Irs Federal Gift Tax Exclusion 2024 About IRS Careers Operations and Budget Tax Statistics Help Find a Local Office

Application for IRS Individual Taxpayer Identification Number Get or renew an individual taxpayer identification number ITIN for federal tax purposes if you are not eligible Your refund was used to pay your IRS tax balance or certain state or federal debts Your refund from a joint return was applied to your spouse s debts If your refund is missing or destroyed

Irs Federal Gift Tax Exclusion 2024

Irs Federal Gift Tax Exclusion 2024

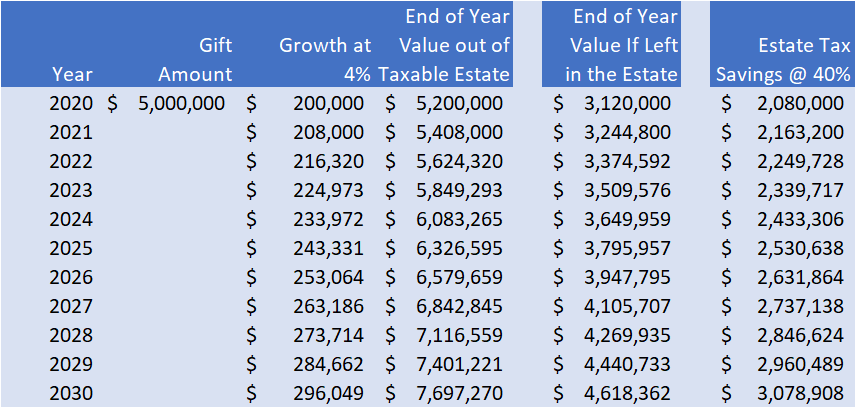

https://www.agencyone.net/wp-content/uploads/2020/08/8.26.20-table.png

2025 Gift Tax Exclusion Annual Tansy Kerstin

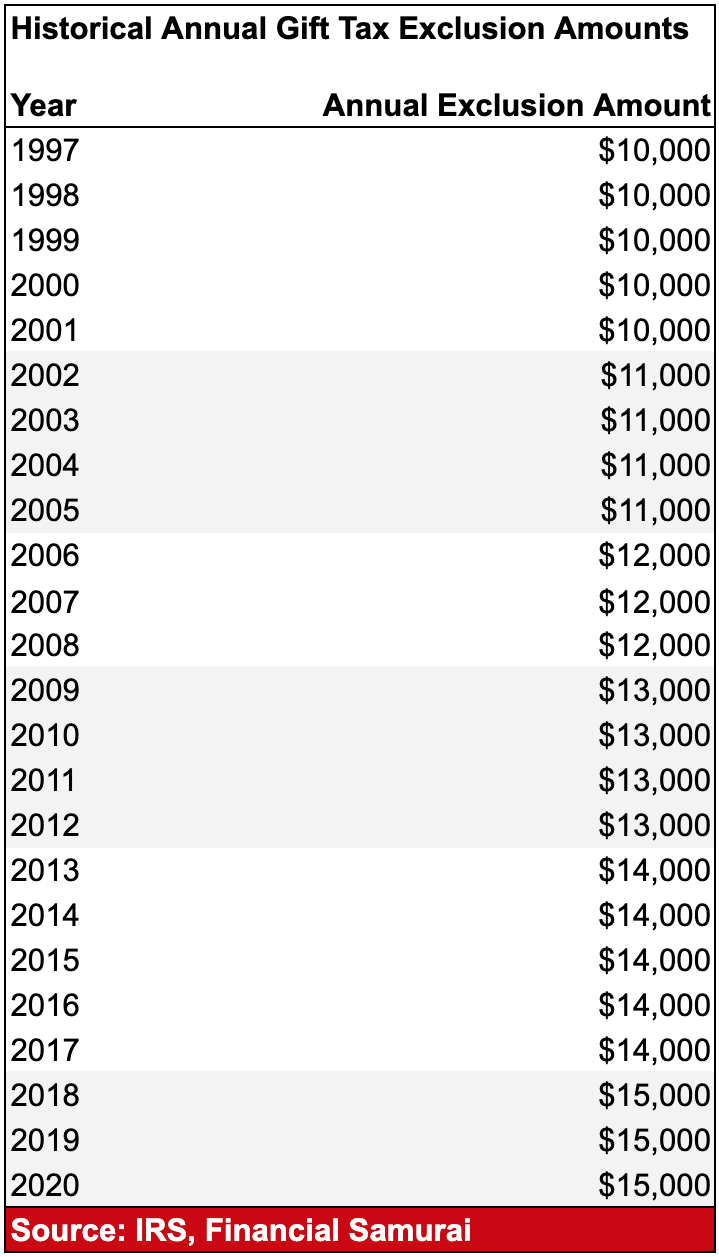

https://www.financialsamurai.com/wp-content/uploads/2020/05/historical-annual-gift-tax-exclusion-amounts.png

2025 Gift Tax Exclusion Annual Tansy Kerstin

https://learn.financestrategists.com/wp-content/uploads/Gift_Tax_Rates_for_2022.png

To make a separate assessment payment you must make that payment through IRS individual online account or by check Pay your tax balance due estimated payments or part Statutes of limitations are the time periods established by law when the IRS can review analyze and resolve your tax related issues When the statutory period expires we can no longer

See your personalized refund date as soon as the IRS processes your tax return and approves your refund See your status starting around 24 hours after you e file or 4 weeks Prepare and file your federal income tax online at no cost to you if you qualify using guided tax preparation at an IRS trusted partner site or using Free File Fillable Forms

