Inherited Roth Ira 5 Year Rule Irs A Roth IRA is also subject to a five year inheritance rule The beneficiary must liquidate the entire value of the inherited IRA by Dec 31 of

5 year rule The 5 year rule requires the IRA beneficiaries who are not taking life expectancy payments to withdraw the entire balance of the IRA by December 31 of the year containing the Learn the required minimum distributions for your designated IRA beneficiaries

Inherited Roth Ira 5 Year Rule Irs

Inherited Roth Ira 5 Year Rule Irs

https://i.ytimg.com/vi/v5a2OguyI3E/maxresdefault.jpg

What Is The 5 Year Rule For Roth IRA Conversion YouTube

https://i.ytimg.com/vi/yqUmQpayT70/maxresdefault.jpg

Mastering The Two 5 Year Rules Of Roth IRA Investing YouTube

https://i.ytimg.com/vi/Uyz4Wq12Me0/maxresdefault.jpg

Earnings withdrawn from Roth IRAs less than five years old are subject to income tax at your ordinary tax rate plus a penalty The passage of the SECURE Act changed how the distribution time The 5 year rule for inherited IRAs dictates the timeframe within which beneficiaries must withdraw funds from an inherited account This rule applies to both traditional and Roth

Under the 5 Year Rule the assets are transferred to an inherited Roth IRA in your name You can spread out the distributions but you must withdraw all the assets from the account by Dec 31 of If you are inheriting a Roth IRA as a spouse you have several options including opening an Inherited IRA You transfer the assets into your own existing or new Roth IRA At any time but earnings generally will be taxable until you reach

