Irs Business Code Number Prepare and file your federal income tax return online for free File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms It s safe easy and

Application for IRS Individual Taxpayer Identification Number Get or renew an individual taxpayer identification number ITIN for federal tax purposes if you are not eligible for a social security Your refund was used to pay your IRS tax balance or certain state or federal debts Your refund from a joint return was applied to your spouse s debts If your refund is missing or destroyed

Irs Business Code Number

Irs Business Code Number

https://www.gap.com/webcontent/0053/376/359/cn53376359.jpg

Relaxed Layering T Shirt Old Navy

https://oldnavy.gap.com/webcontent/0053/757/554/cn53757554.jpg

Smocked Mockneck Tank Top Gap

https://www.gap.com/webcontent/0053/604/805/cn53604805.jpg

View digital copies of notices from the IRS View your audit status currently available for certain audits conducted by mail Make and view payments Make a payment Pay from your IRS account Sign in or create an account to pay now or schedule a payment Individual Online Account Pay balance due payment plan estimated tax and more

See your personalized refund date as soon as the IRS processes your tax return and approves your refund See your status starting around 24 hours after you e file or 4 weeks Get free tax help from the IRS File your taxes get help preparing your return help yourself with our online tools find your local office or call us We re here to help

More picture related to Irs Business Code Number

Moto Boots Gap

https://www.gap.com/webcontent/0053/533/898/cn53533898.jpg

Match Organization Information With IRS Documentation Cheddar Up

https://support.cheddarup.com/hc/article_attachments/10927892730900

When Is Irs Processing Returns 2024 Colly Robinette

https://savingtoinvest.com/wp-content/uploads/2022/02/image-26-768x658.png

If you can t solve your tax issues online you can find your local IRS Tax Assistance Center TAC services offered office hours and how to schedule an appointment Any state tax preparation or non qualifying fees must be disclosed on the trusted partner s IRS Free File landing page Important Note A state tax return is not required to receive a free

[desc-10] [desc-11]

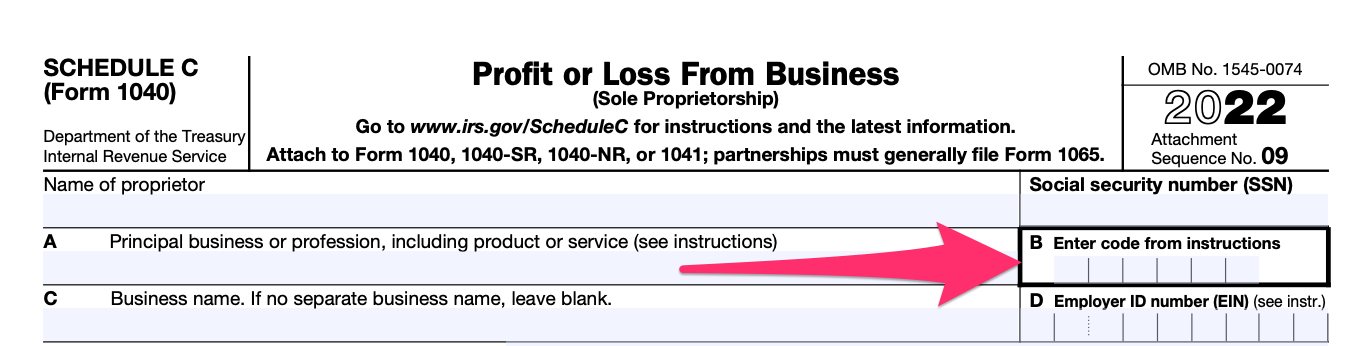

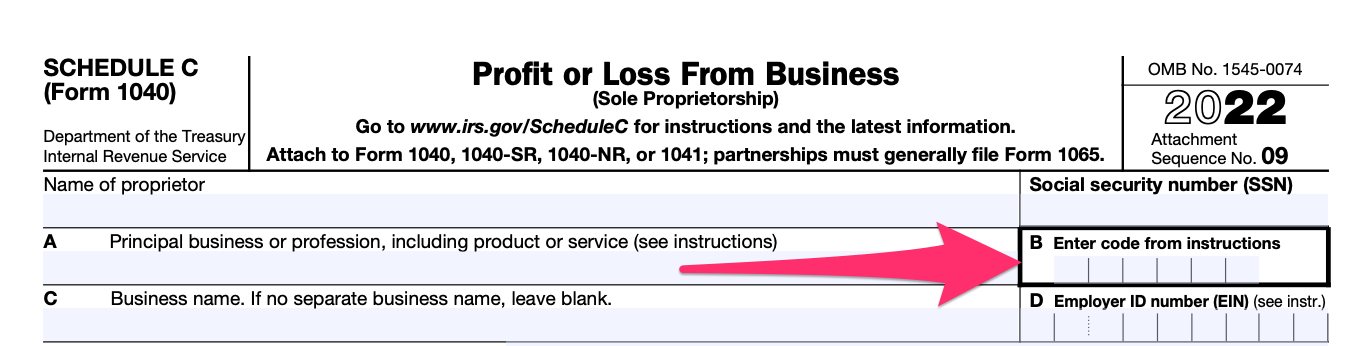

Irs Naics Codes 2022

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6477d5cc9b6a3efa0e4d2a61_business-code-for-taxes-schedule-c.png

Digna Drummond

https://savingtoinvest.com/wp-content/uploads/2022/02/image-2.png

https://www.irs.gov › file-your-taxes-for-free

Prepare and file your federal income tax return online for free File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms It s safe easy and

https://www.irs.gov › form

Application for IRS Individual Taxpayer Identification Number Get or renew an individual taxpayer identification number ITIN for federal tax purposes if you are not eligible for a social security

Long Sherpa Coat Gap

Irs Naics Codes 2022

Linen Blend Shirt Gap

Flannel Big Shirt Gap

Maternity Cotton Nursing Bra Gap

Match Organization Information With IRS Documentation Cheddar Up

Match Organization Information With IRS Documentation Cheddar Up

:max_bytes(150000):strip_icc()/ScheduleB-InterestandOrdinaryDividends-c6ff80bf2c1f4de981e0b0625a4e3dc7.png)

1040 Form 2025 Schedule B Jorja Brabyn

IRS Tax Letters Explained Landmark Tax Group

CashSoft Hoodie Gap

Irs Business Code Number - Pay from your IRS account Sign in or create an account to pay now or schedule a payment Individual Online Account Pay balance due payment plan estimated tax and more