More picture related to Irs Federal Gift Tax Exclusion 2024

2025 Gift Tax Exclusion Annual Tansy Kerstin

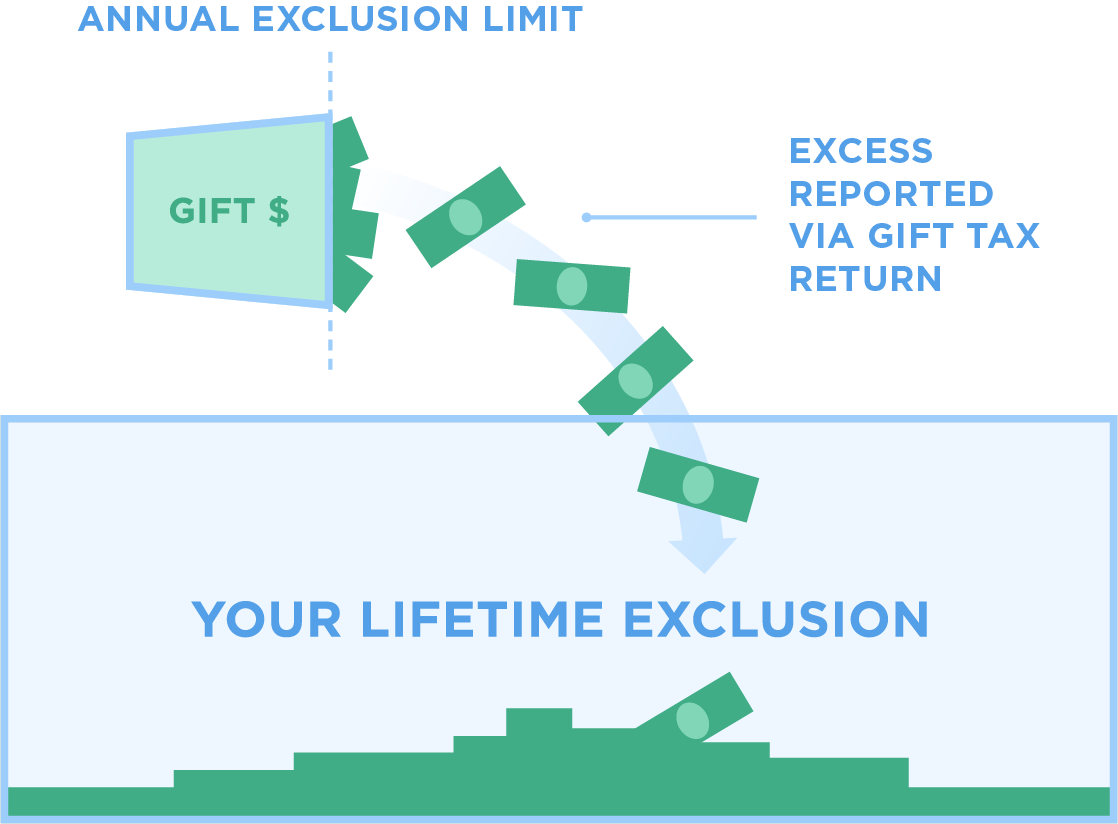

https://www.carboncollective.co/hubfs/Lifetime_Gift_Tax_Exemption.png

Charlotte Dennis News Inheritance Tax Cut 2023

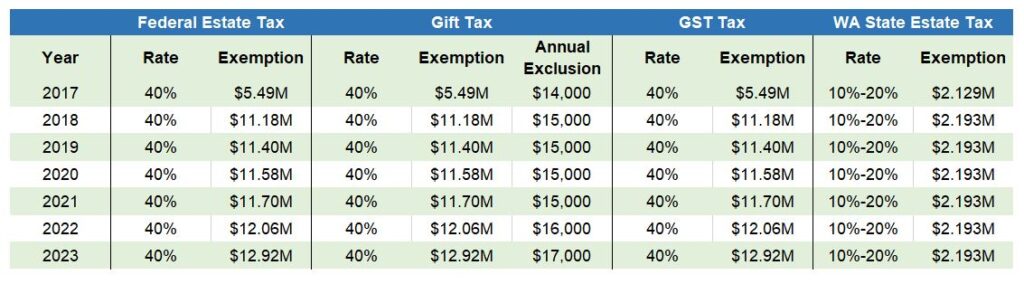

https://www.helsell.com/wp-content/uploads/23-EP-Table.jpg

Gift Tax 2024 Exclusion Kare Sandra

https://cwccareers.in/wp-content/uploads/2023/12/Gift-Tax-Limit-2024-1024x683.jpg

As long as you meet the eligibility criteria for the IRS Free File trusted partner s offer you selected you must not be charged for the electronic preparation and filing of a federal tax return Some The Internal Revenue Service IRS is the revenue service for the United States federal government which is responsible for collecting U S federal taxes and administering the

[desc-10] [desc-11]

