Income Tax E Filing Receipt Download Your income It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year 90 997 for

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

Income Tax E Filing Receipt Download

Income Tax E Filing Receipt Download

https://wallpapercave.com/wp/wp10454607.jpg

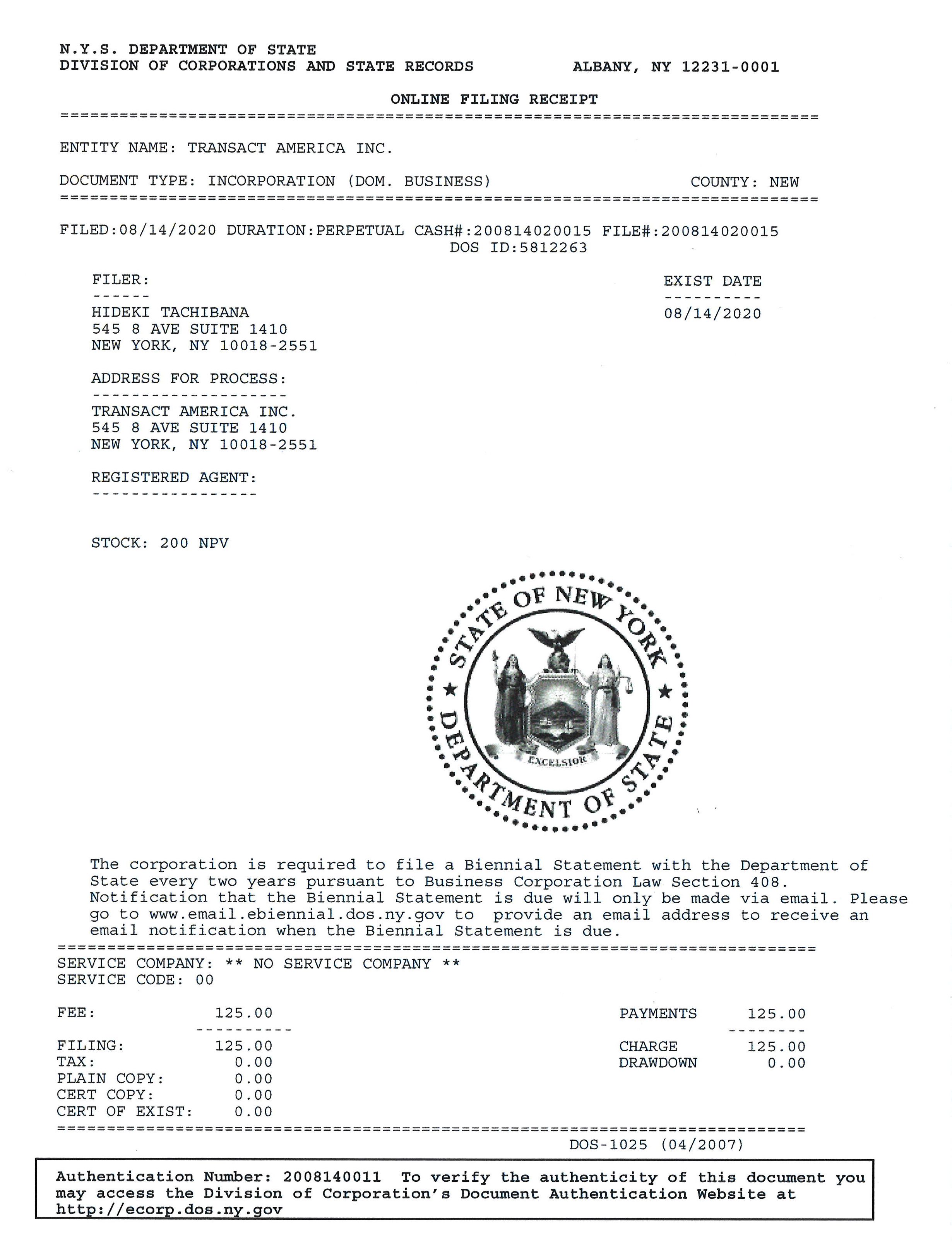

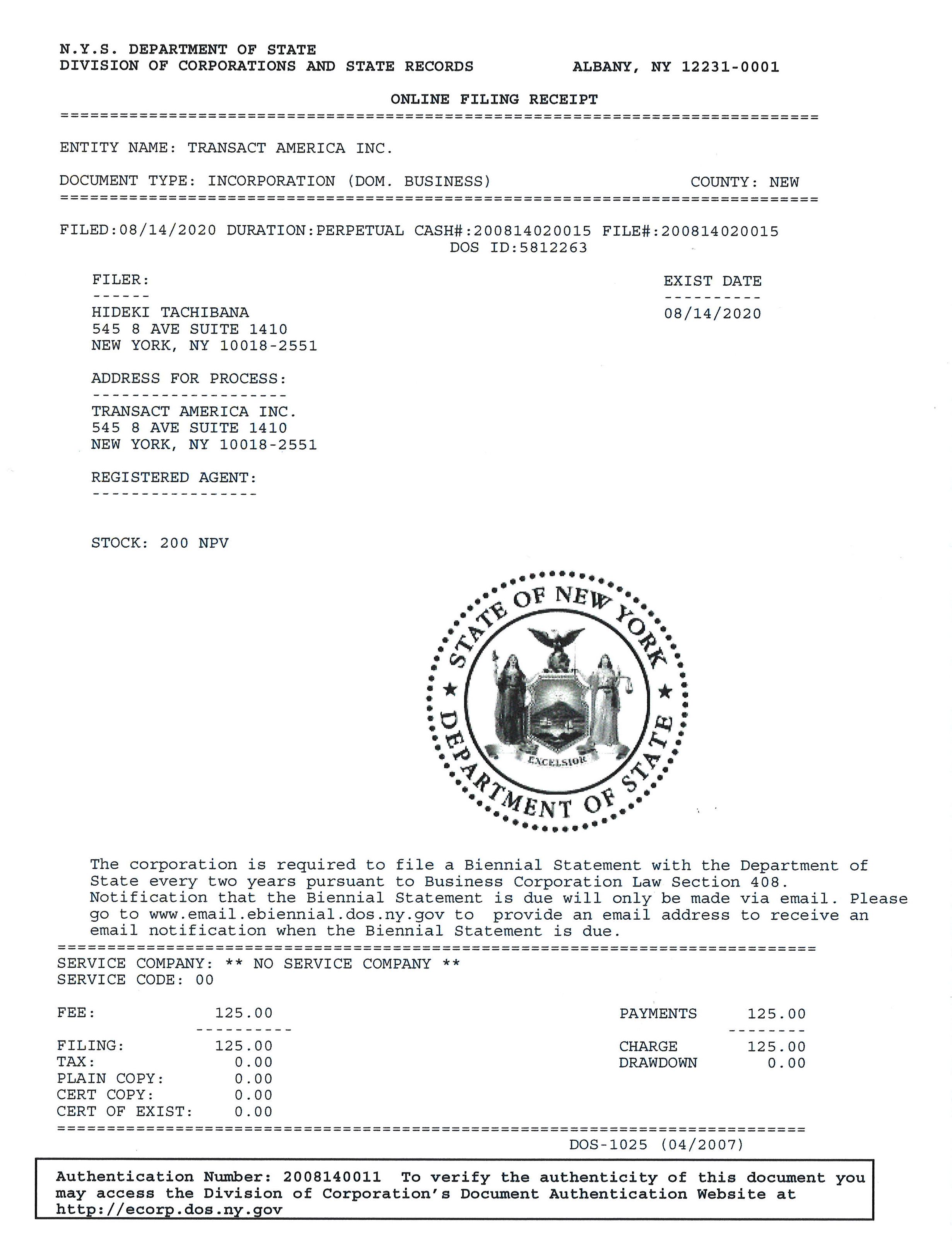

ONLINE FILING RECEIPT TransACT America Inc New York

https://cdn.goope.jp/165894/201026160556-5f967554300a9.jpg

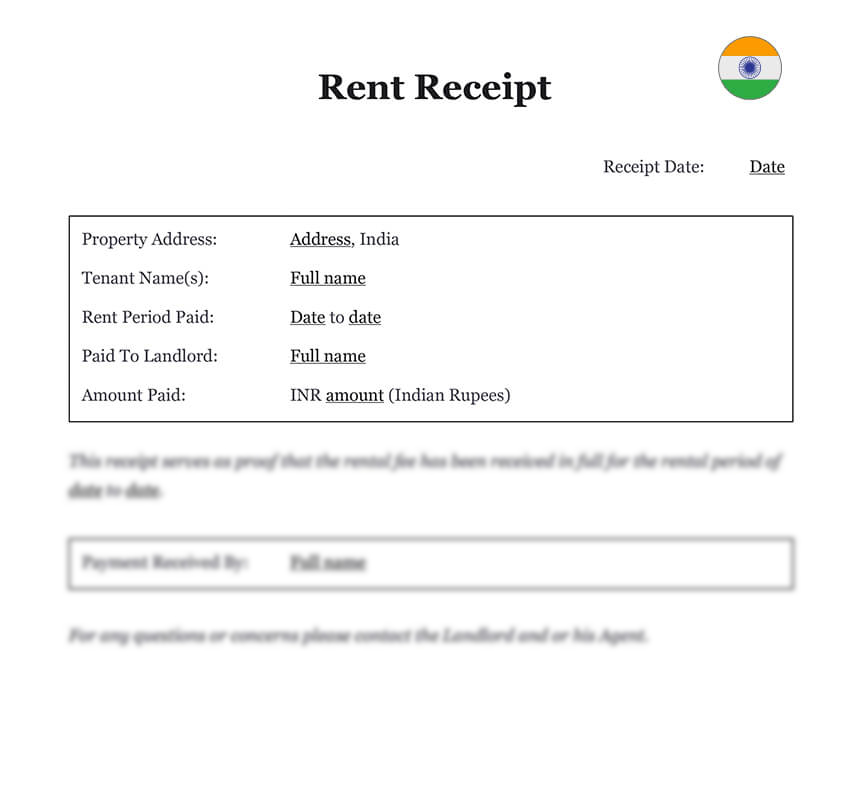

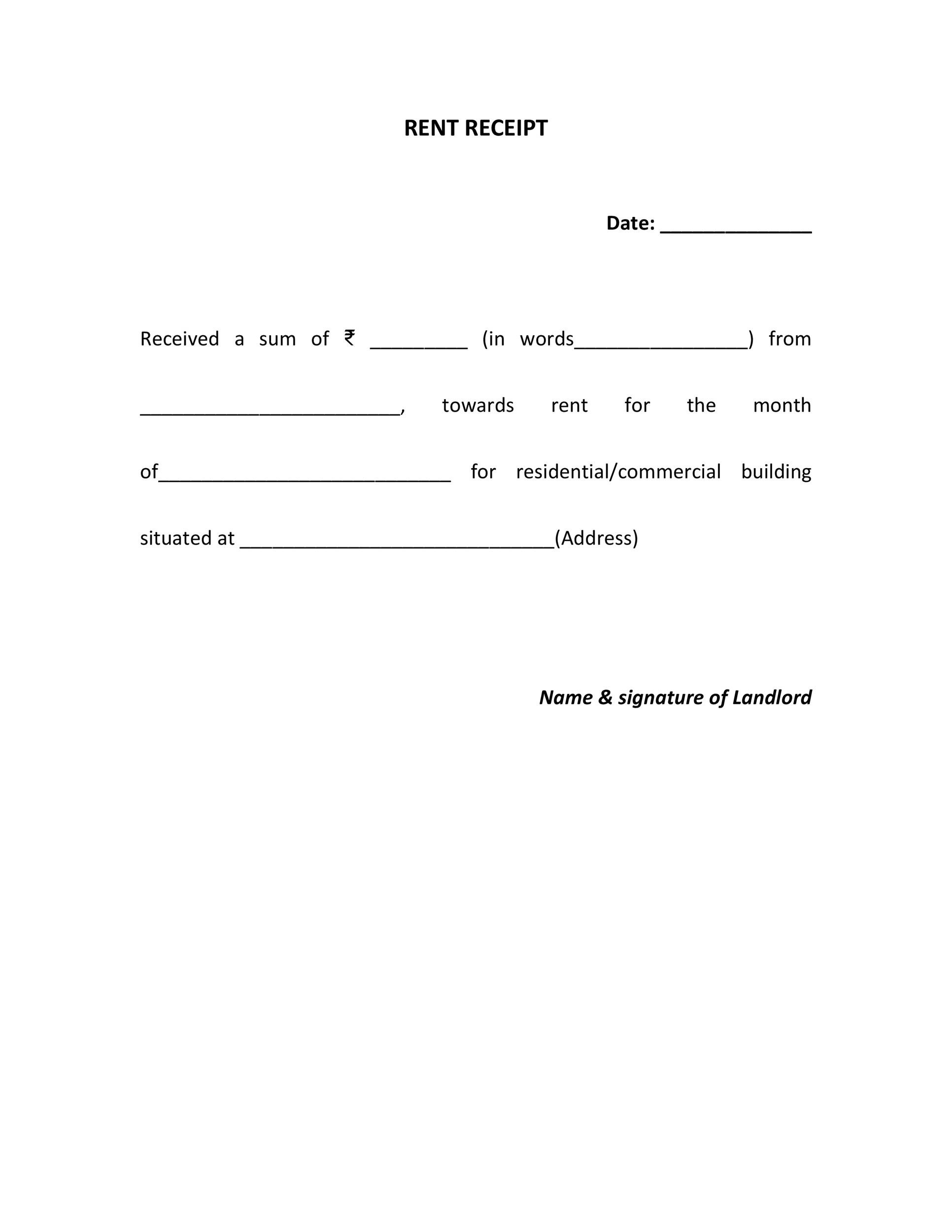

Rent Receipt Rent Receipt India Format Word

https://india.themispartner.com/wp-content/uploads/rent-receipt-india.jpg

NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers

Personal income tax How to file a tax return You may choose to do your own taxes or have someone else do them for you using tax software or on paper If eligible you may be You may request changes to an assessed income tax and benefit return if you need to correct amounts or forgot to include information on your return You must wait until you receive your

More picture related to Income Tax E Filing Receipt Download

Borang E Lhdn Vrogue co

https://ecentral.my/wp-content/uploads/2023/01/edaftar-cukai-lhdn.jpg

ITR E verification Taxation Trading Q A By Zerodha All Your

https://assets.learn.quicko.com/wp-content/uploads/2020/08/22135946/ITR-V-2020-21-1.png

![]()

Partner With KDK Software Partners

https://www.kdksoftware.com/assets/img/logo/kdk_icon_1200x1200.png

The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide What services are covered On this page Services covered How much will be covered Services covered The Canadian Dental Care Plan CDCP will help pay a portion of the cost for a wide

[desc-10] [desc-11]

