Irs Simple Ira 2 Year Rule During the 2 year period you may transfer an amount in a SIMPLE IRA to another SIMPLE IRA in a tax free trustee to trustee transfer If during this 2 year period an amount is paid from a

There are three steps to establishing a SIMPLE IRA plan You can use Form 5304 SIMPLE PDF or Form 5305 SIMPLE PDF to set up a SIMPLE IRA plan Each form is a model Savings If you participate in your employer s SIMPLE Savings Incentive Match Plan for Employees you need to be aware of the 2 year rule that applies when moving your SIMPLE

Irs Simple Ira 2 Year Rule

Irs Simple Ira 2 Year Rule

http://www.jhwfs.com/wp-content/uploads/2018/06/Inherited-IRA-Flowchart.jpg

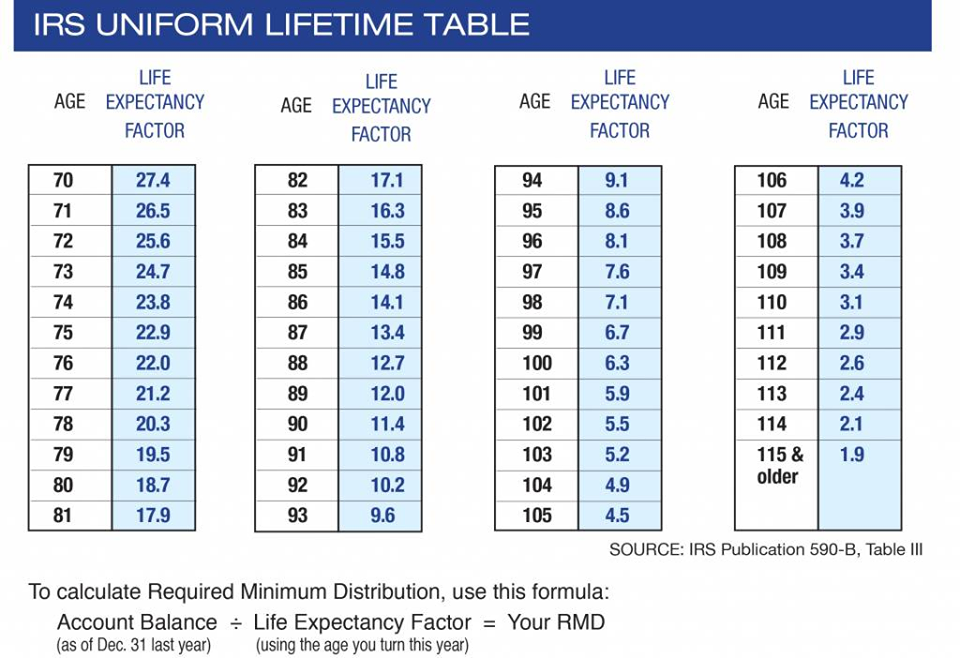

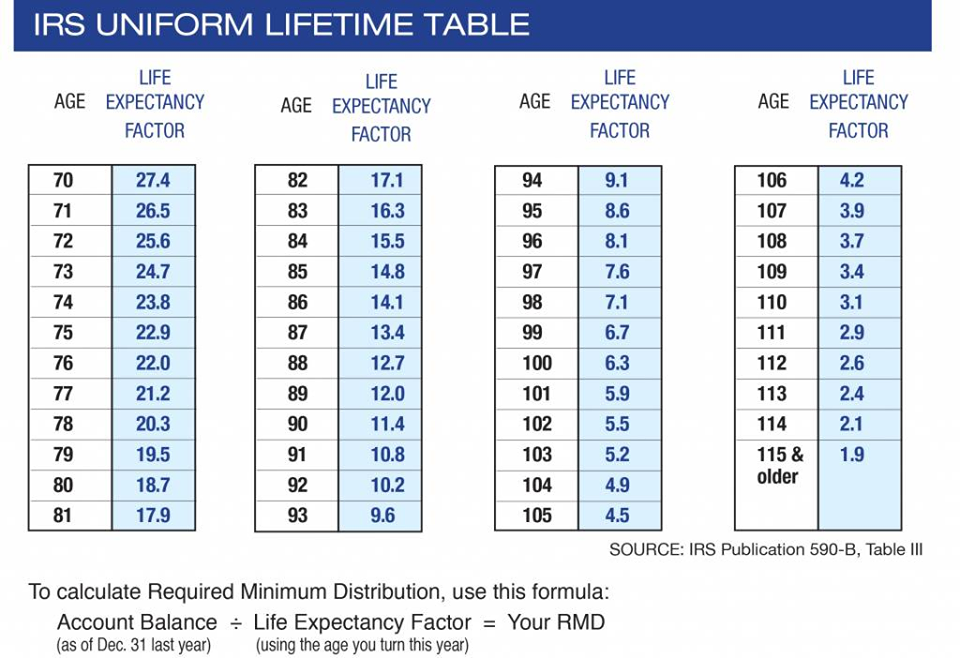

Rmd Table 2025 Pdf 2025 Nani Michaela

https://michaelryanmoney.com/wp-content/uploads/2022/07/RMD-New-Uniform-Lifetime-Tables-2022.jpg

Ira Limits 2025 Contribution Tax Eli Rami

https://meldfinancial.com/wp-content/uploads/IRA-Contribution-Limits-in-2023-846x630.jpg

After the 2 year period you can make tax free rollovers from SIMPLE IRAs to other types of non Roth IRAs or to an employer sponsored retirement plan You can also roll over money into a During the two year holding period SIMPLE IRA funds may only be rolled over or transferred to other SIMPLE IRAs SIMPLE IRA funds may not be rolled over or transferred to

Ontribution limit for SIMPLE IRA plans in 2025 is helpful to the administration of your plan Please see you The Simple IRA transfer rules stipulate a two year waiting period from the date of your first contribution to your SIMPLE IRA During this period you can only transfer your

More picture related to Irs Simple Ira 2 Year Rule

401k Max Contribution 2025 Calculator Alya Zoe

https://www.investors.com/wp-content/uploads/2019/12/wFAP-contribution-122719.jpg

Ira Limits 2025 Contribution Tax Sophia Noor

https://www.theentrustgroup.com/hs-fs/hubfs/2024-ira-contribution-limits.jpg?width=3072&height=2925&name=2024-ira-contribution-limits.jpg

Rmd Tax Factors For 2025 Carey Maurita

https://blogs-images.forbes.com/baldwin/files/2014/03/rmd_own_larger.png