Gift Tax Exclusion 2024 Halli Teressa

https://sederlaw.com/wp-content/uploads/2022/12/Gift-tax-1536x804.png

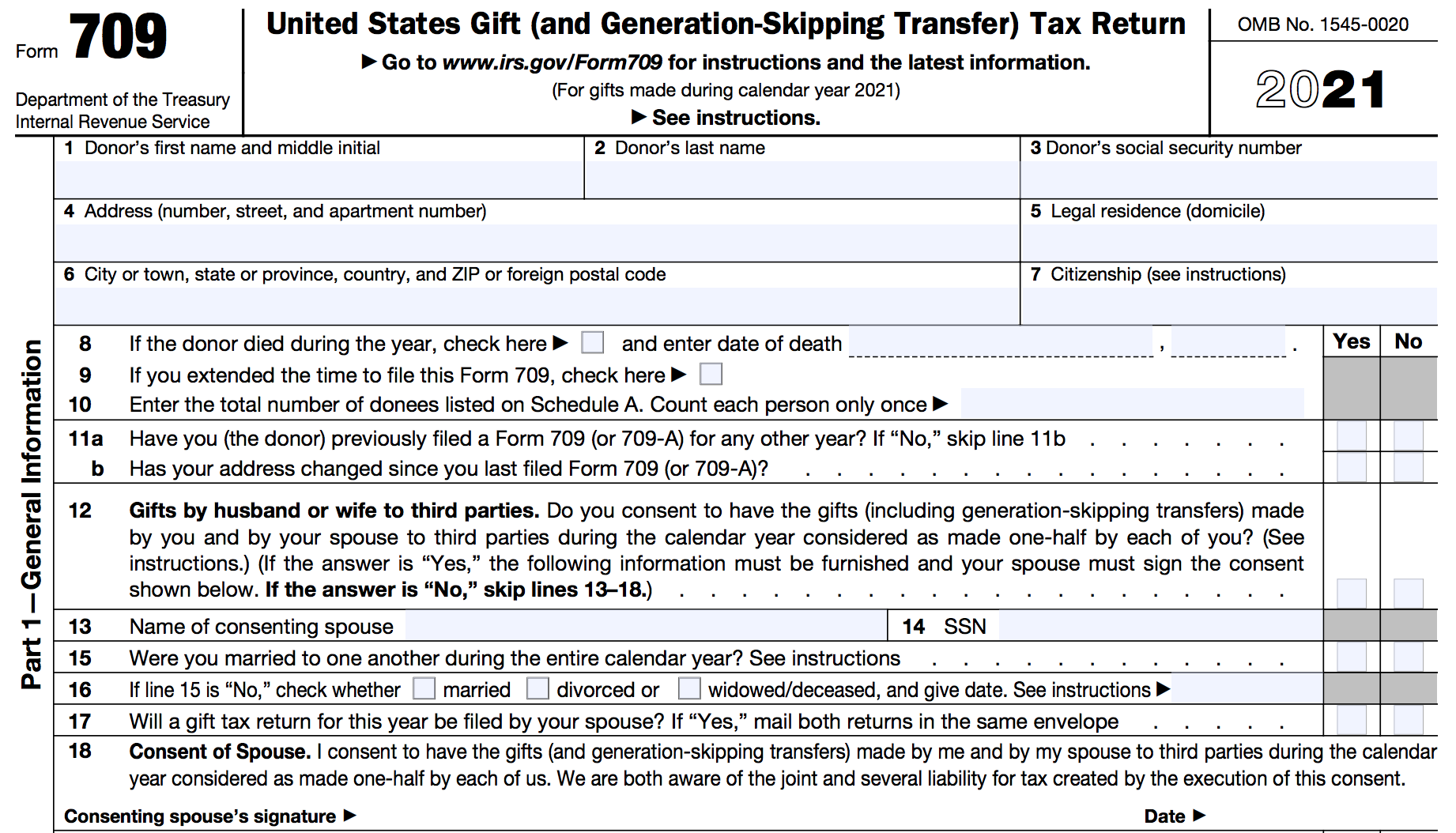

Irs Gift Tax Form 2024 Leyla Jenelle

https://dr5dymrsxhdzh.cloudfront.net/blog/images/a452f9309/2019/02/Screen-Shot-2022-01-11-at-4.38.30-PM.png

https://www.irs.gov › payments › online-account-for-individuals

About IRS Careers Operations and Budget Tax Statistics Help Find a Local Office

https://www.irs.gov › form

Application for IRS Individual Taxpayer Identification Number Get or renew an individual taxpayer identification number ITIN for federal tax purposes if you are not eligible

:max_bytes(150000):strip_icc()/ScreenShot2023-01-18at10.29.18AM-e267e40858b8414fb34572a6eb3d7594.png)

2023 Form 709 Printable Forms Free Online

Gift Tax Exclusion 2024 Halli Teressa

Irs Gift Exclusion 2024 Fiann Annabell

Lifetime Gift Tax Exclusion 2024 Calculator Loise Rachael

Gift Tax Exclusion 2025 Irs Paola Annamarie

Gift Tax Exclusion 2025 Irs Paola Annamarie

Gift Tax Exclusion 2025 Irs Paola Annamarie

Estate Tax 2023 Exemption

Gift Amount For 2024 Blair Coralie

Gift Tax 2025 Limit 2025 Images References Zara Mae

Irs Federal Gift Tax Exclusion 2024 - See your personalized refund date as soon as the IRS processes your tax return and approves your refund See your status starting around 24 hours after you e file or 4 weeks