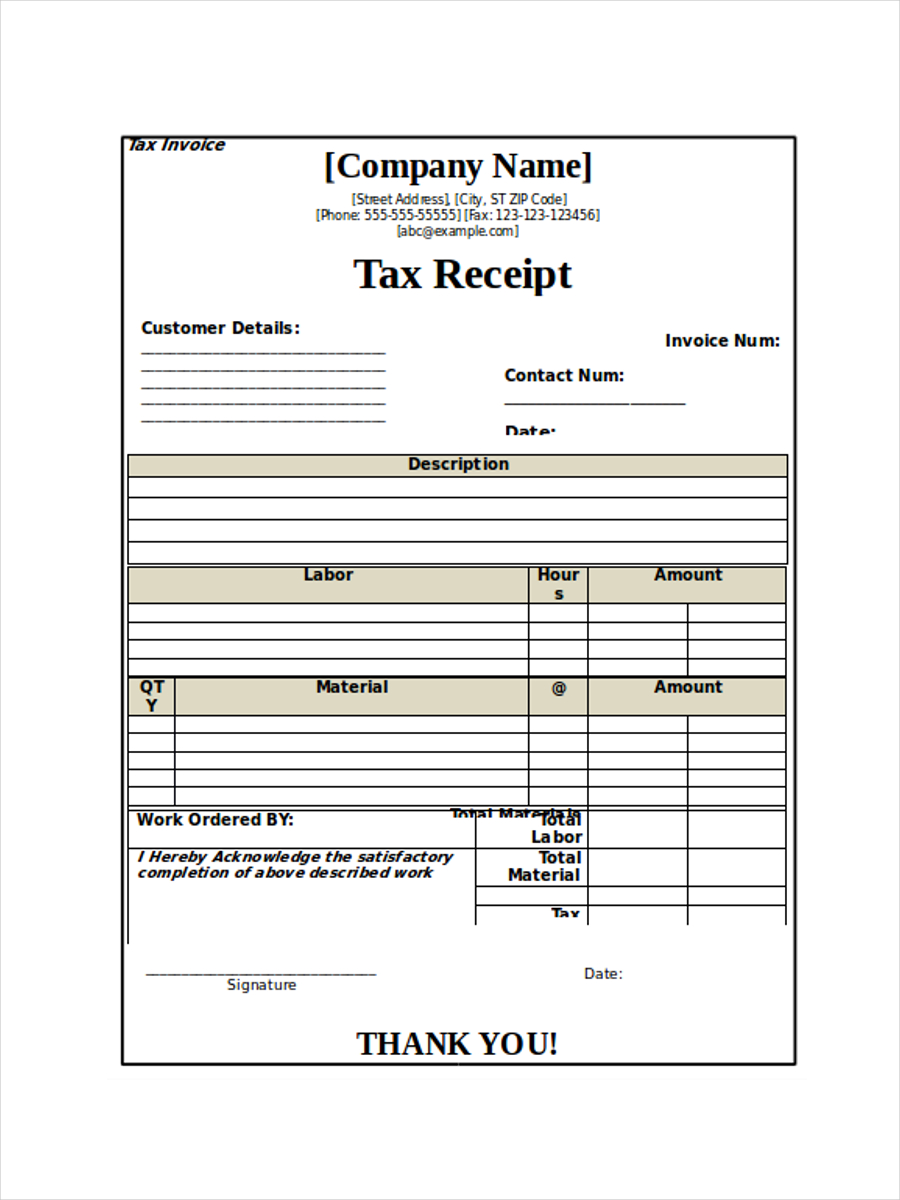

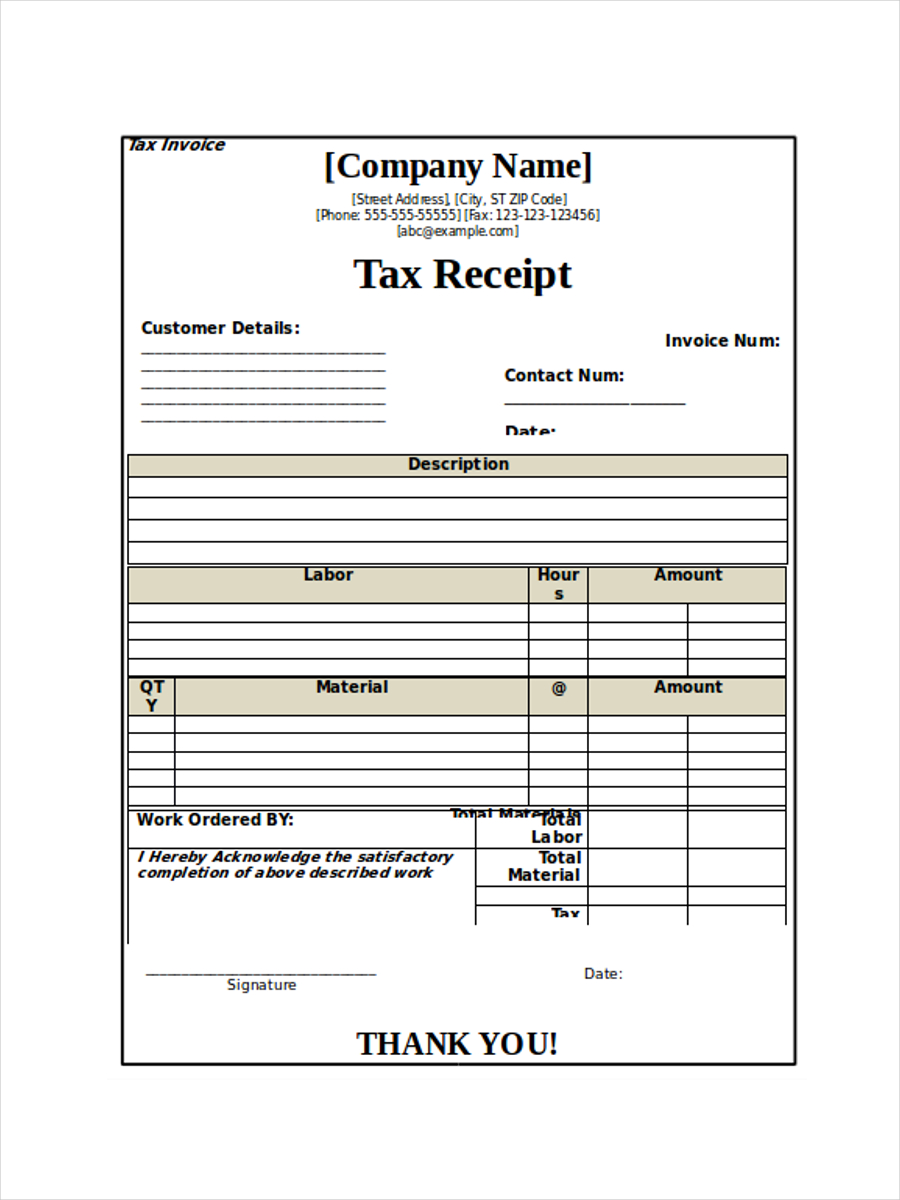

8 Tax Receipt Examples To Download

https://images.examples.com/wp-content/uploads/2017/05/Blank-Tax-Receipt-Sample1.jpg

ITR DUE DATES AY 2023 2024 Archives SuperCA

https://superca.in/news/wp-content/uploads/2023/03/due-dates-for-itr-filing-ay-2023-2024.jpg

https://www.canada.ca › en › services › benefits › publicpensions › old-a…

Your income It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year 90 997 for