Are all eligible employees allowed to participate in the SIMPLE IRA plan An employee who had compensation of at least 5 000 in any two prior years and who s expected to earn at least However a special rule applies to a payment or distribution received from a SIMPLE IRA during the 2 year period beginning on the date on which the individual first

Once 2 years have elapsed employees can roll over assets from their SIMPLE IRA to several other qualified employer sponsored and government retirement plans as well as non Roth IRAs without tax consequences SIMPLE IRAs let small businesses offer retirement benefits with a contribution cap of up to 17 600 Employers must contribute to SIMPLE IRAs with immediate vesting for

Aarp Rmd Calculator 2025 Table Reta Rosemarie

https://blogs-images.forbes.com/mattcarey/files/2018/09/blueprint-income-rmds-wide.png

IRA Rollovers And Transfers Bogleheads

https://www.bogleheads.org/w/images/a/a7/IRS_Rollover_Chart.png

https://www.irs.gov › retirement-plans › retirement...

During the 2 year period you may transfer an amount in a SIMPLE IRA to another SIMPLE IRA in a tax free trustee to trustee transfer If during this 2 year period an amount is paid from a

https://www.irs.gov › retirement-plans › plan-sponsor › simple-ira-plan

There are three steps to establishing a SIMPLE IRA plan You can use Form 5304 SIMPLE PDF or Form 5305 SIMPLE PDF to set up a SIMPLE IRA plan Each form is a model Savings

IRA Rollovers And Transfers Bogleheads

Aarp Rmd Calculator 2025 Table Reta Rosemarie

Roth Ira Limits 2025 Income Statement Ruth A Paige

Qmb Limits For 2024

Rmd Age Factor Table 2023

Rmd Calculator 2025 Aarp 2025 Daile Fionnula

Rmd Calculator 2025 Aarp 2025 Daile Fionnula

Rmd Rules Inherited Ira 2024 Benny Kaitlin

What Is The Roth 401k Limit For 2025 Zahira Belle

Simple Ira Plan Contribution Limits 2025 Alba Lane

Irs Simple Ira 2 Year Rule - After the 2 year period you can make tax free rollovers from SIMPLE IRAs to other types of non Roth IRAs or to an employer sponsored retirement plan You can also roll over money into a