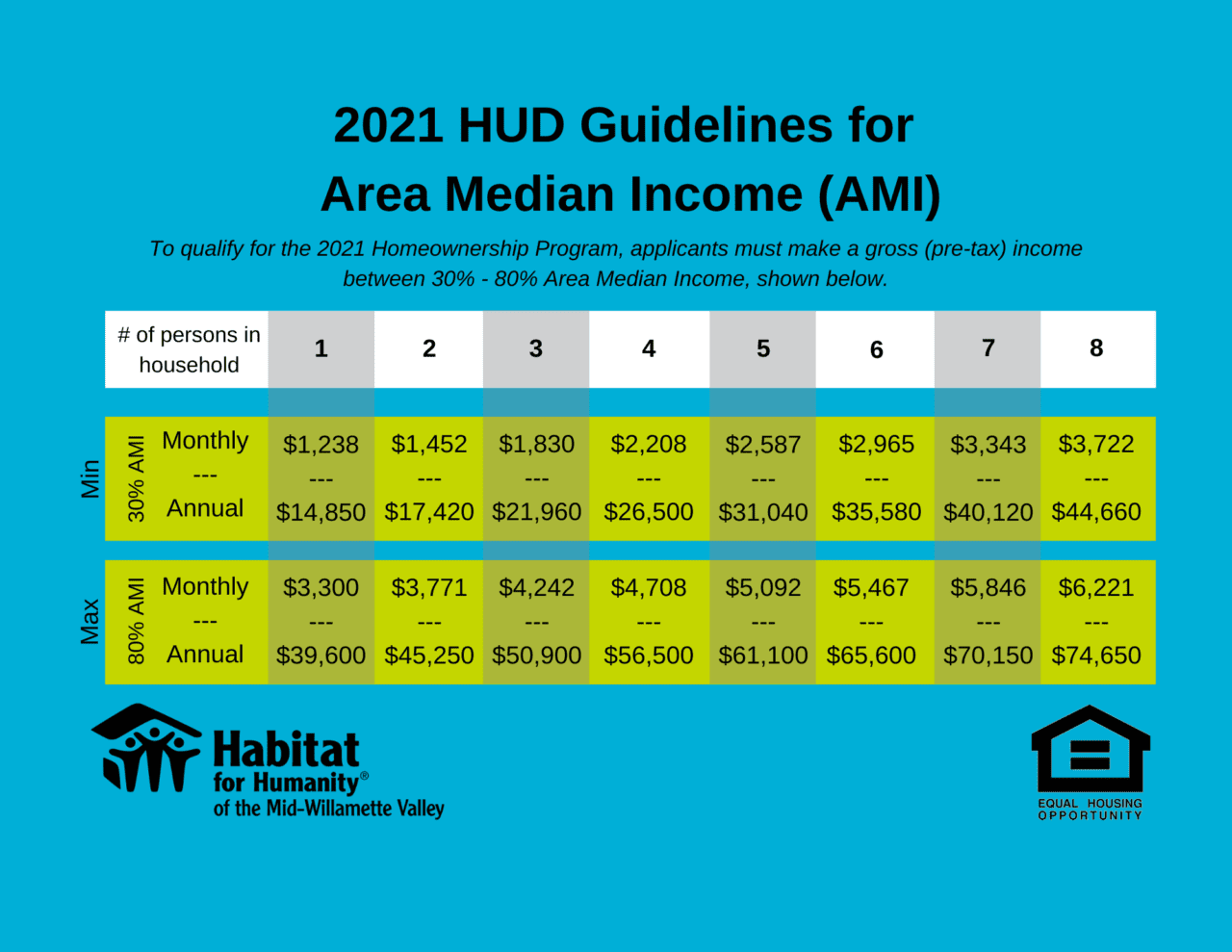

How Do I Qualify As Low Income For HUD Senior Housing

https://www.eldercaredirection.com/wp-content/uploads/2019/01/How-Do-I-Qualify-As-Low-Income-for-HUD-Senior-Housing_.png

General information for corporations on how to complete page 3 of the T2 Corporation Income Tax Return Personal income tax Manitoba tax information for 2024 Use the information on this page to help you complete your provincial tax and credits form

Just how much tax can you save You save tax by investing in a retirement annuity But the amount of tax you save depends on your income level This table shows how much tax you Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