More picture related to Inherited Roth Ira 5 Year Rule Irs

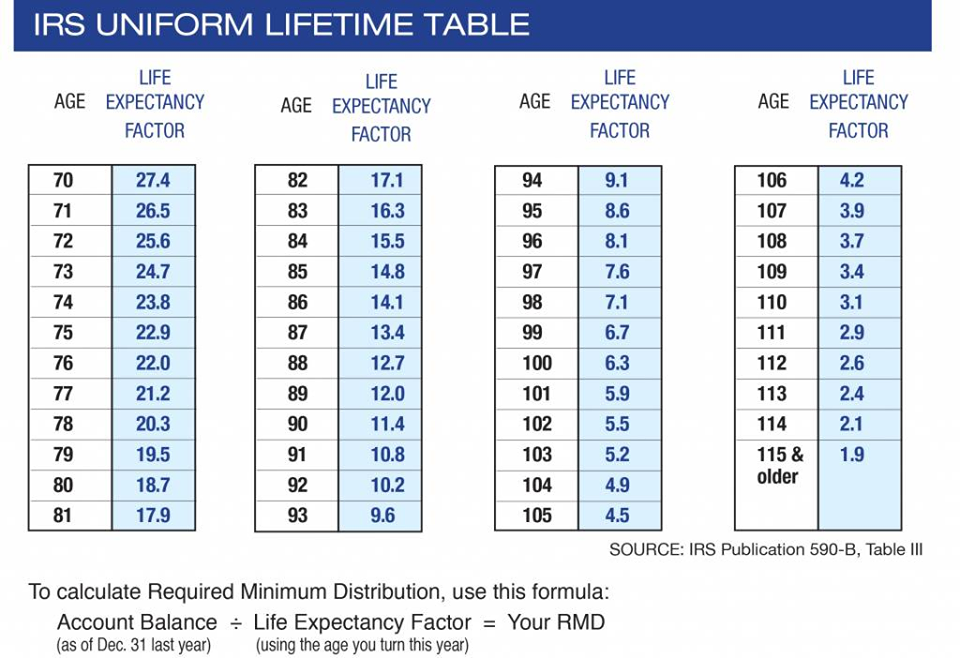

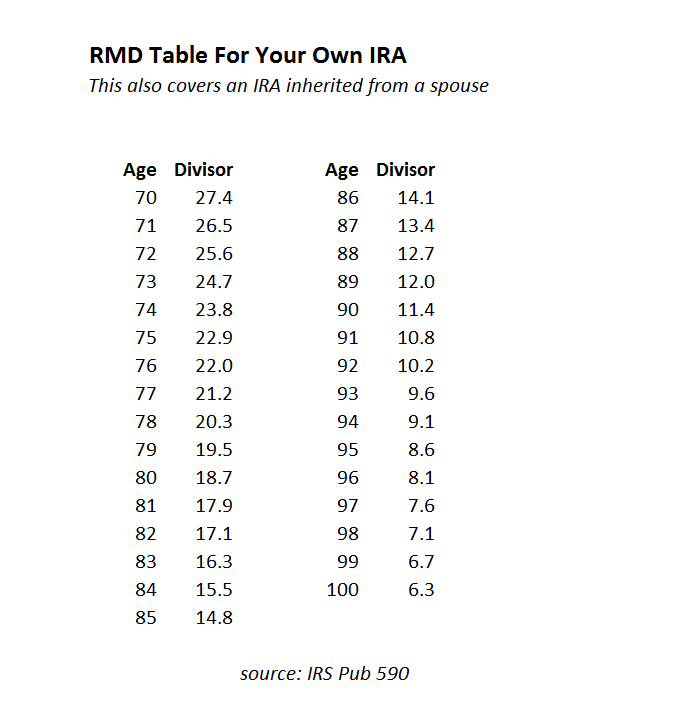

Rmd Table 2024 Deana Estella

https://michaelryanmoney.com/wp-content/uploads/2022/07/RMD-New-Uniform-Lifetime-Tables-2022-750x579.jpg

Rmd Calculator 2025 Aarp Medicare Otis G Hawkins

https://www.mrbaccounting.com/uploads/7/1/9/8/7198582/rmd-table_orig.png

Rmd Table 2025 Pdf Free Windy Lilian

http://www.jhwfs.com/wp-content/uploads/2018/06/Inherited-IRA-Flowchart.jpg

Withdrawal rules that apply to inherited Roth IRAs are slightly different because the original owner was never required to take an RMD from their account Review the rules below to learn more What Is the Five Year Rule for Roth IRAs The five year rule applies in three situations You withdraw earnings from your Roth IRA You convert a traditional IRA to a Roth

If the assets were in a Roth IRA beneficiaries are not taxed on the withdrawal as long as the Roth IRA was funded for five years or more Finally realize that inherited IRAs aren t exempt from creditors The Roth IRA 5 year rule refers to a waiting period in which you can make penalty and tax free withdrawals from your Roth IRA The 5 year rule applies to three specific

Rmd Table 2025 Pdf 2025 Nani Michaela

https://michaelryanmoney.com/wp-content/uploads/2022/07/RMD-New-Uniform-Lifetime-Tables-2022.jpg

Inherited Ira Rules 2024 Perla Kristien

https://www.newcenturyinvestments.com/wp-content/uploads/2019/08/inherited-IRA.png

https://www.investopedia.com › terms › fiv…

A Roth IRA is also subject to a five year inheritance rule The beneficiary must liquidate the entire value of the inherited IRA by Dec 31 of

https://www.irs.gov › publications

5 year rule The 5 year rule requires the IRA beneficiaries who are not taking life expectancy payments to withdraw the entire balance of the IRA by December 31 of the year containing the