https://www.canada.ca › en › department-finance › news › delivering-a-…

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

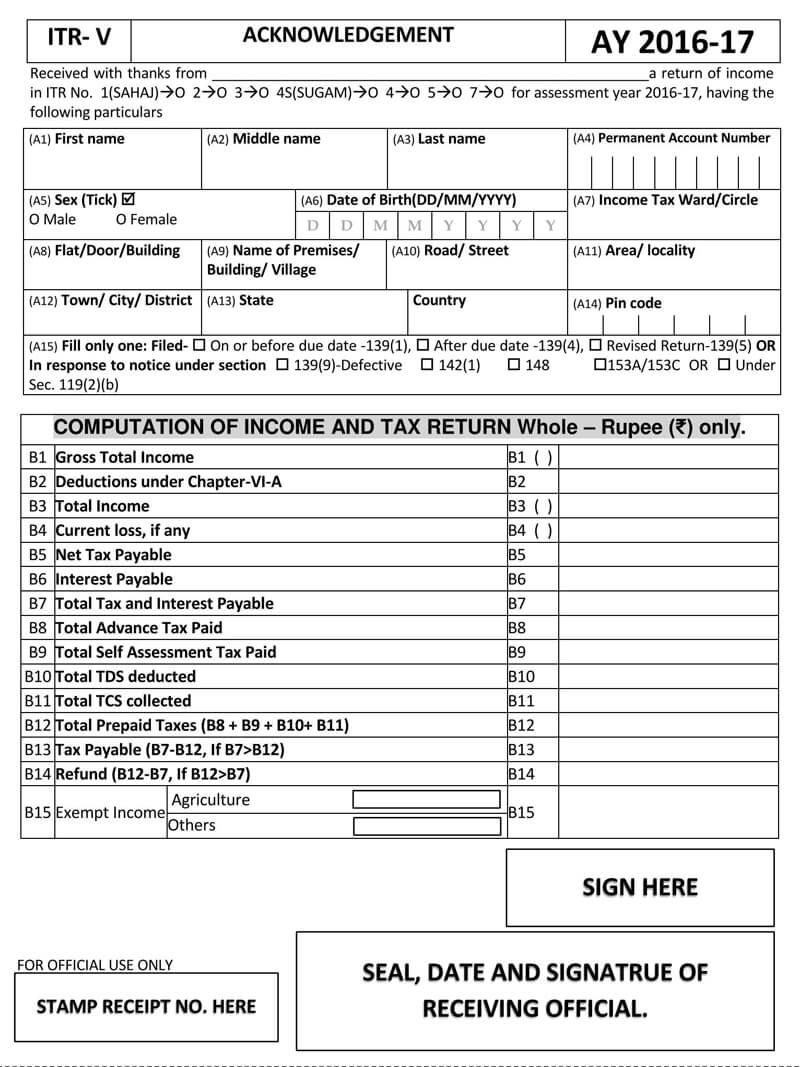

15 Free Acknowledgement Receipt Templates Samples

8 Tax Receipt Examples To Download

Personal Income Tax

First Date To File Taxes 2025 Josephine J Torres

Ontario Rent Receipt Template With Signature Digestaso