More picture related to Income Guidelines For Hud Senior Housing

How Do I Qualify As Low Income For HUD Senior Housing

https://www.eldercaredirection.com/wp-content/uploads/2019/01/How-Do-I-Qualify-As-Low-Income-for-HUD-Senior-Housing_-850x425.png

Who Qualifies For HUD Senior Housing

https://assets-us-01.kc-usercontent.com/ffacfe7d-10b6-0083-2632-604077fd4eca/c671bc72-5bf6-40e8-a11a-c221272bfa5e/What-Is-Section-8-Housing-iStock-1385761657-2023-7-FBLI-1200x630.jpg

Medicaid Eligibility 2022

https://www.macpac.gov/wp-content/uploads/2022/05/PIE-CHART-Share-of-Dually-Eligible-Population-by-Medicaid-Eligibility-Pathways.png

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income tax rates apply

[desc-10] [desc-11]

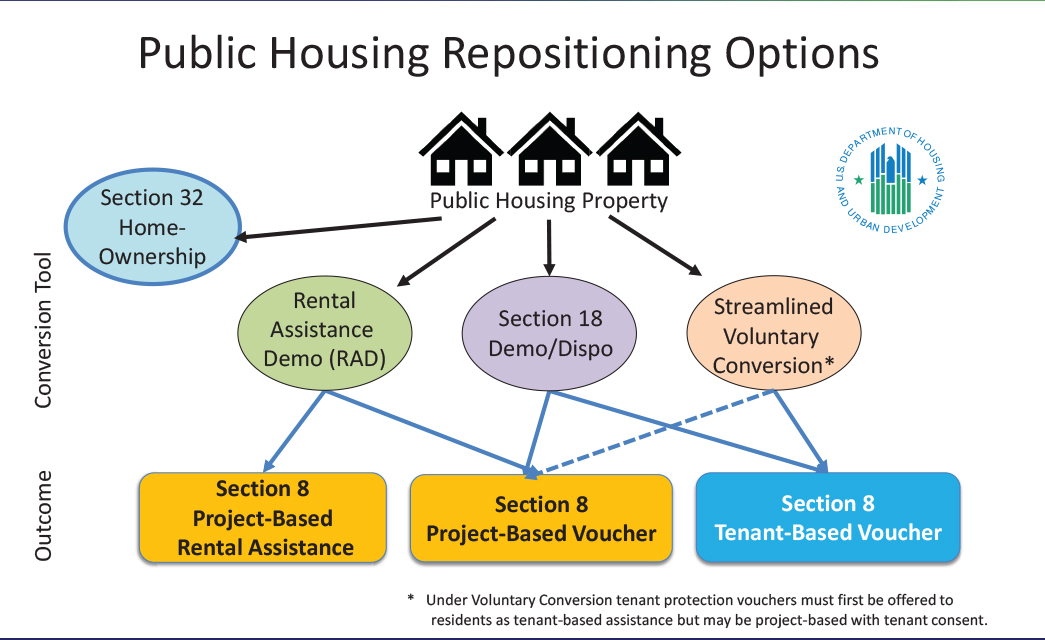

Senior Hud Housing Programs

https://www.seniorlifestyle.com/wp-content/uploads/2016/10/Housekeeper_badge-edit.jpg