Rmd Tax Factors For 2025 Carey Maurita

Rmd Table 2025 Pdf 2025 Nani Michaela

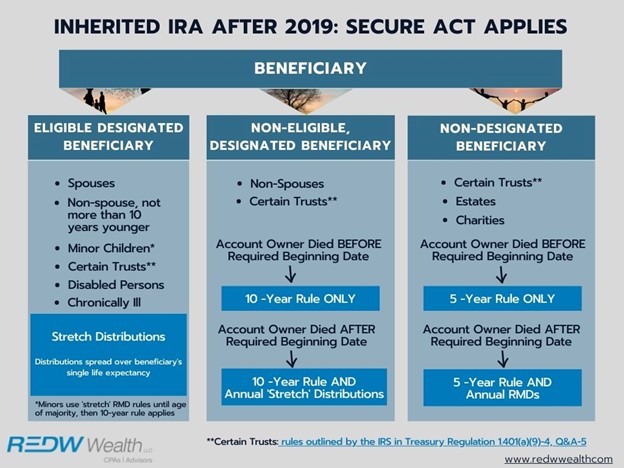

Inherited IRA Required Distributions REDW Financial Advisors CPAs

Aarp Rmd Calculator 2025 Table Reta Rosemarie

Irs Rmd Factor Tables 2023

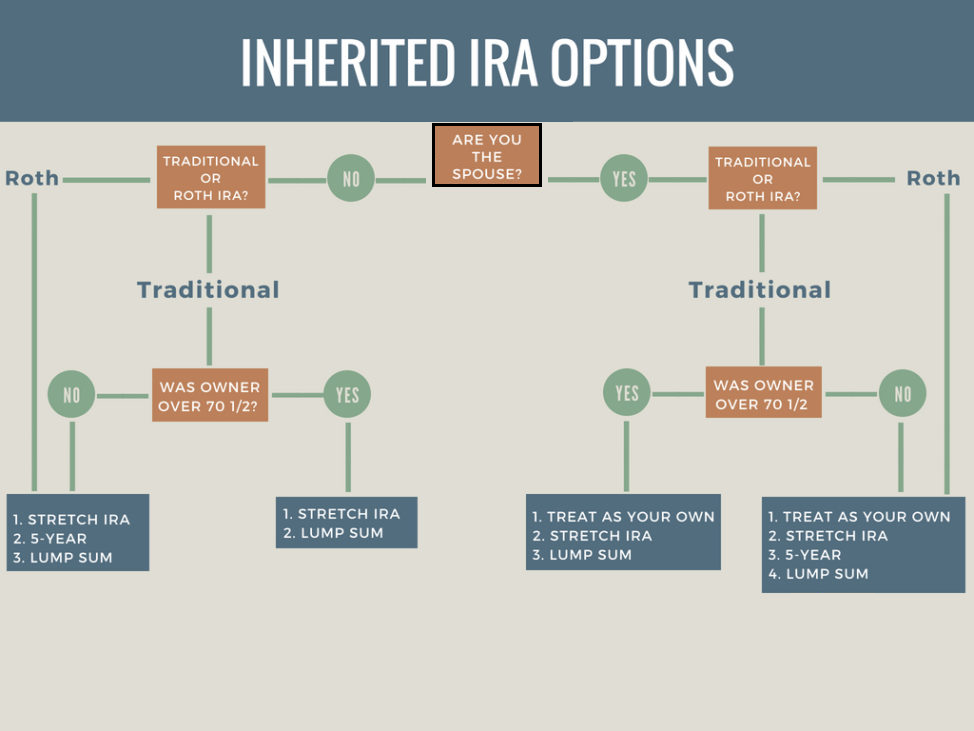

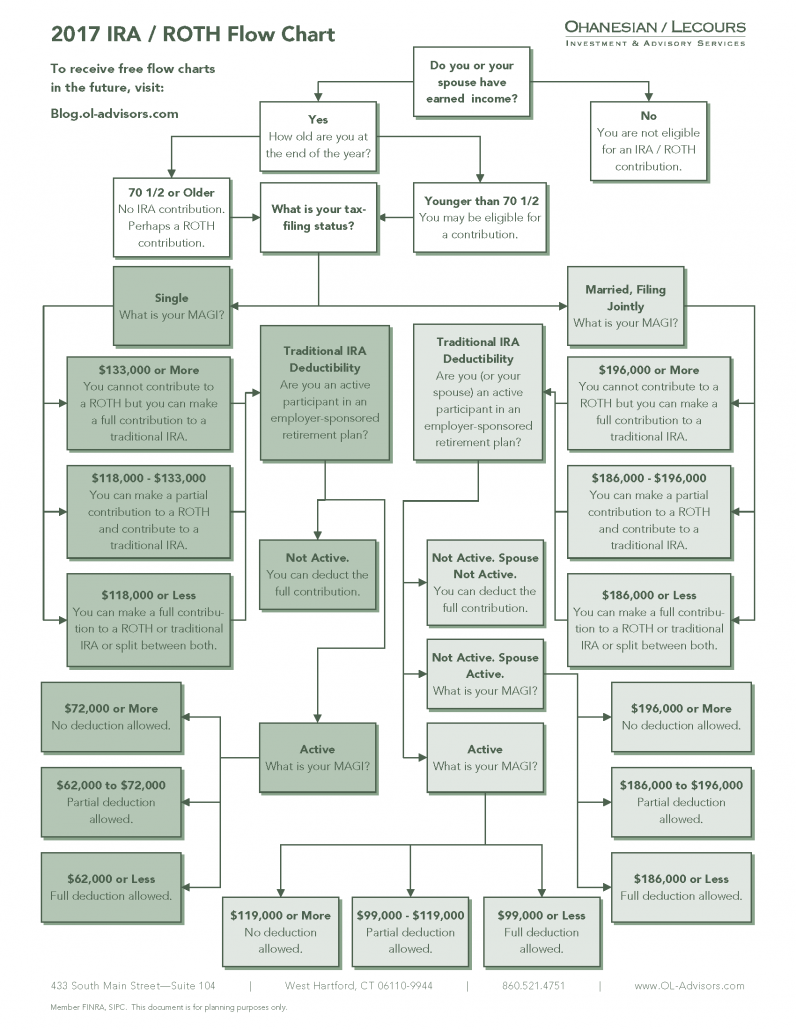

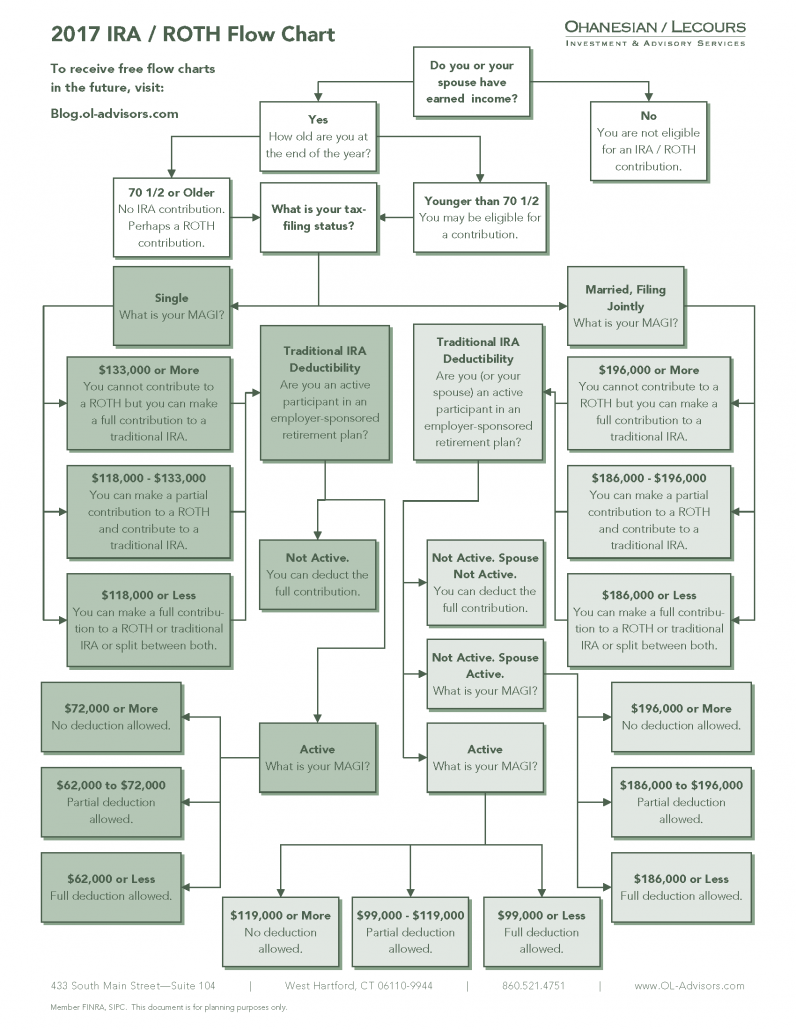

Visualizing IRA Rules Using Flowcharts

Visualizing IRA Rules Using Flowcharts