Calendar Day Calculator 2024 Calendar Faith Jasmine

Calendar Day Calculator 2024 Calendar Faith Jasmine

Tax Day 2025 Date Extension Christine Maize

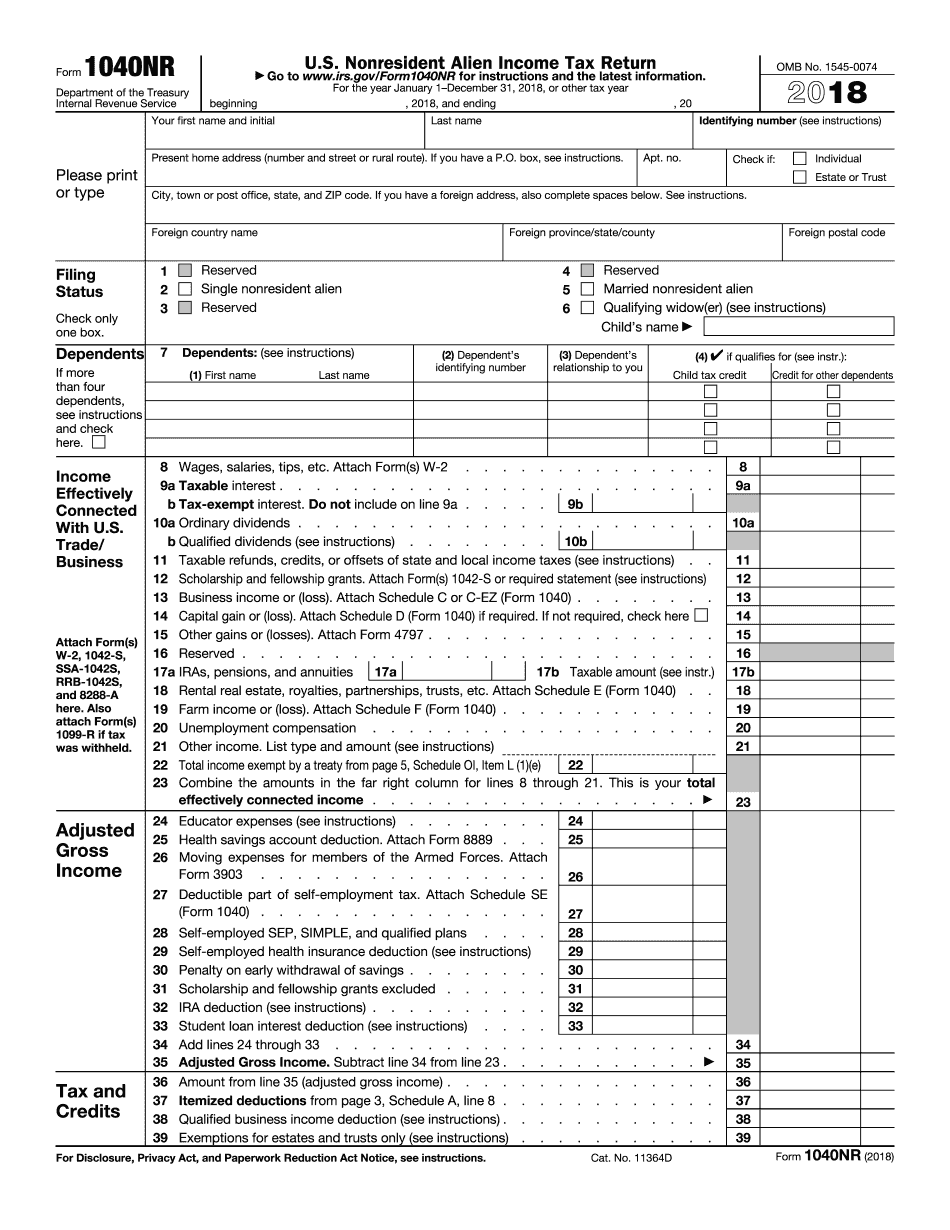

Income Tax E Filing Form Download Osekits

Tax Brackets 2025 Married Jointly Calculator Tilde A Holst

Income Tax E Filing Receipt Download - [desc-13]