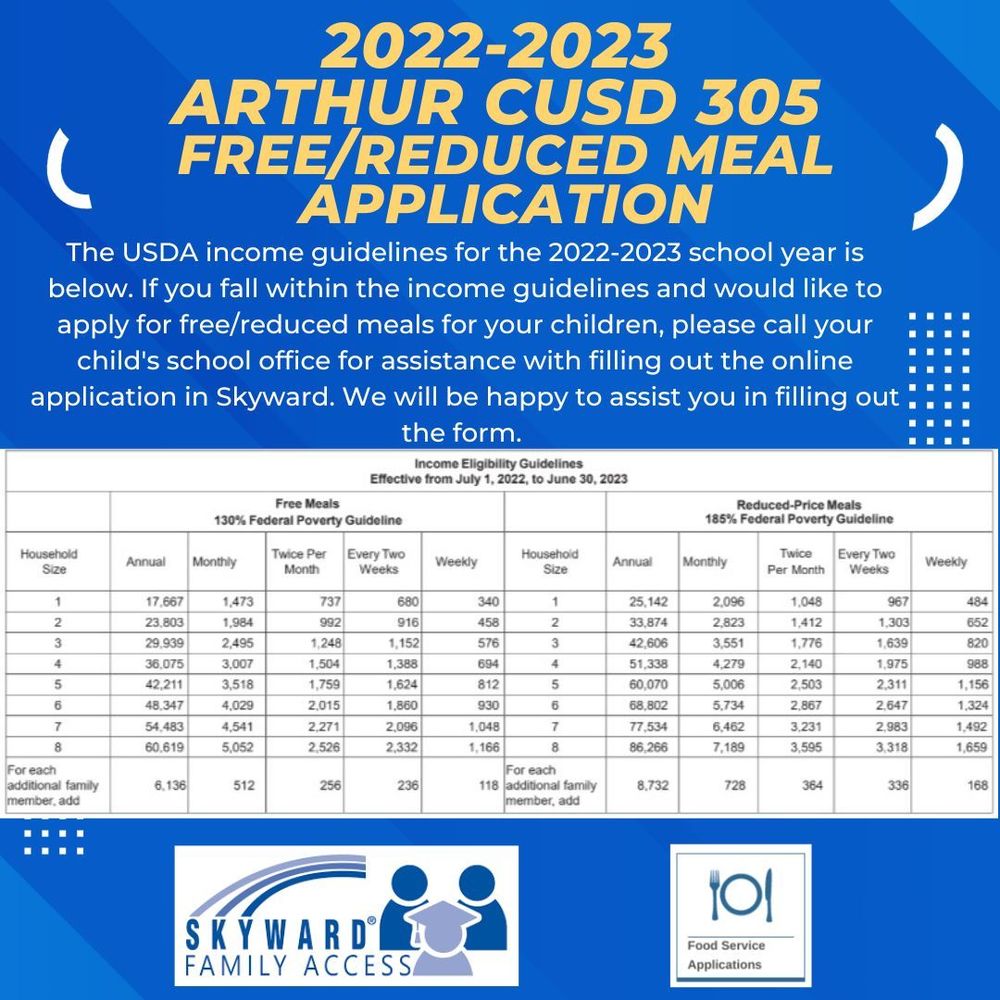

Affordability Denver Catholic Schools

https://denvercatholicschools.com/wp-content/uploads/2023/01/Eligibility-Guide2-soh-1536x1379.jpg

https://www.canada.ca › en › services › benefits › publicpensions › old-a…

For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

Affordability Denver Catholic Schools

Senior Hud Housing Programs

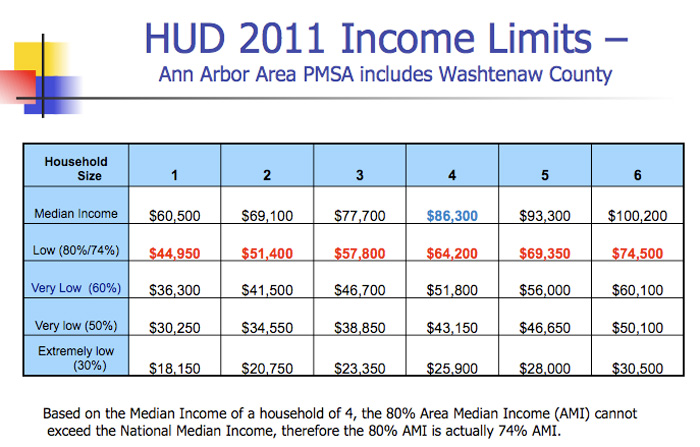

Hud Median Income Limits 2024 Texas Terza Georgine

Affordability Denver Catholic Schools

ISBE Releases Income Guidelines For Free reduced priced Meals At Child

Income Calculation Worksheet For Hud

Income Calculation Worksheet For Hud

What Is The Most To Qualify For Low Income Housing Leia Aqui Who

The Top HALA Recommendations For Seattle s Affordable Housing Future

The Ann Arbor Chronicle Ann Arbor Housing Commission To Expand

Income Guidelines For Hud Senior Housing - General information for corporations on how to complete page 3 of the T2 Corporation Income Tax Return