Irs Rmd Factor Tables 2023

Rmd Table 2025 Inherited Ira To Roth Lila Maysa

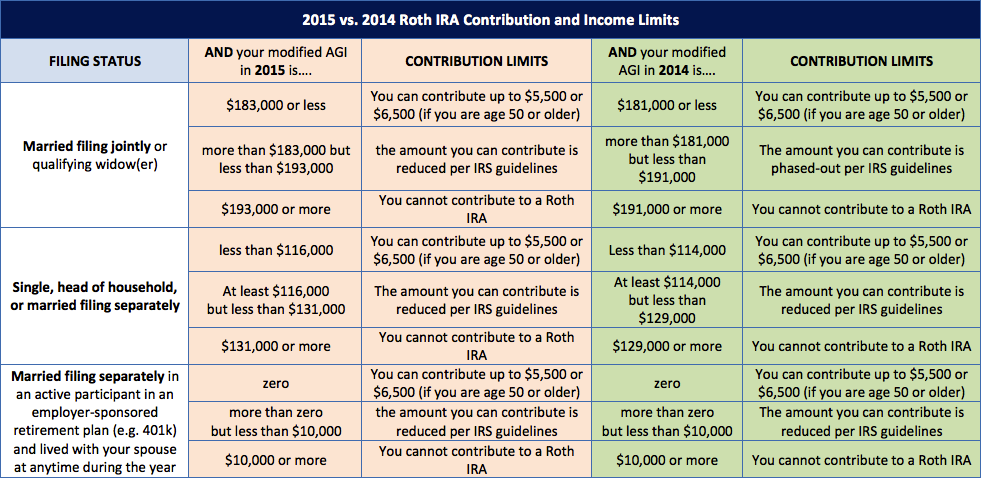

2015 Official IRS IRA Roth IRA And 401K Contribution Limits aving

Inherited Roth Ira 5 Year Rule Irs - If you are inheriting a Roth IRA as a spouse you have several options including opening an Inherited IRA You transfer the assets into your own existing or new Roth IRA At any time but earnings generally will be taxable until you reach